How Much Can I Get From a Car Accident Settlement?

Wondering how much can I get from a car accident? This guide breaks down settlement factors, damages, and claim values to help you estimate your compensation.

If you're asking, "how much can I get from a car accident," the straight answer is: it varies wildly. A minor fender-bender might settle for a few thousand dollars, while a case involving life-altering injuries can run into the millions. The final number hinges entirely on the specific losses you've suffered—things like how badly you were hurt, the mountain of medical bills, and the paychecks you missed.

Your Guide to Car Accident Settlement Values

After a crash, the feeling of being overwhelmed is completely normal. The road to recovery—both physically and financially—can seem foggy, and one of the biggest sources of stress is simply not knowing what your claim is truly worth. Because every accident is different, there's no magic formula. This guide is here to cut through that confusion and give you some clarity.

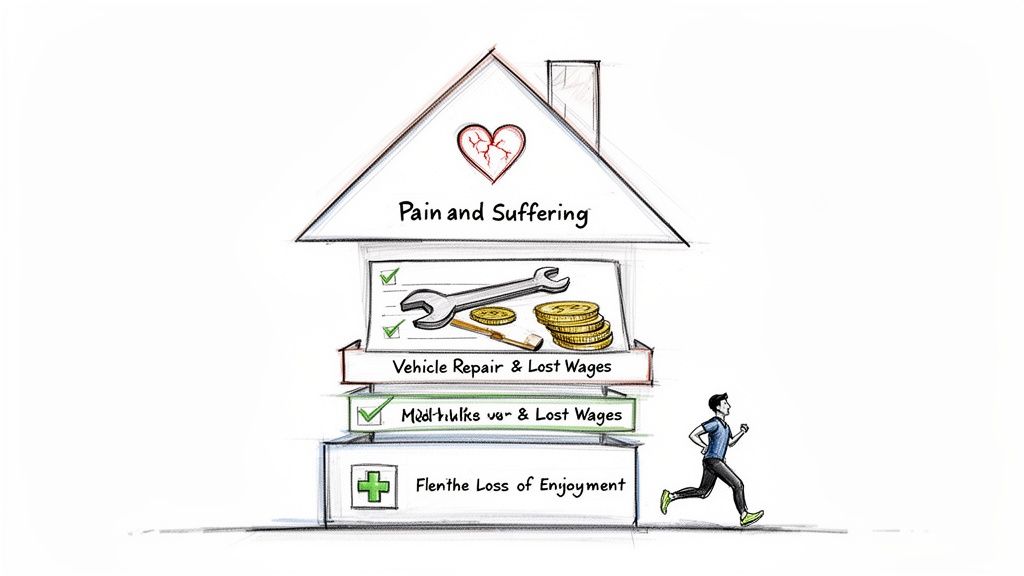

We're going to break down exactly what goes into valuing a claim. I like to think of a settlement claim like building a house. Its final value isn't just about the cost of the lumber and nails; it's also about the quality of the design and the comfort it provides.

The Two Pillars of a Settlement

In the world of personal injury law, these two core components are called damages. They are the absolute foundation of what your settlement could be.

-

Economic Damages: These are the straightforward, calculable costs—the "lumber and nails" of your claim. We're talking about anything with a receipt or a price tag: medical bills, car repair invoices, and proof of lost wages from your employer. They are tangible and easy to add up.

-

Non-Economic Damages: This is where things get more personal. These damages cover the intangible impacts of the accident, like your physical pain, the emotional trauma, and how the injury has affected your ability to enjoy your life. They are harder to put a number on but are a critically important part of your compensation.

Understanding Your Claim’s Potential

Our goal here is to give you the knowledge you need to approach your claim with confidence. Once you understand how these different types of damages come together to form the final number, you'll have a much better sense of what a fair outcome should look like for you.

To get a broader perspective on compensation ranges, you can learn more about how much car accident settlements tend to be. For a more tailored look based on real-world data, our tool can give you some powerful insights. You can start exploring what cases like yours are worth with our car accident settlement calculator and get a clearer picture of the possibilities.

