Why Insurance Companies Deny Claims: why insurance companies deny claims

Learn why insurance companies deny claims and how to overcome common denials with proven appeals and tips to maximize your compensation.

Getting that "claim denied" letter in the mail after an accident is a gut punch. It’s frustrating, confusing, and feels like you've hit another wall right when you're trying to recover.

At the end of the day, insurance companies are businesses. They have a bottom line to protect, and paying out on every claim cuts into their profits. This simple financial reality means they are always looking for legitimate reasons—from tiny paperwork mistakes to major disagreements over who’s at fault—to reject a claim.

Decoding the Denial Letter

Here's something most people don't realize: a denial isn't always the end of the story. Often, it's just the start of a negotiation. Insurance adjusters are trained to be meticulous, poring over every document to find any reason to reduce a payout or deny it outright.

Think of it like the opening move in a chess game. Your denial letter is your opponent showing their hand, revealing the exact arguments you need to overcome. Grasping this is the first crucial step toward turning their "no" into a "yes."

Common Reasons for a Claim Denial

While the specifics of every accident are different, most denial reasons fit into a few familiar patterns. Knowing what they are ahead of time helps you see what's coming and build a much stronger case from the start.

To help you get a clearer picture, here’s a quick breakdown of the most common reasons insurers give for denying a claim.

Quick Guide to Common Claim Denial Reasons

| Denial Category | Common Example | What It Means for You |

|---|---|---|

| Policy Exclusions | Using your personal car for a ride-sharing service without a commercial policy. | Your policy has specific limitations. You need to prove the incident falls within the covered terms. |

| Liability Disputes | The insurer claims their driver wasn't at fault, citing a lack of witnesses or conflicting statements. | You must provide compelling evidence (police reports, photos, witness testimony) to prove the other party's fault. |

| Documentation Issues | You missed the deadline to file your claim or failed to submit complete medical records. | This is often fixable. You'll need to gather the missing documents and resubmit your claim promptly. |

| Lack of Medical Necessity | The adjuster argues that the physical therapy you received wasn't medically required for your injury. | You need a strong statement from your doctor explaining why the treatment was essential for your recovery. |

Seeing these patterns makes it easier to anticipate and counter the insurer's arguments.

A major headache, and a frequent reason for denial, is getting into an accident with someone who has no insurance at all. It's wise to understand your accident rights and claims when hit by an uninsured driver before you ever need them.

By getting familiar with these common roadblocks, you can start building a much more persuasive, evidence-backed appeal from the get-go.

