How Are Car Accident Settlements Calculated: Your Guide to Fair Payouts

Discover how are car accident settlements calculated and what factors like medical costs, lost wages, and pain and suffering affect your final payout.

So, how is a car accident settlement actually calculated? It’s not just a number pulled out of thin air. The final figure comes from a methodical process of adding up your concrete financial losses (economic damages) and then placing a value on your pain and suffering (non-economic damages). From there, this total gets adjusted by real-world constraints like fault and insurance coverage to arrive at the final payout.

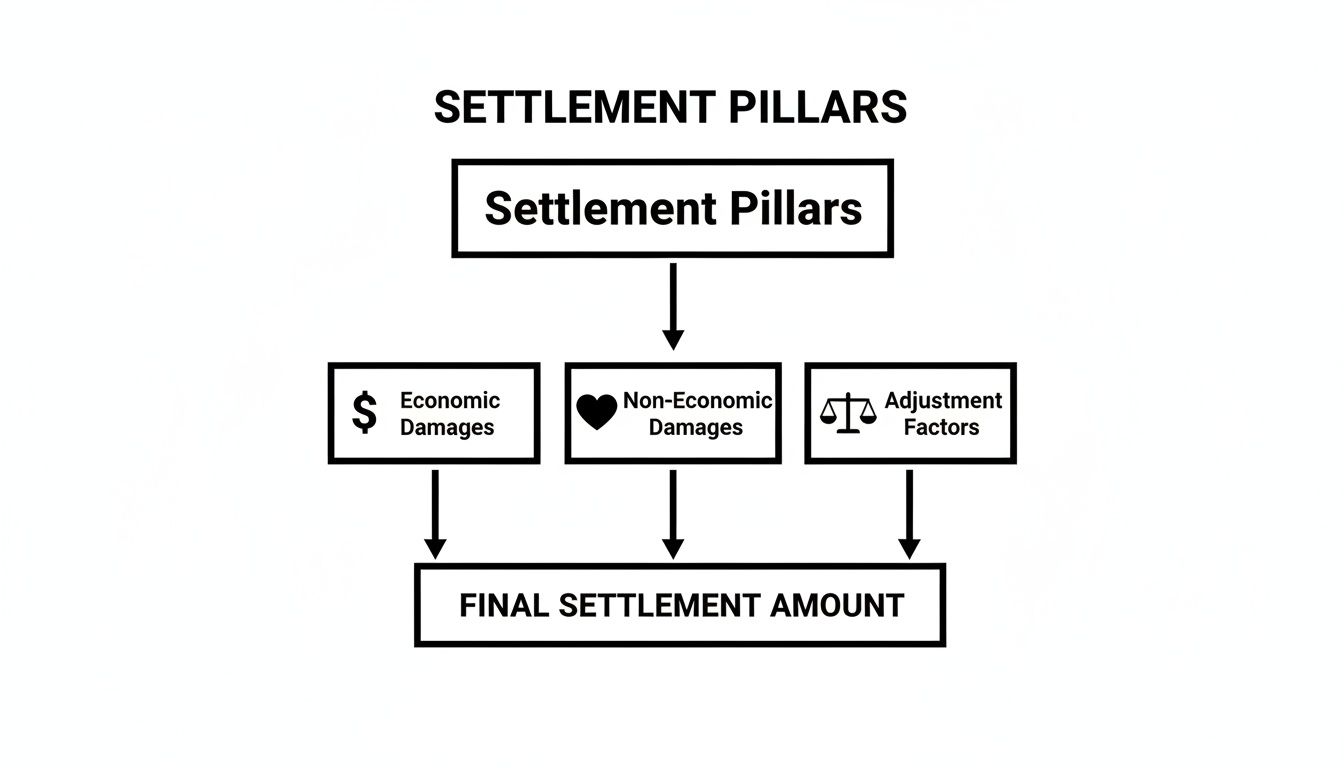

The Three Pillars of Your Car Accident Settlement

When an insurance adjuster or an attorney sits down to figure out what your case is worth, they’re not just guessing. They're building a valuation, piece by piece, based on three fundamental pillars. Think of it like building a house: you start with a solid foundation of hard costs, build the structure that represents the human impact, and then apply the finishing touches that account for the rules and limitations of the real world.

