What Is a Settlement Agreement? A Guide (what is a settlement agreement)

Discover what is a settlement agreement and how it may affect your personal injury claim. Learn key clauses and negotiation tips for fair resolution.

A settlement agreement is the final chapter in a legal dispute. It's a legally binding contract that officially puts the conflict to rest, allowing both sides to move on with certainty. Think of it as the formal, documented end to a personal injury case—you agree to give up your right to sue in the future in exchange for a specific amount of money today.

The entire point is to avoid the cost, stress, and sheer unpredictability of going to trial.

What Is a Settlement Agreement at Its Core

Picture a lawsuit as a rough voyage into a storm with no guaranteed destination—that's a jury verdict. A settlement agreement, on the other hand, is like charting a course directly to a safe, predictable harbor. It's the written peace treaty that spells out exactly how the conflict will end.

At its heart, this document does one primary thing: the injured person (the plaintiff) agrees to drop their lawsuit and any future claims related to the incident. In return, the other party (the defendant) provides an agreed-upon amount of money. This trade-off gives both sides closure and completely removes the risk of a jury handing down an unfavorable decision.

Why You Need a Formal, Written Agreement

So, why not just take a check and call it a day? The formality is absolutely critical. A written settlement agreement leaves no room for confusion or future arguments about what was decided. It clearly and legally defines everyone's obligations.

For instance, it locks down key details like:

- The precise dollar amount the defendant will pay.

- Who, exactly, is being released from any future liability.

- The timeline and method for payment (e.g., lump sum vs. structured payments).

- Any confidentiality clauses that prevent you from discussing the terms.

This contract is the finish line. It turns a messy, contentious fight into a clear, predictable, and legally enforceable resolution. It provides the finality everyone needs to close the book and move on without the threat of the same lawsuit popping up again later.

These agreements aren't just an option; they're the norm. In fact, some studies suggest that over 95% of personal injury cases end in a settlement, never seeing the inside of a courtroom for a full trial. This statistic alone shows just how valuable they are.

Reaching that final agreement often takes serious negotiation, sometimes with a neutral third party guiding the conversation. To see how that works, you can learn more about what mediation is in a lawsuit and how it helps people find common ground. Ultimately, a settlement gives you control over the final outcome of your case.

Breaking Down the Key Clauses in Your Agreement

While every settlement agreement looks a little different, most are built from the same standard parts. Getting a handle on these key clauses is crucial, because they spell out exactly what you're getting and, just as importantly, what rights you're signing away forever. Think of it as reviewing the blueprint before the foundation is poured—this is your last chance to get it right.

Each clause has a specific, legally binding job to do. Once you sign, you're agreeing to every single word.

The Release of Claims

At the very heart of any settlement is the Release of Claims. This is the fundamental trade-off. In plain English, this clause is your legally binding promise that you will never again sue the defendant for anything connected to the incident that caused your injury.

This release is usually written to be incredibly broad. It doesn't just cover the person or company you sued; it often includes their insurance company, employees, agents, and anyone even remotely connected to them. Once that ink is dry, the legal fight is over for good. You're effectively locking the door to the courthouse on this issue and throwing away the key.

Payment Terms and Conditions

Naturally, the section that details the money is where most people focus. It states the total settlement amount the defendant has agreed to pay. But it also lays out the specific rules for how and when that money will get to you.

There are usually two ways this can be structured:

- Lump-Sum Payment: You get the entire settlement amount in one single payment. This is the most common and straightforward option, giving you immediate control over the full amount.

- Structured Settlement: The money is paid out over time in a series of smaller, regular payments. This can be a smart move for managing long-term financial needs, especially if you'll have ongoing medical expenses for years to come.

The payment clause will also nail down a firm deadline, often stating that payment is due within 30 days of signing the agreement.

Confidentiality and Non-Disclosure

It’s almost a guarantee that the defendant—especially if it’s an insurance company or a large corporation—will insist on a confidentiality clause. You might know it better as a non-disclosure agreement, or NDA. This clause legally gags you from discussing the terms of your settlement, especially the dollar amount, with pretty much anyone.

