How to guide: how to negotiate with insurance adjuster

Learn how to negotiate with insurance adjuster effectively to maximize your settlement, protect your rights, and avoid common claim pitfalls.

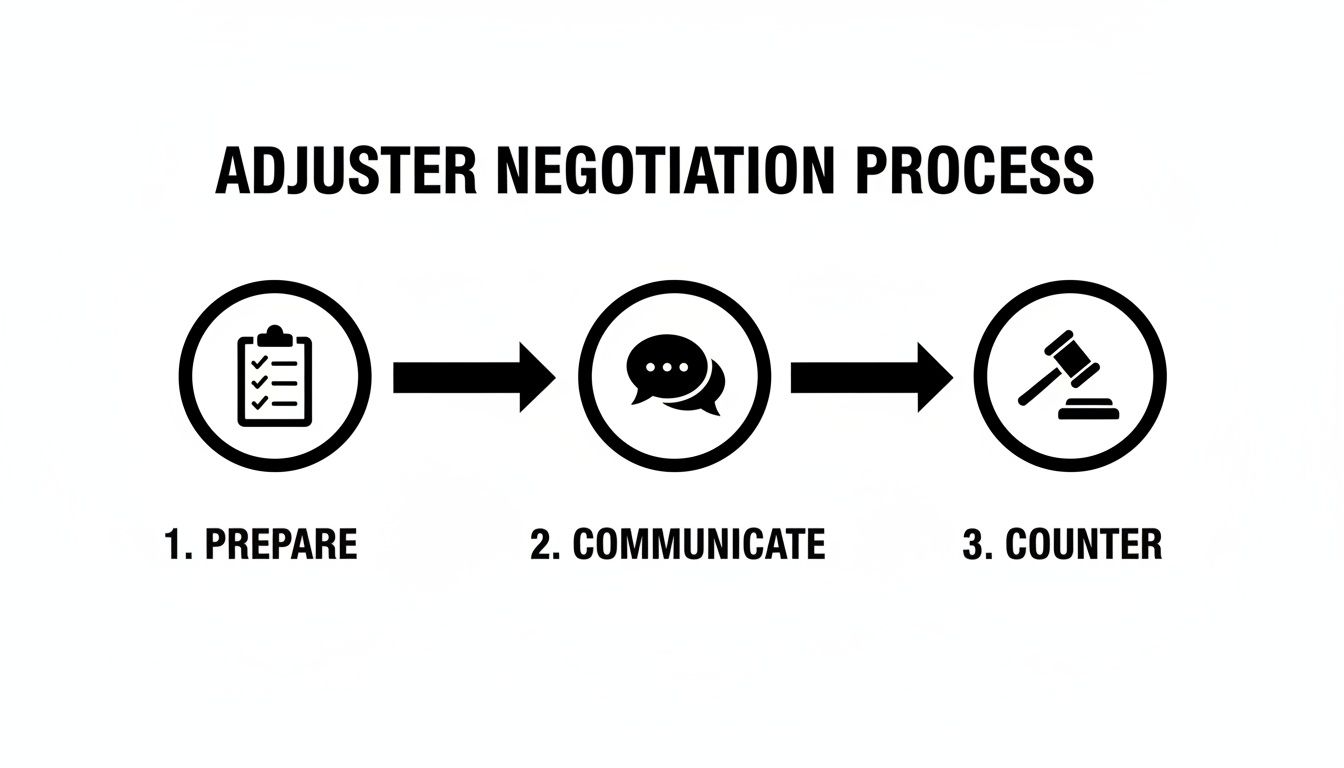

Negotiating with an insurance adjuster is a process, not a one-time event. It really boils down to three things: building an iron-clad case with solid proof, managing your communication like a pro, and knowing how to counter their first offer with facts and data. The whole game is won by being organized, patient, and persistent from start to finish.

Why You Need a Game Plan

After a Texas car accident, getting the compensation you deserve is rarely a straightforward transaction. It's a negotiation. The insurance adjuster you'll be dealing with is a skilled professional. Their job isn't to be your friend; it's to protect their company's bottom line by paying out as little as possible.

