How Much Is My Car Accident Case Worth in Texas?

Wondering how much is my car accident case worth? This Texas guide explains damages, fault, and data to help you estimate your claim's potential value.

It's the first question everyone asks after a crash: "How much is my car accident case worth?" The honest answer is, there's no magic number. The value is deeply personal, tied directly to your specific costs, injuries, and suffering.

While settlements for common injuries often land between $10,000 and $25,000, that's just a ballpark. The final amount is built piece by piece, based on the unique details of your accident.

Your Guide to Estimating a Car Accident Claim's Value

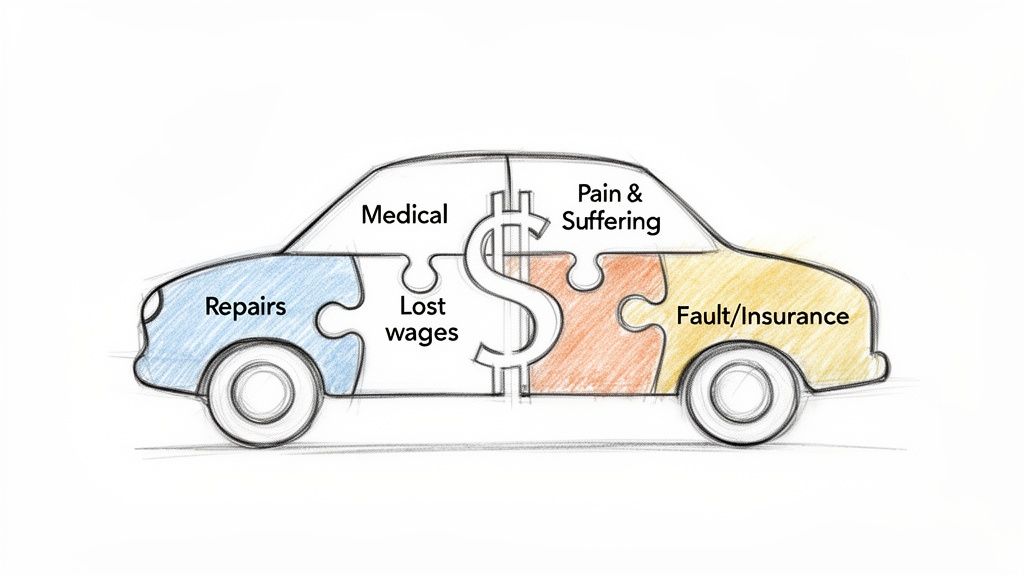

Think of your case value as a puzzle. You can't just look at one piece—like the car repair bill—and see the whole picture. To understand what your claim is truly worth, you have to gather all the individual pieces and see how they fit together.

These puzzle pieces fall into two main categories:

- Economic Damages: These are the straightforward, calculable costs. Think of them as the stack of receipts from your accident—every medical bill, lost paycheck, and repair invoice.

- Non-Economic Damages: This is where things get more personal. This category covers the intangible impact of the crash, like your physical pain, the emotional toll, and how the injuries have affected your quality of life.

Understanding Average vs. Reality

It's easy to get hung up on averages, but they can be misleading. For instance, the nationwide average car accident settlement is around $37,248. But let's look at Texas, where the median settlement is a more modest $12,281. Why the huge difference? The average gets skewed way up to $826,892 by a handful of massive, multi-million-dollar verdicts, which are extremely rare.

For more typical scenarios, like soft tissue injuries from a rear-end collision, payouts are often in the $10,000 to $15,000 range.

Your case's true worth is never just an average. It's a specific calculation based on your unique injuries, financial losses, and personal suffering, adjusted by factors like who was at fault.

The goal is to build a complete, detailed picture that justifies a fair settlement. To get a more tailored estimate, you can use our car accident settlement calculator to see potential outcomes based on real Texas case data.

This guide will walk you through each piece of the puzzle, showing you how they all connect to form a realistic valuation for your claim.

