Someone Hit My Car and Drove Off a Texas Driver's Guide

Someone hit my car and drove off? Get your complete Texas guide on immediate steps after a hit-and-run, from police reports to using UM insurance claims.

When someone hits your car and drives off, it’s a jarring experience. The shock and anger can be overwhelming, but what you do in the next few minutes is absolutely crucial. Your immediate goals are simple: get to safety, gather what evidence you can, and get the police involved. These first few steps lay the groundwork for everything that follows, especially your insurance claim.

Your Immediate Action Plan After a Hit-and-Run

The moments after a hit-and-run are chaotic. Your adrenaline is pumping, and it’s natural to feel a mix of panic and frustration. The best thing you can do is take a deep breath and try to focus. A calm, methodical approach is your best defense—it protects you and strengthens your case later on.

First things first: get yourself and your vehicle out of danger. If you're on a highway or a busy street, don't stop in the middle of a lane. Guide your car to the shoulder, a nearby side street, or the first safe, well-lit place you can find. As soon as you stop, flick on your hazard lights. Before you even think about opening your door, check your mirrors to make sure traffic is clear.

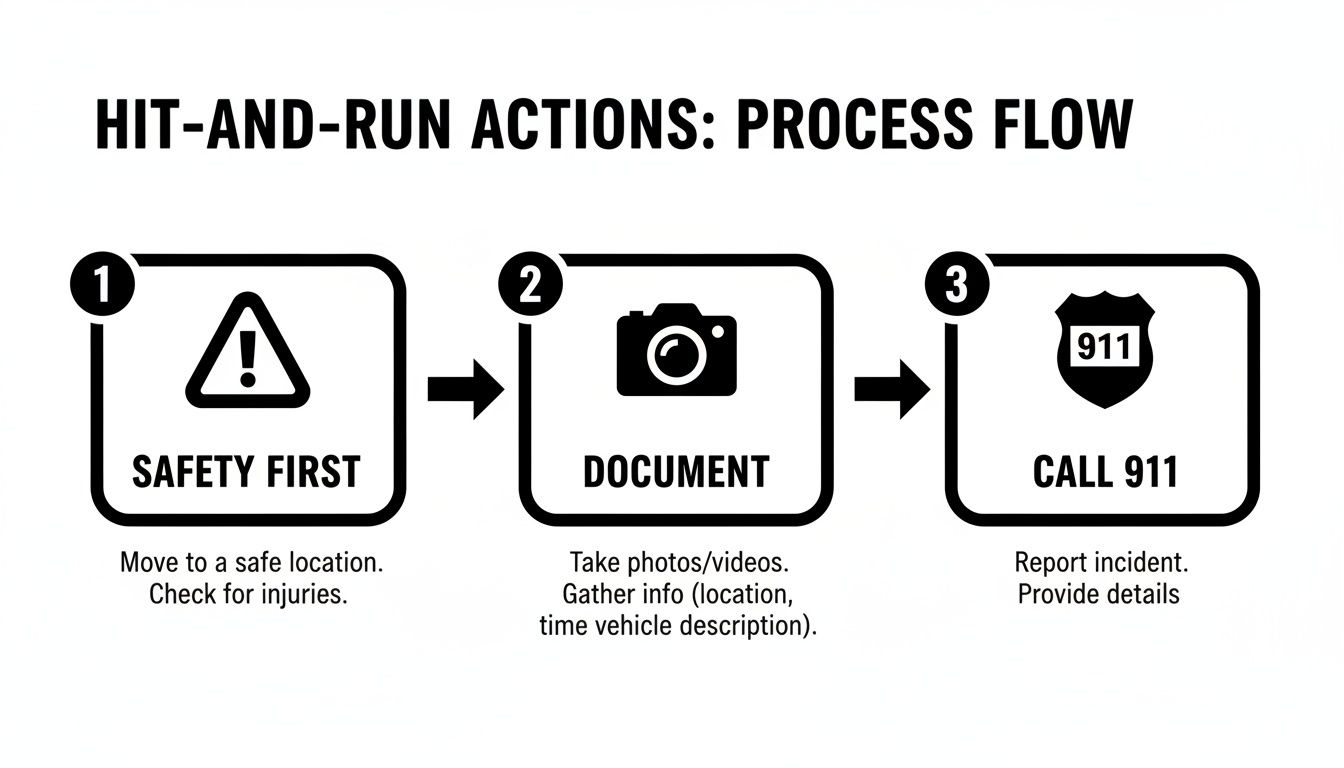

This simple flow chart breaks down the three most important things to do right away.

