Using a Compensation Calculator for Car Accident Claims

Discover how to use a compensation calculator for car accident claims in Texas. Get practical steps for estimating your settlement value with real-world data.

When you're trying to figure out what your car accident claim might be worth, a compensation calculator can be a great first step. It basically works by adding up all your concrete financial losses (like medical bills and lost wages) and then estimating a value for your pain and suffering. This gives you a solid, evidence-based starting point before you even think about talking to an insurance adjuster.

How to Get a Fast Estimate of Your Car Accident Claim

After the initial shock of a crash wears off, one of the first things people wonder is, "What's my claim actually worth?" Getting a ballpark figure isn't just about curiosity; it's about taking back a bit of control. A data-driven estimate helps you set realistic expectations and gives you a benchmark to evaluate any settlement offers that come your way.

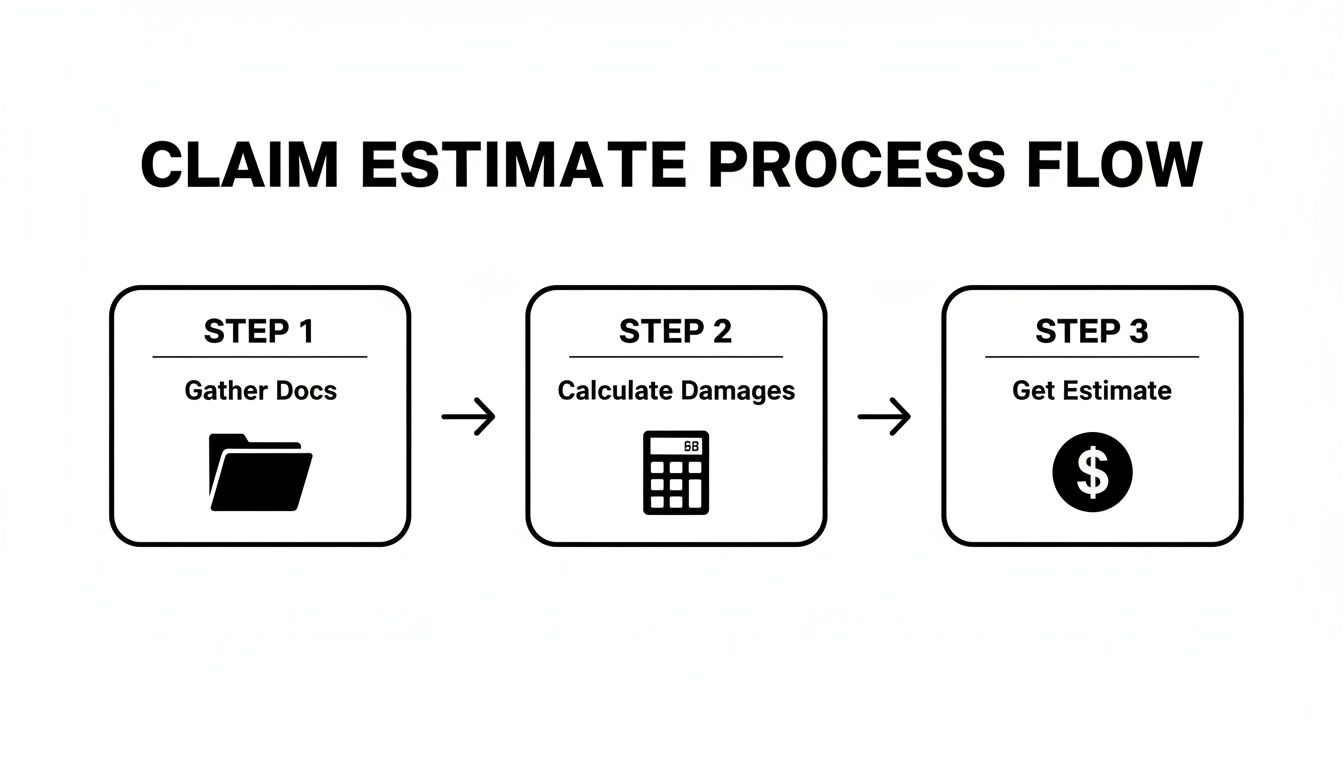

The whole point of a settlement calculator is to translate your entire experience—both the financial and the personal toll—into a dollar amount. The process itself is pretty straightforward.

