Statute of Limitations Car Accident Texas: Your Guide to Deadlines and Claims

Statute of limitations car accident texas: Learn the critical deadlines, exceptions, and tips to protect your claim (statute of limitations car accident texas).

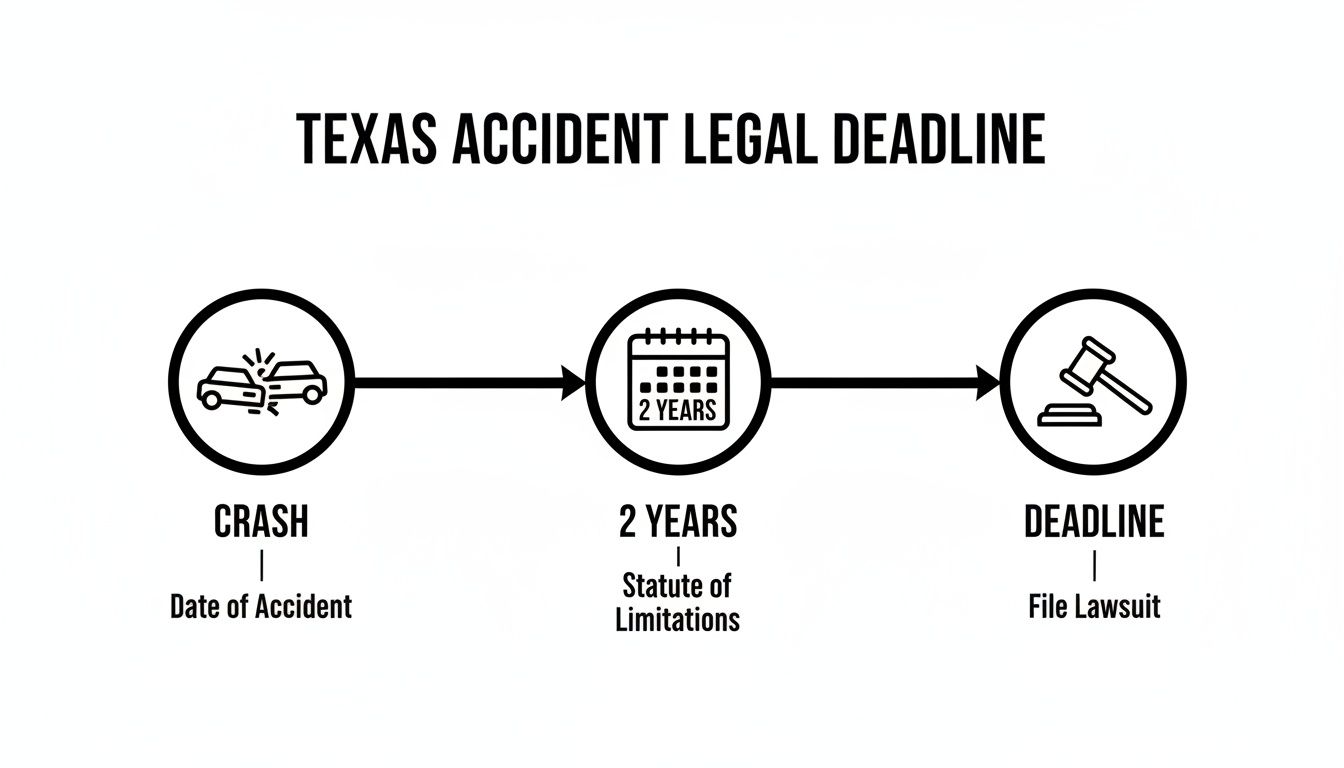

In Texas, the statute of limitations for a car accident is generally two years from the date of the crash. This is the hard deadline for filing a lawsuit to recover compensation for your injuries and vehicle damage. Think of it as a legal countdown clock that starts the moment the accident happens.