Think of it this way: safety first, then evidence, then the official report. Following this sequence sets you up for the best possible outcome.

To make it even clearer, here’s a quick checklist you can mentally run through at the scene.

Immediate Hit-and-Run Checklist

| Priority Action | Why It's Critical | Key Details to Note |

|---|---|---|

| Move to Safety | Prevents a secondary accident and protects you from oncoming traffic. | Pull over to the shoulder or a side street. Turn on hazard lights. |

| Check for Injuries | Your well-being is the top priority. Adrenaline can mask pain. | Note any pain, dizziness, or discomfort, no matter how minor it seems. |

| Note Vehicle Details | This is your best chance to identify the fleeing driver. | License plate (even partial), make, model, color, and any unique features. |

| Look for Witnesses | Independent accounts can corroborate your story and provide missing details. | Get names and phone numbers of anyone who saw what happened. |

| Call 911 | Creates an official record essential for insurance and any legal action. | Tell the dispatcher it was a hit-and-run and provide your exact location. |

Running through these steps helps ensure you don’t miss anything important while you're still processing the event.

Document Key Details of the Fleeing Vehicle

As the other car speeds away, your memory becomes the single most important evidence-gathering tool you have. Try to lock in as many details as you can. Don't stress about getting a perfect description; every little piece of information can be a huge help to the police.

Try to focus on recalling these key things:

- License Plate Number: This is the jackpot. Even a partial plate number is incredibly useful. If you can catch the state, even better.

- Vehicle Description: What was the make, model, and color? Think "blue Ford F-150" or "older white Honda Civic."

- Identifying Features: Was there anything unique about it? A dented fender, a weird bumper sticker, a roof rack, or maybe damage from hitting your car? These details help police pick it out from a crowd of similar vehicles.

- Direction of Travel: Where did they go? Note which street they turned on or the general direction they were heading.

Unfortunately, you're not alone in this experience. Hit-and-runs make up a startling 11-13% of all police-reported crashes each year. Even more tragically, 25% of pedestrian deaths in 2023 were caused by hit-and-run drivers.

Why You Must Call the Police

I get it—if the damage looks minor, you might be tempted to just let it go and avoid the hassle. That's a huge mistake. A formal police report isn't just a good idea; it's a non-negotiable document for your insurance claim.

This report is the official, objective proof that the accident actually happened the way you say it did. It's the key piece of evidence you'll need when filing your claim, especially when you're trying to navigate the complexities of an uninsured driver accident. Without that police report, your insurance company has an easy reason to question the claim or deny it altogether.

Gathering Evidence When the Other Driver is Gone

The shock of realizing someone hit my car and drove off can be overwhelming. But what you do in the next few minutes is absolutely critical. Since the other driver isn't there to exchange information, you've just become the lead investigator of your own accident. The evidence you gather right now can make or break your insurance claim.

Your smartphone is your best friend in this situation. Before you move anything or touch a single piece of debris, start taking photos and videos. This creates an immediate, timestamped record of the scene just as you found it.

Don't settle for just a couple of quick pictures of the dent. You need to build a complete visual story that leaves no room for questions.

Your Smartphone is Now a Forensics Tool

Think of yourself as a crime scene investigator. Your job is to capture both the big picture and the tiny details. Start with wide shots to establish the scene, then zoom in on the specifics. This gallery of images will be invaluable for the police and your insurance adjuster.

Here’s a practical shot list I recommend to clients:

- The Big Picture: Get wide-angle photos from every direction. You want to capture the whole intersection or the layout of the parking lot, including any traffic signs or speed limit postings.

- Your Car's Position: Show exactly where your car was when it was struck. These photos help tell the story of how the collision actually happened.

- The Damage, Up Close: Take detailed shots of the impact area on your car from several angles. Get in close to photograph any paint transfer, deep scrapes, or dents. For scale, place a common object like a car key or a coin next to the smaller marks.

- Scattered Debris: Hunt for any pieces that might have fallen off the other car. A broken shard from a headlight, a chunk of a plastic bumper, or even paint chips can be clues for the police to identify the make and model of the car that fled. Photograph them where they lie before collecting them.

This might feel like overkill in the moment, but this level of detail provides powerful proof that validates your story when you have to report it.