As you can see, it all starts with documentation. From there, you calculate the damages, which leads to your initial estimate.

Grounding Your Estimate in Reality

While the math isn't complicated, the secret to a useful estimate is making sure it's based on what's actually happening in the real world. Car accidents are, by far, the most common reason for personal injury claims, making up over 50% of all cases filed each year.

The numbers show that plaintiffs, on average, receive around $37,248 for car accident cases. When you look specifically at bodily injury claims, that payout averages $26,501. These figures provide some much-needed context.

A calculation without context is just a number. Your goal is to find a number that reflects what Texas courts and insurers are actually paying for injuries like yours.

Gathering Your Essential Documents

To get the most out of any car accident compensation calculator, you need to have your paperwork in order. Start by pulling together every single document related to the accident. Think of these as the building blocks of your claim.

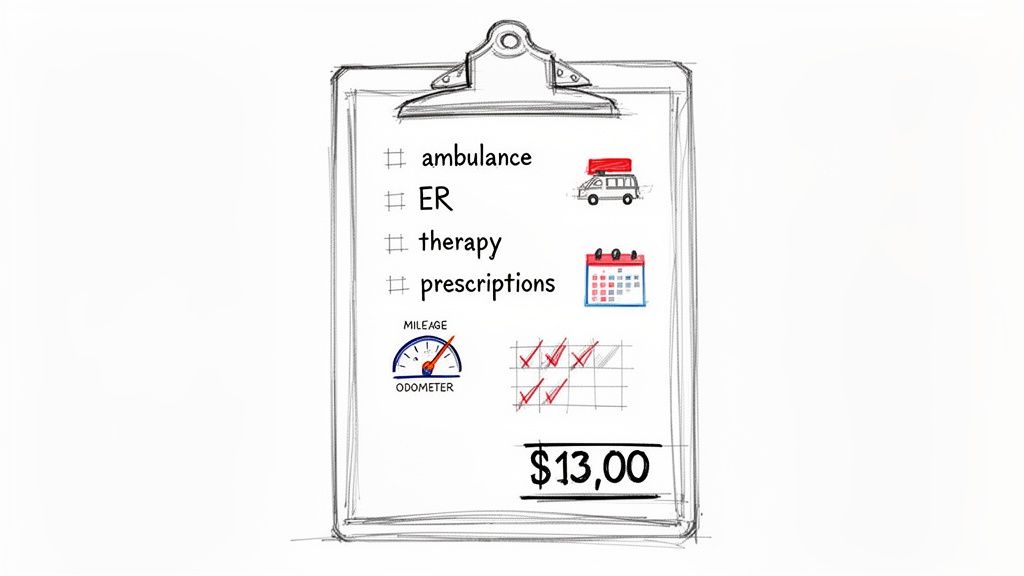

Here’s what you’ll need to get started:

- Medical Records and Bills: This is everything from the ambulance ride and emergency room charges to follow-up doctor visits, physical therapy sessions, and prescription costs.

- Proof of Lost Income: Grab your recent pay stubs, W-2 forms, or even a letter from your HR department that details the hours you missed, any lost opportunities for overtime or bonuses, and any sick or vacation days you had to burn.

- Property Damage Estimates: You'll need the repair quotes from the body shop or, if the car was totaled, the insurance company's valuation report.

Having these numbers tallied up is the first step to seeing the true financial fallout from the crash. For a more detailed walkthrough of this process, check out our guide on how much your car accident is worth. A data-backed approach like this gives you the confidence you need before heading into any negotiations.

Getting a Grip on Your Economic Damages

The bedrock of any solid car accident claim is a precise tally of your economic damages. These are the hard, cold, out-of-pocket costs you've paid because someone else was careless. Getting this figure right isn't just important; it's the absolute foundation of your entire settlement estimate, as it directly impacts every other calculation down the line.