Getting a handle on how these three pillars interact is the key to demystifying the whole settlement process. Each one plays a critical role in shaping that final number.

The Building Blocks of a Fair Settlement

The calculation always starts with the tangible, provable losses before moving into the more subjective, human elements. This makes sense—it ensures your immediate, out-of-pocket expenses form the base of the claim, with everything else built on top.

Let's break down the three core components that form the backbone of every settlement negotiation.

Core Components of a Car Accident Settlement

This table outlines the three essential pillars that determine the value of any car accident claim, moving from the concrete to the abstract.

| Component | What It Includes | Example |

|---|---|---|

| Economic Damages | All verifiable financial losses directly caused by the accident. | Medical bills, lost income from missed work, car repair costs, future medical treatment. |

| Non-Economic Damages | The intangible, human cost of the accident's impact on your life. | Physical pain, emotional distress, anxiety, loss of enjoyment of life, permanent scarring. |

| Adjustment Factors | Real-world variables that can increase or decrease the final payout amount. | Your percentage of fault, the at-fault driver's insurance policy limits, the strength of evidence. |

By understanding these components, you can see how a claim's value is constructed logically rather than arbitrarily.

This visual shows the natural flow: start with hard costs, factor in the human toll, and then ground the total in reality with practical adjustments.

A common mistake is getting fixated only on current medical bills. A truly fair settlement has to account for all three pillars—your past, present, and future losses, both financial and personal, all adjusted for the specific facts of your case.

This structured approach turns a chaotic situation into a logical process. First, you add up the economic damages. Then, you calculate a value for the non-economic suffering. That gives you a baseline claim value. Only after that do you apply the adjustment factors to figure out what a realistic settlement range looks like. In the next sections, we'll dive deeper into each of these pillars.

Calculating Your Economic Damages

When we start putting a number on a car accident claim, the first and most straightforward step is calculating the economic damages. Think of these as the black-and-white, receipt-driven costs of the accident. They are the tangible financial losses that form the bedrock of your entire settlement.

Unlike other parts of a settlement that can be subjective, economic damages are all about the hard numbers. Every single dollar you had to spend or couldn't earn because of the crash fits into this bucket. Getting this part right is non-negotiable for building a solid case.

Tallying Current and Future Medical Expenses

More often than not, the biggest piece of the economic damages puzzle is medical bills. These costs are the engine that drives the entire settlement calculation, directly influencing the final payout you receive.

And we're not just talking about the initial trip to the ER. This is a complete accounting of every medical expense tied directly to the accident.

- Emergency Services: That ambulance ride, the ER treatment, and initial scans like X-rays or MRIs.

- Hospital Stays: The cost for the room, any surgeries, medications given during your stay, and consultations with specialists.

- Follow-Up Care: Every visit to your family doctor, orthopedist, neurologist, or other specialists.

- Rehabilitation: The bills from physical therapy, occupational therapy, or chiropractic care needed to get you back on your feet.

But here’s where many people misstep: the calculation absolutely must include future medical needs. If your injuries demand long-term care—think future surgeries, years of physical therapy, or lifelong medications—those projected costs have to be factored in. Attorneys will often bring in medical experts to testify about why this future care is necessary and what it will cost, making sure nothing gets left on the table.

A classic mistake is only adding up the bills you have right now. A fair settlement has to tell the full story of your recovery, and that story often stretches months, or even years, into the future. If you don't account for future costs, you could end up paying for accident-related care out of your own pocket later on.

Settlement values are heavily weighted by total medical expenses. We see cases where even a "simple" whiplash injury can lead to settlements between $2,500 and $25,000, with the final amount hinging on the extent of documented medical treatment. With healthcare costs on the rise, the national average for an auto liability bodily injury claim hit $26,501 in 2022. It's not just a national trend; a high-cost state like California, which tragically saw over 2,111 passenger vehicle deaths in 2023, already had an average bodily injury claim of $51,634.68 back in 2021—and that number keeps climbing.