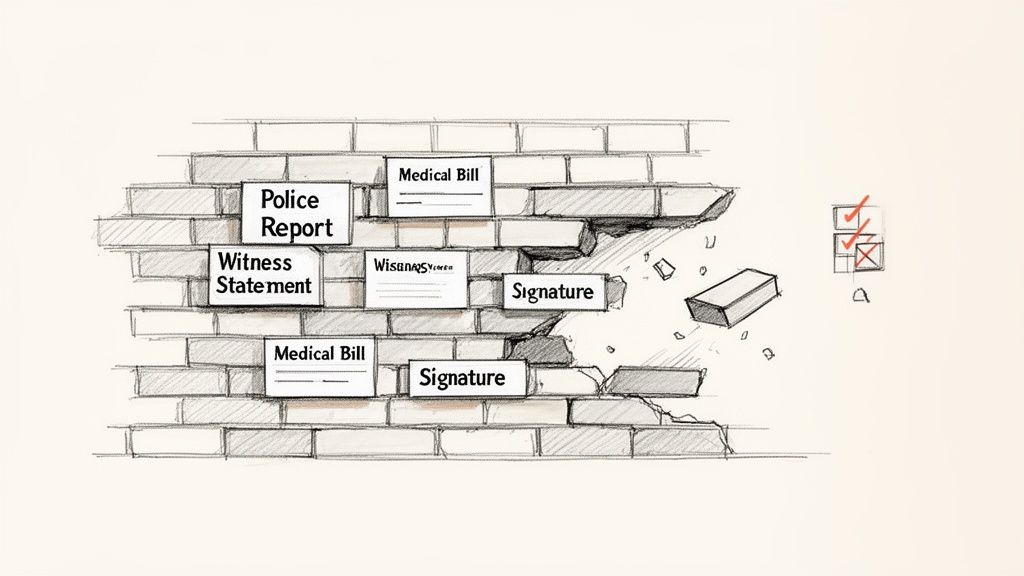

How Missing Paperwork Can Derail Your Claim

It sounds simple, but one of the most common—and preventable—reasons for a claim denial is an incomplete paper trail. Think of your claim submission as building a case. Each document, from the initial police report to the final medical bill, is a piece of evidence. For an insurance adjuster, even one missing piece can create enough doubt to reject the entire claim.

This is why insurers so often deny claims on what feel like administrative technicalities. A missing signature, a blown filing deadline, or forgetting to get prior authorization for a medical procedure can stop your claim dead in its tracks. These aren't just minor slip-ups; in the eyes of an insurer, they’re perfectly valid reasons for a denial.

Building an Airtight Claim File

The moment an accident happens, you need to start thinking like a detective. Every document you collect helps tell your story and quantify your losses. If you don't have a complete file, you’re essentially giving the adjuster an easy out.

A solid claim is built on several key documents. Together, they create a clear, undeniable picture of the incident and its consequences, leaving the insurer little room to poke holes in your story.

Be sure to gather these items right away:

- The Official Police Report: This is ground zero. It’s an unbiased, official account of the accident and usually the first thing an adjuster will ask for.

- Medical Records and Bills: You need everything. From the ER visit to every follow-up physical therapy session, each record proves the extent of your injuries and costs.

- Photos and Videos: Visuals are incredibly compelling. Snap pictures of the vehicle damage, the accident scene, and any visible injuries as soon as you can.

- Witness Information: A statement from an impartial third party is hard for an insurer to argue with. Get names and phone numbers on the spot.

An incomplete claim file is an open invitation for a denial. Insurers run on process, and if you don't follow that process perfectly with all the required documentation, they have a contractual basis to say no.

Common Administrative Tripwires

Beyond just gathering evidence, you have to be precise. Forgetting to get prior authorization for a specific medical treatment is an incredibly common reason for denial in personal injury claims. The insurer’s logic is simple: if they didn’t pre-approve a procedure, they won't pay for it.

Paperwork snags and authorization failures are a massive problem. In 2024, approximately 11.8% of all medical claims were initially denied. The American Hospital Association found that providers spent a staggering $19.7 billion in 2022 just appealing these denials, and more than half were eventually overturned. This shows just how often these rejections are based on fixable administrative mistakes. You can find more denial management trends at gebbs.com.

At the end of the day, your best defense is a meticulously organized file. Treat every form, every bill, and every deadline like it's the most important part of your claim—because it just might be.

Decoding Medical Coding and Necessity Disputes

Sometimes, a claim denial isn't about a missed deadline or a lost form. The real reason can be buried in the technical details of your medical bills, where insurers use two common tactics to deny or shrink payments: flagging coding errors and disputing the “medical necessity” of your care.

Let's break it down.

Think of medical codes as a special language doctors use to communicate with insurance companies. Every service you receive—from an MRI to a simple physical therapy session—gets a unique code. If the billing clerk accidentally types a single wrong number, the insurer's automated system can kick the claim right back out.

And this isn't a rare occurrence. The complexity of this coding system is a major reason claims get denied. In fact, industry reports show that claim denial amounts tied to coding issues skyrocketed by 126% in 2024, hitting an average of $631 per denied claim. For anyone injured in a Texas car accident, these "simple" mistakes can become a huge problem as adjusters use them as an excuse to undervalue a claim. You can dig into these claim denial trends on aha.org to see the full picture.

