Uninsured Driver Accident: What to Do Next — uninsured driver accident tips

Dealt with an uninsured driver accident? Learn essential steps, how to file a claim with your insurer, and options to recover damages.

When you’re in a car wreck, the last thing you want to hear is that the other driver doesn't have insurance. An uninsured driver accident is exactly what it sounds like: a crash caused by someone with no liability coverage, leaving you wondering who's going to pay for your damaged car and medical bills.

It feels like hitting a brick wall, but there's often a built-in solution you might not even know you have. The answer usually lies within your own insurance policy.

What an Uninsured Driver Accident Really Means for You

The normal post-accident script gets thrown out the window when the at-fault driver is uninsured. You can't just call their insurance company and start a claim. So, what’s next?

Fortunately, your own Uninsured Motorist (UM) coverage is designed for this exact moment. Think of it as a safety net you’ve been paying for all along. Instead of chasing down a driver with no insurance and no assets, you turn to your own insurance provider to cover your losses. Your claim simply shifts from their (non-existent) insurance to your own.

This Isn’t a Rare Problem

Getting hit by an uninsured driver is more common than you might think. According to a 2023 report, a staggering 15.4% of drivers on U.S. roads are uninsured. That's more than one out of every seven cars you pass on your daily commute.

For more details on this growing issue, the Insurance Research Council offers in-depth analysis of national and state-specific trends. These numbers highlight just how critical it is to have your own coverage in place.

While getting compensated after this kind of accident is absolutely possible, the dynamic is different. Now, you’re negotiating with your own insurance company. Even though you're a loyal customer, their goal is still to pay out as little as possible. This requires you to be organized and thorough in documenting every single loss.