Lost Wages and Diminished Earning Capacity

The crash didn't just take a toll on your body; it hit your bank account, too. Economic damages must cover the income you lost because you were physically unable to work.

We start with lost wages. This is a simple calculation: the hours or days you missed from work multiplied by your hourly rate or salary. Don't forget to include any lost overtime, commissions, or bonuses you would have earned during that time.

But what if the injury is more serious? It could impact your ability to earn a living for the rest of your life. This is called diminished earning capacity. If your injuries mean you can't go back to your old job or have to take a lower-paying one, the difference in your potential lifetime earnings becomes part of your claim. Proving this usually requires testimony from vocational experts who can explain how the injuries have limited your career path and future income.

Documenting Property Damage and Other Costs

Finally, economic damages cover the cost to repair or replace your property—usually your car, but it could also be personal items that were inside it during the crash.

You need to track every single out-of-pocket expense, no matter how small it seems. These little costs add up fast.

- Vehicle Repair or Replacement: The bill to fix your car or its fair market value if it was totaled.

- Rental Car Fees: What you spent on a rental while your car was in the shop.

- Personal Property: A damaged laptop, a broken cell phone, or a child’s car seat that needs to be replaced.

- Travel Costs: Mileage and parking for all those trips to and from doctor's appointments.

Holding onto every receipt, invoice, and pay stub is absolutely critical. This paper trail is the proof that backs up your numbers, making it much harder for an insurance company to argue with the hard costs of your claim. To see how all these figures fit together, it helps to understand the different types of damages in personal injury cases.

Putting a Price on Pain and Suffering

Once you’ve added up all the medical bills, repair invoices, and lost wages, you’re left with the most human part of the settlement equation: non-economic damages. This is where we have to tackle the tough question: what's a fair price for the physical pain, emotional trauma, and the sheer disruption an accident causes in your life?

Unlike a medical bill, there’s no price tag on being unable to pick up your child or enjoy a favorite hobby. This makes it the most subjective—and often the largest—piece of a settlement. To bring some order to this process, insurance adjusters and attorneys rely on a couple of established methods to translate this very real, but intangible, harm into a dollar figure.

The Two Main Valuation Methods

Because your experience of pain is unique to you, there's no magic formula that spits out a number. Instead, the legal and insurance worlds use two main strategies to get the conversation started. These frameworks help ground a subjective topic in logic, so the negotiation is based on more than just a gut feeling.

The goal is to land on a figure that truly reflects how severe the accident's impact was on your day-to-day life and for how long.

The Multiplier Method

By far, the most common approach is the Multiplier Method. The concept is pretty simple: your total economic damages (mostly your medical bills) are multiplied by a number, usually between 1.5 and 5, to arrive at a value for your non-economic damages.

Think of the multiplier as a severity score. A low multiplier, say 1.5 or 2, might be used for a minor sprain or whiplash case where you recovered quickly and fully. A high multiplier of 4 or 5 is reserved for catastrophic injuries—the kind that leave you with permanent impairments, chronic pain, or significant scarring.

For example, let's say your medical bills totaled $10,000. Your injuries were moderate but required a few months of physical therapy to get back on your feet. An adjuster might suggest a multiplier of 3. This would value your pain and suffering at $30,000 ($10,000 x 3).

The specific multiplier isn't pulled out of thin air. It’s influenced by several factors:

- The seriousness of the injuries documented in your medical charts.

- How long your recovery took and how invasive the treatment was (e.g., surgery vs. physical therapy).

- Whether the injuries left behind permanent scars, a limp, or any other disability.

- The overall effect on your daily life, from your job to your family and hobbies.

The Per Diem Method

Another tool, though less common, is the Per Diem Method. "Per diem" is just Latin for "per day." This method assigns a daily rate for your suffering, which is then multiplied by the number of days you were in pain until you reached what doctors call "maximum medical improvement."

What's a fair daily rate? Often, it’s pegged to your daily earnings. The reasoning is that dealing with the pain and limitations from an injury is at least as demanding as your day job.

