Hit and Run What Happens: Steps After an Accident - hit and run what happens

Hit and run what happens: A concise guide to immediate actions, the investigation process, and how to pursue fair compensation. (hit and run what happens)

When you're reeling from a hit-and-run, the chaos can feel paralyzing. Your first move, however, is simple and critical: prioritize your safety and call 911 immediately. This one call sets everything in motion—getting medical help, alerting the police, and creating the official record you'll need for insurance.

The First 24 Hours After a Hit and Run

The moments right after a hit-and-run are a blur of adrenaline and confusion. It's easy to feel completely lost. But what you do in that first day is incredibly important, laying the groundwork for your physical recovery and any future insurance or legal claims.

The driver who fled left you with more than just a damaged car; they left you with physical injuries, emotional shock, and a mountain of uncertainty. While overall traffic fatalities in the US saw a small drop in 2023, hit-and-runs are a stubborn, tragic problem, figuring into 11% of all deadly crashes. Texas has a particularly tough time with this, as these incidents accounted for 15% of urban crashes in 2023 in major commuter hubs like Dallas-Fort Worth.

Your first gut reaction might be to go after the car that hit you. Don't. It's the most dangerous thing you can do. Your absolute top priority is your safety and the safety of anyone else in your car.

Your Immediate Hit and Run Action Checklist

Staying at the scene and taking methodical steps is the best way to protect yourself. The following checklist breaks down what to do in those first critical moments.

| Priority | Action | Why It's Critical |

|---|---|---|

| 1 | Secure the Scene | If you can, pull your car to the shoulder and turn on your hazard lights. This helps prevent a second accident. |

| 2 | Call 911 Immediately | This is non-negotiable. It creates an official police report, which is the cornerstone of any insurance claim, and gets you medical help. |

| 3 | Check for Injuries | Assess yourself and your passengers. Tell the 911 operator about any pain or symptoms, no matter how minor they seem. |

| 4 | Gather Vehicle Details | Try to recall the make, model, color, and license plate (even a partial one) of the other car. Every detail helps. |

| 5 | Document Everything | Use your phone to take photos of the damage, the scene, skid marks, and any debris. Get contact info from any witnesses. |

| 6 | Seek Medical Attention | Even if you feel okay, get checked out by a doctor within 24 hours. Adrenaline can easily hide serious injuries. |

Following these steps methodically will provide a solid foundation for your police report and insurance claim, turning a chaotic event into a manageable process.

A huge mistake people make is telling police they "feel fine" right after a crash. Adrenaline is a powerful pain-masker. It's crucial to get a full medical evaluation within 24 hours, because serious issues like concussions or whiplash often don't show symptoms for hours or even days.

Document Everything You Can

While you wait for the police to arrive, your phone is your best friend. The evidence you collect in these first few minutes can make or break your case. If you're looking for more details on this, our blog post on what happens when someone hits your car and drives off is a great resource.

Try to jot down anything you can remember about the other car. Don't stress about getting it perfect—every little piece of information helps the investigation.

- Make, model, and color of the car

- License plate number (even a partial one is a huge help)

- Any noticeable damage, dents, stickers, or unique features

- The direction they were headed after they hit you

Next, turn your camera on the scene itself. Get wide shots of the intersection or road, take photos of your car's damage from every angle, and capture any skid marks or debris left behind. If anyone stopped to help, politely ask for their name and phone number. A witness provides an impartial account that gives your claim a lot more credibility.

Inside the Criminal Investigation to Find the Driver

Once you’ve filed a police report, the ball is officially in law enforcement’s court. Think of them as detectives trying to assemble a puzzle, but all the pieces have been scattered across the scene of the crash. Their entire mission is to identify and track down the driver who left, and that all comes down to the quality of the evidence they can find.

Every little detail you managed to catch—a partial license plate, the color and make of the car, what a witness told you—can be the one thread that unravels the whole case.

This visual really drives home how the first things you do are the foundation for everything that comes next.

It shows that getting to safety, seeing a doctor, and gathering information aren’t just separate steps. They’re interconnected actions that feed directly into the police investigation and any future insurance claim.

How Police Piece Together the Clues

Investigators start by sweeping up every bit of physical and digital evidence they can get their hands on. Each fragment is another clue that points them toward the phantom driver.

- Vehicle Debris: You'd be surprised what they can learn from a broken piece of a headlight or a few chips of paint. This kind of physical evidence can help forensic teams pinpoint the exact make, model, and even year of the car that hit you.