The Murky Waters of Medical Necessity

Even if every code on your bill is perfect, you can still face a denial. The insurer might argue that a treatment you received wasn't medically necessary. This is a frustratingly subjective tactic where the insurance adjuster basically overrules your doctor, saying, "We don't think you actually needed that."

You see this a lot in personal injury cases that require ongoing treatment, like chiropractic care or physical therapy. The insurance company might pay for the first few visits and then suddenly stop, arguing that you should be healed by now. It’s a direct challenge to your doctor's professional judgment, and it’s all about protecting their bottom line. When this happens, the process of reviewing medical records becomes absolutely essential for proving them wrong.

A "medical necessity" denial pits the insurer's opinion against your doctor's expert medical decision. To beat it, you have to show not just that you were hurt, but that every treatment you received was a critical part of your recovery.

Fighting Back with Hard Data

So, what do you do when an insurer second-guesses your doctor? This is the moment to move past arguments and bring in objective data. An adjuster’s opinion is just that—an opinion. You can dismantle it with facts.

Let's say the insurance company disputes the need for a specific spinal injection you received after a car wreck. Instead of getting into a back-and-forth debate, you or your attorney can pull up data showing what juries in your exact county have awarded to other people with similar injuries who got the very same injection.

This completely changes the conversation.

Suddenly, it’s not just your word against theirs. You’re using real-world case outcomes to prove that your treatment was reasonable and necessary. By benchmarking your medical care against historical verdicts, you establish a powerful precedent, showing the insurer that your treatment is standard and compensable. It leaves them with very little ground to stand on.

Getting into the Weeds: Liability Fights and Policy Exclusions

So, your paperwork is perfect and your medical bills are all in order, but you still get a denial letter. What gives?

Often, the problem runs deeper than simple administrative errors. Two of the biggest hurdles you'll face are liability disputes and policy exclusions. These aren’t just technicalities; they cut right to the core of your insurance agreement, questioning who was actually at fault and what your policy promised to cover in the first place.

The "It Wasn't Our Fault" Defense

A liability dispute is exactly what it sounds like: the other driver's insurance company is arguing that their customer didn't cause the accident. It’s a classic blame game.

In a state like Texas, which uses a modified comparative fault rule, this gets even more complicated. Insurers will dig into the details to assign a percentage of blame to everyone involved. If they can argue their policyholder was less than 50% responsible for the crash, they can legally walk away without paying you a dime.

Think about a common "he said, she said" scenario at a four-way stop. You’re certain you had the right-of-way, but the other driver spins a completely different tale for their adjuster. If there are no independent witnesses or clear video footage, the adjuster is likely to believe their own customer. Just like that, your claim is denied based on a liability dispute, and the burden of proof is now entirely on you.

Reading the Fine Print: The Exclusions That Bite

Policy exclusions are the other major tripwire. Your insurance policy is basically a rulebook spelling out what’s covered and—more importantly—what’s not. An exclusion is a specific situation or action that the policy explicitly refuses to pay for.

It's crucial to understand the boundaries of your coverage before you need it. To get a better handle on this, you can learn more about what liability insurance covers in our guide.

These exclusions aren't buried in secret code, but most people don't read them until it's far too late.

Here are a few common ones that sink claims all the time:

- Business Use: Using your personal car for work—like for a rideshare service or delivering pizzas—is a huge red flag for insurers if you don't have a commercial policy.

- Intentional Acts: If there's any reason to believe the collision was caused intentionally, forget it. Coverage is out the window.

- Excluded Drivers: Policies often allow you to specifically name people who are not covered to drive your vehicle, usually to lower your premium. If one of those people gets behind the wheel and has an accident, the claim will be rejected flat out.