The Building Blocks of Your Compensation Claim

To figure out what your car accident claim might be worth, you first need to understand what it’s made of. Think of your potential settlement as a house built from different materials. In legal terms, these materials are called damages, and they cover every single loss you've experienced because of the crash.

These damages are broken down into two main categories: the easily calculated costs and the deeply personal ones.

Economic Damages: The Black-and-White Numbers

The first category, economic damages, is the most straightforward part of any claim. These are the tangible, out-of-pocket financial losses that come with a clear paper trail. If you can point to a bill, a receipt, or a pay stub, it probably falls into this group.

These costs are usually the most immediate worry after an accident. They represent the direct financial punch you took because someone else was careless.

An attorney or insurance adjuster will start by adding up all these hard costs to establish a baseline for your claim's value.

Here’s a quick look at what’s usually included:

- Medical Bills (Past and Future): This isn’t just the first ER visit. It includes everything—the ambulance ride, hospital stays, surgeries, physical therapy, prescriptions, and follow-ups with specialists. If your injury needs long-term care, an expert will help estimate those future costs, too.

- Lost Wages: This is the money you couldn't earn because you were recovering and out of work. It’s a simple calculation based on your pay rate and the time you missed.

- Loss of Earning Capacity: This is a big one. If your injuries are so severe you can’t go back to your old job or can't work in the same way, this damage compensates you for that future lost income. It’s a crucial piece for anyone with a life-altering injury.

- Property Damage: This is simply the cost to fix or replace your car. It also covers any personal items that were wrecked in the crash, like a laptop, phone, or car seat.

Getting a handle on these costs is the essential first step. For a much deeper look into the specific formulas adjusters use, check out our complete guide on how car accident settlements are calculated.

Non-Economic Damages: The Human Cost

The second category, non-economic damages, is far more personal and much harder to put a number on. This is compensation for the human cost of the accident—the kind of suffering that doesn’t generate a receipt. While they are tougher to quantify, these damages are just as real and often make up a huge part of a final settlement, especially when injuries are serious.

Think about a weekend warrior who loves running marathons but suffers a permanent leg injury in a crash. The stack of medical bills represents her economic damages. But the loss of her ability to run—her passion, her stress relief—is a profound non-economic loss. This is often called loss of enjoyment of life.

Non-economic damages are meant to compensate you for the very real, but non-financial, ways an accident has wrecked your quality of life. This covers everything from physical pain and emotional trauma to being unable to do the things you once loved.

Other common non-economic damages include:

- Pain and Suffering: This is compensation for the actual physical pain, discomfort, and general misery you have to live with because of your injuries.

- Emotional Distress: This covers the psychological fallout from the accident, like anxiety, depression, insomnia, or even post-traumatic stress disorder (PTSD).

- Disfigurement and Scarring: This is compensation for permanent scars or physical changes that alter your appearance.

To make the distinction crystal clear, let's break it down side-by-side.

Economic vs Non-Economic Damages At a Glance

The table below contrasts the two main types of compensation you can claim in a car accident case, showing what each category covers.

| Damage Type | What It Covers | Examples |

|---|---|---|

| Economic Damages | Verifiable financial losses with a clear paper trail. | Medical bills, lost paychecks, vehicle repair costs, therapy expenses. |

| Non-Economic Damages | Intangible, personal suffering and quality of life impacts. | Physical pain, emotional distress, loss of hobbies, permanent scarring. |

Both of these categories are absolutely essential. A good lawyer knows how to document, argue for, and prove both types of damages to make sure any settlement offer reflects the total impact the crash has had on your life—not just on your bank account.

Key Factors That Influence Your Settlement Amount

While every car accident is different, the value of a settlement isn't just a number pulled out of thin air. Insurance companies and attorneys look at a handful of critical factors to figure out what a case is truly worth. Getting a handle on these key drivers is the first real step toward understanding what you can expect to get from a car accident claim.

Think of it like adjusting the controls on a sound mixer—turning any one of these dials up or down can dramatically change the final result. Let's break down the five most important elements that will shape your potential settlement.

The Severity of Your Injuries

By far, the single biggest factor in any car accident claim is how badly you were hurt. It’s the foundation for everything else. A minor whiplash case that clears up in a few weeks will always result in a much smaller settlement than, say, a traumatic brain injury (TBI) that will require a lifetime of medical care.