Right away, that puts you at a disadvantage. But it's a gap you can close with the right game plan. Walking into this conversation unprepared is like showing up for a final exam without ever cracking a book—you're basically leaving everything up to luck.

A structured, strategic approach flips the script. It’s not about getting loud or aggressive; it’s about being firm and sticking to the facts. This means focusing on a few key areas:

- Valuing Your Claim with Evidence: Your settlement goal can't just be a number you feel you deserve. It needs to be rooted in real-world data. That means meticulously tracking every single expense and looking at what similar Texas cases have actually settled for.

- Controlling the Conversation: Every time you talk to the adjuster, they're listening for anything they can use to chip away at your claim's value. Knowing what to say—and just as importantly, what not to say—is crucial.

- Playing the Long Game: Adjusters know that time can be a powerful tool. They often hope that dragging things out will make you frustrated enough to accept a lowball offer just to be done with it. A patient but persistent attitude signals that you're in it for the long haul.

This infographic gives you a great visual breakdown of how the negotiation process typically flows.

As you can see, a successful outcome is built on a foundation of solid preparation. The real work happens long before you ever make a counteroffer.

The Power of Being Prepared

Think of negotiation as a skill you can learn, and the data backs up just how effective it is. Industry reports from Enlyte show that professional negotiation services for third-party injury claims succeed 60% of the time. Even better, they reduce costs by an average of 30%, which proves that an insurance company's first offer is almost never its best.

Part of your preparation is understanding where the other side is coming from. Their entire position is defined by their liability insurance coverage. Getting a handle on what this coverage entails will help you anticipate the adjuster's arguments and understand the limits they're working within.

Laying the Groundwork Before You Ever Pick Up the Phone

Let me tell you a secret from years of experience: a successful negotiation is won long before you ever speak to an adjuster. The strength of your claim isn't about how you feel or what you think is fair. It’s built brick-by-brick on a foundation of solid, organized evidence.

Think of it like building a case for a trial. Every document, every photo, and every receipt is a piece of evidence that makes your position undeniable. Your very first move should be to create a dedicated file—a physical binder or a folder on your computer—for everything related to this accident. This isn't just about tidying up; it’s about constructing a complete, professional record that an adjuster can't easily poke holes in.

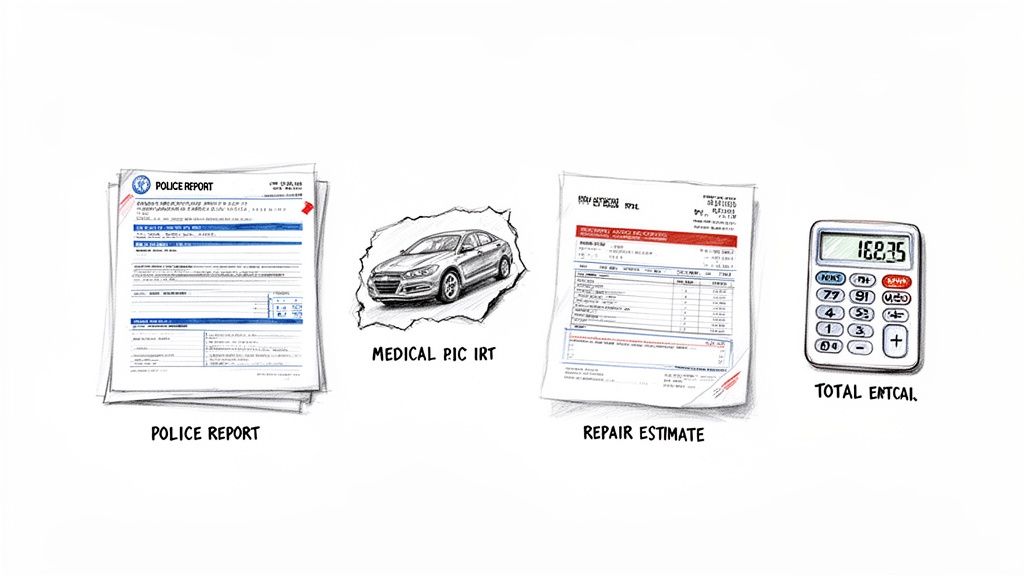

First, Gather the Undeniable Facts

Before you can get into the nitty-gritty of your injuries and losses, you need to lock down the core facts of the accident itself. These documents are the bedrock of your claim. Trying to negotiate without them is like going into a fight with one hand tied behind your back.