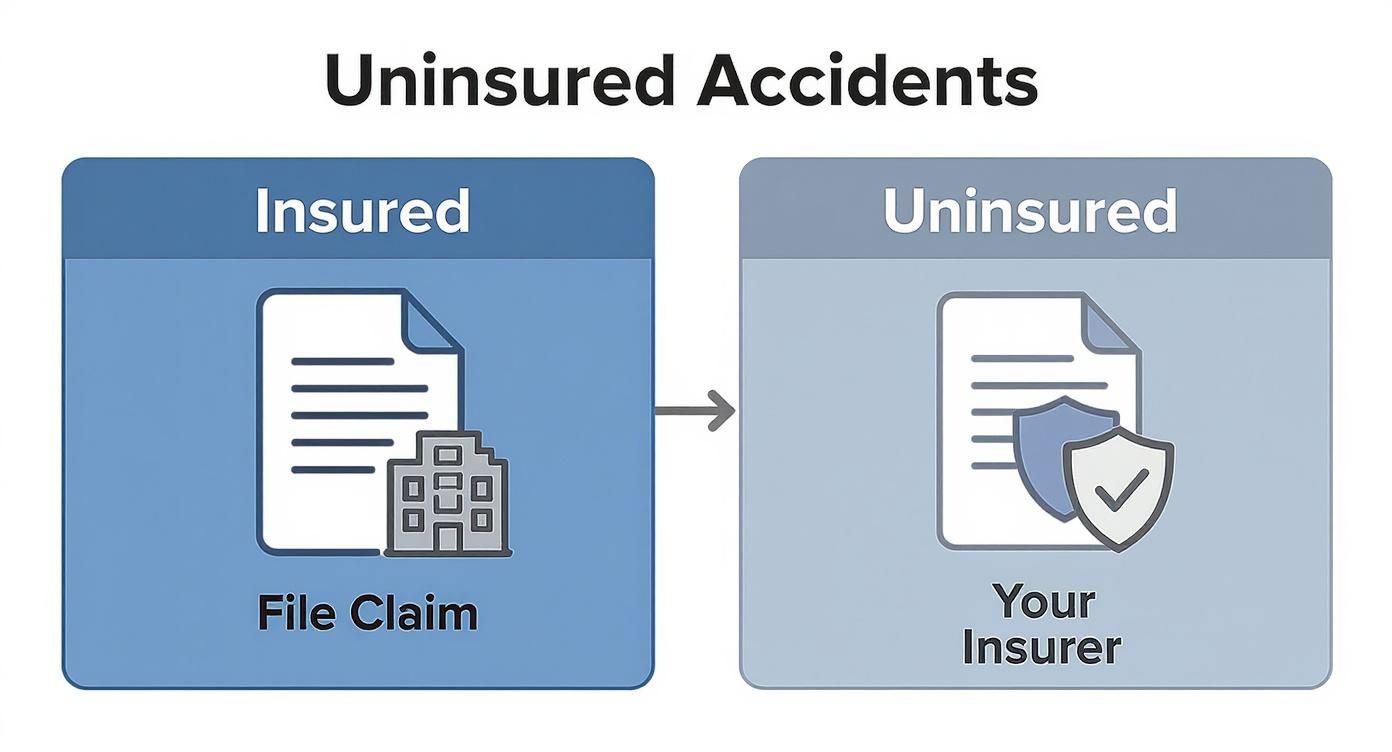

The core difference isn't whether you can get paid, but who pays you. Your claim moves from the other driver's insurance company to your own, making your UM policy the key to your recovery.

To get a clearer picture, it helps to compare the two scenarios directly. The source of the money and the claims process both change significantly.

Insured vs Uninsured Accident Claims at a Glance

This table breaks down the fundamental differences between a standard accident claim and one involving an uninsured motorist in Texas.

| Scenario | Primary Source of Recovery | Typical Process |

|---|---|---|

| At-Fault Driver is Insured | The other driver's liability insurance policy. | You file a third-party claim with their insurer, who investigates and pays for your damages. |

| At-Fault Driver is Uninsured | Your own Uninsured Motorist (UM) policy. | You file a first-party claim with your insurer, who acts as the liable party and pays for your damages. |

Understanding this distinction is the first and most important step in taking control of your claim and ensuring you get the compensation you deserve.

Your First Steps Immediately After the Crash

The moments after a car wreck are a blur of adrenaline and confusion. When you find out the other driver is uninsured, a whole new layer of stress piles on. But what you do right here, right now, at the scene of the crash, can make or break your ability to recover your losses.

Think of these next few minutes as laying the groundwork for your entire claim. Keeping a level head and methodically checking off these steps will protect you both physically and financially.

Prioritize Safety Above All Else

First things first: safety. If you can, move your car out of the flow of traffic and onto the shoulder. This one action can prevent a dangerous secondary collision.

Flip on your hazard lights immediately. Before you even think about getting out, check your mirrors and surroundings to make sure it's safe. Then, do a quick assessment of yourself and anyone else in the car for injuries.

Call 911 and Insist on a Police Report

Even for what looks like a minor fender-bender, call 911 immediately. This is absolutely non-negotiable when the other driver doesn't have insurance. The official police report is the single most important piece of evidence you'll have.

When the officer shows up, stick to the facts of what happened. Be sure to tell them the other driver admitted to having no insurance. The officer's report, with all its documented details and witness statements, becomes the foundation of your Uninsured Motorist (UM) claim with your own insurance company.

Don't ever agree to handle the crash "off the record." Uninsured drivers often try to offer cash on the spot to make the problem go away. This is a trap. The damage to your car and your body is almost always far more expensive than a few hundred dollars.

This diagram shows how the claim process works when you're hit by an uninsured driver—your own insurance policy steps in to cover you.

As you can see, your policy becomes the safety net, stepping into the shoes of the at-fault driver's missing insurance.

Document Everything Meticulously

Your phone is now your most powerful tool. There's no such thing as too many pictures or videos. Start snapping photos from every conceivable angle before anyone moves the cars.

Make sure you get shots of:

- Vehicle Damage: Get close-ups of the damage on both cars, then back up to get wider shots showing how they ended up after the impact.

- The Scene: Capture the whole area. Look for skid marks, broken glass or debris on the road, nearby traffic signs, and even the weather conditions.

- The Other Driver's Information: Take a clear photo of their driver's license and their license plate. Even without an insurance card, this is critical information.