The nature and permanence of your injuries directly drive the settlement value. Insurers and juries place a much higher value on injuries that are permanent, disabling, or disfiguring. It makes sense, really—more severe injuries rack up higher medical bills and come with far greater pain and suffering, both of which you can be compensated for.

Your Medical Treatment and Documentation

Right behind the severity of your injuries is the quality and consistency of your medical treatment. It's not enough to just say you were hurt; you need a clear, documented medical history to back it up. Any long gaps in your treatment or a failure to follow your doctor's orders can seriously hurt your claim.

Why is this so critical? Consistent medical care creates an undeniable paper trail that proves how extensive your injuries are. Every doctor's appointment, physical therapy session, and prescription refill tells the story of your recovery and justifies the costs you’re asking the insurance company to cover.

- Immediate Care: Getting checked out right after the crash establishes a direct link between the accident and your injuries.

- Consistent Follow-Up: Sticking to your appointments shows the insurance company you are taking your recovery seriously.

- Complete Records: Well-documented records from your healthcare providers are the primary evidence used to calculate your economic damages.

The diagram below shows how these different building blocks—both the hard costs and the personal impacts—come together to form your total compensation.

This visual makes it clear: a strong claim is built on both the tangible, receipt-based costs and the very real, human impact the accident had on your life.

Liability and Your Percentage of Fault

So, who was at fault for the crash? The answer to this question plays a massive role in your settlement. Here in Texas, we use a rule called modified comparative fault to determine how liability affects your compensation. Just imagine a pie chart that represents 100% of the blame for the accident.

If the other driver is 100% at fault, you’re entitled to claim 100% of your damages. Simple enough. But if you’re found to be partially at fault, your final award gets reduced by your percentage of blame. For instance, if you're found to be 20% responsible, your total settlement will be cut by 20%.

The 51% Bar Rule: This is the big one in Texas. You can only recover damages if you are found to be 50% or less at fault. If a jury decides you were 51% or more responsible for the accident, you are completely barred from receiving any money at all.

This rule has a huge impact. As long as you’re less than 51% at fault, you can still get compensation, but sharing any fault will reduce your award and can stretch case timelines out to between 12 and 24 months.

The Full Scope of Your Lost Income

A car accident settlement isn't just about the medical bills you’ve already paid. It also has to cover the money you couldn't earn because you were injured. This includes both the paychecks you missed and the income you stand to lose in the future.

This breaks down into two key parts:

- Lost Wages: This is pretty straightforward. It covers the paychecks you missed while you were out of work recovering, and it’s usually easy to calculate using your past pay stubs.

- Loss of Earning Capacity: For those with more serious or permanent injuries, this calculation gets more complex. If you can no longer do your old job or have to take a lower-paying one, this part of the settlement compensates you for the difference in what you could have earned over your lifetime.

For severe injuries, it’s common to bring in economists and vocational experts to project these future losses, which can add a very significant amount to the final settlement. You can see more about how these less tangible losses are valued in our detailed guide on pain and suffering calculation.

The At-Fault Driver's Insurance Policy Limits

Finally, we have to talk about a very practical—and often frustrating—factor: the at-fault driver's insurance policy limit. You can have a million-dollar injury, but if the driver who hit you only carries the Texas state minimum of $30,000 in liability coverage, that’s the absolute most their insurance company has to pay.

This policy limit acts as a hard ceiling on what you can get from the insurer. While you can sometimes go after the driver's personal assets for amounts above their policy limits, it's often a long and difficult process that might not yield anything. This is exactly why it’s so important to have your own Underinsured/Uninsured Motorist (UIM/UM) coverage—it can step in to cover the gap when the other driver’s insurance just isn’t enough.

Real-World Examples: Texas Car Accident Settlements

Theory is one thing, but seeing how these numbers play out in the real world is where it all starts to click. To really answer the question, "How much can I get from a car accident?", let's walk through three common scenarios we see all the time here in Texas—from a simple fender-bender to a more serious crash.

These examples are drawn from aggregated case data and show you exactly how the details of an accident and the severity of your injuries drive the final settlement value. Think of them as a realistic benchmark to help you get a feel for where your own claim might land.