The Search for Witnesses and Cameras

Photos and videos are a fantastic start, but they don't tell the whole story. Eyewitnesses or security footage can fill in the blanks and might even help identify the driver who left you behind. You have to move fast—people walk away and camera footage gets deleted.

Look around immediately. Did someone on the sidewalk see what happened? Was another driver waiting at the light who might have seen the impact? Approach them calmly and politely.

When you talk to a potential witness, try to avoid asking leading questions. Instead of saying, "You saw that blue sedan hit me, didn't you?" ask something more open-ended, like, "Excuse me, did you happen to see what just happened here?" This keeps their account unbiased, which makes it far more credible.

If they saw something, get their name and phone number. A simple, "The person drove off, and my insurance will need a witness. Would you be willing to share your contact info?" is usually all it takes.

Next, shift your focus to technology. Scan the entire area for any cameras that might have caught the incident. Your search should include:

- Business Security Cameras: Check nearby storefronts, especially those with cameras pointed toward the street or parking lot.

- Traffic & City Cameras: Look at nearby intersections for red-light cameras or other traffic-monitoring devices.

- Doorbell Cams: In residential areas, Ring and Nest cameras on nearby homes are often a goldmine of information, potentially capturing the car as it sped away.

When you spot a potential camera, go talk to the business owner or homeowner right away. Explain that someone hit your car and fled, and politely ask if they can check their footage from a specific time. Keep in mind that many systems automatically overwrite recordings after 24 to 72 hours, so you can't afford to wait. Securing that video could be the single most important thing you do to find the person responsible.

Getting the Authorities and Your Insurer Involved

Once the initial shock of the hit-and-run starts to fade, it’s time to shift gears and focus on the official side of things. You’ve gathered what you can from the scene, and now you need to create the two documents that will become the foundation of your recovery: the police report and the insurance claim. This is the point where a personal crisis becomes an official record.

Getting this part right is crucial. A simple misstep here can bog down your claim or, in a worst-case scenario, even lead to a denial. Think of these two reports as separate but equally vital pillars holding up your right to get compensated.

Why You Absolutely Must File a Police Report

Let me be direct: filing a police report after a hit-and-run isn't just a good idea—it's essential. Your insurance company will almost certainly demand an official report to even begin processing a hit-and-run claim, particularly one involving your Uninsured Motorist coverage. It’s the independent, third-party proof that a crime (fleeing the scene) actually happened.

When you talk to the officer, lay out all the details you’ve managed to collect:

- Any part of the vehicle description you caught—make, model, color, even a partial license plate number.

- The photos you snapped of the damage and the surrounding area.

- Contact info for anyone who saw what happened.

- The precise time and location of the collision.

Stick to the facts. It’s easy to want to fill in the blanks, but avoid guessing about things like the other driver’s speed or intentions. Your only job is to provide a clear, factual account.

Before the officer leaves, make sure you get the police report number. This is non-negotiable. Your insurance adjuster will need it to move forward.

Notifying Your Insurance Company—Promptly

With the police report filed, your very next call should be to your insurance provider. Read your policy, and you’ll likely find a clause that requires you to report accidents "promptly." In real-world terms, that usually means within 24 hours. If you wait too long, you’re just giving them a potential reason to question your claim.

Have your policy number and that all-important police report number handy when you call. You'll be connected with a claims adjuster who will handle your case from here on out. Pay close attention to what you say in this first conversation.

Keep your initial statement to the insurer short and to the point. Just say, "I was the victim of a hit-and-run," then provide the date, time, location, and police report number. Don't volunteer information or say things like "I'm okay" or "I don't think I'm hurt." Adrenaline is a powerful pain-masker, and injuries can surface hours or even days later.

This isn't about being dishonest; it's about being smart and protecting your options. You're reporting the known facts of the incident, not making a final diagnosis of your physical condition.

Uninsured Motorist Coverage: Your Financial Backstop

This is the moment your insurance policy really proves its worth. When a driver hits you and flees, they are treated as an uninsured motorist (UM) by default. Your own Uninsured Motorist coverage is designed for precisely this situation. It’s there to cover the costs that the at-fault driver’s insurance should have paid.

In Texas, your UM coverage is designed to help with:

- Property Damage: This is what pays to get your car repaired, up to your specific policy limits.

- Bodily Injury: This can help with medical expenses, wages you lose from being unable to work, and even compensation for pain and suffering.