Think of policy exclusions as the insurer's built-in "get out of jail free" cards. If your situation fits neatly into one of these categories, the denial will be fast, firm, and tough to fight without compelling evidence to the contrary.

At the end of the day, adjusters are trained to view every claim through the lens of liability and the policy's specific rules. Their primary job is to protect their company's bottom line. By understanding these potential roadblocks from the start, you can build a stronger case that anticipates their arguments and is ready to stand up to scrutiny.

Your Step-By-Step Guide to Contesting a Denied Claim

So, you’ve received a denial letter. It’s frustrating, but it’s not the end of the road. Think of it as the starting pistol for your appeal. The key to fighting back effectively is to set aside the emotion and get organized. This isn't a confrontation; it's a negotiation, and your best assets are a structured, evidence-based approach and a healthy dose of persistence.

Your first move is to dissect that denial letter. Don't just glance at it. Read every word to understand the exact reason they're saying no. Did they decide you were at fault? Are they questioning if your treatment was medically necessary? Or is it something as simple as a paperwork error? Whatever their reason is, that's your target. Every piece of evidence you collect from here on out should be aimed squarely at knocking down that specific argument.

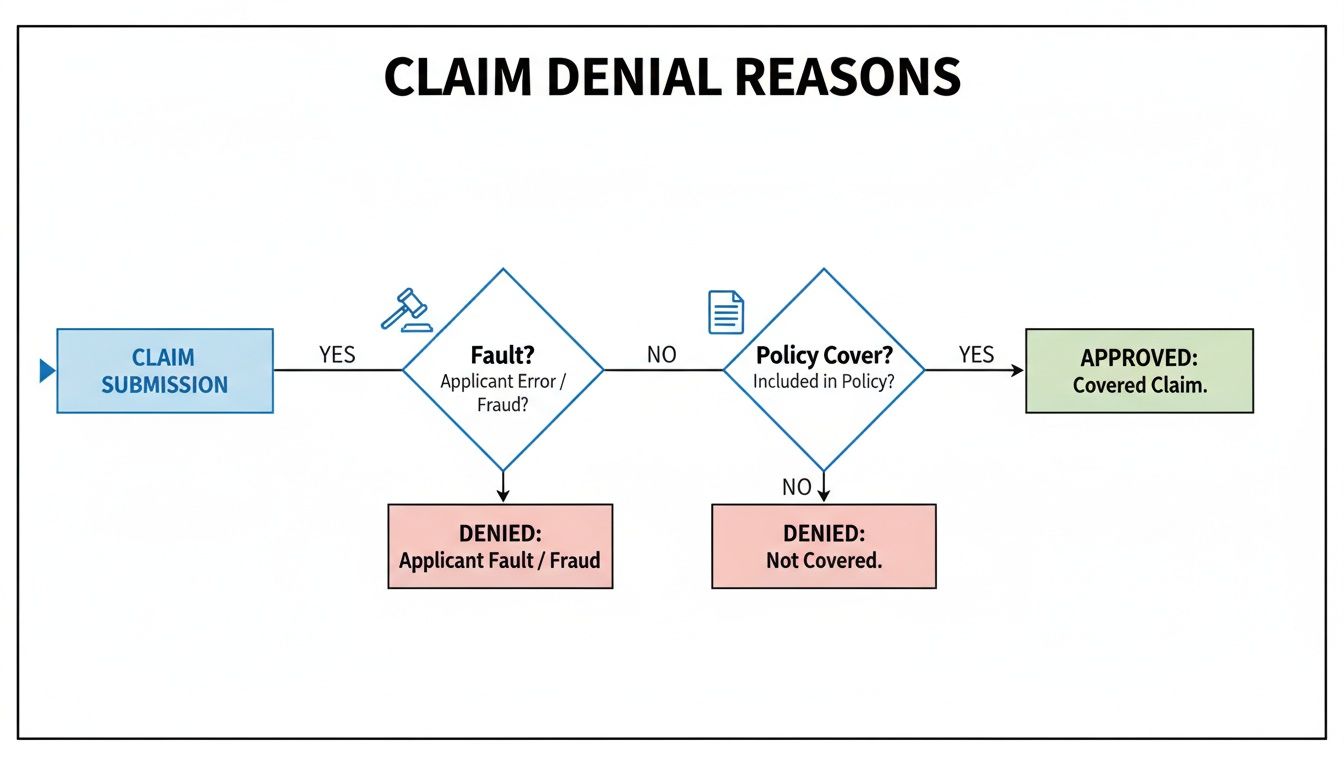

This flowchart shows the typical hurdles a claim has to clear before an insurer will even consider paying out. These are often the very points where denials happen.

As you can see, proving liability and confirming your policy covers the incident are just the first steps. A denial can originate at any one of these checkpoints.

Assembling Your Counter-Evidence

Once you’ve identified the "why" behind the denial, it’s time to build your case. You need to gather new information that directly pokes holes in their conclusion. An appeal that simply repeats your original claim is dead on arrival. You need to give them compelling new evidence that forces them to take a second look.

What does that look like in the real world?

- If they're disputing liability: Your job is to find proof. Track down new witness statements, hunt for traffic camera footage, or even bring in an accident reconstruction expert to show the other driver was clearly at fault.

- If they denied a treatment as "not medically necessary": Go back to your doctor. Get a detailed letter from them explaining precisely why every single procedure was critical for your recovery, ideally with references to established medical guidelines.

- If it's a simple paperwork issue: This is the easy one. Provide the corrected or missing document, whether it’s a form you forgot to sign or an itemized medical bill.