- Witness Statements: What you and any bystanders saw is pure gold. A solid description of the car, the driver, or even just the direction they sped off in can dramatically narrow the search.

- Surveillance Footage: This is where things get interesting. Officers will immediately start canvassing the area for cameras on local businesses, traffic lights, and even home doorbell systems. A clear video of the car and its license plate can be the silver bullet that solves the case.

Modern police work has some impressive tools in its arsenal, too. Automatic Number Plate Recognition (ANPR) systems can be a huge help, scanning footage from traffic cameras to find a vehicle that matches a description or partial plate. This creates a digital breadcrumb trail, showing where the car went after the accident.

It's crucial to remember that the police are focused on the criminal case, which is a totally separate track from your civil claim for damages. Their job is to enforce the law and bring the driver to justice. Your goal is to get the compensation you need to cover your losses.

Setting Realistic Expectations for the Investigation

It’s completely normal to want answers, and fast. But the reality is that the timeline for a hit-and-run investigation can be all over the map. Some are wrapped up in a few days because a clear license plate was caught on camera. Others can drag on for weeks or months. And, unfortunately, if the trail goes cold, some cases are never solved.

The success rate often comes down to technology. Investigations that have CCTV, dashcam video, or cell phone data have a much higher chance of success. In fact, the presence of a dashcam alone helps resolve around 30% of cases, and technology like ANPR can push that success rate up to 35%. These numbers, highlighted in a federal progress report on transportation safety, really show how vital tech has become.

Even when the police have a strong suspect, the legal process doesn't happen overnight. They have to locate the person, bring them in for questioning, and build a case to press charges. This can involve digging through public records, a slow but necessary part of the job. You can get a sense of what that entails by learning about a Texas court records search and the kind of information it turns up.

Just remember, the criminal investigation is only one piece of the puzzle. While the police do their work, you can—and absolutely should—get the ball rolling on your insurance claim to start down the road to financial recovery.

What Are the Penalties for a Hit and Run in Texas?

When a driver takes off after a crash, they aren't just making a poor choice—they're committing a serious crime. And in Texas, the law has very little patience for it. The penalties are stiff, designed to hold drivers accountable for shirking their legal and moral duties.

It’s important to understand that fleeing the scene is a separate crime from whatever caused the crash itself. Texas law looks at the outcome of the accident to decide how serious the hit-and-run charge will be. A minor parking lot scrape is worlds away from a collision that leaves someone seriously injured.

This tiered system ensures the punishment fits the crime, sending a clear signal: leaving the scene is never the right move.

How Texas Law Classifies Hit-and-Run Offenses

The penalties aren't a one-size-fits-all deal. They work on a sliding scale based on the damage done. Think of it as a ladder—the worse the outcome of the crash, the higher the fleeing driver climbs in legal trouble.

- Minor Property Damage: If the only damage is to a vehicle and repairs cost less than $200, the offense is a Class C misdemeanor. This is the lowest rung on the ladder, usually handled with a fine.

- Significant Property Damage: Once the damage tops $200, the charge gets bumped up to a Class B misdemeanor. This means steeper fines and even potential jail time.

- Non-Serious Bodily Injury: If anyone suffers a minor injury in the crash, the driver is now looking at a state jail felony. The stakes get much higher here, with real prison time on the table.

When a Hit and Run Becomes a Felony

The most severe consequences are reserved for accidents where someone is badly hurt or killed. This is where the law comes down hard, reflecting just how serious it is to leave an injured person helpless.

A Texas hit and run becomes a felony the moment someone gets hurt. The penalties can soar as high as 10 years in prison and a $10,000 fine. The tough part? Conviction rates for these cases often hover around a slim 10-15% because it can be so difficult to track down the driver who fled.

When a collision causes a "serious bodily injury"—meaning an injury that creates a substantial risk of death, permanent disfigurement, or long-term impairment—the driver faces a third-degree felony. The penalties are significant:

- Prison Time: From two to ten years in a state facility.

- Fines: Up to $10,000.

If the unthinkable happens and the accident results in a death, the charge is upgraded to a second-degree felony. This is one of the most serious offenses a driver can face, with a potential prison sentence of up to 20 years. These harsh penalties make one thing crystal clear: as detailed in in-depth car accident statistics, Texas law demands that drivers stop, help, and share their information. No exceptions.