The Two-Year Countdown: A Clock You Can't Ignore

That two-year deadline isn't just a suggestion—it's a strict, court-enforced rule. Once that window closes, your opportunity to hold the at-fault driver financially responsible is almost always gone for good, no matter how clear their fault was or how serious your injuries are.

This rule exists for a couple of practical reasons. First, it ensures that legal disputes are resolved while evidence is still fresh. Over time, witnesses' memories fade, physical evidence like skid marks disappears, and crucial documents can get lost. A two-year limit pushes everyone to act before the trail goes cold. It also provides a sense of finality, so potential defendants don’t have the threat of a lawsuit hanging over their heads indefinitely.

Why This Deadline Is a Hard Stop

Let's be clear: the consequences of missing this deadline are severe. If you try to file a lawsuit even one day late, the other side’s attorney will immediately ask the court to throw out your case. And the judge will almost certainly grant their request.

This means you are permanently barred from recovering money for:

- Medical Bills: From the initial ambulance ride and ER visit to ongoing physical therapy and future surgeries.

- Lost Wages: All the income you missed out on because you were too injured to work.

- Property Damage: The cost to get your car repaired or replaced.

- Pain and Suffering: Compensation for the physical pain, emotional trauma, and disruption to your life.

This isn't just a courtroom custom; it's written directly into state law. Texas Civil Practice and Remedies Code §16.003 sets the two-year limit for personal injury claims. Courts rarely make exceptions, and every year, deserving victims lose their right to compensation simply because they waited too long. You can learn more about the impact of these deadlines on Texas accident victims to understand the real-world stakes.

The statute of limitations acts as a final gatekeeper to the courthouse. It doesn't care how strong your case is—only whether you filed it on time.

At the end of the day, that two-year clock highlights just how critical it is to act quickly after an accident. Getting the ball rolling protects your legal rights and ensures you don't accidentally forfeit your chance at justice and financial recovery.

How to Pinpoint Your Exact Filing Deadline

The two-year statute of limitations for a car accident in Texas sounds simple enough, but the devil is truly in the details. The most critical detail? Knowing the exact date your legal countdown begins. Getting this wrong is a surprisingly common and devastatingly expensive mistake.

You have to understand that the trigger date isn't always the day of the crash. It all depends on the specific harm you've suffered.

The Standard Calculation for Injury Claims

For most personal injury cases, the math is straightforward. The clock starts ticking on the exact date the accident happened—the moment of impact, when the negligence occurred and the initial injury took place.

Think of the date on your police report or the time stamp on your accident scene photos as the official start of your two-year window. For example, if you were rear-ended on June 10, 2023, you must file your lawsuit no later than June 10, 2025. That date becomes your absolute, non-negotiable deadline.

As you can see, the path is usually linear: the crash starts a strict two-year countdown that ends with a hard deadline for taking legal action.

When the Starting Line Shifts

But life isn't always so clear-cut. In some situations, the starting line moves, and you need to know exactly which rule applies to your case.

Two key scenarios change when the clock starts ticking:

- Wrongful Death Claims: If a loved one tragically dies from injuries they suffered in a car accident, the two-year clock does not start on the day of the crash. Instead, it begins on the date of the person's death. This is a crucial distinction, especially if they passed away days, weeks, or even months after the collision.

- The Discovery Rule: Sometimes, an injury doesn't show up right away. You might walk away from a crash feeling a little sore, only to discover weeks later that you have a serious spinal injury. In these rare situations, the "discovery rule" might apply. This rule can effectively pause the statute of limitations, starting the clock on the date you knew—or reasonably should have known—about the injury.

The discovery rule is an important exception, but it's complex and heavily scrutinized by the courts. You can't just claim ignorance; you must be able to prove that the injury was not reasonably discoverable any sooner.

Real-World Deadline Examples

Let's look at how these rules play out with a couple of practical examples.

Scenario 1: Standard Injury Claim

- Accident Date: March 1, 2024

- Injury: Broken arm, diagnosed at the scene.