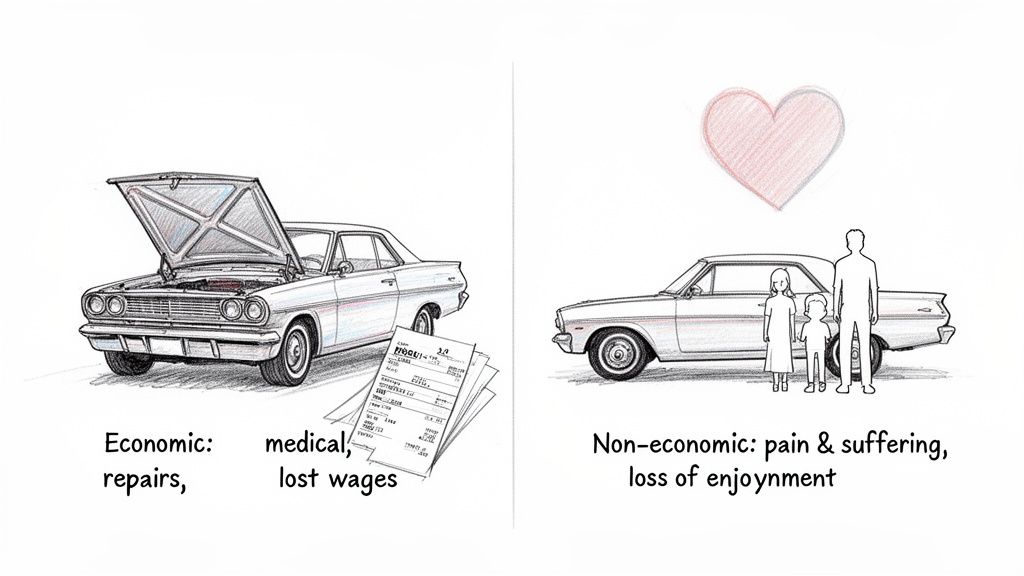

The Two Types of Damages That Form Your Claim

When you're trying to figure out what a car accident case is worth, you have to account for every single loss—from the obvious bills to the hidden personal costs. The legal system in Texas sorts these losses into two main buckets: economic damages and non-economic damages. Getting a grip on both is the key to understanding the true value of your claim.

Think of it this way: if your prized classic car gets hit, you have the repair bill, which is easy enough to calculate. But you've also lost something less tangible—the joy of driving it, the pride of showing it off. A personal injury claim recognizes both kinds of loss.

Economic Damages: The Tangible Costs

Economic damages are all the direct, out-of-pocket financial hits you took because of the crash. These are the "receipts" of your case, the black-and-white numbers that you can add up with a calculator.

They almost always include:

- Medical Expenses: This isn't just the first ambulance ride and ER visit. It's everything that follows—surgeries, specialist appointments, physical therapy, prescription drugs, and even the cost of medical care you'll likely need in the future.

- Lost Wages: If your injuries kept you from working, you're entitled to the income you lost during your recovery. If you can no longer do the same job or earn what you used to, that loss of future earning capacity is part of the calculation, too.

- Property Damage: This one's straightforward—it’s the money needed to either repair your car or, if it's totaled, replace it. It also covers any other personal items destroyed in the wreck, like a laptop or phone.

These costs are the bedrock of your claim's value. That’s why it’s so important to keep a detailed file of every bill, receipt, and pay stub. This paper trail is the hard proof you need.

Non-Economic Damages: The Human Cost

Now we get to the part that’s harder to pin down but just as real. Non-economic damages are meant to compensate you for the human toll of the accident—the suffering that doesn't come with an itemized bill.

A settlement isn't just about covering bills; it's about acknowledging the real, human impact the accident had on your life. This includes your physical pain, emotional trauma, and the loss of daily joys.

Let's go back to that classic car. The economic damage is the $15,000 it costs to fix the engine and crumpled fender. The non-economic damage is the fact that you can no longer take it on those cherished weekend drives or enter it in the local car show. That loss has real value, and the law recognizes it.