- The Official Police Report: This is almost always the first thing an adjuster asks for. It’s a third-party, objective account of what happened, and it often includes the officer’s initial take on who was at fault.

- Photos and Videos: A picture is worth a thousand words, and in this case, it might be worth thousands of dollars. Get shots of everything: the accident scene, the damage to all vehicles (from every angle), and any visible injuries you have. If you have time-stamped photos, even better.

- Witness Information: If someone saw what happened, their contact information is pure gold. An independent witness can be the key to shutting down any attempts by the other driver to change their story later.

Once you have these essentials, it's time to shift your focus to proving the real-world impact this accident had on your life, both physically and financially.

Next, Document Every Single Loss

This is where you start translating your pain, inconvenience, and expenses into a language the insurance company understands: dollars and cents. The adjuster is trained to question every single cost, so your meticulous records become your shield.

You’ll have two main types of damages. The first is economic damages, which are the straightforward, out-of-pocket costs you’ve had to cover.

- Medical Bills & Records: Gather everything. I mean everything—from the ambulance bill and ER co-pays to physical therapy invoices and pharmacy receipts for your prescriptions.

- Vehicle Repair Estimates: Don’t just get one. Go to at least two reputable body shops for repair estimates. This demonstrates you’ve done your homework and aren't just taking the highest number.

- Proof of Lost Wages: This needs to be official. Ask your employer for a letter on company letterhead that states your job title, pay rate, and the exact dates and hours you missed because of the accident. Back this up with pay stubs from before and after the incident to show a clear drop in income.

The second, and often trickier, category is non-economic damages. This is the compensation for the human cost of the accident—your pain and suffering. While there’s no simple receipt for this, you can and should document it. Keep a simple daily journal. Just a few notes each day about your pain levels, what you couldn't do, and how the injuries are affecting your life can be incredibly powerful.

Finally, Set a Realistic Target Based on Data

With all your evidence neatly organized, there's one last critical step before you make that first call: figuring out what your case is actually worth. And I don’t mean guessing or picking a number that feels good. You need to anchor your settlement goal in real-world data.

Let's say you were rear-ended on the Dallas North Tollway and ended up with a herniated disc. Your mission is to find out what a case like yours is typically worth in Dallas County. This is where you put on your researcher hat.

By researching verdicts and settlements for similar injuries in your specific area, you move from "asking" for a settlement to "demonstrating" its value.

This data-driven approach is your secret weapon. It completely changes the dynamic of the negotiation. When you can confidently state, "Based on my research of similar herniated disc cases in this jurisdiction, the median settlement value is $XX,XXX," you’re no longer just another claimant. You’re an informed party speaking the adjuster's own language—the language of data, risk, and precedent.

How to Talk to the Insurance Adjuster—and What Not to Say

Once you have your ducks in a row, it's time to engage with the insurance adjuster. How you handle these conversations is just as important as the documents you’ve gathered. Every call, every email, is a strategic part of the negotiation. Your goal is simple: be calm, be professional, be firm, and document everything.

Remember, the adjuster is not your friend. They are trained professionals whose job is to protect their company’s bottom line by resolving your claim for the lowest amount possible. They are looking for any piece of information they can use to devalue your case. Your job is to give them only the facts they need and nothing more.

Making a Strong First Impression

That first phone call from the adjuster sets the tone for everything that follows. Keep it polite, but keep it brief. All you need to provide is your name, contact information, and the date of the accident. That's it. Resist the urge to tell your story, discuss your injuries, or guess who was at fault.

One of the first things they'll likely ask for is a recorded statement. They'll make it sound like a standard, mandatory procedure. It's not. You are almost never required to provide a recorded statement to the other driver's insurance company.

