Can You Sue Someone in a Car Accident? A Guide to Your Rights

Can you sue someone in a car accident? Learn the critical steps for filing a claim and what it takes to secure fair compensation for your injuries and damages.

Yes, you absolutely can sue someone after a car accident. If another driver's carelessness left you with injuries and a mountain of bills, a lawsuit is often the only way to make things right. It’s not about getting even—it's a legal process designed to hold the responsible driver accountable and help you recover financially when their insurance company won't step up.

Why a Lawsuit Becomes Necessary After an Accident

When we get behind the wheel, we all enter into an unwritten agreement to drive safely. But when another driver shatters that trust by texting, speeding, or blowing through a red light, a lawsuit becomes the tool for dealing with the fallout. It’s your formal demand for them to cover the costs they created, from hospital bills and lost paychecks to the very real, human cost of your pain and suffering.

This step is often forced when the at-fault driver's insurance company makes a lowball settlement offer that doesn't even begin to cover your losses. Remember, an insurer's primary goal is to protect its bottom line and close your claim for the lowest amount possible, which can leave you on the hook for major expenses.

Understanding the Scale of Car Accidents

Taking legal action is far more common than you might think. Car crashes are the single biggest reason for personal injury claims in the U.S. In fact, nearly 400,000 personal injury claims are filed every single year, and a huge chunk of those stem from traffic accidents.

Just to put it in perspective, in 2022 alone, an estimated 5.2 million people needed medical attention after a crash. You can always dig deeper into the data about personal injury cases and industry trends to see the full scope of the problem.

A lawsuit empowers you to demand full compensation for all of your losses—not just what an insurance adjuster thinks your claim is worth. It levels the playing field, making sure your story is heard and your damages are valued fairly.

Filing a lawsuit sends a powerful message: you won't be bullied into accepting an unfair offer. It forces the insurance company to re-evaluate your claim and often brings them to the negotiating table in a much more serious way. And if a fair settlement still isn’t possible, the lawsuit protects your right to have a judge or jury decide what you’re owed.

Proving Negligence: The Foundation of Your Car Accident Claim

Winning a car accident lawsuit is about more than just showing a collision occurred. The whole case hinges on a single legal concept: negligence.

Think of it this way: negligence is the legal system's term for carelessness. To successfully sue another driver, you have to prove they didn't act with the reasonable caution that any other driver would, and that this failure is the direct reason you were hurt.