An appeal is your chance to make a much stronger argument. You're not just asking them to change their minds; you're providing concrete, documented reasons that show their first decision was wrong.

Drafting a Compelling Appeal

With your new evidence organized, you can write your formal appeal letter. The tone should be professional and factual—leave emotion out of it. Start by clearly stating that you are appealing the denial of your claim (make sure to include the claim number!). Then, go point by point, addressing their specific reason for the denial and presenting the counter-evidence you’ve gathered.

Here’s a crucial tip: send your appeal via certified mail. This gives you a legal record of when they received it. From this moment on, document everything. Create a log of every phone call—date, time, who you spoke with, and a summary of the conversation. Save every single email and piece of correspondence. This paper trail is your best friend if negotiations drag on and you need to escalate the fight.

Mastering this stage requires some solid negotiation tactics. For more in-depth strategies, take a look at our guide on how to negotiate with an insurance adjuster.

Using Data to Win Your Insurance Negotiation

When an insurer denies your claim or slides a lowball offer across the table, it’s easy to feel like you have to take what they give you. But this is the exact moment to shift from defense to offense. You can dismantle an adjuster's subjective opinion by grounding your entire negotiation in objective, real-world case data.

Think about it. The adjuster tells you your specific injury is only worth a certain amount. Instead of getting into a "he said, she said" argument, imagine responding with concrete examples of what juries and settlements have actually awarded for similar injuries, right in your own county.

Suddenly, the conversation isn't about opinions anymore. It’s about facts.

From Opinion to Evidence

Insurance adjusters lean heavily on internal software and historical averages that, unsurprisingly, tilt in their company’s favor. Their primary job is to close your claim for as little money as possible. But when you introduce verifiable data from actual court cases, you flip the script entirely.

This approach is especially powerful against denials for "lack of medical necessity." It’s a common tactic insurers use to reject treatments and drive down settlement values. In fact, U.S. hospitals lose a staggering $262 billion a year to initial denials, and an estimated 63% of those are recoverable. You can see the details of this impact at ajmc.com.

By showing them what real juries have awarded for identical injuries needing the same treatments, you’re not just validating your medical care—you're proving their offer is out of touch with reality.