Think of it as building an airtight financial case. You want to present the insurance adjuster with a list of expenses so thoroughly documented that there's simply nothing to argue about. This goes way beyond just the big hospital bill—it’s about accounting for every single cent the accident has cost you.

Tallying Up Every Medical-Related Expense

For most people, medical costs make up the biggest chunk of their economic damages. The trick here is to be relentless with your record-keeping. Don't just hold onto the bills from the ER or surgery; you need to track everything.

Your list of medical bills should be comprehensive:

- Emergency Care: This starts with the ambulance ride, the emergency room visit, and any immediate imaging like X-rays or CT scans.

- Follow-Up Care: Every single specialist visit, physical therapy session, and chiropractic appointment needs to be on this list.

- Medications and Supplies: The cost of prescription painkillers, anti-inflammatories, and even medical gear like a neck brace or crutches all add up.

- Travel Costs: Did you know you can claim the mileage for driving to and from your doctor's appointments? Keep a simple log of your trips—it’s a valid expense.

Calculating Lost Wages and Future Earnings

It’s not just about what you've spent; it's also about what you've lost. The income you couldn't earn while recovering is a critical part of your claim, and this calculation needs to be spot-on. It's more than just your base salary.

First, figure out the exact number of hours or days you missed from work. But don't stop there. Did you miss out on your regular overtime shifts? Was a performance bonus off the table because you were out recovering? These are all real, quantifiable losses that belong in your total.

If you're self-employed, proving lost income takes a bit more legwork, but it's just as crucial. You'll need to pull together past invoices, tax returns, and even emails from clients to show what you would have earned if the accident hadn't happened.

Here's something many people overlook: if your injuries mean you can't go back to your old job or they permanently limit your ability to earn money, this is called lost earning capacity. Figuring out this number often requires help from a financial expert, but it's essential for protecting your long-term financial health.

When you gather this level of detail, you create an undeniable record of your financial hit, setting a strong, factual baseline for your entire settlement negotiation.

Putting a Number on Your Pain and Suffering

How do you possibly assign a dollar value to chronic pain or emotional distress? It’s easily the most subjective part of any car accident claim, but that doesn't mean it’s a guessing game. Insurers and attorneys rely on established methods to calculate these "non-economic damages," and if you want to set a realistic settlement goal, you need to understand them, too.

The go-to approach is the multiplier method. This system takes your total economic damages—that hard number you tallied from medical bills and lost income—and multiplies it by a specific factor. The result is the estimated value of your pain and suffering.

But this isn't just random math. The multiplier itself, which typically ranges from 1.5 to 5, is a direct reflection of your personal ordeal.

What Determines Your Multiplier

So, what’s the difference between a 1.5 multiplier and a 5? It all comes down to the real-world, human impact of the crash. Several key factors will push that number up, and documenting them is just as vital as saving your medical receipts.

The factors that really drive up your multiplier include:

- Severity of the Injury: A minor whiplash case that clears up in a few weeks might get a low multiplier, maybe a 1.5. But a herniated disc that needs surgery and leaves you with permanent limitations? That's going to command a much higher one, like a 4 or 5.

- Length of Recovery: A long, grueling recovery process filled with multiple surgeries or endless physical therapy sessions justifies a higher number. The longer it takes you to get back on your feet, the stronger your case for a higher multiplier.

- Lasting Impact: This is huge. Can you no longer enjoy your hobbies? Does the injury interfere with caring for your family or doing simple daily tasks? Permanent scarring, disfigurement, or any long-term disability will significantly raise the multiplier.

The core idea is simple: the more an accident disrupts your life, the higher the multiplier should be. Your job is to paint a clear, undeniable picture of that disruption.

For instance, an attorney or adjuster might start with a base of $50,000 in economic damages. By applying different multipliers, they can estimate a pain and suffering value anywhere from $75,000 to $250,000. These figures make sense when you look at the broader statistics. While the average bodily injury payout is around $26,501, this shows just how much non-economic damages can increase a claim's total value.