Politely, but firmly, decline the request. A simple, "I'm not comfortable giving a recorded statement at this time," is all you need to say. This one sentence is a powerful tool to prevent your own words from being twisted and used against you later on.

After every single phone call, take a minute to write down the date, time, the adjuster's name, and a quick summary of your conversation. This log is your proof. It will be your best friend if any disputes pop up down the line.

Spotting and Countering Common Adjuster Tactics

Insurance adjusters have a playbook, and you need to know the plays. They are trained to leverage the financial and emotional stress you're under after an accident to push you toward a quick, low settlement.

Here are a few classic moves to watch out for:

- The Pressure Cooker: The adjuster might make an offer and imply it's a "one-time deal" or that it will expire soon. This is just a tactic to rush you into a decision before you understand the full cost of your medical bills and recovery.

- The Downplay: You’ll hear things like, "Oh, we see these kinds of minor injuries all the time." They might question your doctor's diagnosis or treatment plan. It’s a direct attempt to chip away at the value of your pain and suffering.

- The Blame Game: Even if the other driver was clearly at fault, the adjuster may try to pin a percentage of the blame on you. In a state like Texas, which has modified comparative fault rules, this is a very effective way for them to reduce your payout.

Don't take the bait and get into an argument. Your best defense is your documentation. If they downplay your injuries, your response is, "My doctor's reports and the medical records clearly outline the extent of my injuries." If they try to shift blame, you say, "The official police report places your insured at fault." Stick to the facts.

A Quick Guide to Adjuster Communication

Keeping your communication disciplined is key to a successful negotiation. Sticking to a few simple rules can help you avoid common traps and keep you in a position of strength.

Here’s a quick-reference table to keep you on the right track during every interaction.

| Do | Don't |

|---|---|

| Do keep a detailed written log of every call and email. | Don't give a recorded statement to the at-fault driver's insurance company. |

| Do stay calm, professional, and courteous, no matter what. | Don't guess, speculate, or apologize for anything related to the accident. |

| Do stick to the documented facts of your case. | Don't go into detail about your injuries; just refer them to your medical records. |

| Do follow up important phone calls with a summary email to create a paper trail. | Don't sign any release forms or cash any checks without fully understanding what you're agreeing to. |

This disciplined approach shows the adjuster you're organized and serious. It changes the dynamic, forcing them to negotiate based on the evidence you've presented, not on emotional appeals or conversational traps. By mastering your communication, you stay in control and get one step closer to the fair compensation you deserve.

How to Counter the Inevitable Lowball Offer

The call you've been waiting for finally comes. The adjuster is on the line, ready to make an offer. For a moment, you feel a wave of relief—until you hear the number. It's shockingly low. It feels like a personal insult after everything you've been through.

Take a deep breath. This isn't the end of the road. In fact, this is where the real negotiation begins.

That initial settlement offer isn't a reflection of your claim's true value. It’s a calculated business move. Adjusters are trained to start low, hoping you’re stressed out, inexperienced, and desperate enough to accept the first number they throw at you.

Don't fall for it. Your job is to calmly reject their offer and come back with a counteroffer built on undeniable facts.

Deconstructing the Lowball Tactic

Let’s be clear: a lowball offer is standard operating procedure. It's not personal, it's just business. First settlement proposals often come in at just 30-50% of what a case is actually worth. This tactic works because most people have no idea what their claim is really worth and lack the confidence to push back.

This is where your preparation pays off. By arming yourself with real data, you can completely dismantle their strategy. For instance, if you knew that Verdictly's data for Texas auto cases (2015-2025) shows rear-end collisions—a common sight in DFW traffic—resulted in median awards of $18,500 for moderate injuries, you’d have some serious leverage.