Scenario 1: The Minor Rear-End Collision

Picture this: you’re stopped at a red light in Dallas when another car, moving slowly, taps your rear bumper. The damage is minimal—a scratch and a small dent. You feel shaken and your neck is stiff, so you head to an urgent care clinic just to be safe.

The doctor diagnoses you with minor whiplash, a classic soft tissue injury. The treatment plan is simple: rest, over-the-counter pain relievers, and take it easy for a few weeks. You miss two days of work but are back to 100% within a month.

In a situation like this, the math is pretty straightforward:

- Economic Damages: This is the easy part. You’d add up the urgent care bill, the cost of any prescriptions, and the wages you lost from those two missed workdays.

- Non-Economic Damages: For your pain and inconvenience, the multiplier would be on the low end—likely 1.5x to 2x your economic damages. This reflects the minor pain and quick recovery time.

For these common fender-benders, Texas settlements tend to focus on covering your direct financial losses with a modest amount added for the short-term hassle.

Data from Verdictly's Texas database (2015-2025) shows that the median award for minor accidents like this often falls between $12,000 and $15,000. The average gets pulled up to $37,248 by cases with more moderate injuries, like neck sprains that end up needing a few months of physical therapy. You can dig into more recent trends in motor vehicle accident settlements to see how these numbers are evolving.

Scenario 2: The Moderate Side-Impact (T-Bone) Wreck

Now, let's ramp up the severity. You’re driving through a Houston intersection on a green light when another driver blows their red light and slams into your driver's-side door. This is a serious T-bone crash. The impact is hard, your car is a mess, and the side airbags deploy.

You're taken by ambulance to the ER. The diagnosis is a broken arm that needs surgery—they have to put in a plate and screws to set the bone correctly. Your recovery involves a cast for six weeks, followed by three long months of physical therapy to get your strength and motion back. Because your job is physically demanding, you're out of work for four months.

This scenario changes the game completely and drives the settlement value way up. Here’s why:

- Higher Medical Bills: The ambulance ride, ER visit, surgery, hospital stay, and all those physical therapy sessions add up to a mountain of medical expenses.

- Serious Lost Wages: Being unable to work for four months means a significant chunk of lost income.

- Greater Pain and Suffering: A broken bone, surgery, and a long, painful recovery justify a much higher calculation for non-economic damages. Here, the multiplier is more likely to be in the 3x to 4x range.

The key drivers here are the invasive medical treatment (surgery) and the long-term disruption to your everyday life.

Scenario 3: The Severe Head-On Collision

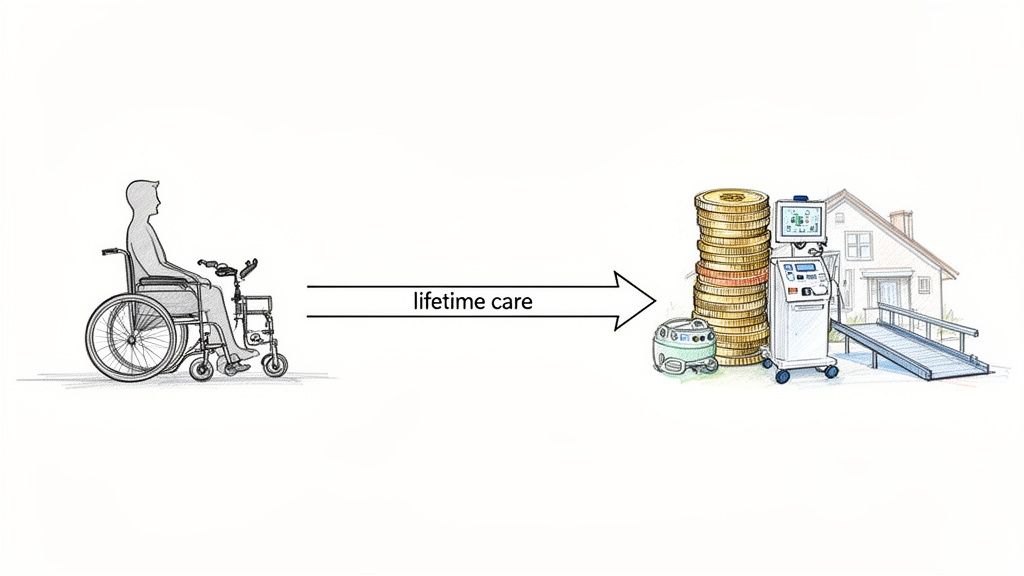

While we’ll cover catastrophic injuries in more detail later, it's helpful to see how the numbers can escalate in a worst-case scenario. A severe head-on collision can easily cause life-altering injuries, like a traumatic brain injury (TBI) or a spinal cord injury.