Seeing the Multiplier in Action

Let’s walk through a real-world scenario. Imagine a driver gets rear-ended and sustains a serious shoulder injury that requires surgery.

- Total Economic Damages: $40,000 (this covers the surgery, physical therapy, and lost wages).

- Injury Impact: The recovery drags on for six months. During that time, they have to cancel a long-awaited family vacation and discover they can no longer lift heavy objects, which affects their job and forces them to give up a favorite hobby.

- Multiplier Selection: Given the surgery and the lasting consequences, a multiplier of 3.5 is a reasonable starting point.

The calculation is straightforward: $40,000 (economic damages) x 3.5 = $140,000 for pain and suffering.

This brings the total estimated claim value to $180,000. Of course, you have to back this up. Effectively documenting your struggle is critical, which is why we created a guide on how to prove pain and suffering with tangible evidence. Using a compensation calculator for car accident claims grounded in this method gives you a powerful, defensible figure to bring to the negotiating table.

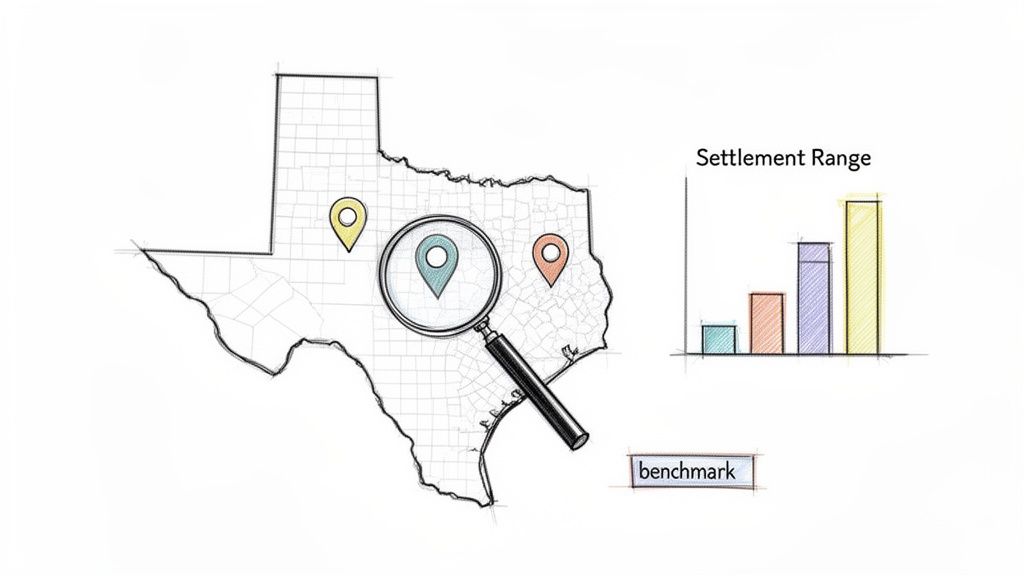

How to Validate Your Claim with Real Texas Case Data

Your initial calculation is a great starting point, but let's be honest—it's still an educated guess. To really hold your own against an insurance adjuster, you need to ground that number in reality. This means checking your estimate against what Texas courts and insurers are actually paying for cases like yours.

This step isn't just about double-checking your math. It’s about transforming your personal estimate into a well-researched demand that's much harder for an adjuster to simply brush aside.

Why Averages Are Not Enough

Relying on national averages for car accident settlements can be a huge mistake. A settlement for a rear-end collision in Dallas County can look drastically different from a similar one in another state, or even in a neighboring Texas county.

Everything from local court precedents to jury attitudes influences what a case is truly worth. This is where digging into specific Texas case data becomes a game-changer. You need to understand the settlement range for a case with your specific variables.

- Injury Type: What’s the typical payout for a herniated disc versus a whiplash injury?

- Accident Location: Do cases in Harris County tend to settle for more or less than those in Tarrant County?

- Collision Details: How are head-on collisions valued compared to side-impact crashes?