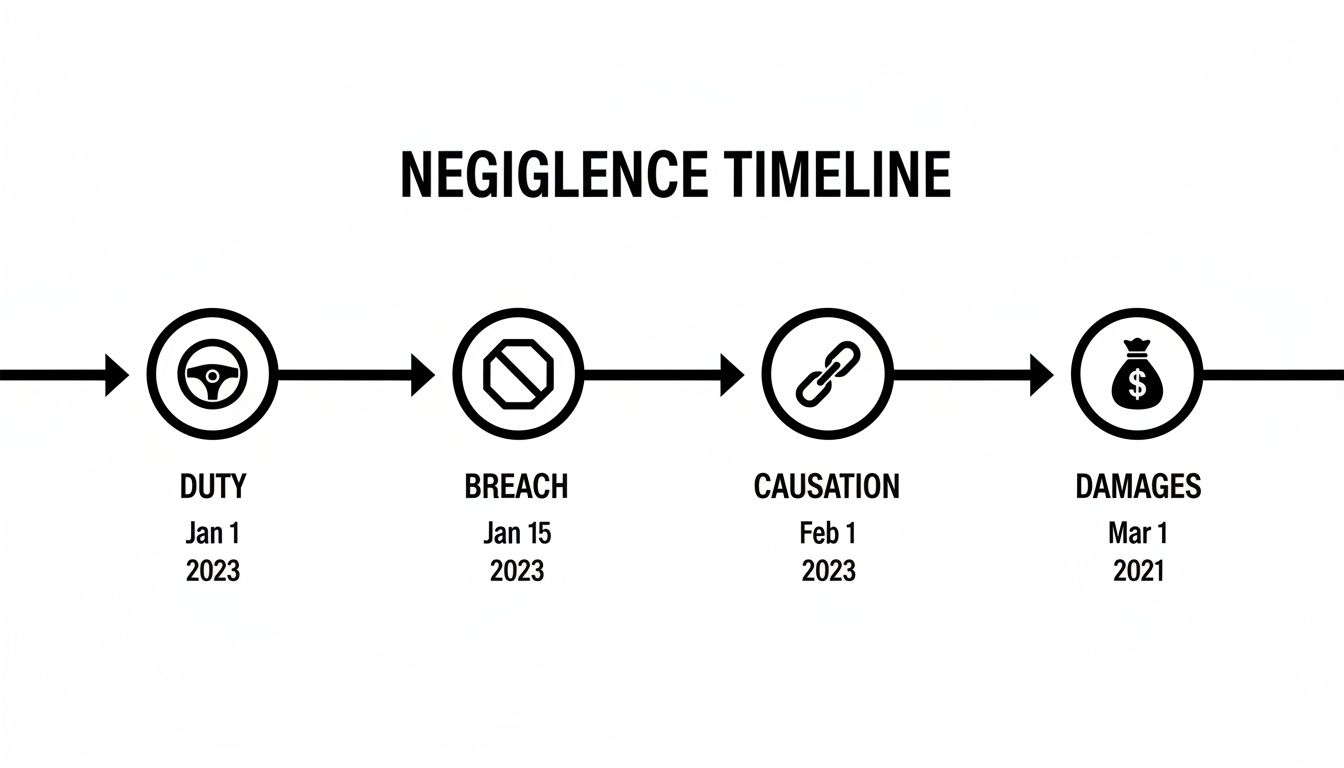

Building a strong case is like constructing a four-legged table. If any one of the legs is weak or missing, the whole thing will fall apart. Your negligence claim is the same—all four elements must be solid for your case to stand up in court.

The Four Pillars of a Negligence Claim

To get compensation, you and your lawyer have to prove each of these four points, creating a clear and unbroken line from the other driver's mistake to your losses.

-

Duty of Care: This is the starting point, and it's usually the easiest to establish. Every driver on the road has an automatic, built-in responsibility—a "duty"—to operate their vehicle safely. That means obeying traffic laws, staying alert, and not endangering others. It's the basic price of admission for getting behind the wheel.

-

Breach of Duty: This is where you pinpoint the what. A "breach" is the specific action the other driver took (or failed to take) that violated their duty of care. Did they run a red light while texting? Were they speeding in a school zone? That specific failure is the breach.

-

Causation: Now you connect the dots. You must show that the other driver’s breach directly caused the accident and your injuries. It’s not enough that they were texting; you have to prove that their texting is what made them run the red light, which in turn caused them to T-bone your car and break your arm.

-

Damages: This is the final piece of the puzzle—the so what?. You have to demonstrate that you suffered real, provable harm as a result of the crash. These losses are what the legal system calls "damages," and they are the basis for the compensation you’re seeking.

Proving negligence isn't about blaming someone emotionally. It's a methodical process of showing how another person's failure to be a responsible driver directly caused your physical, emotional, and financial harm.

These damages fall into two main buckets to cover the full scope of your losses:

- Economic Damages: These are the tangible, out-of-pocket costs with a clear price tag. Think medical bills, lost income from being unable to work, and the bill for repairing your car.

- Non-Economic Damages: These compensate for the very real, but harder-to-calculate, human suffering. This includes things like physical pain, emotional trauma, and the loss of enjoyment of life.

Without solidly proving all four elements—Duty, Breach, Causation, and Damages—it becomes nearly impossible to win a car accident lawsuit.