- Clock Starts: March 1, 2024

- Filing Deadline: March 1, 2026

Scenario 2: Wrongful Death Claim

- Accident Date: August 15, 2024

- Date of Death: August 28, 2024

- Clock Starts: August 28, 2024

- Filing Deadline: August 28, 2026

Pinpointing your deadline is the essential first step, but it's just as important to understand what comes next. To get a better sense of the entire legal timeline, it’s helpful to learn more about how long a civil lawsuit takes and the different stages involved. This knowledge helps you prepare for the road ahead while ensuring you don't miss a single critical date.

Exceptions That Can Pause the Countdown Clock

That two-year deadline for filing a car accident lawsuit in Texas seems pretty rigid, but it’s not always set in stone. The law understands that life happens, and certain circumstances can make it nearly impossible—or just plain unfair—to expect someone to file a claim within that standard window. For these specific situations, the legal system can effectively hit the pause button on the countdown clock.

This legal pause is called tolling. The best way to think about it is like pausing a stopwatch during a race. The timer stops running and only starts back up once the issue causing the delay is resolved. For anyone injured in a wreck, knowing about these exceptions could be the difference between getting the compensation you deserve and losing your rights forever.

The Discovery Rule for Hidden Injuries

One of the most critical exceptions is known as the discovery rule. It’s designed for a frighteningly common scenario: you get into a car accident, feel shaken up but otherwise fine, and head home. But weeks or even months down the road, you start getting debilitating headaches or severe back pain. A trip to the doctor reveals a traumatic brain injury or a herniated disc directly caused by the crash.

Normally, your two-year clock would have started ticking on the day of the accident. But how could you possibly have filed a lawsuit for an injury you didn’t even know you had?

This is where the discovery rule acts as a crucial safety net. It says the statute of limitations clock doesn't start running until the date you discovered the injury, or the date you reasonably should have discovered it.

Real-World Example: Let's say you were in a collision on May 1, 2024. You felt okay at first, but on September 15, 2024, a doctor diagnoses a serious spinal injury from the wreck that simply wasn't obvious before. Thanks to the discovery rule, your two-year deadline would likely start from September 15, 2024, not the day of the accident.

This isn't a get-out-of-jail-free card, though. Courts look at these claims very carefully. You’ll need to show that the injury was truly hidden and that a reasonable person wouldn't have found it any sooner.

Special Protections for Minors

The law also gives special consideration to children who are hurt in an accident. Since a minor can’t legally file a lawsuit for themselves, the statute of limitations is tolled—or paused—until they are no longer a child in the eyes of the law.

For a minor injured in a Texas car wreck, the two-year countdown doesn't even begin until their 18th birthday. In practice, this means an injured child generally has until their 20th birthday to file a personal injury lawsuit. This extension ensures they have the chance to pursue their own legal rights once they become an adult.

When the At-Fault Party Causes Delays

Sometimes, the person who caused the accident is the one who causes a delay. The law has rules in place to stop a defendant from dodging responsibility just by hiding or trying to game the system.

A few key situations can toll the deadline:

- The Defendant Leaves Texas: If the at-fault driver leaves the state for a period of time, the clock can be paused for the duration of their absence. It essentially stops when they leave and only resumes when they return to Texas.

- Criminal Proceedings: If the at-fault driver's actions also constituted a crime (like a DUI), the civil case can be affected. The link between drunk driving and devastating accidents is all too real; in 2023, crashes involving DUIs were responsible for 26.26% of all traffic fatalities in Texas. While a criminal case is ongoing, the statute of limitations for your civil injury claim can be put on hold until those proceedings are finished. You can learn more about the stark realities of fatal Texas car accidents and what causes them.

These exceptions are complex and depend entirely on the specific details of your case. Trying to rely on one without talking to a lawyer first is a huge risk. An experienced attorney can look at your situation, figure out if your deadline might be different, and make sure your claim is filed correctly and on time.

