Settlement for car accident injury: How to Maximize Your Settlement

Learn how to secure settlement for car accident injury and maximize your claim.

When you're injured in a car accident, a settlement is a formal agreement that gets you paid for your losses by the at-fault driver's insurance company. Think of it as a resolution that happens outside of court, designed to put you back in the financial position you were in before the crash.

What Is a Fair Settlement for a Car Accident Injury?

It’s tempting to think of a settlement as some kind of windfall, but it's more like a meticulous reconstruction project. If your home were damaged in a storm, you wouldn't just accept a random check. You'd expect the insurance payment to cover the precise cost of every single repair needed to make it whole again. A car accident settlement works the same way—it's not about rebuilding a house, but about rebuilding your life.

This is how over 95% of personal injury claims are ultimately resolved. A negotiated settlement allows everyone to sidestep the time, cost, and sheer unpredictability of a trial. The real goal is to land on a number that truly accounts for every single loss you've suffered due to someone else's mistake.

The Building Blocks of a Settlement

A fair settlement isn't just one number pulled from thin air. It’s a carefully built sum of several different parts, with each part representing a specific type of damage you’ve incurred. To get a just outcome, you have to account for every single piece.

These components fall into two main buckets:

- Economic Damages: These are the straightforward, black-and-white financial hits. We're talking about things with a clear paper trail—all your medical bills (both what you've already paid and what you'll need in the future), lost wages from being out of work, and any damage to your long-term earning capacity.

- Non-Economic Damages: This is where things get more personal. These damages cover the intangible losses that don't come with a receipt. This is compensation for your physical pain, emotional trauma, scarring, and the general loss of enjoyment of life that comes after a serious injury.

A settlement is a compromise. It gives you a guaranteed outcome and quicker access to the money you need. A trial, on the other hand, might offer a shot at a bigger payout, but it also comes with the very real risk of walking away with nothing.

Getting a handle on these foundational elements is the first step toward fighting for what you deserve. By learning about the different types of damages in personal injury cases, you can walk into negotiations far better prepared. Every piece of the puzzle, from a single hospital bill to the daily pain you live with, adds to the final value. The key is making sure nothing gets left on the table.

What's a Typical Car Accident Settlement Really Worth?

It’s the first question everyone asks after a crash: “What is my case actually worth?” It's a completely fair question, but there's no magic formula that spits out a number. The final settlement amount is a complex calculation that hinges on the unique, nitty-gritty details of your accident and your injuries.

Think of it like valuing a house. You can glance at what other homes in the neighborhood sold for, but the final price always comes down to specifics—the square footage, the custom kitchen, the roof's condition, the exact location. In the same way, two car accident claims that look identical at first can end up with wildly different settlement values.

Why You Should Ignore the "Average" Settlement and Focus on the "Median"

As you start digging into settlement numbers, you'll see two words pop up everywhere: average and median. Knowing the difference is crucial for setting realistic expectations for your own case.

An average is simple: add up all the settlement amounts and divide by the number of cases. The median, on the other hand, is the true middle number—the exact point where half of all settlements are higher and half are lower.

For car accident claims, the average is almost always way higher than the median. Why? Because a few massive, multi-million dollar verdicts for catastrophic injuries drag the entire average upward. These rare, tragic cases don't reflect what happens in the vast majority of claims.

The median settlement is a much more honest yardstick for what a typical case is worth. It gives you the real middle ground, unaffected by the outlier cases that inflate the average and create a false picture.

This statistical quirk becomes crystal clear when you look at the actual data. Nationally, the average settlement for car accident injuries often lands between $20,000 and $55,000. But this number is incredibly misleading.

Right here in Texas, for example, the median personal injury settlement is $12,281. The average? A mind-boggling $826,892. That massive gap shows you just how much a handful of huge payouts can skew the numbers.

Settlement Ranges Based on How Badly You Were Hurt

While every case is different, we can get a clearer picture by looking at potential settlement ranges based on the severity of the injury. The value of your claim is tied directly to how serious your injuries are and what their long-term impact will be. A minor sprain that heals in a few weeks will, naturally, result in a much smaller settlement than an injury that requires major surgery and lifelong care.