How Texas Law Shapes Your Car Accident Claim

When you're thinking about suing after a car accident, you're stepping into a legal arena with a very specific rulebook. In Texas, a few key laws can make or break your case, acting as the guardrails that guide your claim from the moment of impact to a final resolution. Getting a handle on them isn't just a good idea—it's absolutely essential.

The Two-Year Countdown: Texas's Statute of Limitations

First up is the statute of limitations. Think of this as a non-negotiable legal deadline. In Texas, you typically have just two years from the date of the wreck to file a lawsuit.

If you let that two-year window close, your right to seek compensation is almost certainly gone for good, no matter how clear-cut the other driver's fault was. This is why acting promptly is so critical. For a deeper look at this deadline, check out our guide on the statute of limitations for a car accident in Texas.

Proving fault is the foundation of any claim, and it boils down to four key elements.

You have to demonstrate that the other driver had a duty to drive safely, breached that duty, directly caused your injuries, and that you suffered real damages as a result.

The 51% Bar: How Shared Fault Works in Texas

Another major Texas rule is modified comparative fault, which is often called the 51% rule. This law comes into play when there's a question of whether both drivers share some of the blame. It's not an all-or-nothing system; it works more like a sliding scale.

Let's say a jury decides you were 20% responsible for the accident—maybe you were going a few miles over the speed limit when the other driver blew through a red light. If your total damages are calculated at $100,000, your final award would be reduced by your percentage of fault, meaning you'd receive $80,000.

But there's a strict cutoff.

If you are found to be 51% or more at fault for the collision, you are completely barred from recovering any money. You get nothing.

This rule is precisely why insurance adjusters work so hard to pin even a tiny fraction of the blame on you. They know that every percentage point they can shift in their favor directly reduces what they have to pay out—and if they can push you over that 50% line, they owe you nothing at all.

Why Being an "At-Fault" State Matters

Finally, it’s important to know that Texas is an "at-fault" state. This simply means the person who caused the crash is financially on the hook for the harm they caused. Unlike "no-fault" states where you first turn to your own insurance policy, the process here is to go directly after the at-fault driver's insurance.

This system puts the burden of proof squarely on your shoulders. It also highlights the importance of Uninsured/Underinsured Motorist (UM/UIM) coverage. If the driver who hit you has no insurance or not enough to cover your bills, filing a lawsuit against them personally might be your only option—unless you have that crucial UM/UIM protection on your own policy.

Understanding the Compensation You Can Recover

When you decide to sue after a car accident, the goal is to recover "damages." That's the legal term for the money meant to make you financially whole again, as if the crash never happened. Think of it like putting together a detailed invoice for every single loss the at-fault driver caused. The whole point is to ensure you aren't left holding the bag for a crisis you didn't create.

The compensation you can pursue generally falls into three different buckets. Each one covers a specific type of harm you've suffered, from the obvious bills you can hold in your hand to the less visible, human costs of the collision.

Calculating Your Economic Damages

The most straightforward category is Economic Damages. These are the tangible, verifiable losses that have a clear price tag. They're the financial backbone of your claim because they represent all your direct, out-of-pocket expenses.

Common examples of economic damages include:

- Medical Bills: This covers the entire chain of care, from the ambulance ride and ER visit to ongoing physical therapy, necessary surgeries, and even future medical treatments your doctor says you'll need.

- Lost Wages: If your injuries forced you to miss work, you can claim the income you lost. This can also include your "loss of earning capacity"—meaning, compensation if you can no longer do your old job or earn the same living.

- Property Damage: This is simply the cost to either repair your car or, if it's totaled, replace it. It also includes any personal belongings destroyed in the crash, like a phone, a car seat, or a laptop.

Calculating these damages is a matter of simple math: adding up all the receipts, invoices, medical bills, and pay stubs. These are the black-and-white numbers that prove the immediate financial hit you took.

