What To Do If Someone Hit Your Car and Run in Texas

Discover the crucial steps to take if someone hit your car and run in Texas. Our guide covers gathering evidence, filing reports, and handling insurance claims.

The first few moments after a hit-and-run are pure chaos. Your head is spinning, adrenaline is surging, and it's tough to think straight. But what you do in the first 15 minutes is absolutely critical. The key is to take a deep breath and focus on a few simple, methodical steps.

This isn't just about your car; it's about your safety and setting the foundation for everything that comes next, from the police report to your insurance claim.

First Things First: Get to a Safe Place

Before you even think about the damage, your immediate priority is safety. Is your car still in the flow of traffic? If so, you need to move.

Flick on your hazard lights right away. If the car is drivable, carefully pull over to the shoulder, a side street, or the nearest well-lit parking lot. The absolute last thing you want to do is chase the driver who fled. It's incredibly dangerous, rarely works, and can make a bad situation much worse.

Once you’re out of the way of traffic, take a second to check on yourself and anyone else in the car. Injuries like whiplash or even a mild concussion might not be obvious at first. If anyone feels dizzy, sore, or just "off," stay put and wait for paramedics.

Think of it as a simple sequence: Safety, Reporting, and Assessment. Getting this right from the start makes all the difference.

Making the Official Report to 911

With everyone safe, your next call is to 911. This isn't just about getting an ambulance if needed; it’s about creating an immediate, official record of the hit-and-run. This police report becomes the cornerstone of your insurance claim.

When you speak to the operator, stay calm and provide the essentials:

- Where you are: Give them cross-streets, highway mile markers, or landmarks.

- What happened: State clearly that it was a hit-and-run.

- Vehicle description: Anything you remember—color, make, model, even part of a license plate number—is valuable.

- Direction of travel: "Headed north on the I-35 service road."

- Any injuries: Let them know if you or a passenger needs medical help.

This first report is a big deal. Hit-and-run accidents are a shockingly common and growing problem. In fact, fatalities from these crashes have been rising by an average of 7.2 percent each year since 2009. Getting the police involved right away is your first and best step toward justice.

To give you a quick reference for those chaotic first moments, here's a simple checklist of what to prioritize.

Hit and Run Immediate Action Checklist

| Action | Why It's Important |

|---|---|

| Turn on Hazard Lights | Immediately alerts other drivers to your presence, preventing a secondary collision. |

| Move to a Safe Location | Gets you out of the flow of traffic. Your personal safety is the top priority. |

| Check for Injuries | Assess yourself and passengers. Some injuries aren't immediately obvious. |

| Call 911 | Creates an official police report, which is essential for any insurance claim or legal action. |

| Do NOT Pursue the Driver | Chasing the other vehicle is dangerous and can lead to another accident or confrontation. |

Following these steps ensures you've protected yourself and started the documentation process correctly. What happens next depends heavily on this initial report and the evidence you gather at the scene.

For a deeper look into the entire process, from filing a claim to potential legal outcomes, you can learn more about what to expect after a hit-and-run.

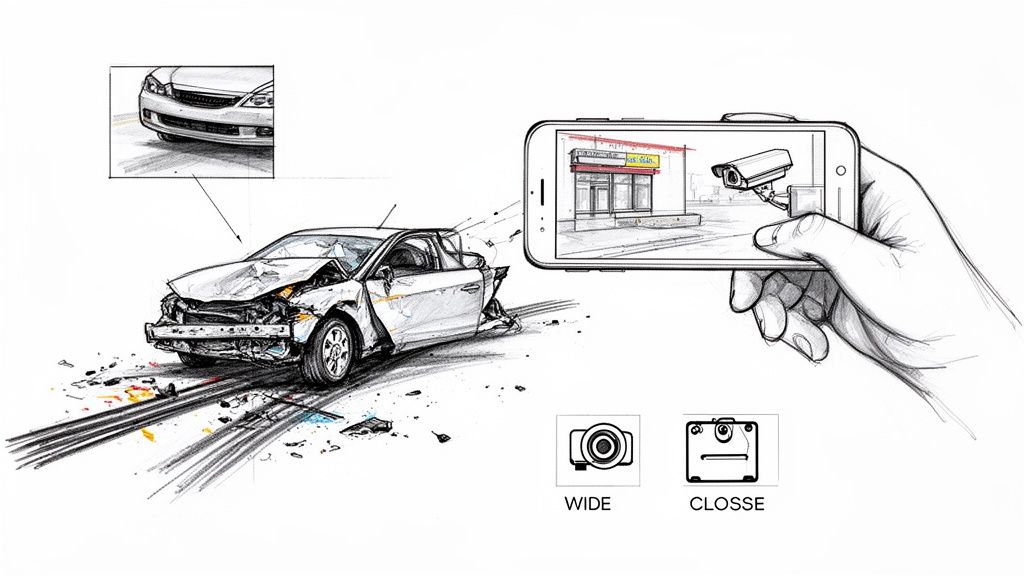

Documenting the Scene Like a Pro

While you're waiting for the police, your smartphone is your best friend. Every photo you take and every note you jot down helps piece together the puzzle of what just happened. The goal here is to collect details that seem minor now but can become the backbone of your insurance claim or police report.