So, if you earn $200 a day and it took you 150 days to recover, the per diem calculation for your pain and suffering would be $30,000 ($200 x 150). This approach works best for shorter-term injuries with a clear and well-documented recovery timeline. It gets tricky and less practical for permanent or lifelong injuries where there’s no real end date to the suffering.

Comparing the Methods

Both the multiplier and per diem methods aim to quantify the unquantifiable, but they are suited for different situations. One is based on the financial cost of your medical care, while the other is tied to the time it took to recover.

Multiplier vs. Per Diem Method A Comparison

| Method | How It Works | Best For |

|---|---|---|

| Multiplier | Total Medical Bills x Severity Multiplier (1.5 to 5) | A wide range of injuries, especially those with significant medical costs or long-term effects. This is the industry standard. |

| Per Diem | Daily Rate (often daily wage) x Number of Recovery Days | Shorter-term, straightforward injuries where the recovery period has a clear start and end date. |

Ultimately, these methods are just starting points for negotiation. The final number will depend on the strength of your evidence.

Proving Your Pain and Suffering Claim

No matter which method is used to start the calculation, the number has to be backed up by solid proof. You can't just say you were in pain; you have to show how it turned your life upside down. Strong documentation is everything. If you need a deeper dive, our guide explains how to prove pain and suffering with practical steps.

Here’s the kind of evidence that really makes a difference:

- Medical Records: These are the foundation. Notes from doctors, surgeons, and physical therapists provide objective proof of your injuries.

- Photos and Videos: A picture is worth a thousand words. Photos of your injuries right after the accident and during your recovery can be incredibly persuasive.

- Personal Journals: Keeping a simple daily log of your pain levels, emotional struggles, and all the things you can’t do anymore creates a powerful, personal narrative.

- Witness Testimony: Statements from family, friends, or coworkers can confirm how the accident changed you—your mood, your abilities, and your overall quality of life.

By combining a logical calculation with compelling evidence, you and your attorney can build a powerful case that reflects the true human cost of your injuries, making sure this critical part of your settlement is taken seriously.

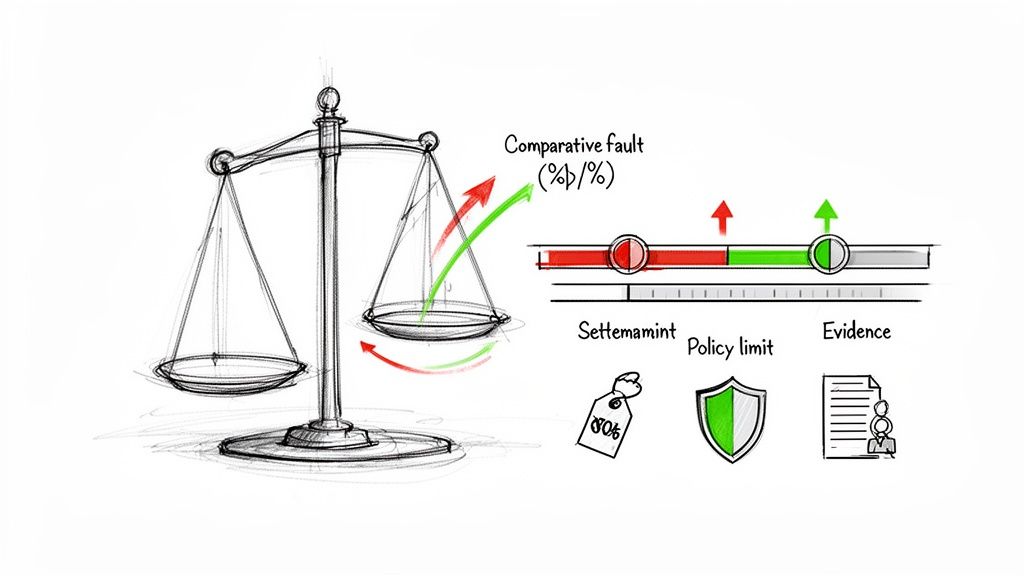

How Real-World Factors Adjust Your Settlement

Once you’ve added up your economic and non-economic damages, you have a solid starting point for your claim's value. But that number is just the beginning of the story. Several powerful, real-world factors will now come into play, and they can drastically change the final check an insurance company writes.