Valuing Your Non-Economic Damages

Next up are Non-Economic Damages. These are just as real as a hospital bill, but they're much trickier to put a number on. This is compensation for the human toll—the actual suffering you went through. While you can't use a calculator to quantify pain, the legal system absolutely recognizes that it has value.

Non-economic damages acknowledge that a car accident's true impact goes far beyond the bills. It accounts for the physical pain, the emotional trauma, and the disruption to your daily life.

These damages are meant to cover harms like:

- Pain and Suffering: This is for the physical pain your injuries caused.

- Emotional Distress: This covers things like the anxiety, depression, or even PTSD that can follow a traumatic crash.

- Loss of Enjoyment of Life: You can be compensated for the inability to do the things you used to love, whether it's playing a sport, gardening, or just picking up your kids.

Because these losses are so personal and subjective, figuring out their value is a complex process. You can get a deeper look into the methods used by reading our guide on how car accident settlements are calculated.

Punitive Damages in Extreme Cases

Finally, there's a third category you'll only see in rare cases: Punitive Damages. These aren't about paying you back for a loss. Instead, their sole purpose is to punish the defendant for truly egregious or reckless behavior—think a drunk driver speeding through a school zone.

Punitive damages are awarded to send a clear message and deter others from acting so dangerously. While they aren't common in most car accident cases, they serve as a powerful tool for justice when the circumstances are particularly shocking.

How to Gather Evidence for a Stronger Claim

When you decide to sue someone after a car accident, the strength of your case really boils down to the quality of your evidence. You have to shift your mindset and become the lead investigator on your own claim. From the moment the crash happens, the clock is ticking, and every little detail you can collect might just be the puzzle piece that wins your case.

This isn't just about pointing the finger and proving the other driver was at fault. It's about meticulously documenting every single loss you've suffered because of their actions. The more solid evidence you have, the harder it is for an insurance adjuster to lowball your claim or argue with the facts.

Creating an Official Record

The very first thing you need to do is get official, unbiased accounts of the accident and its aftermath. These documents are the concrete foundation you'll build your entire claim on.

- The Police Report: This is almost always the most critical piece of evidence. It's an objective, third-party summary of what happened, often with diagrams, the officer's initial thoughts on who was at fault, and a record of any tickets issued. Make sure you get a copy.

- Medical Records: You need a paper trail for everything. Every ER visit, every doctor's appointment, every physical therapy session, and every prescription filled. These records create an undeniable timeline that connects your injuries directly back to the accident.

Capturing the Scene and Its Impact

The raw evidence at the scene of the crash can vanish in a matter of minutes. That's why your smartphone is your best friend in this situation. Use it to create a visual diary before cars are towed or debris is cleared away.

Start snapping photos and taking videos of everything you can think of:

- The damage to both cars from every possible angle.

- The wider scene, including traffic lights, skid marks on the road, and even the weather conditions.

- Any visible injuries you have, like bruises, cuts, or swelling.

While you're at it, get the contact information for anyone who saw the accident happen. A neutral witness who can back up your story is worth their weight in gold. Their testimony provides a powerful, unbiased perspective. Even your own text messages about the accident can sometimes be used as evidence; you can learn more by reading our guide on whether texts hold up in court.

The more detailed your documentation, the clearer the story you can tell a judge, jury, or insurance adjuster. Your goal is to paint a complete picture of what happened and how it has affected your life.

Lastly, start a personal journal. It might feel strange at first, but writing down your daily pain levels, your emotional state, and all the things you can no longer do is incredibly powerful. This running narrative turns the abstract idea of "pain and suffering" into a real, compelling human story that resonates.

Negotiating a Fair Settlement with Confidence

Here’s a reality of car accident claims: most of them never end up in a courtroom. The overwhelming majority are resolved through a settlement, which is basically a negotiated agreement between you and the other driver's insurance company. But that brings up the million-dollar question: how do you know if their offer is actually fair?