The infographic below breaks down the key pieces that form the foundation of any settlement calculation.

As you can see, the final number is a mix of concrete costs you can add up (like medical bills and lost paychecks) and the more intangible, but very real, harm you've suffered (like pain and suffering).

For a much more tailored estimate, you have to look at the specific type of injury. To help people get a better sense of where they stand, our team built a comprehensive personal injury lawsuit calculator that lets you explore potential outcomes based on real-world case data.

To give you a general idea, the table below provides some estimated settlement ranges for common types of car accident injuries.

Typical Car Accident Injury Settlement Ranges by Injury Type

| Injury Type | Description | Typical Settlement Range |

|---|---|---|

| Minor Injuries | Soft tissue damage like whiplash, strains, or bruises. Treatment is often limited to a few doctor visits or physical therapy. Full recovery is expected. | $10,000 – $25,000 |

| Moderate Injuries | Simple bone fractures, herniated discs, or concussions requiring more significant medical care and a longer recovery. Lost wages are often more substantial. | $25,000 – $100,000 |

| Severe Injuries | Complex fractures needing surgery, traumatic brain injuries (TBI) with lasting effects, or significant back injuries. Involves extensive medical bills and impacts quality of life. | $100,000 – $500,000+ |

| Catastrophic Injuries | Life-altering harm like spinal cord damage causing paralysis, severe burns, or permanent brain damage. The settlement must cover a lifetime of care and lost earning capacity. | $500,000 – several million |

This is just a starting point, of course. Knowing where your injuries fall on this spectrum helps you set a more grounded baseline for valuing your claim as you head into negotiations.

What’s My Car Accident Settlement Really Worth? The Key Factors at Play

That final settlement number isn't just pulled out of thin air. It’s the result of a careful, often intense, calculation where insurance adjusters and attorneys weigh a specific set of factors to figure out what your case is truly worth. Building a strong claim means looking far beyond just the stack of hospital bills; it requires a detailed accounting of every single loss you’ve suffered, both financial and personal.

Think of it like an appraiser looking at a classic car. They don’t just see an old vehicle. They examine its condition, its history, its rarity, and what similar cars are selling for. In the same way, your settlement value is a combination of unique variables that, when pieced together, tell the complete story of your ordeal.

The Two Pillars of Damages: Economic and Non-Economic

Every settlement is built on two core types of damages. Getting a handle on both is crucial because a fair outcome has to cover every loss—not just the ones that come with a receipt.

-

Economic Damages: These are the straightforward, dollars-and-cents losses that are a direct result of the crash. They have a clear paper trail, making them relatively easy to prove. This bucket includes:

- All Medical Expenses: We're talking about everything from the ambulance ride and ER visit to surgery, physical therapy, prescriptions, and any medical care you'll need down the road.

- Lost Wages: This is simply the income you couldn't earn because you were out of work recovering.

- Loss of Future Earning Capacity: This is a big one. If your injuries stop you from returning to your old job or limit your ability to earn a living long-term, this calculation estimates the income you’ll miss out on over your working life.

-

Non-Economic Damages: These are the personal, human losses that don’t have a price tag. This is compensation for the real-life toll the injury has taken on you, and it’s often the largest part of a settlement. This includes:

- Pain and Suffering: Compensation for the physical pain, chronic discomfort, and emotional distress you've had to live with.

- Mental Anguish: This covers things like anxiety, depression, fear, or PTSD that developed because of the accident.

- Loss of Enjoyment of Life: This accounts for how the accident has impacted your ability to enjoy your hobbies, daily activities, and even your relationships.

Since non-economic damages are so personal, putting a number on them is more of an art than a science. One of the go-to methods the industry uses is the multiplier method.

How the Multiplier Method Works An adjuster or attorney will add up all your concrete economic damages (medical bills, lost wages, etc.) and then multiply that total by a number, usually between 1.5 and 5. A minor sprain with a quick recovery might get a 1.5x multiplier. A catastrophic, life-changing injury could easily command a multiplier of 4 or 5.