Think of your initial damage calculation as the sticker price on a new car. It's an important number, but it's not what you'll actually pay. The final price gets shaped by negotiations, dealer incentives, and other market forces. For car accident settlements, those forces are things like fault laws, insurance policy limits, and the strength of your evidence.

The Impact of Comparative Fault in Texas

One of the biggest game-changers is comparative fault. Let's be honest, very few accidents are 100% one person's fault. Texas law gets this, and it uses a legal doctrine called "modified comparative fault" that has a massive effect on settlements.

The rule is simple: your final settlement gets reduced by your percentage of blame. So, if your total damages are calculated at $100,000 but a jury decides you were 20% at fault—maybe you didn't signal a lane change perfectly—your award gets slashed by 20%. You'd walk away with $80,000.

The 51% Bar Rule Here’s the critical part. Texas has what’s known as the "51% bar rule." If you are found to be 51% or more responsible for the crash, you get nothing. Zero. This rule makes proving the other driver was primarily at fault the absolute cornerstone of your case.

This is exactly why insurance adjusters fight so hard to pin even a tiny bit of blame on you. Every single percentage point they can shift in their favor is money they don't have to pay. It’s a key battleground in every negotiation.

Insurance Policy Limits Create a Ceiling

Another hard truth is that you can’t squeeze blood from a stone. Every insurance policy has limits, and that number acts as a firm ceiling on what the insurance company will pay out, no matter how high your damages are.

In Texas, the state minimum liability coverage is $30,000 for bodily injury per person, $60,000 per accident, and $25,000 for property damage. If your medical bills and lost wages add up to $80,000, but the driver who hit you only carries the minimum $30,000 policy, the insurer is only on the hook for that $30,000.

- Minimum Coverage: If the at-fault driver is underinsured, their policy may not even come close to covering a serious injury.

- Underinsured Motorist (UIM) Coverage: This is where your own insurance policy can be a lifesaver. If you have UIM coverage, you can file a claim with your own insurer to cover the gap.

- Personal Assets: While you can sue the at-fault driver personally for the rest, collecting that money is often a long shot unless they have significant assets.

An experienced attorney always investigates the policy limits first. It defines the sandbox you're playing in and sets realistic expectations from day one.

The Strength of Your Evidence Matters

At the end of the day, a claim is only as good as the proof you have to back it up. A case built on a foundation of strong, clear evidence is worth far more than one based on he-said-she-said arguments. Why? Because it tells the insurance company you have a real chance of winning at trial, and that’s a risk they don't want to take.

Your ability to present compelling proof directly influences every offer and counteroffer.

Here’s the evidence that really moves the needle:

- The Police Report: While it's not always admissible in court, the investigating officer's opinion on who was at fault carries a lot of weight during settlement talks.

- Witness Statements: An independent third party who saw what happened and backs up your story is priceless.

- Photos and Videos: Nothing tells a story like a picture. Clear images of the crash scene, vehicle damage, and your injuries are incredibly powerful.

- Medical Documentation: This is the bedrock of your claim. You need clean, consistent medical records that draw a straight line from the accident to the injuries you suffered.

When you have a slam-dunk police report, a credible witness, and detailed medical records, you're negotiating from a position of strength. But if your story has holes or you have gaps in your medical treatment, the adjuster will pounce on those weaknesses to justify a lowball offer.

Walking Through Sample Settlement Calculations

Theory is one thing, but seeing how the numbers come together in the real world is what really makes it click. Let's walk through two common Texas car accident scenarios to connect all these concepts. We'll build each settlement calculation from the ground up, showing exactly how the hard costs, the human impact, and other factors all come together.

This will give you a much clearer picture of how the evidence you gather directly affects the bottom line.

Scenario One: A Moderate Dallas Rear-End Collision

Imagine you're stopped at a red light in Dallas. The driver behind you is looking at their phone and doesn't notice you've stopped, hitting you at a moderate speed. The impact leaves you with a painful whiplash injury and a herniated disc in your lower back. Your recovery means months of physical therapy, forcing you to miss some time at your office job.