Why do they care so much? It’s simple. It prevents your settlement from becoming a yardstick for what they might have to pay in the next case, and it helps them control their public image. If you breach this clause, the consequences can be severe. You could be on the hook for major financial penalties, and in some cases, you might even have to give back the entire settlement.

A confidentiality clause is the defendant's way of buying your silence. It ensures the nitty-gritty details of the case stay private, protecting their reputation and future legal strategies from the public eye.

Disclaimer of Liability

Finally, you’ll almost certainly see a clause where the defendant states that by paying you, they are not admitting to any fault or wrongdoing. This is the disclaimer of liability, and it’s a standard feature. It allows the defendant to close the book on your claim without ever legally confessing they were responsible for what happened.

For them, this is non-negotiable. It protects them from having your settlement used as an admission of guilt in another lawsuit down the road. For you, it means you're getting financial compensation for your damages, but the other party isn't formally taking the blame as part of the deal.

How a Texas Personal Injury Settlement Actually Works

Getting from an injury to a final settlement in a Texas personal injury case isn't like what you see in the movies. The whole process is a structured, and often long, journey that rarely starts in a courtroom. Instead, it begins with a crucial document: the demand letter.

Your attorney will put together this letter, which is the official kick-off to negotiations. It lays out the facts of what happened, details the injuries and financial hits you’ve taken, and makes a formal demand for a specific dollar amount from the at-fault party's insurance company.

Think of the demand letter as the opening serve in a tennis match. The insurance adjuster on the other side will review your demand, pick through the evidence like medical records and police reports, and then hit the ball back with a counteroffer. You can bet that their first offer will be a lot lower than what you asked for, and just like that, the back-and-forth negotiation begins. This part can take weeks or sometimes months.

Breaking Down the Negotiation Process

This is where the real work happens, and the quality of your evidence makes all the difference. A claim that’s well-documented with clear proof of who was at fault and what you've lost puts you in a much stronger negotiating position.

Insurance adjusters are professional negotiators. Their job is to pay out as little as possible for their company. They might try to downplay how serious your injuries are or argue that you were partly to blame for the accident—anything to justify a lower number.

This is why having objective data is such a game-changer. If you know what similar cases in your specific Texas county have settled for, you can set realistic expectations and have a solid benchmark for what’s fair. For instance, if you know the median settlement for your type of injury is way higher than the adjuster's lowball offer, your lawyer has the ammunition to push back hard. You can see how this plays out in our guide to the average settlement for a car accident injury.