- Visible Injuries: If you have any cuts, scrapes, or bruises, take pictures of them right away.

Get the other driver's name, phone number, and address. If anyone stopped to see what happened, get their name and number, too. A neutral witness can be incredibly helpful down the line. Just remember to be polite but firm, and never apologize or admit fault. Anything you say can be twisted and used against you later.

How Your Own Texas Insurance Policy Can Save the Day

Getting hit by a driver with no insurance feels like a dead end. It’s natural to think you're stuck with the bills, but that's usually not the case. Your own auto insurance policy is more than just liability coverage; it has a built-in safety net designed for this exact situation.

This protection is a lifesaver, especially here in Texas. When so many drivers are on the road without proper coverage, it puts a huge financial strain on everyone else. In fact, responsible drivers across the country pay an estimated $16 billion annually in extra premiums to cover this gap—that's about $100 per vehicle each year. You can dig deeper into these numbers with reports from the Insurance Research Council.

The good news is, Texas law has your back. It provides a couple of powerful tools right within your own policy to make sure you don’t have to pay for someone else’s mistake.

Uninsured/Underinsured Motorist Coverage: The Hero You Didn't Know You Had

The single most important protection you have is Uninsured/Underinsured Motorist (UM/UIM) coverage. Think of it this way: your UM/UIM coverage steps into the shoes of the at-fault driver's missing insurance. Instead of chasing down someone with no money, you file a claim with your own insurance company.

Here’s the key part: in Texas, insurance companies must offer you UM/UIM coverage. You only go without it if you've specifically signed a form rejecting it in writing. A lot of people have this coverage and don't even realize it until they need it.

UM/UIM is usually split into two parts:

- Bodily Injury (UMBI): This is the big one. It covers your medical bills, lost wages from being out of work, and compensation for pain and suffering for both you and your passengers.

- Property Damage (UMPD): This part pays to get your car repaired. Just remember, there’s a standard $250 deductible for UMPD claims in Texas.

Basically, UM/UIM makes sure there's a source of money available to cover the damages you would have rightfully claimed from the other driver's insurance, if they had any.

Personal Injury Protection: Your Financial First Aid Kit

Another crucial part of your policy is Personal Injury Protection (PIP). Just like UM/UIM, insurers have to offer it to you, and you have to reject it in writing to opt out. The great thing about PIP is that it's "no-fault," meaning it pays out quickly, regardless of who caused the crash.

Its whole purpose is to get money in your hands fast for immediate expenses, so you’re not waiting weeks or months for a final settlement to get medical care.

PIP is your first line of financial defense after a crash. It typically covers 80% of your reasonable medical expenses and a portion of your lost income, up to your policy limit—which is often $2,500 or more.

This coverage is a game-changer. While your UM claim is being investigated, PIP can provide a quick cash benefit to cover that emergency room visit, initial doctor's appointments, and the first few paychecks you miss. It’s designed to keep you afloat right after the accident.

How PIP and UM/UIM Work Together

Think of PIP and UM/UIM as two specialists on your recovery team. PIP is the medic who provides immediate first aid, and UM/UIM is the long-term specialist who manages your full recovery.

Here’s how it works in a real-world scenario:

- First, you use your PIP coverage to pay for the ambulance ride and your initial doctor appointments right away.

- At the same time, you file a claim under your UM Bodily Injury policy. This will cover the medical bills that go beyond your PIP limit and, importantly, compensate you for things like pain and suffering.

- For your car, you’ll file a UM Property Damage claim. You'll pay the $250 deductible, and your insurer will cover the rest of the repair costs.

When used together, these coverages can make a massive difference. For a real-world example of how these claims can play out, see this case where a Dallas jury awarded $300,000 in a UIM claim after a rear-end crash. Knowing how these tools work gives you the power to get back on your feet financially.

Building Your Claim and Calculating Damages

Getting hit by an uninsured driver is just the first step. Now, you have to prove your case to your own insurance company. Just telling them what happened isn’t going to cut it; you need to build a compelling claim backed by solid evidence to get the full compensation you're entitled to.