The Make-or-Break Variables in Your Claim

Beyond just adding up damages, a few other critical factors can cause your final settlement for car accident injury to swing dramatically in one direction or the other. These are the details that separate a weak claim from a strong one.

Clarity of Fault The question of who caused the wreck is the absolute foundation of your claim. If the other driver was clearly 100% at fault—say, they blew through a red light and a traffic camera caught it all—you’re in a very strong negotiating position.

But it’s not always that simple. Texas operates under a modified comparative fault rule. In plain English, this means that if you’re found to be partly to blame for the accident, your settlement will be reduced by your percentage of fault. And there's a hard line: if you are found 51% or more at fault, you get nothing.

Strength of Your Documentation Your ability to prove your losses is everything. Your claim is only as strong as the evidence you have to back it up. If your documentation is weak, incomplete, or disorganized, you’re handing the insurance company an open invitation to lowball or deny your claim.

- Your Evidence Checklist:

- The official police report.

- Photos and videos of the scene, the damage to all vehicles, and your injuries.

- All medical records, bills, and doctor's notes that detail your diagnosis, treatment plan, and prognosis.

- Statements from anyone who witnessed the crash.

- Proof of your lost income, like pay stubs or a letter from your HR department.

Insurance Policy Limits This is a huge factor that people often forget about. You might have a million-dollar injury, but if the driver who hit you only has the Texas state minimum liability coverage of $30,000 per person, that’s the absolute most their insurance company has to pay.

This is exactly why carrying your own Underinsured Motorist (UIM) coverage is so important. It acts as a safety net, kicking in to cover the difference when the at-fault driver's policy isn't enough to cover your damages. Without it, getting the full value you deserve can be nearly impossible unless the other driver happens to have significant personal assets to go after.

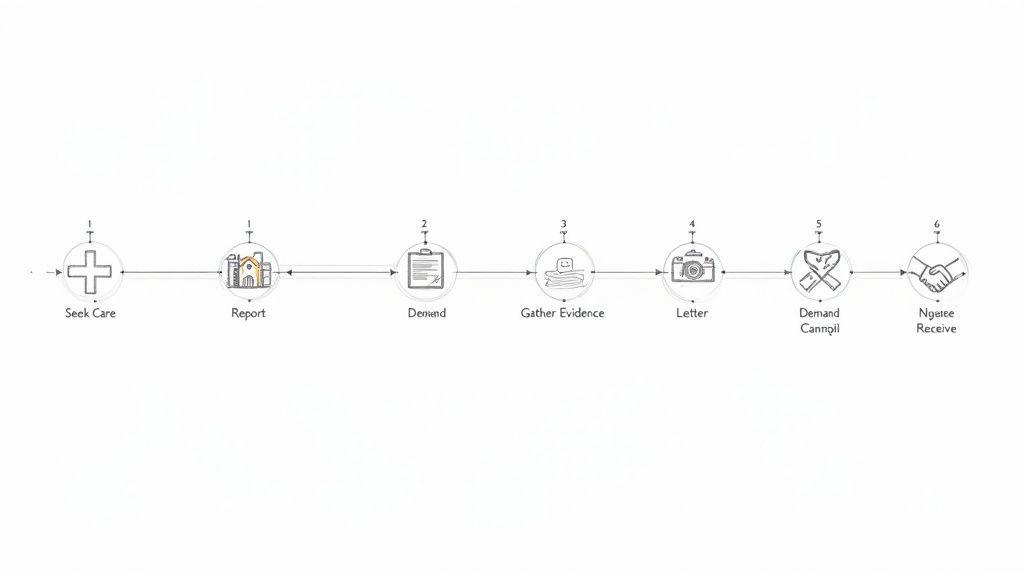

A Step-by-Step Guide to the Settlement Process

The journey from the moment of impact to receiving a settlement check can feel like navigating a maze. But if you have a map—if you understand each step and what to expect—you can move forward with confidence and protect the value of your claim.