In these tragic situations, the settlement isn't just about the past—it has to cover a lifetime of future needs.

- Lifetime Medical Care: This includes everything from future surgeries and ongoing therapy to prescription drugs and even in-home nursing care.

- Loss of Earning Capacity: If the victim can never work again, the settlement has to compensate them for decades of lost future income.

- Permanent Loss of Enjoyment of Life: The non-economic damages are massive, reflecting the profound and permanent change in the person's quality of life. The multiplier could easily be 5x or higher.

Claims this complex require experts like life care planners and economists to project all these future costs accurately. As you can imagine, the final settlement would be exponentially higher than in the first two scenarios.

To give you a clearer snapshot, let’s put some typical ranges to these scenarios.

Typical Texas Car Accident Settlement Ranges

We’ve analyzed aggregated case data from across Texas to give you a sense of typical settlement ranges based on the severity of the crash.

| Accident Severity | Common Injuries | Typical Settlement Range (Texas) |

|---|---|---|

| Minor | Soft tissue injuries (whiplash, sprains), minor cuts | $10,000 - $25,000 |

| Moderate | Broken bones, herniated discs, concussions | $50,000 - $100,000+ |

| Severe | Spinal cord injuries, TBI, amputations, paralysis | $250,000 - $1,000,000+ |

This table makes one thing crystal clear: the more severe your injury and the more it impacts your life, the higher your potential settlement will be.

Understanding Catastrophic Injury Claims

While even a moderate injury can lead to a significant settlement, claims involving catastrophic injuries are in a totally different ballpark. When an accident results in a traumatic brain injury (TBI), spinal cord damage, paralysis, or an amputation, the whole mindset for calculating compensation has to shift. These cases aren't just about recovery; they’re about adapting to a new, permanent reality.

The financial scope is enormous because the settlement must account for a lifetime of needs. It's not just the initial hospital bill. The compensation has to cover decades of ongoing medical care, specialized equipment like wheelchairs or ventilators, and often, extensive home modifications just to make daily life possible.

Calculating Lifetime Needs

Figuring out these future costs is an incredibly complex job. It goes way beyond just adding up the bills you have so far. For these high-stakes claims, you almost always need a team of experts to build a complete and accurate picture of what the victim’s future will look like.

This team usually includes:

- Life Care Planners: These are medical specialists who map out a detailed, itemized plan of every single medical and personal care need for the rest of the victim's life. This covers everything from future surgeries and therapy sessions to round-the-clock nursing care at home.

- Economists: An economist takes that life care plan and crunches the numbers, calculating the total future cost in today's dollars. They have to factor in inflation and rising medical costs to get it right.

- Vocational Experts: If the victim can no longer work in their chosen field, these experts assess the total loss of their earning capacity over what would have been their entire career.

The reports from these experts become the foundation for the economic damages part of the claim, which can easily soar into the millions.

The Human Cost and Its Value

On top of the staggering financial numbers, the non-economic damages—the human cost—are just as profound. In these cases, the pain and suffering multiplier is much higher, often 5x the economic damages or even more. This is meant to reflect the massive, permanent impact on the victim's quality of life: losing their independence, being unable to enjoy hobbies, and dealing with constant physical and emotional pain.

A catastrophic injury claim isn’t just about paying for past damages. The real goal is to provide a lifetime of financial security for someone whose life has been changed forever. The settlement has to be big enough to replace lost income and cover every future need, ensuring they get the care they require for the rest of their life.