Think of it this way: you're essentially playing the role of a plaintiff's attorney, and your insurance company is acting like the defense. Your job is to gather all the proof needed to show the other driver was at fault and document every single loss you've suffered. This is how you justify the payout from your Uninsured Motorist (UM) policy.

Gathering Your Core Evidence

To build a strong foundation for your claim, you need a few critical pieces of evidence. Without them, your claim is just a story. With them, it becomes a powerful case that's hard for an adjuster to deny.

This is more than just paperwork; this is the factual backbone of your entire claim.

To make this easier, here’s a quick-glance table of what you absolutely need to collect.

Evidence Checklist for Your UM/UIM Claim

| Evidence Category | Specific Items to Collect | Why It's Important |

|---|---|---|

| Official Documentation | The official police or crash report (Form CR-3 in Texas) | This is the most crucial document. It's an unbiased account from law enforcement that often includes an initial assessment of fault and confirms the other driver's insurance status. |

| Eyewitness Accounts | Names, phone numbers, and written or recorded statements from anyone who saw the crash. | Independent witnesses are incredibly powerful. Their testimony backs up your version of events and adds credibility that can't be questioned. |

| Scene Documentation | Photos and videos of vehicle damage, skid marks, road conditions, traffic signs, and your visible injuries. | A picture is worth a thousand words. Visual evidence captures the scene in a way that words can't, providing undeniable proof of the crash's severity and circumstances. |

| Medical Records | All medical bills, treatment records, prescription receipts, and notes from doctors, physical therapists, and specialists. | This proves the extent of your injuries and directly connects them to the accident. Every bill is a piece of your economic damages puzzle. |

| Financial Records | Pay stubs showing time missed from work, a letter from your employer, and receipts for out-of-pocket expenses (e.g., medical supplies, transportation to appointments). | These documents are essential for proving lost wages and other direct financial losses you've incurred because of the accident. |

Treat this checklist seriously. The more organized and thorough you are from the beginning, the smoother the claims process will be.

Understanding and Calculating Your Damages

Once you've established fault, the next job is figuring out what you’re owed. In legal terms, your losses are called "damages." This isn't just one lump sum; it's a detailed calculation of every single way the accident has cost you, from the obvious medical bills to the less tangible human suffering.

Damages are generally split into two buckets: economic and non-economic.

Economic Damages: The Tangible Costs

These are the straightforward, black-and-white financial losses. You can add them up with a calculator because there’s a receipt, bill, or pay stub for almost everything.

Think of them as the direct hit to your wallet:

- Medical Bills: This covers the full spectrum of care—the ambulance ride, ER visit, surgeries, physical therapy, prescriptions, and even estimated costs for future medical needs.

- Lost Wages: If you couldn't work because of your injuries, you are owed that lost income. If your injuries permanently affect your ability to earn a living, you can also claim loss of future earning capacity.

- Property Damage: This is the cost to repair or replace your car and anything valuable inside it that was destroyed in the crash.

Pro Tip: Keep a dedicated folder for every single piece of paper related to your expenses. Every receipt, every bill, every explanation of benefits. An undocumented expense is an unrecoverable one.

Non-Economic Damages: The Human Cost

This is where things get more complex. Non-economic damages compensate you for the real, but intangible, suffering the accident caused. There’s no price tag for pain, but these damages are designed to acknowledge its impact on your life. They often make up the largest portion of a settlement.

For a deeper dive, our guide explains the types of damages in personal injury cases and how they're valued in Texas.

These damages account for:

- Pain and Suffering: The physical pain, discomfort, and general misery you've had to endure because of your injuries.

- Mental Anguish: This includes emotional trauma like anxiety, depression, fear, sleep loss, or PTSD that so often follows a violent car wreck.

- Physical Impairment: This compensates you for the loss of your ability to do the things you used to enjoy, whether it’s playing with your kids, hiking, or simply getting through a day without pain.