On top of prison and fines, a conviction almost always means a driver's license suspension, or even having it revoked for good. This combination of penalties is meant to be a powerful deterrent, making any driver think twice before hitting the gas and leaving a crash scene behind.

Your Path to Compensation Through Insurance Claims

While the police are focused on the criminal side of a hit-and-run—finding the person who fled the scene—that investigation won't pay your medical bills or get your car back on the road. For that, you’ll need to turn to the civil process.

This is where your own car insurance policy becomes your most important tool for financial recovery. It’s a bit counterintuitive, but you won't be chasing a ghost driver's insurance company. You'll be working with your own.

From an insurance perspective, an unknown driver is treated the same as an uninsured motorist. This is a critical distinction because it triggers specific coverages within your policy that are designed for exactly this kind of mess.

Your Insurance Policy is Your Financial Safety Net

Think of your auto insurance policy like a Swiss Army knife. It has different tools for different situations. The standard liability coverage that Texas requires won't help you here—that's for damage you cause to others.

Instead, your recovery will almost certainly rely on these three optional, but crucial, coverages:

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This is your MVP in a hit-and-run. It essentially stands in for the at-fault driver's missing insurance, covering everything from your medical bills and lost wages to pain and suffering, all up to your policy limits.

- Personal Injury Protection (PIP): This is "no-fault" coverage, which means it kicks in right away to pay for your initial medical treatments and a chunk of your lost income, regardless of who was at fault. It’s the immediate first aid for your finances while the bigger UM claim gets sorted out.

- Collision Coverage: This part of your policy is what pays to repair or replace your vehicle. You'll have to pay a deductible, but it's the fastest way to get your car fixed without having to wait and see if the other driver is ever found.

How to File a Claim After a Hit and Run

Navigating the claims process is all about being methodical. The more organized you are from the start, the smoother things will go. Your goal is simple: present a clear, well-supported case to your insurance adjuster that proves your losses.

Here’s a step-by-step guide to get it right:

- Notify Your Insurer Immediately: Don't delay. Most policies require "prompt" notification. Call your agent or the claims hotline within 24 hours to report the accident and get a claim number.

- Share the Police Report: The official police report is the cornerstone of your claim. Your adjuster will need the report number to verify that the incident was, in fact, a hit-and-run.

- Document Absolutely Everything: Start a file and keep everything in it. This means all medical records, bills, pharmacy receipts, and a running log of days you missed from work.

- Keep Communications in Writing: After you talk to an adjuster on the phone, send a quick follow-up email summarizing what was discussed. This creates a paper trail and prevents any "he said, she said" confusion down the line.

Good news for Texans: Filing a claim against your own UM/UIM policy for an accident you didn't cause, like a hit-and-run, should not make your insurance rates go up. State law prevents insurers from penalizing you for using the benefits you pay for when you're the victim.

Dealing With the Adjuster and Proving Your Case

Even though you’re filing a claim with your own insurance company, remember that the adjuster’s job is still to manage the company's financial risk. They aren't just going to write a blank check. They will investigate the facts and determine a value for your damages.

To build a solid case, you need to clearly document both your financial and non-financial losses.

Types of Damages to Document:

- Economic Damages: These are the straightforward, tangible costs with a clear price tag. Think medical bills, future therapy costs, lost wages, and vehicle repair estimates.

- Non-Economic Damages: These are the intangible losses, like pain and suffering, emotional distress, or the inability to enjoy hobbies. They are harder to put a number on but are a very real and critical part of your overall compensation.

The specifics of what happens in uninsured driver accidents can get complicated, and our detailed guide offers more insight into these situations.

And what if the police eventually find the driver? If that happens, your insurance company will then go after them and their insurer to get back the money they paid you. This process, called subrogation, takes the burden completely off your shoulders.

How Data Can Level the Playing Field in Your Hit-and-Run Claim

When you're trying to get a fair settlement after a hit-and-run, it often feels like you’re negotiating in the dark. Insurance companies have a massive advantage: they handle thousands of claims a year and have a mountain of internal data on what cases like yours typically cost them. This information gap puts you on the back foot from day one.

They know the numbers. You’re left guessing. This is precisely where real-world case data becomes your most powerful tool, giving you the leverage you need.

It’s a lot like selling a house. You wouldn't just guess a price. You'd pull "comps" to see what similar homes in your neighborhood have sold for recently. That data gives you a realistic, evidence-based starting point for your asking price.