For many hit-and-run victims, filing a UM claim is the only practical way to get their car fixed and medical bills handled without draining their own bank account. This is exactly why carrying enough UM coverage is so critical.

When someone hits your car and takes off, you're suddenly in the middle of a frustrating claims process. Based on Verdictly’s AI analysis of Texas court records from 2015-2025, hit-and-run cases account for a staggering 35% of verdicts in the DFW metroplex. While property-only settlements often land in the $3,000 to $8,000 range, that figure can easily shoot past $30,000 if there are documented injuries. For a broader view, you can review the latest NHTSA data on traffic fatalities to understand national accident trends.

Understanding What Your Texas Claim Is Worth

Once the initial shock of a hit-and-run wears off, the financial reality starts to sink in. Someone just damaged your property—and maybe injured you—and then vanished, leaving you to figure out how to cover repairs, medical bills, and all the other costs that pop up. The good news is that in Texas, you have the right to go after compensation for these losses, which the law calls "damages."

Knowing what these damages include is the first real step toward figuring out what a fair settlement should look like. This isn't just about getting a check for your car's bumper; it's about being made financially whole after an incident that wasn't your fault.

The Two Main Types of Damages

When you're dealing with a Texas car accident claim, compensation is typically split into two big buckets: economic and non-economic damages. The easiest way to think about it is tangible versus intangible losses. Both are critical for calculating the true value of your claim.

Economic damages are the straightforward, out-of-pocket costs you can prove with receipts and invoices. They have a clear paper trail and include things like:

- Vehicle Repair or Replacement: This is the cost to fix your car. If it’s totaled, this would cover its actual cash value right before the crash.

- Medical Bills: Think of everything from the ambulance ride and ER visit to physical therapy, chiropractor appointments, and prescriptions.

- Lost Wages: If your injuries kept you from working, you can claim the income you lost during that time. This is a huge deal for anyone who can't earn a living if they're not physically on the job.

Non-economic damages, on the other hand, are for the harms that don't come with a price tag. They are just as real and compensate you for how the accident has personally impacted your life. These often include:

- Pain and Suffering: This accounts for the physical pain and emotional toll your injuries have caused.

- Mental Anguish: A traumatic event like a hit-and-run can lead to very real anxiety, stress, or even PTSD. This is meant to compensate for that.

A Look at What's Claimed in a Typical Hit-and-Run

To make this clearer, let's break down the common types of damages and what they actually cover in a real-world scenario.

Typical Hit-and-Run Damage Claims in Texas

| Type of Damage | What It Covers | Example |

|---|---|---|

| Property Damage | Cost to repair or replace your vehicle. | A body shop quote for $4,500 to fix a smashed rear quarter panel and bumper. |

| Medical Expenses | All treatment costs related to the accident. | ER visit, X-rays, physical therapy sessions, and pain medication totaling $8,000. |

| Lost Income | Wages you missed while unable to work. | Missing two weeks of work at $1,000/week, resulting in a $2,000 loss. |

| Pain and Suffering | Compensation for physical discomfort and emotional distress. | Chronic neck pain from whiplash that disrupts sleep and daily activities. |

| Mental Anguish | The psychological impact, like anxiety or fear of driving. | Developing a persistent fear of driving in parking lots after being hit. |

As you can see, the claim goes far beyond just the car's repair bill. A full and fair settlement should address every single way this incident has cost you.

A Real-World Scenario in Dallas County

Let’s put this into practice. Imagine you’re in a Dallas parking lot, and someone slams into the back of your car and then floors it. The jolt leaves you with whiplash—a common but miserable injury. Suddenly, you’re dealing with a damaged car, medical bills from a chiropractor, and you’ve had to miss a full week of work.

So, how much is a claim like that actually worth? There's no magic number. It all comes down to the specific details of your case, how bad your injuries are, and what kind of proof you have. This is where looking at real data becomes so important.

A hit-and-run does more than just dent your car; it can turn your life upside down. This is a daily reality for drivers in Texas, especially in the DFW metroplex. In fact, over 50% of motor vehicle cases in Verdictly’s 2015-2025 court compendium are from rear-end or parking lot hit-and-runs. When victims can prove who was at fault with witness testimony or camera footage, the median injury awards for conditions like herniated discs can hit $20,000 to $50,000. You can explore more global insights on the impact of road traffic injuries from the World Health Organization.

This data is proof that even injuries that seem "minor" at first can lead to significant compensation when you have the evidence to back it up.