Let's walk through the entire process, breaking down the path to a fair settlement for a car accident injury.

Keep in mind, this timeline isn't always a straight line. Some stages might overlap, and the severity of your injuries can stretch out how long each step takes. Still, the fundamental milestones are the same for almost every claim.

Stage 1: The First 24 Hours After the Crash

What you do in the immediate aftermath of an accident lays the groundwork for your entire claim. Your absolute top priorities should be your health and getting an official record of what happened.

- See a Doctor Right Away: Even if you feel okay, get a medical evaluation. Adrenaline is a powerful pain-masker and can hide serious issues like whiplash or internal injuries that won't show symptoms for hours or even days. If you wait, the insurance company will almost certainly argue your injuries aren't from the crash.

- Report the Accident: Always call the police to the scene. An official police report is a cornerstone piece of evidence that establishes the basic, unbiased facts of the incident.

Stage 2: Kicking Off the Claim and Investigation

Once you’re medically stable, it’s time to formally start the claims process and begin gathering the proof you need to build your case. This is also when the insurance company starts its own evaluation.

You'll need to notify the at-fault driver's insurance company that you're filing a claim. They’ll assign an adjuster who will immediately start investigating. Make no mistake: their goal is to find ways to challenge liability and minimize what they might have to pay.

Your focus during this period should be on collecting every single document related to the accident and your recovery. This means medical records, every bill, photos from the scene, witness contact info, and pay stubs showing lost income.

It's crucial to remember that the insurance adjuster works for the insurance company, not for you. Their primary objective is to protect their company's bottom line, which means paying out as little as possible.

Stage 3: Building Your Case and Sending the Demand

You'll eventually reach a point doctors call Maximum Medical Improvement (MMI). This is when your condition has stabilized and your future medical needs are clear. It's the green light to calculate your total damages and finally put a number on your losses.

This calculation includes all your economic damages (medical bills, lost wages) and non-economic damages (pain and suffering). Once you have this comprehensive figure, you or your attorney will put together a formal demand letter.

This isn't just a simple note asking for money. It's a detailed legal document that lays out the facts, proves the other party’s liability, itemizes your injuries and damages, and makes a specific monetary demand for settlement. For a closer look at this crucial step, you can learn how to craft an effective settlement demand letter in our detailed guide.

Stage 4: The Negotiation Dance

Once the insurance company gets your demand letter, the negotiation phase begins. The adjuster will review everything and come back with a counteroffer. It will almost always be drastically lower than what you asked for. Don't panic; this is expected.

This back-and-forth is the heart of the settlement process. A successful outcome depends on tough negotiation backed by solid evidence. If you and the insurer can reach a number you both find acceptable, you'll sign a release form, which officially ends your claim in exchange for the payment.

If you hit a wall and can't agree, the next option is filing a lawsuit. However, it's worth knowing that the vast majority of cases—over 95%—settle long before they ever see the inside of a courtroom.

Why Most Car Accident Claims Settle Out of Court

You’ve probably seen the dramatic courtroom showdowns in movies, but when it comes to real-life car accidents, that’s rarely how it plays out. The vast majority of these claims are resolved long before a judge or jury ever gets involved, ending in a carefully negotiated settlement for a car accident injury. This isn’t a coincidence; it's a very intentional choice made by both sides for some very practical reasons.

Think of it this way: a trial is a high-stakes gamble. You could hit the jackpot, or you could walk away with nothing after pouring months, or even years, into a stressful legal battle. A settlement, on the other hand, is a sure thing. It takes all that uncertainty off the table and gives everyone a predictable outcome.

For the person who's been injured, the advantages are immediate and personal. For the insurance company, it’s all about cold, hard risk management.

Why You (The Plaintiff) Would Want to Settle

When you’re trying to recover from an injury, the last thing you need is a prolonged, exhausting fight. The reasons an injured person chooses to settle are usually rooted in a desire for security and a faster path back to normalcy.