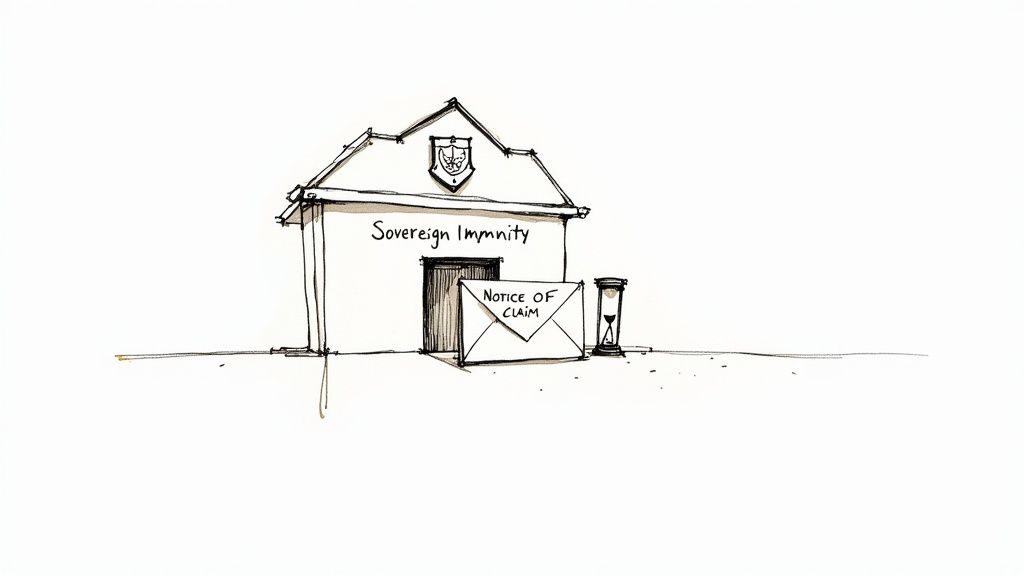

Navigating Claims Against Government Entities

If your car accident involved a government vehicle—maybe a city bus, a state trooper, or even a public works truck—you've just stepped into a completely different legal arena. Forget everything you know about the standard two-year statute of limitations. When the government is involved, a much shorter, stricter clock starts ticking immediately.

This all comes down to a very old legal concept called sovereign immunity, which basically shields government bodies from lawsuits. Luckily, the Texas Tort Claims Act creates a limited waiver, giving you a narrow window to seek compensation for accidents caused by the on-the-job negligence of government employees.

But there's a huge catch. Before you can even consider filing a lawsuit, you must give the government a formal notice of claim. This isn't just a good idea; it's a non-negotiable first step.

The Six-Month Notice of Claim Deadline

For most state and local government entities in Texas, the deadline to provide this formal written notice is just six months from the date of the crash. Some cities have their own charters with even shorter timelines, so you have to verify the specific local rules for the agency involved.

To be clear, this notice is not the lawsuit itself. It’s a formal heads-up to the government that you were injured and intend to hold them responsible.

Missing the notice of claim deadline is a fatal blow to your case. It doesn't matter if you have a year and a half left on the standard statute of limitations; if you fail to provide proper notice on time, your right to recover any money is gone forever.

A government attorney will immediately move to have your case thrown out on this technicality, and the court will almost certainly agree. The exceptions are incredibly rare, making this one of the most dangerous deadlines in Texas law.

What Your Notice Must Include

This isn't a casual email or a quick phone call. Your notice of claim has to be a formal document, delivered to the right person or department, containing specific information. It generally needs to lay out:

- Your Information: Your full legal name and current address.

- Incident Details: The precise date, time, and location of the collision.

- A Clear Description: A narrative of how the accident occurred and the reasons you believe the government employee was at fault.

- Injury and Damage Information: A description of the injuries you suffered and the damage to your vehicle.