The exact same principle applies to your personal injury claim.

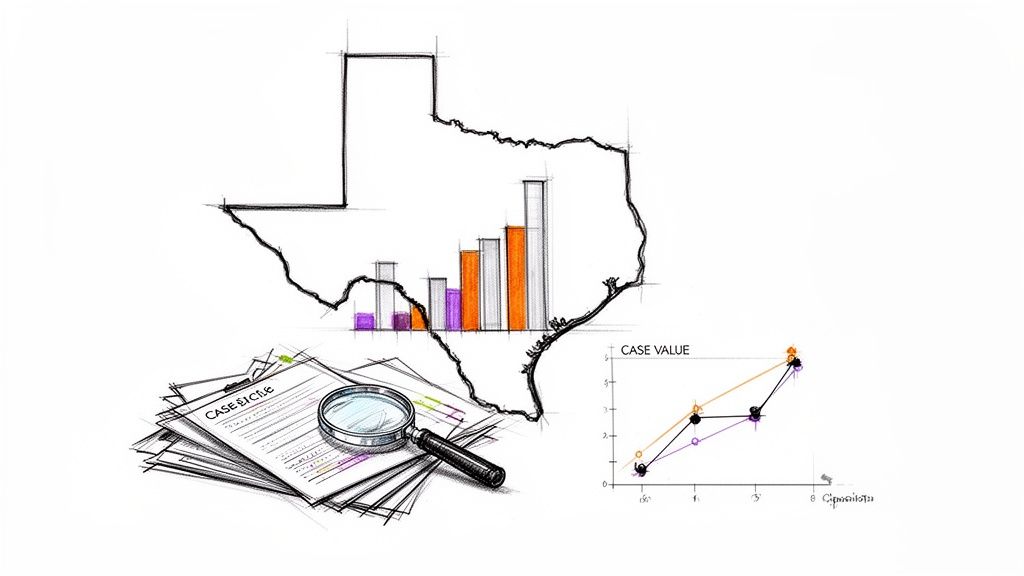

The image above really gets to the heart of this idea, showing how analyzing past cases helps illuminate the potential value of a current claim. By looking at real outcomes, you can stop guessing and start building a real strategy.

From Uncertainty to a Position of Strength

Instead of just taking the insurance adjuster's word for it, you can now see what actually happens in similar Texas hit-and-run cases. By digging into data from past settlements and jury verdicts, you can find out what victims with comparable injuries, in your specific part of Texas, have actually recovered.

This data-driven approach completely changes the negotiation dynamic. It allows you and your attorney to build a demand letter that’s based on historical reality, not just an estimate.

Think about it: a lowball offer from an adjuster doesn't carry much weight when you can counter it with hard evidence. You can point to several other cases with similar facts that settled for a much higher number, making it very difficult for them to justify undervaluing your claim.

By arming yourself with data, you shift the entire conversation. You're no longer just a victim asking for what you think is fair; you become an informed party negotiating from a position of confidence and strength.

Using Real Texas Case Data to Your Advantage

In the past, this kind of information was locked away. Now, modern platforms have opened up access to real case outcomes, letting you filter the results based on the factors that match your own situation.

- Injury Type: See what the median settlement is for whiplash compared to a more serious injury like a herniated disc.

- Accident Location: Compare outcomes from a dense urban area like Dallas County with those from a more suburban or rural county.

- Accident Details: You can even focus specifically on hit-and-run incidents to see how the unidentified driver impacted what others were paid.

This level of detail is a game-changer. For instance, data compiled from Texas court records shows that median settlements for hit-and-run pedestrian cases in the Dallas-Fort Worth area often fall between $150,000 and $300,000, depending on how severe the injuries are. Having this kind of insight can help boost recoveries by 20-30% simply by enabling more informed negotiations. What's more, the data reveals that hit-and-run cases often secure 15-25% higher settlements when new forensic evidence helps identify the at-fault driver later in the process. You can explore more of these trends by looking at detailed car accident statistics.

Ultimately, when you know what your case is really worth based on real-world results, you're in a much better position to fight for what you deserve. This information gives you the power to reject unfair offers, push back against adjuster tactics, and make sure your final settlement truly covers the full extent of your damages.

Common Questions About Texas Hit and Run Accidents

Getting hit by a driver who then speeds off is a uniquely frustrating and disorienting experience. You're left dealing with the aftermath—injuries, a damaged car, and a mountain of questions—all while the person responsible is nowhere to be found. Let's walk through some of the most pressing concerns victims have in Texas and get you the clear answers you need.