Because these losses are subjective, insurance adjusters often use formulas to come up with a number—for example, multiplying your total medical bills by a factor of 1.5 to 5, depending on how severe the injuries are. Your ability to tell a compelling story, backed by evidence, is what pushes that multiplier higher and leads to a fair settlement that truly reflects all you've been through.

Understanding Your Legal Options and Deadlines

With your evidence in hand and a clear picture of your damages, you’ve reached a critical turning point. Now, it’s about taking action to get the compensation you deserve. This means choosing the right legal path and, just as importantly, staying on top of strict deadlines that can make or break your entire case.

Essentially, you have two main routes to take after being hit by an uninsured driver: filing a claim with your own insurance company or suing the at-fault driver directly. Let's break down what each option realistically looks like.

Negotiating a Settlement with Your Own Insurer

For most people, the best and most direct route is filing a claim under your own Uninsured Motorist (UM) coverage. You’ll start by sending a formal demand letter to your insurance company, laying out all the evidence you’ve gathered and detailing the full cost of your damages.

An adjuster will review everything and then make a settlement offer. Brace yourself, because this first offer is almost always lower than what your claim is worth. Insurance companies, even yours, are businesses that want to minimize what they pay out. This is where the negotiation starts. You can—and should—reject an unfair offer and present a counteroffer, using your evidence to back up why you need more.

If they deny your claim or just won't budge on a lowball offer, you have the right to fight their decision. It can be a frustrating process, but a well-documented claim is your most powerful tool.

Remember, you aren't asking for a handout. You are claiming a benefit you have paid for with your premiums. Your Uninsured Motorist policy is a contract, and your insurer is legally required to handle your claim in good faith.

Suing the Uninsured Driver Directly

You always have the legal right to file a personal injury lawsuit against the person who caused the accident. If you take them to court and win, you’ll get a judgment—a legal order for that driver to pay you.

But here’s the harsh reality: winning in court is only half the battle. The real challenge is collecting the money. Someone who can't afford basic car insurance is extremely unlikely to have the money or assets to pay a large court judgment. You could end up with a piece of paper that says you won, but never actually see a dime. This is what's known as being "judgment proof." For this reason, suing the driver is usually a last resort, not the first plan of attack.

The Unbreakable Rule: The Statute of Limitations

In Texas, there's a hard deadline for filing a personal injury lawsuit, and it’s called the statute of limitations. For nearly all car accident cases, you have two years from the date of the crash to file your lawsuit.

This deadline is non-negotiable. If you miss it, you permanently lose your right to sue and get compensation, no matter how strong your case is. This two-year clock doesn't just apply to suing the other driver; it often applies to suing your own insurance company if they refuse to pay your UM claim fairly.

It's easy to lose track of time while you're going back and forth with an adjuster. Don't let them string you along until it's too late. The law is there to make sure these things are handled promptly.

Interestingly, while making insurance mandatory seems like a clear win, some studies reveal surprising side effects. One study found that for every 1% decrease in uninsured drivers, there can be a 2% increase in traffic fatalities. The theory is that newly insured drivers might feel less personal financial risk and drive more carelessly. You can explore more about how insurance laws impact driving habits in research from the National Bureau of Economic Research.

When Should You Hire a Car Accident Lawyer?

It might seem strange to need a lawyer to deal with your own insurance company, but that’s often the reality with an Uninsured Motorist (UM) claim. At first, you might feel capable of handling it yourself. But you can quickly find yourself in a frustrating fight with the very company you pay to protect you.

While a minor fender bender might not need a lawyer, some situations are clear red flags. An experienced attorney steps in to level the playing field, making sure your insurer treats you fairly.

Think of a lawyer as a professional advocate whose only goal is to protect your interests. This is absolutely critical when the stakes are high—like when you’ve suffered significant injuries that need ongoing medical care. The more serious your injuries and the bigger your medical bills, the more pushback you can expect from the insurance company.

Key Scenarios That Warrant Legal Help

Hiring an attorney isn't about creating conflict; it's a smart, strategic move to protect your rights when you are at your most vulnerable. It can make all the difference in the outcome of your case.