Given how much is at stake, this is not a DIY project. The severe consequences of getting it wrong mean this process should always be guided by an experienced attorney who knows how to navigate the system.

The federal government plays by its own strict rules, too. The Federal Tort Claims Act (FTCA) has its own unforgiving deadlines that can get a case dismissed before it even starts. To see a real-world example of how these rules are applied, you can read an analysis of a federal court decision dismissing an FTCA car crash claim because the deadline was missed.

What Happens If You Miss the Filing Deadline?

Think of the statute of limitations as a door to the courthouse. For two years after your car accident, that door is wide open. But the second that deadline passes, the door slams shut and locks for good. It’s a harsh reality with permanent consequences.

File your lawsuit even one day late, and the outcome is swift and brutal. The other driver's attorney will immediately file a motion to dismiss your case. The judge will have no choice but to grant it. Just like that, your case is over before it ever really began.

This isn't just a simple setback. It’s the complete loss of your right to seek justice. You are permanently blocked from recovering a single penny for your medical bills, lost wages, car repairs, and the pain and suffering you've been forced to endure.

Why Insurance Companies Watch the Clock

Insurance adjusters are acutely aware of this deadline. They know that if they can stall your claim long enough, their legal duty to pay you can disappear into thin air. It’s a powerful and often-used negotiation tactic.

An adjuster might drag you into endless conversations, ask for the same documents over and over, or string you along with a series of lowball offers. All of these are classic delay tactics designed to run out the clock. Their goal is simple: keep you focused on a potential settlement so you lose track of the calendar. Once that two-year mark passes, they can legally cut off all communication and deny your claim, leaving you with nothing.

Never make the mistake of thinking that active negotiations with an insurer will pause the statute of limitations. The clock is always ticking, no matter what an adjuster promises you.

The Financial Stakes Are High

The cost of missing this deadline is massive, especially when you look at the real dangers on Texas roads. In 2023 alone, there were 18,765 serious injuries from vehicle crashes across the state. With Texas requiring only a minimum of $30,000 in liability coverage per person, many victims find their medical bills and other losses quickly surpass what a basic policy can pay. If you miss your filing deadline, you're left to cover all those costs yourself. You can dig deeper into the data behind fatal Texas car accidents to understand just how high the stakes are.

Failing to act quickly also means crucial evidence starts to vanish.

- Witnesses forget: The sharp details of what someone saw can fade surprisingly fast.

- Physical evidence disappears: Skid marks wash away in the rain, and damaged vehicles get repaired or sent to the scrapyard.

- Digital records get erased: Traffic camera footage and a vehicle's "black box" data are often recorded over on a short, automatic cycle.

This isn’t just about a legal technicality; it’s about protecting the very proof you need to win your case. Waiting until the last minute weakens your position and could make it impossible to prove fault and get the compensation you deserve.

Proactive Steps to Protect Your Legal Rights

It’s one thing to know about the two-year statute of limitations for a car accident in Texas. It's another thing entirely to take the right steps to protect your claim. The clock starts ticking the moment the crash happens, and what you do in the days and weeks that follow can make or break your case.

If you wait too long, you don't just risk missing the filing deadline. You also risk losing crucial evidence as it gets lost, memories fade, and physical proof degrades. Being proactive isn't just a good idea—it's the best defense you have.

Your Immediate Post-Accident Checklist

Of course, your health and safety come first. But once the dust settles and you're out of immediate danger, the actions you take can fundamentally shape your ability to get fair compensation down the road.

Here’s what you absolutely must do:

- Seek Immediate Medical Attention: Get checked out by a doctor, even if you think you’re okay. Adrenaline can mask serious injuries like concussions or internal bleeding. Going to an ER or urgent care clinic creates a vital medical record that connects your injuries directly to the accident.

- Document Everything at the Scene: Your smartphone is your best tool here. Take pictures and videos of everything—the damage to all cars from every angle, skid marks, road conditions, and any relevant traffic signs. If there are witnesses, get their names and phone numbers before they leave.