Common examples in a personal injury case include:

- Pain and Suffering: This covers the actual physical pain, discomfort, and limitations caused by your injuries.

- Mental Anguish: This is the emotional fallout—the anxiety, depression, fear, or even PTSD that so often follows a traumatic crash.

- Loss of Enjoyment of Life: If you can no longer play with your kids, go for a run, or work in your garden, you deserve to be compensated for that loss.

- Disfigurement: This provides compensation for permanent scarring or other lasting changes to your appearance.

Because there's no price tag on suffering, these damages are where insurance companies love to argue. They are subjective, and proving them requires more than just receipts—it requires showing the real-world impact the crash had on your day-to-day life.

How Insurance Companies Calculate Your Settlement

Ever wonder how an insurance adjuster comes up with that first settlement offer? They don't just pull a number out of a hat. There's a method to the madness, and it often starts with a common industry formula.

Many insurers use what's known as the "multiplier method" as a starting point to put a dollar figure on your pain and suffering. Think of it as their internal calculator for trying to make an objective estimate out of a very subjective situation.

While it's not a hard-and-fast legal rule, this formula gives you a crucial peek behind the curtain. Understanding how it works is your first line of defense against a lowball offer.

The formula itself looks simple enough:

(Total Medical Bills + Lost Wages) x Multiplier = A Starting Settlement Figure

The real battleground, and where your case's value can swing dramatically, is that last part: the multiplier.

What Determines Your Multiplier

The multiplier is a number, usually between 1.5 and 5, that’s supposed to reflect how severe your injuries and suffering are. The bigger the impact on your life, the higher the multiplier.

So, what convinces an adjuster to use a higher number? It boils down to a few key things.

-

Severity of Injuries: This is the big one. A minor whiplash case that resolves with a few physical therapy sessions might only get a 1.5x or 2x multiplier. But if you're dealing with a herniated disc that needs surgery or a broken bone that leaves you with a permanent limp? That's when you start arguing for a 4x or 5x multiplier.

-

Recovery Time: A long, painful recovery tells a story of significant suffering. Months of rehabilitation or a permanent disability will push your multiplier to the higher end of the scale because it shows the accident has had a lasting, disruptive effect.

-

Quality of Medical Records: Your medical records are your proof. If they are clear, detailed, and show consistent treatment, they back up your claim. On the other hand, big gaps in treatment or vague notes from your doctor give the adjuster an easy excuse to use a lower multiplier and downplay your injuries.

-

Impact on Daily Life: How has this injury really affected you? If you can show that you can no longer work, enjoy your hobbies, or even play with your kids, that's powerful. Solid proof of a major life disruption is exactly what justifies a higher number.

Keep in mind, the multiplier method is just the insurance company's starting point. It’s a basic framework, not a final word. Your job—or your attorney's—is to build a case with compelling evidence that proves you deserve a multiplier on the higher end of that scale.

Why Your Percentage of Fault Matters in Texas

When you're trying to figure out what your car accident case is worth, don't just add up your bills. The other driver’s insurance company is asking one make-or-break question: were you partly to blame for the crash? In Texas, the answer can slash your settlement or wipe it out completely.