Think of yourself as an investigator. You're not just taking a quick picture of a dent; you're building a complete visual record of the entire incident. A single close-up shot rarely tells the whole story.

Your Essential Photo and Video Shot List

To make sure you capture everything, think like a photographer: get wide, medium, and close-up shots. This simple framework ensures you document both the damage and the surrounding context while the details are still fresh in your mind.

Here’s a practical shot list to follow:

- The Big Picture: Start with wide shots from a distance. Get photos from different corners of the intersection or angles of the parking lot. Be sure to include traffic signs, lane markings, and even the weather conditions. These photos establish the scene.

- Your Car's Position: Now, move in a bit for medium shots. Capture your entire vehicle from all sides, showing where it came to rest in relation to the road or other landmarks. It’s a good idea to get your license plate in a few of these.

- The Nitty-Gritty Damage: Get right up close to the damage. Take detailed pictures of every single scratch, dent, or broken part. A helpful trick is to place a common object, like a coin or your car keys, next to the scuffs to give a clear sense of scale.

- What They Left Behind: Scan the ground for any debris from the other car. You might find paint chips, fragments of a headlight, or maybe even a busted side mirror. Photograph these pieces where you find them before you touch anything.

Pro Tip: Don't forget about video. Switch your phone to video mode and do a slow walk-around of the scene. As you walk, narrate what you see—the street names, the time of day, a description of the damage. This creates a powerful, time-stamped piece of evidence.

Finding Witnesses and Spotting Hidden Evidence

Physical evidence from the scene is critical, but what people saw can be just as game-changing. Take a moment to look around. Are there people on the sidewalk, in other cars, or looking out of nearby businesses?

When you approach someone, stay calm. A simple, direct approach works best. Most people are happy to help if you make it easy.

Just ask for the basics:

- Their full name and phone number.

- A quick, one-sentence description of what they witnessed, like, "I saw a red pickup truck hit your bumper and speed off."

Once you've talked to anyone who was immediately present, broaden your search. Many hit-and-runs are solved by evidence the fleeing driver didn't even know existed. Look up. Are there security cameras on nearby storefronts? Traffic cams at the intersection? What about doorbell cameras on nearby houses?

Jot down the address of any building that has a camera pointing toward the accident. This is information the police or your insurance adjuster can use to formally request the footage, which could be the very thing that identifies the driver who hit you.

Getting the Authorities and Your Insurance Involved

After you’ve done everything you can at the scene, the next part of this ordeal involves bringing in the officials. This means dealing with the police and your insurance company. It can feel like a bureaucratic headache, but these steps are absolutely critical for getting your car fixed and handling any injuries without paying out of pocket. You're not just filing paperwork; you're creating the official record of a crime.

In Texas, you don't really have a choice about filing a police report. The law requires it for any accident that involves an injury or more than a certain amount of property damage. For you, this report is the single most important piece of paper in a hit-and-run case. It’s the unbiased, official story that your insurance company will rely on.

The Police Report Is Your Foundation

When the police show up, they'll create a formal crash report. This isn't just a formality—it’s the document that validates everything you're claiming. Without it, your insurance company just has your word to go on. With it, you have an official record that a crime was committed against you.

This is especially true in a hit-and-run. You need to prove that another driver, who is now long gone, caused the damage. The police report is what separates a legitimate claim from a situation where it might look like you hit a pole and are trying to avoid your deductible. It formally establishes the "unknown driver" element, which is key to unlocking the right insurance coverage.

While overall traffic fatalities have recently seen a slight dip, the numbers for certain kinds of crashes, like those involving pedestrians or motorcycles, have actually gone up. This just goes to show how important official documentation is for every single incident. It ensures your case is taken seriously and contributes to a bigger picture of road safety. You can dive deeper into these trends by checking out the full report on recent traffic fatality data from the NHTSA.

Figuring Out Your Insurance Coverage

Once you have a police report number, it's time to call your insurance agent. This is where the specifics of your policy really matter. In a hit-and-run, a couple of specific coverages become your financial lifeline.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This is the MVP in a hit-and-run. Since the driver fled, they are treated as an "uninsured" party. Your UM/UIM policy is designed for exactly this scenario and can cover everything from your medical bills to your car repairs.