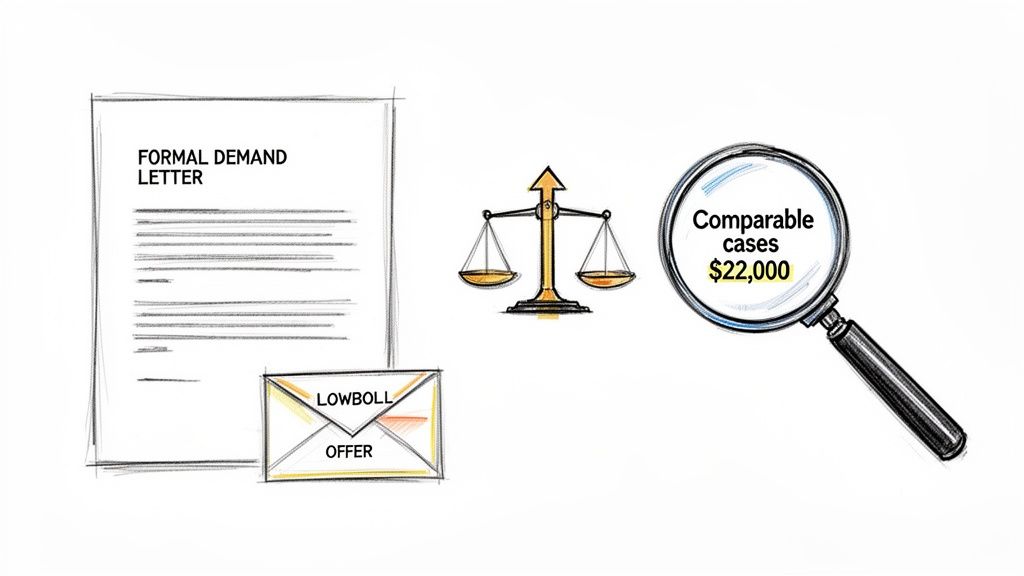

Instead of getting angry, see the low offer as your cue to educate the adjuster on the facts of your case. Your response should always be professional, firm, and—most importantly—in writing. This brings us to your demand letter.

Crafting a Powerful Counteroffer with a Demand Letter

A simple "no" over the phone won't cut it. You need to formalize your counteroffer with a comprehensive settlement demand letter. This document is your chance to lay out your entire case in a clear, logical story that the adjuster can't simply brush aside. It effectively moves the negotiation from their turf to yours, forcing them to respond to your specific points and evidence.

Your letter needs to be structured to methodically build your argument.

- Start with the Facts: Kick things off with a concise summary of the accident. State plainly why their insured driver was at fault, referencing the official police report to nail this point down.

- Detail Your Injuries and Treatment: Describe your injuries in detail, making a direct connection between them and the accident. You'll want to list every single medical provider you saw, from the ER doctor to your physical therapist, and summarize the care you received.

- Itemize Your Damages: This is the heart of your letter. Create a clean, itemized list of all your economic damages—medical bills, lost wages, property damage—with a specific dollar amount for each. Be sure to enclose copies of receipts and bills to back up every single number.

- Justify Your Pain and Suffering: After you've listed the hard costs, you need to explain your non-economic damages. This is where your pain journal becomes invaluable. Use it to describe how the injuries disrupted your daily life, caused emotional distress, and stopped you from doing things you love.

- Make Your Demand: Wrap up the letter with your specific settlement demand. This number should be higher than your absolute bottom line but still grounded in the reality of your total damages and your research into similar case values. You can learn more about how to structure a compelling settlement demand letter to make sure you cover all the bases.

The goal of your demand letter is to leave no room for ambiguity. You are presenting an airtight case that shows the adjuster exactly how you arrived at your number, supported by a mountain of evidence.

Justifying Your Number with Data

The single most powerful part of your counteroffer is justification. Just asking for more money is not a strategy. You have to show the adjuster why your number is fair and reasonable.

This is exactly where your earlier research into comparable verdicts and settlements pays off big time.

In your letter, you can drop in a sentence that sounds something like this:

"My demand of $45,000 is based on my documented economic damages of $15,000 and is further supported by verdicts in Harris County for similar whiplash injury cases, which have a median settlement value of $22,000 for non-economic damages."

A statement like this does two critical things. First, it anchors your demand in cold, hard data, not emotion. Second, it signals to the adjuster that you're a serious, informed claimant who understands the landscape. You're not just pulling a number out of thin air; you're negotiating from a position of knowledge. This forces them to take your counteroffer seriously and come back with a much more reasonable figure.