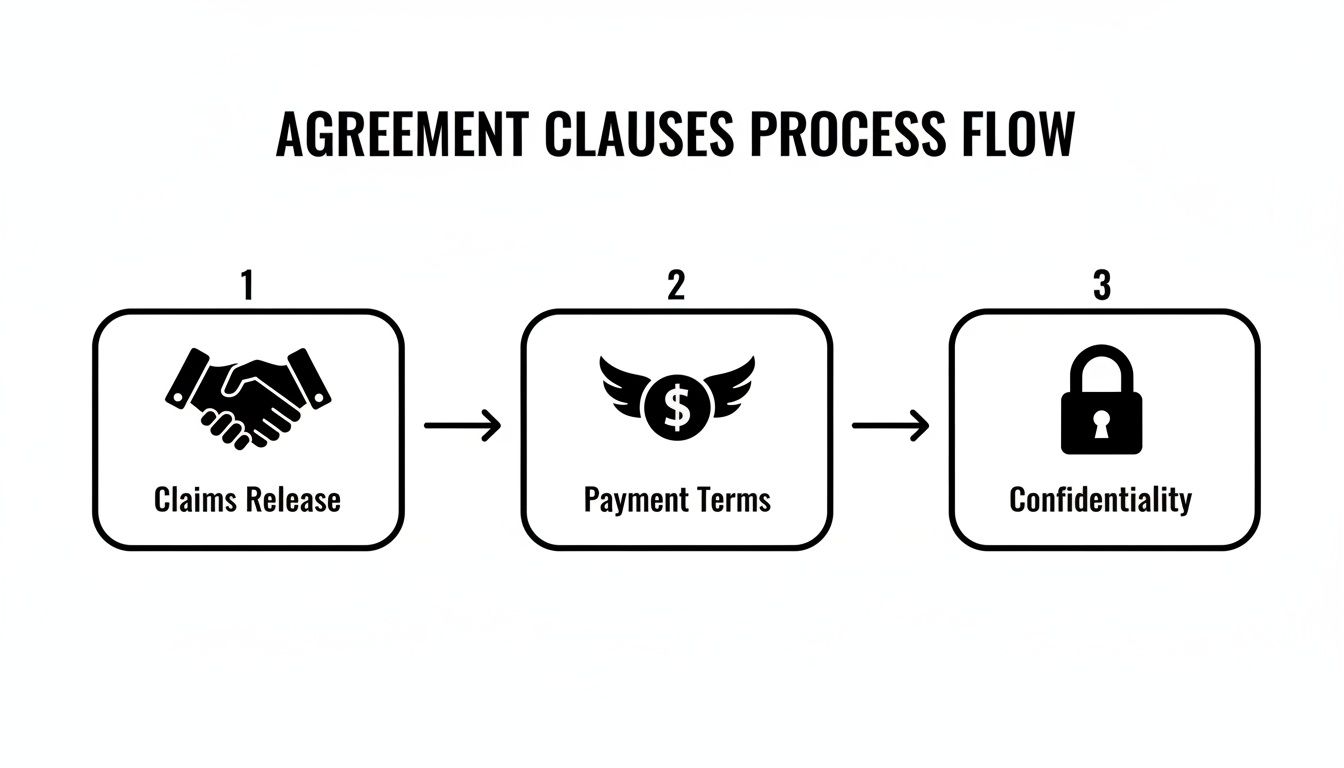

The infographic below shows the core components that are negotiated and eventually become the key clauses in the final agreement.

As you can see, the claims release, payment terms, and confidentiality clause are the three pillars that hold up the entire final document.

Finalizing a Legally Binding Agreement

Once you and the other side finally shake hands on a number and the terms, the insurance company’s attorney drafts the formal settlement agreement. This document takes your verbal agreement and turns it into a written, legally enforceable contract, complete with all the clauses we discussed.

Once you sign on the dotted line, that’s it. The negotiation is over, and the terms are legally binding. There’s no turning back, which is why it is absolutely critical to have your attorney review every single word before you sign.

After the agreement is signed, the defendant is legally required to pay you the agreed-upon amount, usually within 30 days or so. That final payment closes the book on the legal dispute, getting you the compensation you fought for and letting you move on without the stress and uncertainty of a trial.

Why Data-Driven Negotiations Secure Fairer Settlements

Walking into settlement negotiations without knowing what your case is worth is like trying to sell a house without looking at the neighborhood comps. Sure, you'll get an offer, but how can you possibly know if it's a fair one? This is precisely where hard, objective data becomes your greatest asset.

Insurance companies have a massive upper hand. They deal with thousands of claims every single year, giving them a treasure trove of internal data on what they’ve paid for similar injuries. A data-driven approach is the only way to level that playing field.

Instead of relying on gut feelings or what you think your case is worth, using real Texas verdict and settlement data provides a solid, defensible benchmark. It lets you and your attorney see what cases with similar injuries, accident types, and even specific counties have actually settled for.

Using Data as Your Benchmark

The real estate "comps" analogy is perfect here. A good agent doesn't just pull a price out of thin air. They pull up recent, comparable sales to determine a home's fair market value. The exact same logic applies to your personal injury claim.

When you analyze what similar cases have resolved for in the past, you can establish a realistic settlement range for your own. This empowers you to:

- Set a Strong Opening Demand: Your first number should be grounded in reality, not wishful thinking. Our guide on crafting a settlement demand letter example digs into why a well-supported opening offer is so critical.

- Spot Lowball Offers Immediately: When an adjuster’s offer is miles below the typical range for cases like yours, you can reject it with confidence and counter with actual evidence.

- Negotiate from a Position of Strength: Facts are always more convincing than feelings. Referencing actual settlement data for comparable local cases adds serious weight and credibility to your arguments.