You should seriously think about calling a lawyer if:

- You have serious injuries. Any injury that puts you in the hospital, requires surgery, or needs long-term physical therapy comes with huge costs. Calculating future care and putting a number on pain and suffering is incredibly complex.

- The insurance company is fighting you. Is the adjuster questioning who was at fault? Challenging your doctor’s treatment plan? Denying the claim entirely? That’s your cue to get a professional to fight back.

- You get a lowball settlement offer. Insurance adjusters are trained to pay out as little as possible. An attorney knows how to calculate what your claim is actually worth and has the experience to negotiate for a fair amount.

An experienced lawyer takes over the entire claims process. They launch a full investigation, gather all the evidence, accurately calculate your damages, and handle every single phone call and email with the insurance company so you don't have to.

Understanding the Attorney's Role and Fees

A lawyer is both your shield and your sword. They'll build a comprehensive demand package and submit it to the insurer on your behalf. To get a better idea of what this looks like, you can see our breakdown of a sample demand letter for an auto accident.

Maybe the best part is how personal injury lawyers get paid. The vast majority work on a contingency fee basis.

This means you pay zero upfront costs. The lawyer’s fee is simply a percentage of the settlement or verdict they win for you. If they don’t get you any money, you don’t owe them anything. This system gives everyone access to expert legal help without any financial risk, so you can fight for the full compensation you deserve.

Uninsured Accident FAQs: Your Questions Answered

Getting hit by an uninsured driver can feel like a maze of confusing rules and what-ifs. Let's clear up some of the most common questions that pop up for victims in Texas.

Can I Still Recover Money if the Uninsured Driver Flees the Scene?

Yes, absolutely. A hit-and-run is incredibly frustrating, but this is precisely why you have Uninsured Motorist (UM) coverage. Think of it as a safety net designed for exactly this kind of situation.

Your main goal is to prove that an unknown "phantom" driver caused the wreck. This is where a police report becomes your most powerful tool. Get one filed immediately. Your account of what happened, backed up by witness statements and any physical evidence from the scene (like paint scrapings or debris), helps build the case for your UM claim.

Even if the other driver is long gone, your UM policy steps in to cover your losses. You aren't left holding the bag just because someone else broke the law and ran away.

Will Filing a UM Claim Make My Insurance Rates Go Up?

It shouldn't, no. Texas law is on your side here. It’s illegal for an insurance company to raise your premiums just because you filed a UM claim for an accident you didn’t cause. After all, you’ve been paying for this exact coverage for this exact reason.

Using the benefits you pay for shouldn't come with a penalty. If your insurer tries to hike your rates or add a surcharge after a not-at-fault claim, that’s a red flag. You have the right to file a complaint with the Texas Department of Insurance.

Can I Sue the Uninsured Driver Personally?

Legally, yes, you can file a lawsuit. But there’s a huge gap between winning a judgment and actually collecting any money.

Here's the unfortunate truth: someone driving without insurance is very unlikely to have the money or assets to pay what a court says they owe you. You might win the case and get a piece of paper confirming the debt, but you may never see a dime. That's why your Uninsured Motorist (UM) coverage is almost always the most realistic and reliable path to getting compensated. It provides a real source of funds when the at-fault driver has none.

Navigating the aftermath of a car wreck is tough, but data can bring clarity. Verdictly provides access to real Texas motor vehicle verdicts and settlements, helping you understand what similar cases are worth. See what others have recovered and approach your negotiations with the power of information. Explore case outcomes today at https://verdictly.co.

Related Posts

What to Do After a Hit and Run Car Accident in Texas

A complete guide on what to do after a hit and run car accident in Texas. Learn the critical first steps, your legal options, and how to file a claim.

Calculating pain and suffering car accident: A Practical Guide to Damages

Learn how calculating pain and suffering car accident damages works, with factors and tips to maximize your settlement.

Pain and Suffering Calculation (pain and suffering calculation): Texas Damages

Explore how the pain and suffering calculation works in Texas, including multiplier and per diem methods, to help you estimate your settlement.