Knowing When to Escalate and Hire an Attorney

Sometimes, no matter how well-prepared you are, the negotiation hits a brick wall. The adjuster just won't play ball, the communication dries up, or the whole thing becomes more complex than you can handle alone. Knowing when to call in a professional isn't about giving up—it's a smart, strategic move to protect your claim.

This moment often comes when the stakes get high. If you're dealing with serious or permanent injuries, the potential settlement value is significant. In these cases, the insurance company brings out its top adjusters and legal teams whose entire job is to minimize the payout. Going it alone is like stepping into the ring with a pro boxer; you’re at a massive disadvantage from the start.

Red Flags That Signal It's Time for Legal Help

Certain moves from the adjuster are clear signs you need to lawyer up. These aren't just negotiation tactics; they're indicators of bad faith or a sign the fight is about to get much tougher.

Keep an eye out for these warning signs:

- Outright Denial of a Valid Claim: The insurer rejects your claim with a flimsy or nonsensical reason, hoping you’ll just walk away.

- Refusal to Make a Reasonable Offer: The adjuster digs their heels in on a ridiculously low offer and flat-out ignores the evidence you’ve provided.

- Aggressive Blame-Shifting: They try to pin a large portion of the fault on you. Remember, in Texas, this can slash or even eliminate your settlement.

- The Stall and Ghost: The adjuster drags the process out for months, misses their own deadlines, or simply stops returning your calls and emails.

If you see any of these, it’s a pretty good bet the insurer has no intention of negotiating fairly. They're banking on you getting frustrated and giving up.

The Real-World Benefits of Hiring an Attorney

Bringing a personal injury attorney into the picture changes the entire dynamic. Instantly, the adjuster has to drop the old playbook because it won't work on a legal professional. An attorney takes over all communication, which shields you from the stress and the risk of saying something that could hurt your case.

More importantly, they know how to maximize your recovery. An experienced attorney understands the nuances of Texas liability laws, can accurately calculate complex damages like future medical needs or lost earning capacity, and can bring in expert witnesses. They know exactly what your claim is worth and won't be rattled by an adjuster's lowball tactics. Our guide on hiring a personal injury attorney dives deeper into what you should look for.

Turning the Tables on Denials and Delays

One of the biggest impacts an attorney has is fighting an unfair denial. Many people think a "no" from the insurance company is the end of the road, but the data tells a very different story.

A deep dive into claim appeals reveals that over 50% are eventually successful, turning initial rejections into fair payouts. Yet, a shocking 1% of policyholders even bother to appeal, leaving money they are rightfully owed on the table.

An attorney doesn't just appeal; they're prepared to file a lawsuit if needed. The simple act of filing suit often forces the insurer to come back to the table with a serious offer. They know litigation is expensive and risky for them, especially against a skilled lawyer who has built a rock-solid case. It’s the ultimate strategic move to level the playing field for good.

Wrapping It Up: Your Path to a Fair Settlement

At the end of the day, successfully handling an insurance claim really comes down to a few key things. This isn't just about getting a payout; it's about making sure the final number truly reflects what you've lost and what you've been through. It all hinges on being organized, staying persistent, and thinking strategically from the very beginning.

Think of the adjuster's first offer as the opening bid in an auction, not the final sale price. The real power to drive that number up comes from all the prep work you've done. When you frame the discussion as a business deal, with your evidence as the main exhibit, you completely change the dynamic.

The Negotiator's Final Checklist

As you head into the final stages, keep these core principles front and center. They are the bedrock of any solid negotiation.

- Become a Master of Documentation: Every single piece of paper, from the initial police report to the receipt for your last physical therapy session, is a building block for your case. A well-organized file is your best weapon against an adjuster trying to downplay your claim's value.

- Let Data Drive Your Demand: Don't pull a number out of thin air. By researching what similar cases have settled for, you can set a realistic, evidence-based target. This turns what could be seen as an emotional plea into a business proposition they have to take seriously.