- Collision Coverage: If you don't have UM/UIM to cover property damage, your collision coverage will step in to pay for repairs to your vehicle. The catch is that you'll almost certainly have to pay your deductible. Some insurance companies might waive it if you have a police report for a clear, not-at-fault hit-and-run, but don't count on it.

Knowing which coverage applies helps you understand what to expect.

Here’s a quick breakdown of how standard Texas auto insurance policies work when you're the victim of a hit-and-run.

Texas Insurance Coverage for Hit and Run Accidents

| Coverage Type | What It Covers | Is It Required in Texas? |

|---|---|---|

| Liability Coverage | Damage you cause to others | Yes, mandatory minimums apply |

| Uninsured Motorist (Bodily Injury) | Your medical bills and lost wages | No, but must be offered; you can reject it |

| Uninsured Motorist (Property Damage) | Your vehicle repairs (subject to deductible) | No, but must be offered; you can reject it |

| Collision Coverage | Your vehicle repairs (subject to deductible) | No, optional coverage |

The table makes one thing painfully clear: your own policy is what protects you when the other driver vanishes. If you only carry the state-minimum liability insurance, you will be on the hook for 100% of your own repair costs.

The most important takeaway is that your own insurance policy is what protects you when the at-fault driver is nowhere to be found. Relying solely on Texas's minimum liability coverage will leave you paying for your own repairs out of pocket.

When you get on the phone with your insurance adjuster, stick to the facts. Give them the police report number, send them your photos, and pass along any witness contact info. Don't guess or speculate about what happened. Never say things like, "I guess I didn't see them," as that can be twisted to imply fault.

From here on out, document everything. Keep a simple log of every call you make—note the date, time, who you talked to, and what was said. This simple habit can save you from major headaches down the road and keeps your claim on track.

Using Data to Understand What Your Claim is Really Worth

Once the police report is filed and your insurance company is in the loop, the next chapter begins: negotiation. You’ll soon be talking to an insurance adjuster, and it’s important to remember their job is to protect their company's bottom line by settling your claim for as little as possible. This is where having cold, hard data can completely flip the script.

Instead of just guessing what a fair offer looks like, you can walk into that conversation with real numbers from actual Texas cases. When you know what juries have awarded and what similar claims have settled for, you're no longer negotiating based on hope—you're negotiating from a position of strength.

Get Beyond Guesswork with Real Case Data

Insurance companies have a massive advantage. They've handled thousands of claims and have deep databases guiding every offer they make. Why shouldn't you have that same kind of insight? This is precisely where a platform like Verdictly can become your most powerful tool.

You can sift through thousands of real Texas motor vehicle case outcomes, filtering them down to find scenarios that are almost identical to yours. This isn't about some abstract legal theory; it's about seeing exactly what a jury in your county awarded for a specific injury or a certain amount of vehicle damage.

Here's a glimpse of the kind of clear, organized data you can get your hands on.

This kind of dashboard gives you an instant, data-backed perspective on case values, which is crucial for setting realistic expectations for your own claim.

Let’s say your hit-and-run left you with a herniated disc. You could jump into the data and search for cases in Harris County that involved rear-end collisions and that specific injury. The results would show you the median award, typical settlement ranges, and even short summaries of those individual cases.

Suddenly, that lowball offer from the insurance company doesn't feel so final. You can go back to the adjuster and say, "Based on recent settlements for similar injuries right here in this jurisdiction, the median award is actually closer to X. Let's talk about why your offer is so far off that mark."

How Data Works in the Real World: An Anonymized Case

Here’s a practical example pulled from the Verdictly database. A driver in Dallas County was sideswiped by a hit-and-run driver, causing $8,500 in vehicle damage and a whiplash injury that needed a few months of physical therapy.

- The Insurance Company's First Offer: The driver’s own UM/UIM insurance offered $12,000. This was just enough to cover the medical bills with a tiny bit left over for "pain and suffering."

- What the Verdictly Data Showed: A quick search for similar whiplash cases in Dallas County revealed a median settlement value closer to $25,000 for injuries with a comparable treatment plan.

- An Informed Negotiation: Armed with this information, the driver was able to have a much more serious conversation with the adjuster, pointing to specific, comparable case outcomes.

- The Final Settlement: The claim ultimately settled for $23,500—almost double the initial offer.

This is a perfect illustration of how data empowers you. It gives you a factual leg to stand on, turning a subjective argument over what "pain and suffering" is worth into a data-driven discussion about fair market value. For a deeper dive into all the factors that go into a claim's valuation, check out our complete breakdown of how much a car accident case is worth. This knowledge is your best defense against taking less than you deserve after a hit-and-run.

Knowing When to Hire a Personal Injury Lawyer

You might be able to handle a simple fender-bender claim on your own, but a hit-and-run is a different beast entirely. The whole situation can get complicated, fast. While you don't need a lawyer for every single case, there are some definite red flags that should tell you it's time to at least get a consultation.