Because the stakes are so incredibly high, the settlement amounts for these cases are dramatically larger. Catastrophic car accidents, like a severe T-bone crash or a head-on collision, can result in life-changing payouts, averaging anywhere from $500,000 to over $25 million. These figures can be 15x to 25x larger than claims for less severe injuries, which really shows the massive scale of the damages involved. You can dive deeper into the data with these injury compensation charts.

Trying to secure fair compensation in these situations without an experienced legal team is next to impossible. An attorney’s job is to bring in the right experts, build a rock-solid case, and fight to make sure the final award truly covers decades of essential care while also acknowledging the immense human loss.

What to Do Next to Get a Fair Settlement

Okay, you now have a solid understanding of how car accident claims are valued. That knowledge is your first line of defense, but what you do next is what really matters. It's time to put that knowledge into action.

Think of it like building a house. Each step you take from here on out is another brick in the foundation of your claim. A strong foundation makes it much harder for an insurance company to poke holes in your case or try to lowball you. Here’s a simple roadmap to follow.

Document Everything—And I Mean Everything

From the second the accident is over, your new job is to be the chief historian of your case. The more proof you have, the stronger your position will be. Insurance adjusters need documentation to approve every dollar, and if you can’t prove a loss, it’s like it never happened in their eyes.

Start a file—a physical folder, a digital one, whatever works for you—and put everything in it.

- Evidence from the Scene: Did you take photos or videos of the car damage, your injuries, the road, or traffic signs? Get them in the file.

- The Police Report: Get a copy of the official report. It’s a cornerstone of your claim.

- All Medical Paperwork: Every single bill, doctor's note, diagnosis, treatment summary, and pharmacy receipt needs to go in there.

- A Daily Journal: This is so important. Every day, just jot down a few notes. How’s your pain on a scale of 1 to 10? What couldn't you do today that you normally would? How are you feeling emotionally? This journal is pure gold when it comes time to argue for pain and suffering damages.

Benchmark Your Case Against Real-World Data

Never, ever walk into a negotiation with an insurance adjuster without a realistic number in your head. If you go in blind, you’re practically asking them to give you a lowball offer. This is where data becomes your secret weapon.

By comparing the facts of your accident to real verdicts and settlements from similar cases right here in Texas, you get a huge advantage. Knowing the typical payout range for your specific injuries gives you an objective, evidence-based starting point for what’s fair. You’re no longer just a victim hoping for a good offer; you’re an informed advocate for yourself.

Having a data-backed answer to "how much can I get from a car accident?" is the single most effective way to level the playing field. It gives you the confidence to evaluate any offer the insurance company slides across the table.

Know When to Call in a Professional

You can handle a minor fender-bender claim on your own. But for anything more serious, trying to go it alone can be a costly mistake. A huge part of getting the compensation you deserve is knowing when to hire a personal injury lawyer.

It's probably time to make that call if you're in one of these boats:

- Your Injuries Are Serious: If you're facing long-term care, permanent impairment, or significant medical treatment, the stakes are simply too high. You need an expert.

- They're Trying to Blame You: Is the other driver or their insurance company pointing the finger at you? An attorney will step in and fight to protect your rights.

- The Insurance Company is Ghosting You or Lowballing: Adjusters are trained to pay out as little as possible. An experienced lawyer knows all their tactics and isn't afraid to push back hard.

By documenting everything, benchmarking your case with real data, and getting legal help when you need it, you’ll be in the best possible position to navigate the claims process and get the money you rightfully deserve.

Don’t guess what your case is worth. Use Verdictly to see what thousands of real Texas car accident cases like yours actually settled for. Our AI-powered platform shows you the verdicts and settlements you need to understand your claim's true potential value and negotiate from a position of strength. Start your research on Verdictly today and get the clarity you deserve.

Related Posts

Using a Compensation Calculator for Car Accident Claims

Discover how to use a compensation calculator for car accident claims in Texas. Get practical steps for estimating your settlement value with real-world data.

A Guide to Medical Records Reviews in Personal Injury Claims

Learn how medical records reviews can strengthen your Texas injury claim. This guide explains the process, key findings, and how to build a stronger case.

Why Insurance Companies Deny Claims: why insurance companies deny claims

Learn why insurance companies deny claims and how to overcome common denials with proven appeals and tips to maximize your compensation.