When you're armed with objective data, the negotiation stops being a subjective argument and becomes a fact-based discussion about fair value. You're no longer asking, "What do I think this is worth?" Instead, you're stating, "Here's what cases like mine have been worth."

This is a fundamental shift in strategy, and it’s key to getting fair compensation. It ensures the final number in your settlement agreement isn't just what the insurance company wants to pay, but what your case truly merits based on real-world outcomes. It gives you the power to make informed decisions, knowing you're aiming for a resolution that is both just and supported by precedent.

A Look at Settlement Agreements Around the World

While we’re zeroing in on how settlement agreements work here in Texas, it’s helpful to pull back the lens for a moment. Settling a legal fight instead of dragging it through a full-blown trial isn't some quirky local habit. It’s a core feature of justice systems all across the globe.

Seeing how other countries handle settlements reinforces just how powerful and often preferred this path is. But make no mistake, the road to resolution looks wildly different depending on where you are.

The legal culture, the economic pressures, and the nitty-gritty procedural rules all play a huge role in whether a case is likely to settle. And these aren't small differences—they're massive.

Why Do Settlement Rates Vary So Much?

Some legal systems are practically designed to push parties toward an early agreement, making a trial the expensive, unpredictable last resort. In other places, the cultural or legal framework might actually encourage more cases to go before a judge for a formal decision. Think of places like the United States and Australia, where the entire legal environment is geared toward negotiation and settlement.

Now, contrast that with other major economies where the story is completely different.

A deep dive into the world’s largest economies reveals a staggering gap. In countries like France, Belgium, and Russia, settlement rates can plummet below 15%. Meanwhile, in Australia, more than two-thirds of cases end in a settlement. If you're curious about the data, this report on global dispute resolution trends lays out the fascinating differences.

So, what does this global perspective mean for your personal injury case right here in Texas?

Understanding that settlement is the norm in many of the world's most advanced legal systems confirms its value. It’s not a fallback plan or a weak compromise; it's the main way justice gets done efficiently and with a predictable outcome.

This worldwide preference for settling isn't just a coincidence. It points to a universal truth in any legal conflict: certainty has immense value. When you sign a settlement agreement, you grab the reins, sidestep the colossal costs and risks of a trial, and get a final, guaranteed result. That’s a goal shared by people seeking justice everywhere.

8. Your Final Settlement Agreement Review Checklist

Before you put pen to paper, it's time for one last, careful look. Signing a settlement agreement isn't just an administrative step; it's a final, legally binding act. Once you sign, your right to any future legal action over this incident is gone for good.

Think of it as the final walkthrough before buying a house. You and your attorney need to check every corner to make sure there are no surprises. This is your last chance to ensure the deal you negotiated is the deal you’re getting.

Your Pre-Signing Huddle with Your Attorney

Sit down with your lawyer and go through these key questions. This isn't just about double-checking the dollar amount—it's about protecting yourself from hidden clauses and future headaches.

-

Who, exactly, are we releasing from liability? The agreement must specifically name every single person and company you're releasing. Be wary of vague, catch-all phrases like "and all other persons, known or unknown." That kind of language can accidentally prevent you from pursuing a legitimate claim against another party down the road.

-

Is every single cost accounted for? The settlement figure needs to cover the entire scope of your damages. That means all past and future medical bills, lost wages, property damage, and fair compensation for your pain and suffering. Have you factored in any medical liens that must be paid back out of these funds?

-

Are the payment terms airtight? The document needs to state the exact settlement amount and a hard deadline for payment. Typically, this is within 30 days of signing. If you see vague language like "in a timely manner," that's a major red flag. Nail down a specific date.

Your final review is the last line of defense for your financial future. A tiny oversight—like an ambiguous payment clause or an overly broad release—can blossom into a huge legal and financial problem later on.

Treat this final step with the seriousness it deserves. By meticulously reviewing these details with your attorney, you can be confident that the agreement provides the complete and fair resolution you fought for. It’s what gives you true peace of mind to finally close this chapter and move on.

Here is a simple checklist to guide your final conversation with your legal counsel.