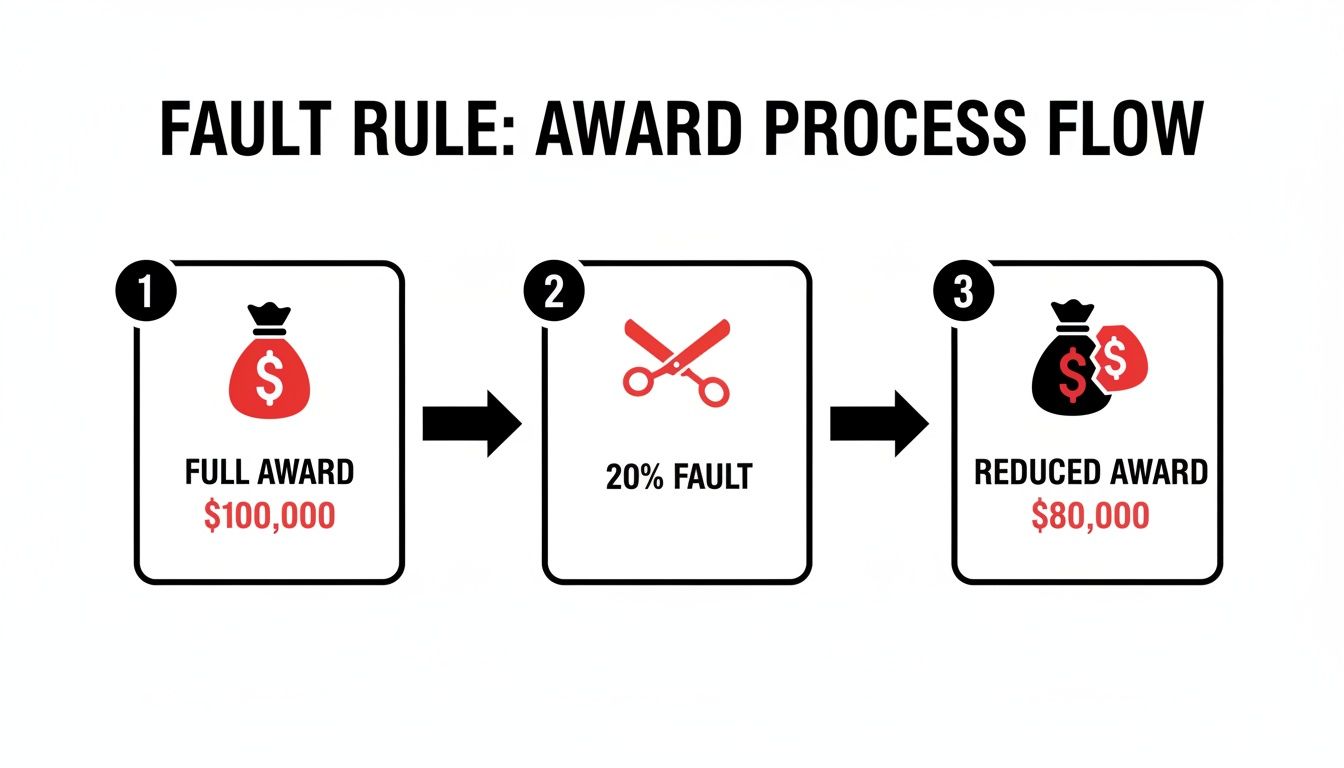

This all comes down to a legal rule called modified comparative fault. Think of it like a pie chart of blame. If you're found to be even a little bit responsible for the accident, your final payout gets reduced by your exact percentage of fault.

It’s a simple concept with some pretty harsh consequences.

The Math Behind Modified Comparative Fault

Let's walk through an example. Say your total damages—medical bills, lost income, pain and suffering—come out to $100,000. The other driver blew through a stop sign, so they're clearly the one mostly at fault. But what if evidence shows you were going just a few miles over the speed limit? A jury might decide you were 20% responsible for what happened.

Under Texas law, that $100,000 award gets cut by your 20% share of the blame. So, you’d lose $20,000 right off the top, leaving you with $80,000. The more fault they can pin on you, the less you get. If you were found 30% at fault for a $30,000 case, you'd only walk away with $21,000.

The Critical 51 Percent Bar

Here’s where the rule gets really unforgiving. Texas law has a strict cut-off point known as the 51% bar.

If you are found to be 51% or more responsible for the accident, you are legally barred from recovering a single penny from the other driver. You get nothing.

This rule is precisely why proving the other driver’s negligence is so critical. Insurance adjusters are experts at this game. They will look for any reason—distracted driving, a delayed reaction, an improper lane change—to shift blame onto you and drive up your fault percentage.