Here’s how we would start to piece together the settlement value:

-

Tally Up the Economic Damages: We always start with the hard costs—the numbers you can see on paper.

- Medical Bills: $15,000 (this covers the ER visit, MRI, orthopedic consults, and physical therapy).

- Lost Wages: $5,000 (for the two weeks you were unable to work).

- Total Economic Damages: $20,000

-

Estimate the Non-Economic Damages: Now for the pain and suffering. Given the herniated disc and the months of painful recovery, a multiplier of 3 is a very reasonable starting point.

- Calculation: $20,000 (Economic Damages) x 3 = $60,000

-

Find the Initial Case Value: Simply add the two figures together.

- Total: $20,000 + $60,000 = $80,000

This $80,000 is our starting point—the full, baseline value of your claim before we factor in any real-world adjustments.

Scenario Two: A Severe T-Bone Crash

Now, let's look at a much more serious T-bone collision at an intersection. The other driver blew through a stop sign, and the severe side impact left you with a broken leg that required surgery and a concussion. The recovery is longer, the pain is far more intense, and the disruption to your life is immense.

Let’s run the numbers for this case:

- Medical Bills: $50,000 (covering the ambulance, surgery, hospital stay, and follow-up care).

- Future Medical Costs: $10,000 (an estimate for the ongoing physical therapy you'll need).

- Lost Wages: $15,000 (due to a much longer recovery period).

- Total Economic Damages: $75,000

For a case this serious, the multiplier needs to reflect the gravity of the injuries. Because of the surgery, broken bone, and concussion, a multiplier of 4 is completely justified.

- Non-Economic Damages Calculation: $75,000 x 4 = $300,000

- Initial Settlement Value: $75,000 + $300,000 = $375,000

You can see how the severity of the injuries and that higher multiplier create a dramatically larger baseline value. In fact, lost wages and earning capacity can be a huge driver of settlement values, often making up 20-40% of the total in moderate to severe cases.

Applying a Real-World Adjustment

Let's bring this back to reality with a common curveball: comparative fault. We'll use our first scenario, the rear-end collision with the $80,000 baseline value. Suppose the insurance adjuster digs up a witness who claims you braked a little too suddenly. They argue this makes you 20% at fault for the collision.

How Comparative Fault Changes Everything In Texas, your settlement gets reduced by your percentage of fault. This one factor can wipe out tens of thousands of dollars from your final payout, which is exactly why adjusters fight so hard to place even a little bit of blame on you.

Here’s how that 20% fault would slash the final number:

- Initial Value: $80,000

- Reduction Amount: $80,000 x 0.20 = $16,000

- Adjusted Settlement Value: $80,000 - $16,000 = $64,000

Suddenly, the negotiation is no longer about $80,000; it's now centered in the $60,000 to $70,000 range. These examples show just how critical it is to understand every piece of the puzzle. To get a better sense of where your specific case might fall, you can use a data-driven car accident settlement calculator to see real-world examples.

Back Up Your Numbers with Real-World Case Data

Figuring out what your car accident claim is worth is a huge first step, but it’s only half the journey. The real challenge? Convincing the insurance adjuster that your number is fair and reasonable.

Adjusters live and breathe this stuff. They handle hundreds, sometimes thousands, of claims and have a ton of internal data at their fingertips. This creates a classic information gap, and it almost always puts you at a disadvantage.

This is precisely where real-world case data can level the playing field. Instead of just relying on a formula, you can ground your entire negotiation in what has actually happened in cases just like yours. By comparing the specifics of your accident to a deep database of past verdicts and settlements, you shift the conversation from a subjective "he said, she said" argument to one based on objective facts.

From "I Think It's Worth..." to "The Data Shows It's Worth..."

Imagine walking into a negotiation. In one hand, you have a number you feel is right. In the other, you have a number you can prove is right, backed by historical precedent. Which one do you think is more powerful?