Final Settlement Agreement Review Checklist

Use this checklist with your attorney to ensure all key aspects of the agreement are covered and protect your interests.

| Checklist Item | What to Verify |

|---|---|

| Parties & Release | Are only the correct parties being released from liability? Is the language specific and not overly broad? |

| Payment Amount | Is the total settlement amount stated clearly and correctly, down to the last cent? |

| Payment Terms | Is there a specific deadline for payment (e.g., "within 30 days of signing")? |

| Confidentiality Clause | Do you fully understand the rules of the non-disclosure agreement (NDA), if there is one? |

| Lien Repayment | Are all outstanding medical liens, subrogation claims, and other debts properly addressed? |

| Dismissal of Lawsuit | Does the agreement correctly state that the lawsuit will be dismissed "with prejudice"? |

| Tax Implications | Have you discussed the tax treatment of the settlement funds with your attorney or a tax professional? |

| No Admission of Fault | Does the agreement include a standard clause stating the defendant does not admit any liability? |

| Entire Agreement Clause | Does the document confirm that this written agreement supersedes all prior verbal or written promises? |

| Your Understanding | Have you read the entire document, and has your attorney answered all of your questions to your satisfaction? |

Going through this checklist helps ensure that the document you sign is a powerful tool for your recovery, not a source of future regret.

Got Questions? We've Got Answers

Even after the long journey of a personal injury claim, a few last-minute questions always seem to surface right before you cross the finish line. Getting these final details straight is key to feeling confident when you sign on the dotted line.

Let's break down some of the most common questions we hear from clients.

Is Settling the Same as Winning My Case in Court?

Not at all—they're two completely different paths to resolving a claim. Think of a settlement as a private deal, a negotiated truce between you and the other side. No judge or jury declares a "winner" or "loser." Instead, you both agree to a specific outcome, usually a financial payment, to end the dispute for good and avoid the risk and stress of a trial.

Winning in court is a public declaration. It means a judge or jury heard all the evidence and officially decided in your favor. While that can be incredibly validating, it's never a guaranteed win. The trial process is unpredictable, and even a victory can be tied up in costly and time-consuming appeals. A settlement, on the other hand, gives you certainty.

Can I Change My Mind After I Sign the Agreement?

The short answer is almost always no. Once you and the other party have signed the settlement agreement, it becomes a legally binding contract. Backing out at that point is extremely difficult, if not impossible.

This finality is actually one of the main benefits of a settlement—it creates a predictable and enforceable end to the conflict. That's why that final review with your attorney is so critical. You need to be 100% sure you understand and agree to every single term before you sign, because once that ink is dry, there's usually no going back.

Do I Have to Pay Taxes on My Personal Injury Settlement?

For the most part, you won't. The IRS generally does not treat money you receive for physical injuries or the related emotional distress as taxable income. This means the core portion of your settlement—the part meant to compensate you for your injuries and suffering—is typically tax-free.

But here’s the fine print: some parts of a settlement can be taxed. For instance, if a portion of your settlement is specifically meant to cover lost wages, that amount could be considered taxable income. The same often goes for punitive damages, which are designed to punish the defendant rather than compensate you for a loss.

Tax laws are notoriously tricky, so it's always a smart move to run the agreement by both your attorney and a tax professional. They can help you understand the specific tax implications for your situation and make sure you aren't caught off guard by an unexpected tax bill down the road.

Don't negotiate in the dark. Verdictly provides access to real Texas verdict and settlement data, empowering you to understand your case's potential value with objective insights. See what similar cases are worth and negotiate from a position of strength. Explore our database and see for yourself.

Related Posts

What Is a Statute of Repose and How Does It Affect Your Legal Rights

Understand what is a statute of repose and how this absolute deadline differs from a statute of limitations, especially in personal injury cases.

A Guide to Medical Records Reviews in Personal Injury Claims

Learn how medical records reviews can strengthen your Texas injury claim. This guide explains the process, key findings, and how to build a stronger case.

Why Insurance Companies Deny Claims: why insurance companies deny claims

Learn why insurance companies deny claims and how to overcome common denials with proven appeals and tips to maximize your compensation.