It's a common strategy designed to devalue your claim. To protect your settlement, you have to be ready to fight back against these arguments with solid evidence. You can learn more about the specifics of this law in our detailed guide on comparative negligence in Texas.

Using Real Case Data to Strengthen Your Claim

Those generic online settlement calculators? They’re a starting point, at best. The same goes for the formulas insurance companies use. They give you a rough sketch, but they completely miss the crucial details that make your case unique. If you really want to know what your car accident case is worth, you have to stop guessing and start looking at real-world outcomes.

This means digging into what actual juries and insurance adjusters in your specific Texas county have paid for cases just like yours. A data-driven approach completely changes the conversation. It shifts the focus from what an adjuster thinks your claim is worth to what comparable cases have already proven to be worth.

Finding Your Case's Precedent

Imagine you could see the final settlement amounts for every other rear-end collision in Tarrant County that resulted in a herniated disc. How much more powerful would that be than some vague estimate from a calculator? When you analyze real verdicts and settlements, you transform the question from a guess into a concrete, evidence-based discussion.

The key is to filter through historical case data to find claims that mirror your own. You’ll want to compare factors like:

- Accident Type: A T-bone collision at an intersection is a world away from a low-speed fender bender in a parking lot, and the values reflect that.

- Specific Injury: A claim involving a traumatic brain injury is valued completely differently than one for soft tissue whiplash.

- Geographic Location: Jury pools and settlement trends can vary wildly from one Texas county to another. A case in Harris County might settle for a very different amount than an identical case in Dallas County.

Even a small percentage of fault assigned to you can make a huge difference in the final award.

As you can see, being found just 20% at fault can slash a $100,000 potential award down to $80,000. Every single detail matters.

Leveraging Data in Negotiations

When you walk into a negotiation and can show the insurance adjuster concrete examples of similar cases that settled for a certain amount, your argument becomes incredibly difficult to dismiss. You’re no longer just talking about what you feel you deserve; you’re showing them what the local legal system has already determined is fair.

By grounding your claim in real case data, you arm yourself with the same kind of information that insurance companies and attorneys use every day. This empowers you to negotiate from a position of knowledge, not just hope.

A specialized tool can help you sift through thousands of Texas cases to find the ones most relevant to your situation. For instance, Verdictly’s case finder lets you explore these details, turning public records into powerful, actionable insights for your claim.

To give you an idea of what this looks like, here’s a sample of the kind of data you might find for rear-end collisions in the Dallas-Fort Worth area.

Sample Verdictly Data for DFW Rear-End Collisions

| Injury Type | Median Settlement Range (Dallas County) | Key Influencing Factors |

|---|---|---|

| Cervical Strain (Whiplash) | $12,000 - $25,000 | Length of physical therapy, lost wages, vehicle damage severity |

| Herniated Disc (Cervical) | $75,000 - $250,000 | Whether surgery was required, impact on daily activities, future medical needs |

| Rotator Cuff Tear (Shoulder) | $50,000 - $150,000+ | Surgical intervention, loss of motion, impact on job duties |

This kind of targeted evidence helps you build a compelling story, backing up the value of your economic and non-economic damages with real-world precedent. It’s the single most effective way to push back against a lowball offer and advocate for the full and fair compensation you are owed.

So, When Is It Time to Call a Lawyer?

Knowing the data and running the numbers gives you a huge head start. But let's be realistic—some situations are just too messy to handle on your own. Figuring out what a car accident case is really worth is part art, part science. It involves navigating a legal minefield where one wrong move could cost you dearly.

The key is knowing when you've crossed the line from a simple insurance claim to a complex legal battle.

For a minor fender-bender where you just have a sore neck for a day, you might be able to handle it yourself. But the moment the stakes get higher, the game completely changes. An experienced personal injury attorney does more than just file paperwork; they build a legal strategy from the ground up, designed to get you the most money possible and shield you from the insurance company's army of adjusters and lawyers.