Using Data to Set Realistic Expectations

It’s almost impossible to know if an insurance company’s first offer is fair or if they're just trying to get rid of your claim cheaply. This is where having access to real case data gives you a serious edge. Tools like Verdictly work by compiling public court records, which lets you see what similar cases in your own county have actually paid out.

For example, by filtering for "Dallas County," "rear-end collision," and "whiplash/neck injury," you can find a range of verdicts and settlements. This kind of information is not a substitute for professional legal advice, but it does give you a powerful benchmark. It changes the conversation from a guessing game to a data-driven negotiation. To get a better handle on this, check out our guide on how to calculate what your car accident is worth.

Armed with an insight like knowing that Harris County verdicts have seen an average 15% higher payout post-2020 because juries are more sympathetic in hit-and-run cases, you have serious leverage. That kind of knowledge helps you and your attorney build a much stronger case and ensures you don't walk away with less than you deserve.

Knowing When to Hire a Car Accident Attorney

After someone slams into your car and takes off, you're left holding the bag. It's a frustrating, often overwhelming, experience. You've done the right things so far—you secured the scene, filed a police report, and called your insurance company. Now comes the hard part, and you might be wondering if you can handle the claim yourself.

Honestly, for a minor dent with no injuries, you probably can.

But when things get complicated, the game changes fast. An attorney isn't just for suing people. They become your advocate, your shield against an insurance company whose primary goal is to protect its own profits by paying you as little as possible.

Red Flags That Signal You Need Legal Help

There are a few tell-tale signs that should have you immediately picking up the phone to call a professional. If you run into any of these roadblocks, going it alone could mean leaving thousands of dollars in deserved compensation on the table.

Here are the most common signs that it's time to get a lawyer involved:

- Significant Injuries: If you or a passenger got hurt—and I mean anything more than a few scrapes—you need legal counsel. Things like whiplash, a sore back, or even a mild concussion can have serious, long-term consequences. An attorney makes sure your future medical care is priced into any settlement.

- A Lowball Settlement Offer: Insurance companies love to make a quick, low offer right out of the gate. They’re hoping you’re desperate enough to take it and just go away. If their offer doesn't even cover your car repairs, let alone your medical bills or lost time at work, that’s a massive red flag.

- Claim Denial or Delays: Is your own insurance company giving you the runaround on your Uninsured Motorist claim? Maybe they keep asking for the same documents over and over, or they've gone completely silent. These are classic stall tactics designed to wear you down until you give up.

- Disputes Over Fault: This one seems crazy in a hit-and-run, but it happens. An insurer might try to argue you were somehow partially to blame to justify cutting their payout. A good lawyer will take the evidence you collected and shut that argument down, proving the other driver was 100% responsible.

Think of it this way: the insurance adjuster is paid to protect their company's bottom line. Your attorney’s only job is to protect yours.

The Strategic Advantages of Hiring an Attorney

Bringing a lawyer into the picture does more than just stop the insurance company's games. A skilled attorney takes over the whole stressful process, giving you strategic advantages that can completely change the outcome of your hit-and-run case.

They become your single point of contact, handling every phone call and email from adjusters so you can actually focus on getting better. They also track all the critical legal deadlines. For example, in Texas, you generally have a two-year statute of limitations to file a personal injury lawsuit from the date of the accident. If you miss that window, your right to sue is gone forever.

An attorney acts as your investigator, negotiator, and legal guide. They can subpoena security footage from a gas station that won't cooperate, track down witnesses you might have missed, and even bring in accident reconstruction experts to prove exactly what happened. This is a level of evidence-gathering that’s nearly impossible to do on your own.

On top of all that, a lawyer knows how to properly calculate the full value of your claim. They’re experts at putting a number on the "non-economic" damages like pain and suffering, which are often the largest part of a settlement. They’ll build a comprehensive demand package—backed by medical records, expert reports, and real-world data—to force the insurer to negotiate from a position of strength, not weakness.

Making the Right Choice for Your Case

While a tool like Verdictly gives you powerful data to see what your case might be worth, it’s meant to inform your strategy, not replace a legal professional. An attorney uses this kind of data every day to build a rock-solid argument, fight on your behalf, and take the insurance company to court if they refuse to be fair.

The decision to hire a lawyer is yours, but it's often the single most important move you can make to get a just outcome. When the stakes are high, especially when you've been injured, having an expert in your corner is your best bet.