Recognizing these signs early can be the difference between getting the compensation you deserve and walking away with a fraction of what you're owed.

When the Stakes Are High

If you walked away with anything more than a few scrapes and bruises, it’s a smart move to get some legal advice. An attorney becomes absolutely essential when you're dealing with significant injuries—the kind that need ongoing medical treatment, physical therapy, or could cause long-term problems.

Trying to calculate future medical costs is incredibly difficult, and getting an insurance company to pay for them without a fight is even harder. That's where an expert can step in.

When Your Claim Gets Complicated

Sometimes, the clearest sign you need help comes from your own insurance company. If the adjuster starts questioning your story, downplaying your injuries, or throws out a lowball offer that won't even cover your car repairs, you’re not on a level playing field anymore. They have a team of professionals on their side; you deserve one on yours, too.

It's probably time to call a lawyer if:

- Your own insurer is fighting your claim: They might try to argue you were somehow at fault or that your damages aren't covered by your UM/UIM policy.

- The other driver is found but has no insurance (or not enough): This turns into a messy claim, often requiring an expert to find and "stack" different policies to cover your losses.

- You're facing a mountain of medical bills and lost income: A good attorney will work with medical and financial experts to build a solid case for your total long-term costs.

Trying to navigate all this while you're recovering is a nightmare. An experienced lawyer takes over, handling the paperwork, gathering evidence, and using their expertise to negotiate a settlement that's actually fair.

Hit-and-runs are serious incidents. The World Health Organization reports that road traffic injuries are the leading cause of death for people aged 5-29. An attorney understands the gravity of what happened and will fight to make sure your case is taken seriously.

For a deeper dive into making this decision, check out our guide on hiring a personal injury attorney for more practical insights.

Common Questions About Texas Hit and Run Accidents

When you're the victim of a hit-and-run in Texas, the questions start flooding in almost immediately. The shock of the event quickly gives way to a lot of uncertainty, which can feel just as overwhelming as the accident itself. Let's tackle some of the most common concerns head-on with clear, straightforward answers.

Will My Insurance Rates Go Up After a Hit and Run Claim?

This is usually the first thing people worry about after their safety. I get it. The good news? In Texas, the law is on your side. Insurers are generally prohibited from jacking up your rates for an accident that wasn't your fault, and a hit-and-run is the classic example of a not-at-fault incident.

Your claim will almost always fall under one of two parts of your policy:

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This is the exact reason this coverage exists—to protect you when the at-fault driver is unknown or uninsured.

- Collision Coverage: You can also use this to cover repairs, but keep in mind you'll have to pay your deductible upfront.

Since you're not the one to blame, your insurance company shouldn't penalize you. Still, it never hurts to pull out your policy documents and confirm the specifics, just for peace of mind.

What Is the Statute of Limitations in Texas?

Time is not on your side after an accident. In Texas, you have a firm deadline of two years from the date of the hit-and-run to file a personal injury lawsuit. This is called the statute of limitations. If you miss this window, you lose your legal right to sue for compensation, period.

While the court gives you two years, your insurance company won't be nearly as patient. Most policies require you to report an accident "promptly"—often within days—to keep your coverage intact. Don't put this off.

What if I Have No Information About the Other Car?

This is the reality for most hit-and-run victims. You're left standing there with a damaged car, maybe some injuries, and absolutely no clue who did it. No license plate, no witnesses, nothing. It’s incredibly frustrating, but it’s not a dead end.

This is precisely what Uninsured/Underinsured Motorist (UM/UIM) coverage was designed for.

Even if you have zero information on the other driver, you can still file a claim with your own insurance company to handle your medical bills and car repairs. This is why getting a police report is so critical. It serves as the official, documented proof your insurer needs to see that an unknown driver caused your damages, paving the way for your UM/UIM claim.

Trying to figure out what your claim is actually worth can feel like guesswork, especially in a hit-and-run. Verdictly gives you a massive advantage by providing real Texas motor vehicle case data. You can see what claims just like yours have settled for, giving you the power to negotiate a fair outcome. See how it works at https://verdictly.co.

Related Posts

Can You Sue Someone For a Car Accident? A Practical Guide

Can you sue someone for a car accident? Learn the steps to take, who you can sue in Texas, and how to determine what your case might be worth.

Hit and Run What Happens: Steps After an Accident - hit and run what happens

Hit and run what happens: A concise guide to immediate actions, the investigation process, and how to pursue fair compensation. (hit and run what happens)

Someone Hit My Car and Drove Off a Texas Driver's Guide

Someone hit my car and drove off? Get your complete Texas guide on immediate steps after a hit-and-run, from police reports to using UM insurance claims.