The goal isn't to find a single magic number. It's to build a data-backed argument that shows the insurance company you’ve done your homework and you know what a fair offer looks like in your specific jurisdiction.

Using Data to Build a Stronger Case

This is where a legal data platform can make all the difference. Instead of guessing, you can see concrete examples of past verdicts and settlements. For example, using a Texas car accident case finder lets you filter outcomes by the details that actually match your situation. This gives you a realistic picture of potential high, low, and median awards.

A data-driven approach is more critical than ever right now. As we move through 2025, the landscape of car accident claims is shifting. While overall claim volumes have dipped 7% in the U.S. since before the pandemic, the severity and costs of those claims are climbing fast.

Bodily injury claims are on the rise, pushing the average third-party payout to $29,100 per injured person. That's 11% higher than late 2023 and a massive 36% increase since 2020. Having access to specific local data—like knowing the median awards in Dallas-Fort Worth for soft-tissue injuries often range from $20,000 to $60,000—helps you make sense of these trends and set realistic expectations. You can read more about how claim severities are rising on ClaimsJournal.com.

When you back your estimate with real case data, it stops being just a number you came up with. It becomes a strategic tool, built on the same kind of information that attorneys and insurance companies use themselves. This puts you in a much stronger position for a fair and effective negotiation.

Knowing When You Need More Than a Calculator

Running the numbers through a compensation calculator for car accident claims is a fantastic starting point. It gives you a solid, fact-based estimate of what your claim could be worth, which brings a welcome sense of clarity when everything else feels chaotic.

But let's be clear: these calculators are best for more straightforward cases. They have limitations. The real key is knowing when your accident has become too complex for a simple calculation and it's time to bring in a professional.

Think of it like this: the calculator gives you the basic vital signs of your case. It tells you your temperature and blood pressure, so to speak. But it can't diagnose a complex condition or perform surgery. When your claim gets complicated, you need a specialist. The data you’ve gathered is still incredibly valuable, but you need an expert who can turn those numbers into a winning legal strategy. Spotting the signs early can make all the difference in what you ultimately recover.

Red Flags That Signal You Need an Attorney

Some issues immediately throw a wrench into the works, creating problems that no online tool can solve. If any of these sound like your situation, it's a neon sign telling you to consult with a lawyer. These aren’t just small bumps in the road; they're major legal roadblocks.

A fight over who was at fault is one of the biggest red flags. Under Texas's modified comparative fault rule, if you’re found even partially to blame, your settlement gets cut. Insurance adjusters are masters at finding ways to pin some of the fault on you, and even 10% or 20% of the blame can slash thousands of dollars from your check.

Certain injuries also instantly raise the stakes and the complexity:

- Catastrophic Injuries: Any injury leading to a long-term disability, permanent scars, or the need for lifelong medical care—think spinal cord damage or a traumatic brain injury (TBI)—is beyond a calculator's scope. These cases require life care planners and other experts to project costs accurately over a lifetime.

- A Government Vehicle Was Involved: If you were hit by a city bus, a police car, or any government-owned vehicle, your claim falls under a completely different set of laws. The Texas Tort Claims Act has its own strict deadlines and procedural hoops you have to jump through perfectly.

- There Are Multiple Parties: Wrecks with three or more vehicles or several at-fault parties quickly become a tangled mess of finger-pointing and competing insurance claims. It’s incredibly tough to navigate that chaos alone.

Remember, a compensation calculator gives you a powerful baseline for negotiations. But when the insurance company comes back with a ridiculously low offer or starts dragging its feet, they aren't just negotiating—they're testing you to see if you'll fight.

This is where an attorney comes in. They don't just talk for you; they force the insurer to treat your data-backed claim with the seriousness it deserves. They have the power to subpoena records, hire accident reconstruction experts, and shut down an adjuster's weak arguments with strong legal precedent.

A calculator tells you what your claim might be worth. A good lawyer shows you how to actually get it, especially when the other side is determined to pay you as little as possible.