Think about it. Insurance companies do this all day, every day. They have teams of adjusters, lawyers, and access to massive internal databases on what claims like yours usually cost them. This creates a huge knowledge gap, putting you at a serious disadvantage from the get-go when trying to figure out what your case is truly worth.

Arming Yourself with Real-World Data

This is where having objective, real-world data completely changes the dynamic. Instead of just accepting what the insurance company tells you your claim is worth, you can counter their assessment with hard facts and figures from similar cases.

When you can show an insurance adjuster what actual juries in Texas have awarded—or what similar claims have settled for—the entire conversation shifts. Your demand is no longer just your story; it’s a realistic financial expectation backed by precedent.

By tapping into real verdict and settlement data from Texas, you can build a credible, evidence-based valuation for your claim. This is crucial for deciding whether to push for a better settlement or prepare to file a lawsuit.

Turning the Tables on a Lowball Offer

When you benchmark your case against what has happened in the real world, you can spot a lowball offer from a mile away and confidently reject it. This equips you to argue from a position of strength, not desperation.

Imagine being able to have a conversation like this:

- "The injuries I sustained are very similar to Case X from Harris County, which settled for $75,000."

- "Based on recent jury verdicts for this type of collision in my area, the median award is about 30% higher than your current offer."

This approach takes the guesswork out of the negotiation. It gives you—and your attorney—the ammunition needed to build a compelling case for a settlement that truly covers your losses, making sure you don't leave money on the table just because you didn't know what to ask for.

A Few Common Questions We Hear All the Time

After a crash, it's natural for your mind to race with questions about what comes next. Let's tackle some of the most common concerns people have when they start thinking about the legal side of things in Texas.

"How in the World Can I Afford a Lawyer?"

This is probably the number one question people ask, and the answer is simpler than you think. Almost all personal injury lawyers in Texas work on what’s called a contingency fee basis.

In plain English, this means you don't pay a dime out of your own pocket to get started. Your lawyer’s fee is just a percentage of the money they recover for you, typically somewhere between 33% and 40%. If they don't win your case, you owe them nothing for their time. It's a system that makes sure everyone can get quality legal help, not just those who can afford to write a big check.

"What If the Other Driver Doesn't Have Insurance?"

It’s a frustrating scenario, but you still have options. You can technically sue the uninsured driver personally, but the reality is that if they can't afford insurance, they probably don't have the money or assets to pay a judgment. It can be like trying to get blood from a stone.

A much better route is usually found in your own insurance policy. Look for Uninsured/Underinsured Motorist (UM/UIM) coverage. This is an add-on you pay for precisely for this situation. It lets you file a claim with your own insurance company, who then steps in and covers the damages the at-fault driver should have paid for.

"Can I Still Get Compensation If I Was Partially to Blame?"

Yes, you often can. Texas operates under a rule that lawyers call "modified comparative fault," but the concept is pretty straightforward.

As long as you are found to be 50% or less at fault for the accident, you can still recover damages.

Here’s how it works: Your total compensation is simply reduced by your percentage of fault. For instance, if a jury decides your case is worth $100,000 but finds you were 20% responsible for the crash, you would receive $80,000. The critical point is the 51% mark. If you are deemed 51% or more at fault, you can't recover a single penny.

Knowing what your case could be worth is the foundation of a fair settlement. Verdictly gives you a real-world look at Texas verdict and settlement data, providing the insight you need to understand your claim's value and negotiate effectively. You can see how similar cases have resolved and arm yourself with crucial information.

Related Posts

A Guide to Medical Records Reviews in Personal Injury Claims

Learn how medical records reviews can strengthen your Texas injury claim. This guide explains the process, key findings, and how to build a stronger case.

Why Insurance Companies Deny Claims: why insurance companies deny claims

Learn why insurance companies deny claims and how to overcome common denials with proven appeals and tips to maximize your compensation.

How Much Can I Get From a Car Accident Settlement?

Wondering how much can I get from a car accident? This guide breaks down settlement factors, damages, and claim values to help you estimate your compensation.