Red Flags: When You Absolutely Need an Attorney

If any of these situations sound familiar, it's a clear sign you need to lawyer up. Think of them as giant red flags telling you that your case has moved beyond a simple negotiation and into serious legal territory.

-

You Were Seriously Hurt: We're talking about injuries that need surgery, months of physical therapy, or leave you with a permanent disability. When this happens, the value of your case skyrockets, and you need a professional to make sure every future medical bill and lifelong impact is calculated and proven.

-

They're Trying to Blame You: Is the other driver or their insurance company pointing the finger at you? This is a classic tactic. As we covered, even a small percentage of fault can slash your payout in Texas. You need someone in your corner to fight back and prove what really happened.

-

The Insurance Company is Playing Games: If the adjuster is dragging their feet, throwing out a ridiculously low offer, or just flat-out denying your claim, they aren't negotiating in good faith. An attorney can light a fire under them and force them to take you seriously.

Take a severe side-impact or T-bone crash, for example. In Texas, these often lead to devastating injuries like broken bones, which pushes the settlement value way up. These aren't quick claims; they can easily take 24-36 months to resolve. While most (66%) do settle before trial, the high stakes and complexity make having a lawyer non-negotiable. You can dive deeper into Texas accident timelines and settlement trends on richman-law.com.

An attorney levels the playing field. They know the playbook, handle the legal legwork, and negotiate from a position of strength. This frees you up to focus on what actually matters: getting better.

At the end of the day, talking to an attorney isn't admitting defeat—it's making a smart, strategic move to protect your future. It's the best way to ensure you get the full and fair compensation you're legally owed.

Common Questions We Hear About Case Value

After a car wreck, your head is probably swimming with questions. It’s a confusing time, and when it comes to figuring out what your case is worth, a few key questions pop up over and over. Let's tackle them head-on.

How Long Will It Take to Settle My Case?

This is the classic "it depends" answer, and for good reason. The timeline for settling a car accident claim is all over the map.

If your case is straightforward—meaning minor injuries and crystal-clear fault—you might see a resolution in just a few months. But don't bank on it. The more complex things get, the longer it takes. For cases with severe injuries, arguments over who's to blame, or a high-dollar value, you should probably brace yourself for a one to two-year process, especially if it looks like a trial might be on the horizon.

Will I Have to Go to Court?

Almost certainly not. The statistic that gets thrown around is that over 95% of personal injury cases settle out of court, and from my experience, that's spot on.

Settlements are worked out in negotiations between your lawyer and the insurance company. Filing a lawsuit and heading to trial is the "nuclear option"—it’s the last resort when a fair agreement just isn't possible through negotiation.

Keep in mind that the value of your case is heavily influenced by the severity of your injuries. A serious injury justifies a higher settlement demand and a more aggressive negotiation strategy.

How Does Injury Type Affect Settlement Value?

The type of injury you sustain is probably the single biggest factor driving the value of your case. In 2022 alone, there were 5.2 million car accident injuries in the U.S. that required medical attention, with the average bodily injury claim settling for $24,211.

But averages can be misleading. A case involving broken bones, for instance, often settles in the $50,000-$150,000 range. On the other end of the spectrum, a traumatic brain injury can justify multipliers of 5x the economic damages and easily push a case into the millions. You can get a better sense of how injury severity impacts settlement timelines on richman-law.com.

Do Insurance Policy Limits Affect My Payout?

Yes, absolutely. Think of the at-fault driver's insurance policy limit as a hard ceiling on what you can get from their insurance company.

If your damages add up to more than that limit, getting the full amount becomes a real challenge. Your options are to go after the driver's personal assets (if they have any) or, hopefully, to use the underinsured motorist (UIM) coverage from your own policy.

Don't guess what your case is worth. At Verdictly, we provide access to real Texas verdicts and settlements so you can see what cases like yours have actually paid. Get data-driven insights at https://verdictly.co.