Here’s what it boils down to:

- A Guaranteed Payout: A settlement means you get a definite amount of money, period. A jury is a wild card; you can have the strongest case in the world and still lose.

- Getting Paid Sooner: Trials can take years to get to court, and all that time, the medical bills are piling up and you might not be able to work. A settlement gets you the funds you need much, much faster.

- Avoiding the Stress and Expense: Going to trial is not just expensive—with court fees and expert witness costs—it's also an incredible emotional drain. Settling lets you avoid all of that.

Why the Insurance Company Wants to Settle

Insurance companies are massive businesses built on one thing: calculating risk. A trial is one of the biggest, most unpredictable risks they face, and they’ll do almost anything to avoid it. For them, settling isn't about fairness; it's a strategic business decision.

An insurance company's biggest fear is a "runaway jury"—a sympathetic panel that hands down a verdict far bigger than anyone expected. Settling is their way of taking that multi-million dollar possibility off the board.

At the end of the day, insurers want to control their losses. A trial means paying their own lawyers for countless hours, plus staring down the barrel of a potentially massive verdict. It’s no surprise that most cases end in an agreement. In fact, some data shows that as few as 4% of personal injury cases actually make it to a trial verdict. If you're curious about the numbers, you can find more personal injury law statistics on Clio.com.

By settling, the insurance company closes the file for a fixed, manageable number and moves on to the next claim. It’s just good business for them.

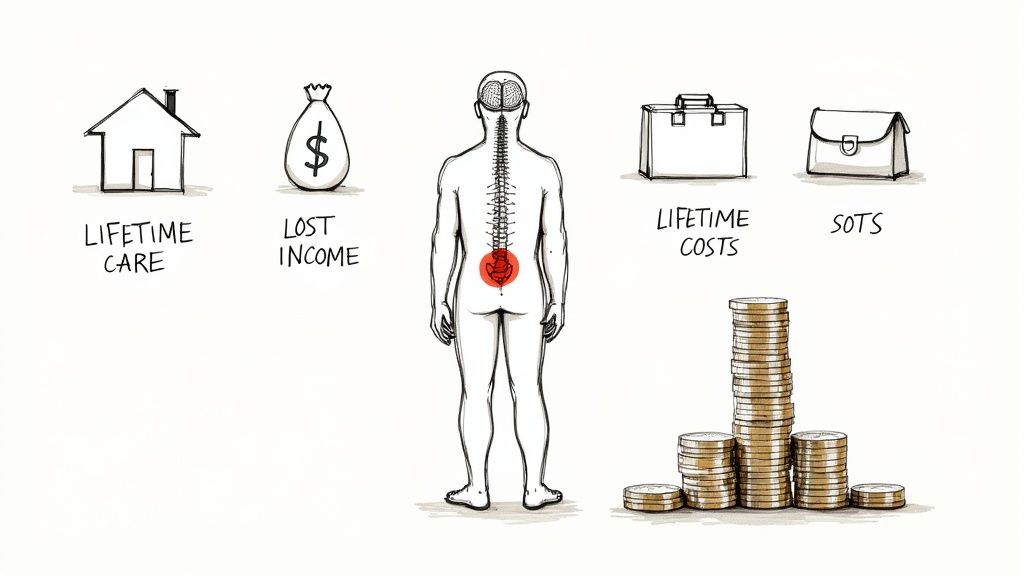

Understanding High-Value Catastrophic Injury Claims

Not all injuries are created equal. When a car accident leads to a catastrophic injury, the settlement process is a whole different ballgame. We’re not talking about sprains or simple fractures here; we're talking about life-altering harm that permanently reshapes a person's future.

A catastrophic injury is one that leaves the victim with permanent disabilities, serious disfigurement, or a lifelong dependency on medical care. Think of devastating outcomes like a traumatic brain injury (TBI) that impairs cognitive function, spinal cord damage causing paralysis, severe burns, or the amputation of a limb. It’s no surprise that these claims command the highest settlement amounts—the damages are immense and last forever.