Data platforms are designed to give you that power. They gather publicly available court records, jury verdicts, and settlement outcomes, then organize them so you can see exactly what similar cases have paid out.

- Injury Type: What’s the typical range for a herniated disc versus a simple fracture?

- Accident Details: How do outcomes differ between a straightforward rear-end collision and a more complex T-bone accident?

- Location, Location, Location: You can even see how settlement values change from one county to the next.

Suddenly, your claim isn't just an emotional plea for fairness. It's a business-like proposition supported by hard evidence. You’re no longer just another claimant hoping for a good offer; you're an informed negotiator presenting a data-backed valuation.

When you can analyze the outcomes from thousands of similar cases, you build a credible settlement range. This simple step makes it much harder for an adjuster to lowball your claim with an offer that’s completely out of line with what's normal for your situation.

For instance, a tool like Verdictly gives you the ability to filter through case histories and find ones that mirror your own circumstances.

As you can see, this kind of tool lets you turn abstract legal theories into concrete dollar figures. This transparency doesn't just empower you; it helps you and your attorney have much more productive strategy sessions and gives you the confidence to push back against an adjuster's first low offer.

Car Accident Settlement FAQs: Your Questions Answered

When you're dealing with the fallout from a car accident, questions are bound to pop up. It's a confusing process, and understanding things like timelines, taxes, and negotiation tactics is crucial. Let's clear up some of the most common questions that come up when calculating a car accident settlement.

Getting straight answers helps you set the right expectations and make informed decisions as you move forward.

How Long Will It Take to Settle My Case?

There’s no single answer here—the timeline for a car accident settlement can be anywhere from a few months to a few years. For a straightforward case where the other driver is clearly at fault and your injuries are minor, you might see a settlement in three to six months.

But if your injuries are serious, if there’s a fight over who caused the crash, or if a lot of money is on the line, be prepared for a longer haul. These more complex cases often take one to three years, especially if a lawsuit becomes necessary. The biggest factors are usually how long your medical treatment lasts and how cooperative the insurance company decides to be.

Will I Owe Taxes on My Settlement Money?

For the most part, no. The IRS generally does not consider money you receive for physical injuries, medical bills, or property damage to be taxable income. You're just being made whole for your losses.

However, there are exceptions. Any portion of the settlement specifically for lost wages or emotional distress (if it's not directly caused by a physical injury) is usually taxable. Punitive damages are always taxable. It's always a smart move to run your settlement by a tax professional to be sure.

Is the Insurance Company's First Offer a Good One?

Almost never. Accepting the first offer is one of the biggest mistakes you can make. Insurance adjusters are skilled negotiators whose job is to protect the company's bottom line by paying out as little as possible.

Think of the first offer as the opening bid in a negotiation, not the final word. It's almost guaranteed to be a lowball figure. Before you even think about accepting, you need a crystal-clear picture of all your damages—past, present, and future.

What if I Was Partially to Blame for the Accident?

You can still recover money. Texas operates under a "modified comparative fault" rule, which you'll sometimes hear called the 51% bar rule.

This legal rule means you can still get a settlement as long as you weren't 51% or more responsible for the crash. Your final settlement will simply be reduced by whatever percentage of fault is assigned to you. For instance, if you're awarded $100,000 but are found to be 20% at fault, your award is cut by $20,000, and you'd receive $80,000.

Stop guessing what your claim is worth and start knowing. Verdictly gives you a clear view of thousands of real Texas motor vehicle case outcomes, letting you benchmark your claim against cases just like yours. Head to https://verdictly.co to replace uncertainty with data-driven confidence.

Related Posts

How Much Can I Get From a Car Accident Settlement?

Wondering how much can I get from a car accident? This guide breaks down settlement factors, damages, and claim values to help you estimate your compensation.

Calculating Pain and Suffering: calculating pain and suffering in Texas

Learn how to calculate pain and suffering damages in a Texas car accident. See key factors and how calculating pain and suffering affects your claim.

Calculating pain and suffering car accident: A Practical Guide to Damages

Learn how calculating pain and suffering car accident damages works, with factors and tips to maximize your settlement.