The moments after a hit-and-run are critical. When a driver flees, they don't just leave a scene; they create a dangerous information vacuum. This can delay EMS response by an average of 10 to 15 minutes, a lifetime when someone is seriously hurt. In a state like Texas, already grappling with a massive distracted driving problem, these accidents add a terrifying layer of risk.

What Should I Do If I Witness a Hit and Run?

If you see a hit-and-run unfold, your first instinct should be to protect your own safety. Never try to chase or confront the fleeing driver—that's a job for law enforcement. Instead, pull over safely and call 911 right away.

Give the operator every detail you can remember.

- The exact location of the crash.

- A description of the car that fled (make, model, color, any visible damage).

- The license plate number. This is the single most important piece of information you can provide, so even a partial plate is incredibly helpful.

After you've made the call, check on the victim if it's safe to approach them. Your witness statement is a powerful piece of evidence that can help police track down the driver and is invaluable for the victim’s insurance claim.

Can I File a Claim If the Driver Is Never Found?

Yes, absolutely. This is precisely why Uninsured/Underinsured Motorist (UM/UIM) coverage exists. In Texas, an unidentified driver is treated the same as an uninsured one, which means your own insurance policy can step in to help.

Your UM/UIM coverage is designed to cover your medical bills, lost income, and even your pain and suffering when the at-fault driver can't be held accountable.

On top of that, your Personal Injury Protection (PIP) coverage can provide immediate funds for medical care and a portion of your lost wages, no matter who was at fault. The key is to report the crash to both the police and your insurance company as quickly as possible to get the ball rolling.

The chaos of a hit-and-run doesn't end when the car disappears. Without an at-fault driver on the scene to provide information, EMS response can be delayed by 10-15 minutes on average, a delay that studies show can increase mortality rates. In a state like Texas, which saw 289,310 distracted driving injuries in 2023, the 12% hit-and-run rate in major hubs like DFW makes our roads even more dangerous. You can learn more by reviewing these preliminary motor vehicle safety estimates.

How Long Do I Have to Report a Hit and Run in Texas?

You need to act fast. The most important first step is calling 911 from the scene of the accident. This creates an immediate, official police report, which is the foundation for any future insurance claim or legal action.

When it comes to filing a lawsuit, the Texas statute of limitations generally gives you two years from the date of the crash. But don't let that lull you into a false sense of security. Your insurance policy has its own, much tighter deadlines.

Most insurers require you to give "prompt" or "timely" notice. If you wait more than a few days, you could jeopardize your entire claim. The best rule of thumb? Notify your insurance company within 24 hours.

Will My Insurance Rates Go Up for a Hit and Run Claim?

This is a huge worry for most victims, but the good news is that Texas law is on your side. State regulations generally prevent insurance companies from raising your premiums for an accident that wasn't your fault.

By its very nature, a hit-and-run is not your fault. Filing a claim under your UM/UIM or PIP coverage should not cause your rates to spike. This protection is in place so you can use the benefits you’ve paid for without being punished for being the victim of a crime.

The financial and physical toll of these accidents can be staggering. Data from platforms like Verdictly, analyzing cases from 2015-2025, reveals a stark trend: hit-and-run cases involving a traumatic brain injury (TBI) in Dallas have a median award of $400,000. This is four times higher than the $100,000 median for reported crashes with similar injuries, reflecting the severe consequences when a driver flees.

Trying to figure out a fair settlement for a hit-and-run can feel like guessing in the dark. You don't have to. At Verdictly, we believe everyone deserves access to the same data that insurance companies use. Our platform lets you see what real Texas cases like yours have actually settled for, empowering you to negotiate from a place of strength and knowledge. Explore real verdicts and settlements to understand the true value of your case at https://verdictly.co.

Related Posts

Someone Hit My Car and Drove Off a Texas Driver's Guide

Someone hit my car and drove off? Get your complete Texas guide on immediate steps after a hit-and-run, from police reports to using UM insurance claims.

What to Do After a Hit and Run Car Accident in Texas

A complete guide on what to do after a hit and run car accident in Texas. Learn the critical first steps, your legal options, and how to file a claim.

A Texas Guide to Your Hit and Run Auto Accident Claim

Involved in a hit and run auto accident in Texas? This guide walks you through the critical steps, your legal rights, and how to value your claim.