Answering Your Top Questions About Car Accident Calculations

After an accident, the questions can feel endless. When you start trying to figure out what your claim is worth, the legal jargon and insurance company tactics can make your head spin. Let's cut through the noise and tackle some of the most common questions people have when they're putting a number on their claim.

Think of this as a quick FAQ from someone who's been in the trenches. Getting these concepts down will help you build a much stronger estimate and go into any conversation with an adjuster on solid ground.

How Does Texas Fault Law Affect My Payout?

This is a huge one. Texas uses a legal rule called "modified comparative fault," and it has a direct impact on your final compensation.

Here's the bottom line: you can still recover money as long as you are 50% or less to blame for the crash. But—and this is a big but—your final award gets cut by your exact percentage of fault. So, if your total damages add up to $100,000 and a jury decides you were 20% responsible, your payout is slashed to $80,000.

Insurance adjusters are masters at using this rule to their advantage. They will hunt for any little thing they can use to pin a piece of the blame on you because every percentage point they assign to you is money they get to keep. This is why the fight over fault is often one of the most intense parts of negotiating a Texas car accident claim.

Can I Actually Claim for Future Medical Bills?

Yes, and you absolutely have to if you want a fair outcome. Future medical care is a critical part of your economic damages, especially if you’re dealing with a serious injury that will require long-term attention. This isn't just about guessing what you might need down the road; it requires hard proof.

To make a solid claim for these costs, you need detailed evidence from medical professionals. This usually looks like:

- A formal prognosis from your doctor explaining your long-term medical needs.

- Expert opinions from specialists who can outline future surgeries, physical therapy, or other necessary treatments.

- A life care plan that projects the costs for this ongoing care.

Honestly, this is where having an attorney becomes almost essential. They have the resources and experience to line up these experts and make sure your future needs are fully documented and powerfully argued for in your demand. It’s about protecting your health and your finances for years, not just days.

Why Was Their First Settlement Offer So Insultingly Low?

That first quick, lowball offer can feel like a slap in the face. But try not to take it personally. It’s a standard business tactic. The insurance company's initial offer is almost never a reflection of your claim's true value.

An insurer's first offer is just a test. They're dangling a small amount of cash, hoping your immediate financial stress will make you bite. They want to see if you know what you're doing.

They are counting on you being overwhelmed and desperate enough to take whatever they put on the table. This is exactly why doing your homework and coming up with your own data-backed estimate is so powerful. It gives you the confidence to push that low offer aside and counter with a number that’s actually based on reality.

What's the Real Difference Between a Settlement and a Verdict?

You'll hear these two terms thrown around a lot, and they mean very different things.

A settlement is a private agreement you reach with the insurance company. Your claim is resolved, you get paid, and you both walk away without ever stepping into a courtroom. The overwhelming majority of personal injury cases—over 95% of them—end in a settlement because it avoids the time, expense, and sheer unpredictability of a trial.

A verdict, on the other hand, is the official decision handed down by a judge or jury after a full-blown public trial. Verdicts are a gamble. They can sometimes be much, much higher than any settlement offer, but they can also be far lower—or you could walk away with nothing at all. Looking at data for both settlements and verdicts gives you the most complete picture of the financial goalposts for a case like yours in Texas.

Ready to stop estimating and start benchmarking? With Verdictly, you can search a massive database of real Texas verdicts and settlements from 2015-2025. Filter by the specific injury, accident type, and even your county to see what similar cases are actually worth. Arm yourself with real data and start negotiating from a position of strength. Get the insights you need today.

Related Posts

How Much Can I Get From a Car Accident Settlement?

Wondering how much can I get from a car accident? This guide breaks down settlement factors, damages, and claim values to help you estimate your compensation.

A Guide to Medical Records Reviews in Personal Injury Claims

Learn how medical records reviews can strengthen your Texas injury claim. This guide explains the process, key findings, and how to build a stronger case.

Why Insurance Companies Deny Claims: why insurance companies deny claims

Learn why insurance companies deny claims and how to overcome common denials with proven appeals and tips to maximize your compensation.