If you're thinking about taking this step, it's smart to know what you're looking for. We put together a guide that walks you through how to pick a personal injury lawyer who is the right fit for you and your case. The good news is that most work on a contingency fee basis, which means you don't pay a dime unless they win.

Answering Your Texas Hit-and-Run Questions

When someone hits your car and takes off, you're left with a damaged vehicle and a ton of questions. The legal and insurance side of things can feel like a maze, especially when you're already stressed out. Let's clear up some of the most common concerns that pop up after a Texas hit-and-run.

Will a Hit-and-Run Claim Make My Insurance Rates Go Up?

This is probably the first thing that crosses your mind after a hit-and-run. Fortunately, Texas law is on your side here. Insurers are legally prohibited from raising your rates for an accident you didn't cause, as long as you have reasonable proof you weren't at fault.

That police report you filed? It's your most important ally. It officially documents the crash as a hit-and-run, a crime committed by the other driver. When you file a claim under your Uninsured Motorist (UM) coverage, you’re using a protection you paid for, not admitting fault. So, while every policy is slightly different, the law provides a strong shield against a rate hike.

What Happens If the Police Actually Find the Driver?

If you get that call from the police saying they’ve found the driver who fled, the whole game changes—for the better. For starters, that driver is now facing serious criminal charges for leaving the scene of an accident, which can give your civil claim a lot more leverage.

Even better, you can now pivot your strategy. Instead of making a claim against your own Uninsured Motorist coverage, your attorney can go directly after the at-fault driver's liability insurance. This is almost always the preferred path because their policy might have higher limits, offering a better chance at getting you fully compensated for all your damages, from car repairs to medical bills.

This is a critical moment where having a good attorney really pays off. They can immediately switch gears, handle all the communication with the other driver's insurance, and get the new claim filed without missing a beat. This move keeps your own insurance record clean and often opens the door to a much better settlement.

Essentially, finding the driver turns your claim from a frustrating case against a ghost into a standard at-fault accident case, dramatically improving your odds of a full recovery.

What If I Don’t Have Uninsured Motorist Coverage?

This is a tough spot to be in. Realizing you don’t have Uninsured Motorist (UM) coverage after a hit-and-run seriously limits your options. That safety net just isn't there.

For fixing your car, your only real choice is to use your Collision coverage. It will get the repairs done, but you'll have to pay your deductible—which could be $500, $1,000, or even more—right out of your pocket.

The bigger problem is that Collision coverage does nothing for injuries. It's strictly for property damage. To get your medical bills paid, you'll have to rely on other sources:

- Personal Injury Protection (PIP): If you have it, PIP is a lifesaver. It helps cover medical costs and some lost wages, no matter who was at fault.

- Health Insurance: Your personal health plan can cover your treatment, but you’ll still be on the hook for deductibles and co-pays.

Without UM coverage, getting compensated for things like pain and suffering becomes nearly impossible unless the other driver is found and has assets you can sue for. This is exactly why we always tell Texas drivers that UM coverage is a must-have.

How Long Do I Have to File a Hit-and-Run Claim in Texas?

Time is not on your side after an accident. In Texas, you're dealing with two different clocks, and if you let either one run out, you could lose your right to compensation.

First, your insurance policy has its own deadline. Most policies require you to report an accident "promptly." While that sounds a bit vague, the best practice is to notify both the police and your insurer within 24 hours. If you wait too long, the insurance company might get suspicious and look for reasons to deny your claim.

The second, non-negotiable deadline is the Texas statute of limitations. This law gives you exactly two years from the date of the accident to file a lawsuit for personal injuries. If you miss that two-year window, you're out of luck. The courts will throw out your case, and your right to sue is gone forever.

Navigating a hit-and-run claim requires clarity and confidence. Verdictly provides access to real Texas court verdicts and settlements, empowering you with the data you need to understand what your case could be worth. Level the playing field and negotiate from a position of knowledge by exploring our database at https://verdictly.co.

Related Posts

Hit and Run What Happens: Steps After an Accident - hit and run what happens

Hit and run what happens: A concise guide to immediate actions, the investigation process, and how to pursue fair compensation. (hit and run what happens)

What to Do After a Hit and Run Car Accident in Texas

A complete guide on what to do after a hit and run car accident in Texas. Learn the critical first steps, your legal options, and how to file a claim.

A Texas Guide to Your Hit and Run Auto Accident Claim

Involved in a hit and run auto accident in Texas? This guide walks you through the critical steps, your legal rights, and how to value your claim.