An adjuster's offer is a starting point, not the final word. Arming yourself with comparable case data is the single most effective way to counter their initial lowball tactics and demonstrate the true value of your claim.

Leveling the Negotiation Field

This strategy does more than just give you talking points; it levels the playing field. It empowers you and your attorney to argue for a fair settlement backed by undeniable evidence. The secret is finding cases that are genuinely comparable to yours to set a credible benchmark.

Here’s how you can use data to build an airtight negotiation position:

- Identify Similar Injuries: Start by filtering past cases by the specific injury you suffered, whether it's a herniated disc, a concussion, or a rotator cuff tear.

- Pinpoint the Location: Next, narrow those results down to your specific county in Texas. Jury awards can—and do—vary wildly from one jurisdiction to another.

- Analyze the Outcomes: Finally, review the range of settlements and verdicts for those cases. This helps you establish a realistic and defensible valuation for your own claim. You can get a feel for how this works by using a compensation calculator for car accidents.

When you follow these steps, you’re no longer just asking for a number you feel is fair. You are showing the adjuster exactly what similar cases are worth in front of a local jury. This fact-based approach forces them to justify their low offer against what's really happening in the courthouse down the street, dramatically increasing your chances of a fair outcome.

Common Questions After a Claim Denial

Getting a denial letter from your insurance company can be frustrating and confusing. It often raises more questions than it answers. Here, we'll tackle some of the most common concerns Texas drivers have when facing a denied claim.

How Long Do I Have to Appeal a Denied Insurance Claim in Texas?

This is one of the first questions people ask, and the answer isn't found in state law—it's buried in your insurance policy.

Your denial letter should clearly state the deadline for an appeal. You need to find that date and mark it on your calendar immediately. For car accidents and injury claims, your policy is the ultimate authority on this timeframe. Missing that window could permanently close the door on your ability to challenge the insurer's decision.

Should I Hire an Attorney if My Claim Is Denied?

The answer really depends on why your claim was denied. If it was something simple, like a missing form or a clerical error you can fix yourself, you might not need a lawyer to handle the appeal.

However, if the denial involves more serious issues, it's a good idea to at least talk to a personal injury attorney. You should definitely consider it for claims involving significant injuries, complex arguments about who was at fault, or if you feel the insurance company is simply not treating you fairly. A good lawyer knows the playbook insurers use and can build a solid, evidence-backed case to fight for the compensation you deserve.

An attorney can navigate the tangled appeals process, gather the right evidence, and use legal data to dismantle an insurer's arguments. This can dramatically improve your chances of success.

What Is an Insurance Bad Faith Claim in Texas?

An insurance company has a contractual duty to act in "good faith." Insurance bad faith is what happens when they break that promise.

It occurs when an insurer unfairly denies, delays, or underpays a legitimate claim without a good reason. Examples include not bothering to investigate your claim thoroughly, twisting the words in your policy to avoid paying, or refusing to settle when it’s obvious their driver was at fault. If you can prove an insurer in Texas acted in bad faith, you may be able to sue for damages that go far beyond the original value of your claim.

Dealing with a claim denial is tough, but you shouldn't have to go into it blind. Verdictly gives you access to real Texas motor vehicle case outcomes, so you can see what claims like yours are actually worth. Use our transparent data to set a realistic benchmark for your claim and negotiate from a position of strength.

Explore real case data to see for yourself.

Related Posts

A Guide to Medical Records Reviews in Personal Injury Claims

Learn how medical records reviews can strengthen your Texas injury claim. This guide explains the process, key findings, and how to build a stronger case.

How Much Can I Get From a Car Accident Settlement?

Wondering how much can I get from a car accident? This guide breaks down settlement factors, damages, and claim values to help you estimate your compensation.

Can You Sue Someone in a Car Accident? A Guide to Your Rights

Can you sue someone in a car accident? Learn the critical steps for filing a claim and what it takes to secure fair compensation for your injuries and damages.