Valuing a Lifetime of Losses

Putting a number on a catastrophic injury claim is far more complicated than just totaling up past medical bills. The entire focus shifts to forecasting a lifetime of future needs. This requires a specialized, evidence-based approach to secure a fair settlement for a car accident injury.

Several key components have to be meticulously calculated:

- Lifelong Medical Treatment: This covers everything from future surgeries and medications to in-home nursing, physical therapy, and assistive devices like wheelchairs or home modifications.

- Permanent Disability: This is compensation for the permanent loss of physical or mental function.

- Lost Future Income: If the victim can no longer work, this calculation projects their lost earnings over what would have been their entire career.

- Profound Pain and Suffering: The non-economic damages are massive, reflecting a permanent loss of independence and the simple joys of life.

Because the stakes are so high, these cases often require a team of expert witnesses to prove the full extent of the damages. Life care planners create detailed reports outlining future medical needs and costs, while economists project lost earning capacity into the millions.

These expert-driven calculations are what build the foundation for multi-million dollar demands. Catastrophic car accident injuries consistently drive the highest settlements, often surpassing $2 million and sometimes reaching into the tens of millions. One landmark case resulted in a $36.4 million verdict for a woman who was T-boned and suffered injuries requiring extensive long-term care.

You can see more examples in these insights on major personal injury payouts. These significant outcomes reflect the true, devastating cost of a catastrophic event. Without this level of detailed proof, victims would be left with settlements that cover only a fraction of their lifelong needs.

Answering Your Top Questions About Car Accident Settlements

When you're dealing with the aftermath of a car wreck, you're bound to have a lot of questions. Getting straight answers is the first step toward feeling in control again. Let's tackle some of the most common concerns we hear from folks across Texas.

How Long Do I Have to File an Injury Claim in Texas?

In Texas, the clock is ticking from the moment of the crash. You generally have two years to file a personal injury lawsuit. This legal deadline is called the statute of limitations.

Miss that two-year window, and the courthouse doors will almost certainly slam shut on your right to compensation. That’s why it’s so important to get the ball rolling well before the deadline. You need time to investigate what happened, gather all your evidence, and negotiate properly.

Will I Have to Pay Taxes on My Car Accident Settlement?

Good news on this front: for the most part, no. The IRS doesn't treat money you receive for physical injuries or to cover medical bills and property damage as taxable income. The core parts of your settlement are usually tax-free.

That said, there are a few exceptions where Uncle Sam might want a cut:

- Lost Wages: If you get a specific amount to cover lost income, that portion may be treated like regular wages and taxed accordingly.

- Emotional Distress: Compensation for emotional distress can be taxable if it isn't directly tied to your physical injuries.

- Punitive Damages: These are rare, but if you're awarded punitive damages (designed to punish the other party), that money is almost always considered taxable.

When in doubt, it’s always smart to run it by a tax professional who can look at your specific numbers.

What Happens if the Other Driver Doesn't Have Enough Insurance?

This is a scenario that plays out all too often. You could be facing serious medical bills, only to find out the at-fault driver has a bare-bones policy that won't even scratch the surface of your losses.

If you find yourself in this situation, the first place to look is your own insurance policy. You’ll want to see if you have Underinsured Motorist (UIM) coverage. This is coverage you buy for yourself precisely for this kind of problem—it steps in to cover the gap when the other driver's insurance falls short.

Don't guess what your case is worth. Verdictly provides access to real Texas court records and settlement data, so you can benchmark your claim and negotiate from a position of strength. Explore similar cases and understand your potential outcome.

Related Posts

What to Do After a Hit and Run Car Accident in Texas

A complete guide on what to do after a hit and run car accident in Texas. Learn the critical first steps, your legal options, and how to file a claim.

Calculating pain and suffering car accident: A Practical Guide to Damages

Learn how calculating pain and suffering car accident damages works, with factors and tips to maximize your settlement.

Pain and Suffering Calculation (pain and suffering calculation): Texas Damages

Explore how the pain and suffering calculation works in Texas, including multiplier and per diem methods, to help you estimate your settlement.