- Be Professionally Persistent: Insurance negotiations can feel like they're moving at a glacial pace. That's often by design. Keep your cool, stand firm in your position, and always follow up in writing. This shows the adjuster you mean business and won't be pushed aside or worn down by their tactics.

- The First Offer Is Just the Beginning: Never, ever accept the first offer. See it for what it is: an invitation to start the real negotiation. Your response should always be a detailed counteroffer, backed by the proof you've gathered, that lays out exactly why you deserve more.

Putting Yourself in the Driver's Seat

Ultimately, the best tool you have in this process is knowledge. No one will fight for your case as hard as you will. When you arm yourself with the right information and a clear strategy, you level the playing field. The adjuster is a professional negotiator—your job is to become one, too.

The goal is to shift from feeling like a victim of the accident to being an empowered, informed leader in your own financial recovery. Your diligent preparation and refusal to back down are what turn a lowball offer into a fair settlement.

Common Questions We Hear All the Time

When you're trying to negotiate with an insurance adjuster, you're bound to run into some tricky situations. Here are some of the most common questions that pop up, along with some straight-to-the-point answers to help you know what to expect.

How Long Does a Car Accident Settlement Negotiation Take in Texas?

Honestly, there's no magic number. A negotiation can wrap up in a few weeks or drag on for more than a year. The biggest variable is how complex your case is.

If your claim is straightforward—say, a minor fender-bender with clear fault and minimal injuries—you might settle pretty quickly, maybe within a month or two.

But things can get drawn out. Here’s what usually causes delays:

- Serious Injuries: If you have significant injuries, you absolutely should not settle until you've reached what's known as Maximum Medical Improvement (MMI). This is the point where your doctor says you’re either as good as you're going to get or your condition has stabilized. Settling before this point is a huge mistake.

- Disputes Over Fault: If the insurance company is trying to pin some of the blame on you, expect a much longer process. They'll dig in, and the back-and-forth can take a while.

- High-Value Claims: The more money on the line, the more scrutiny you can expect. Insurers don't write big checks without a fight, which means a longer, more detailed negotiation.

Should I Give a Recorded Statement to the Other Insurer's Adjuster?

The short answer? No. It’s almost never a good idea. You're typically under no legal obligation to give a recorded statement to the other driver's insurance company.

Adjusters are skilled at their jobs, and that includes asking questions designed to trip you up. They know how to get you to say something—anything—that could damage your claim.

A simple "I'm sorry" at the scene or telling the adjuster "I'm feeling okay" can be spun to suggest you admitted fault or that your injuries aren't severe. Your best bet is to politely decline. A simple, firm "I'm not comfortable providing a recorded statement at this time" is all you need to say.

What Should I Do If the Adjuster Stops Responding?

When an adjuster goes radio silent, it's rarely because they're busy. This is a classic tactic called "stalling." The hope is that you'll get frustrated, give up, or cave and accept their last lowball offer.

Don't fall for it.

Your first move should be to follow up in writing. Send a polite but firm email. Make sure to reference your claim number, recap your last conversation, and request an update by a specific date. This creates a paper trail, which is incredibly important.

If you still get nothing but silence, that's a massive red flag. It’s a strong indicator of bad faith negotiation, and it's your cue to seriously consider getting a lawyer involved.

When you go head-to-head with an insurance adjuster, nothing is more powerful than cold, hard data. Knowing what similar cases are actually worth changes the entire dynamic. Verdictly gives you a searchable database of real Texas verdicts and settlements, so you can build a demand letter based on facts, not guesswork. It's how you counter lowball offers with confidence. Level the playing field at https://verdictly.co.

Related Posts

6 Winning Personal Injury Demand Letter Example Templates for 2026

Explore our 2026 personal injury demand letter example collection. Get annotated templates for motor vehicle claims, backed by Texas case data.

How Much Can I Get From a Car Accident Settlement?

Wondering how much can I get from a car accident? This guide breaks down settlement factors, damages, and claim values to help you estimate your compensation.

Kinds of Negligence (kinds of negligence): How They Impact Your Injury Claim

Discover kinds of negligence in Texas personal injury cases and how they can impact your motor vehicle claim. Get clear guidance on your rights now.