- Obtain the Official Police Report: This report is a cornerstone of your claim. It contains the officer's initial observations, driver and insurance details, and sometimes even a preliminary finding of fault. Make sure to get a copy as soon as it's available.

These initial steps create a clear, time-stamped snapshot of the accident and its consequences. This evidence becomes invaluable when an insurance adjuster tries to argue that the crash wasn't that serious or that your injuries came from something else.

The Most Important Step to Take

While gathering evidence yourself is critical, the single most effective action you can take is to speak with an experienced Texas personal injury attorney. Don't put this off. The sooner a legal professional is on your side, the better protected you are.

A good lawyer immediately takes over the stressful parts, freeing you up to focus on healing. They will handle all the back-and-forth with insurance adjusters, who are professionally trained to get you to settle for as little as possible.

More importantly, your attorney will preserve evidence, calculate the full extent of your damages (including future medical costs and lost wages), and ensure your lawsuit is filed correctly long before the deadline expires. Understanding how to pick a personal injury lawyer who is right for you is the key. Making that one decision can be the difference between a costly mistake and securing the financial recovery you deserve.

Frequently Asked Questions

After a car wreck, it’s normal for your head to be spinning with questions. Let’s clear up some of the most common ones about Texas's statute of limitations for car accidents.

Does the Two-Year Deadline Also Apply to Vehicle Damage?

Yes, it absolutely does. In Texas, the two-year statute of limitations covers both your personal injury claim and the property damage claim for your vehicle.

You have exactly two years from the date of the accident to file a lawsuit for everything—from your medical bills to your car repair costs. Don’t think of them as separate timelines; the clock for both starts ticking the moment the crash happens.

What if I Was Partially at Fault for the Accident?

Texas law has a straightforward way of handling this, known as the "51% bar" rule. It means you can still recover money as long as you weren't 51% or more to blame for the collision.

Your final compensation is just reduced by your share of the fault. For instance, if a jury decides you were 20% responsible for an accident that caused $100,000 in damages, you could still walk away with $80,000. The key thing to remember is that being partially at fault doesn't change your two-year deadline. You still have to file on time.

Does Negotiating with an Insurer Extend the Deadline?

No. This is a trap that many people fall into. Talking with an insurance adjuster, no matter how promising the negotiations seem, does not pause the two-year statute of limitations.

An adjuster can talk to you right up to the day your deadline expires and then simply stop returning your calls. If you haven't filed a lawsuit by then, you're left with no options.

Never assume that good-faith negotiations protect your right to sue. Your lawsuit must be filed before the deadline, period.

When Does the Clock Start for a Wrongful Death Claim?

This is a crucial distinction. For a wrongful death lawsuit stemming from a car accident, the two-year clock starts on the date of the victim's death, which may not be the same as the date of the wreck.

If a loved one tragically passes away from their injuries days, weeks, or even months after the collision, the family has two years from the day they passed to file a lawsuit. It’s a small but vital detail that ensures grieving families have the time they need to seek justice.

Knowing what your case could be worth is essential for a sound legal strategy. Instead of relying on guesswork, you can use real data. Verdictly gives you access to a massive database of actual Texas car accident verdicts and settlements, showing you what similar cases are truly worth. Explore our data to build your strategy from a position of strength at https://verdictly.co.

Related Posts

A Guide to Medical Records Reviews in Personal Injury Claims

Learn how medical records reviews can strengthen your Texas injury claim. This guide explains the process, key findings, and how to build a stronger case.

Why Insurance Companies Deny Claims: why insurance companies deny claims

Learn why insurance companies deny claims and how to overcome common denials with proven appeals and tips to maximize your compensation.

How Much Can I Get From a Car Accident Settlement?

Wondering how much can I get from a car accident? This guide breaks down settlement factors, damages, and claim values to help you estimate your compensation.