Uninsured Driver Accidents (uninsured driver accidents) Steps to Compensation

If you're dealing with uninsured driver accidents, learn the immediate steps, how to file claims, and your legal options to secure compensation.

The moments after a car crash are always a shock. But when you find out the other driver doesn't have insurance, that shock can quickly turn into a full-blown panic. It’s a gut-wrenching feeling.

In that chaotic situation, the single most important thing you can do is to call the police and get an official report. This isn't just a suggestion; it's the bedrock of your entire case. You might be tempted to accept a cash offer on the side of the road, but following a clear protocol is the only way to protect yourself financially.

Your First Steps After an Accident With an Uninsured Driver

Getting hit by someone with no insurance feels like hitting a dead end. How can you get compensated if there's no policy to file a claim against? The good news is, you likely have options through your own insurance.

But here’s the catch: your ability to use that coverage hinges entirely on what you do in the minutes and hours right after the crash. Your top priority is to build an undeniable record of exactly what happened. Think of yourself as a detective building a case from minute one—every photo, witness name, and official document is a crucial piece of evidence.

This table provides a quick rundown of what to do at the scene.

| Action | Why It's Critical |

|---|---|

| Call 911 Immediately | Secures a police report, which officially documents the other driver's lack of insurance and often provides an initial assessment of fault. |

| Ensure Safety | Move vehicles out of traffic if possible, turn on hazard lights, and check for injuries. Adrenaline can mask pain, so be cautious. |

| Document Everything | Use your phone to take extensive photos/videos of vehicle damage, the scene, the other driver's license, and their license plate. |

| Exchange Information | Get the other driver's name, address, and phone number. Keep conversation minimal and avoid discussing fault. |

| Gather Witness Contacts | If anyone saw the accident, get their name and number. Independent accounts are incredibly powerful. |

Following these steps methodically transforms a chaotic scene into a clear narrative for your insurance company, making your claim much harder to dispute.

Secure the Scene and Ensure Safety

Before you do anything else, make sure everyone is okay. If you can, move your car to the shoulder and switch on your hazard lights to warn other drivers.

Check on yourself and your passengers. Even if you feel fine, adrenaline is a powerful painkiller. It’s best to get checked out by a medical professional later. When talking to the other driver, keep it brief. Stick to exchanging basic information and avoid getting into an argument about who caused the accident.

Document Everything Meticulously

Once the scene is safe, it’s time to become a diligent record-keeper. Your smartphone is your best tool here. Take far more photos and videos than you think you’ll need, from every possible angle.

Be sure to capture:

- Vehicle Damage: Get close-ups of the impact points on both cars, as well as wider shots showing the full scope of the damage.

- Scene Context: Photograph the positions of the cars, any skid marks on the road, traffic signs, weather conditions, and debris.

- Driver Information: Snap clear pictures of the other driver's license, their license plate, and the Vehicle Identification Number (VIN) on their dashboard.

This visual evidence is priceless. It helps reconstruct the accident and shuts down any attempts to change the story later on.

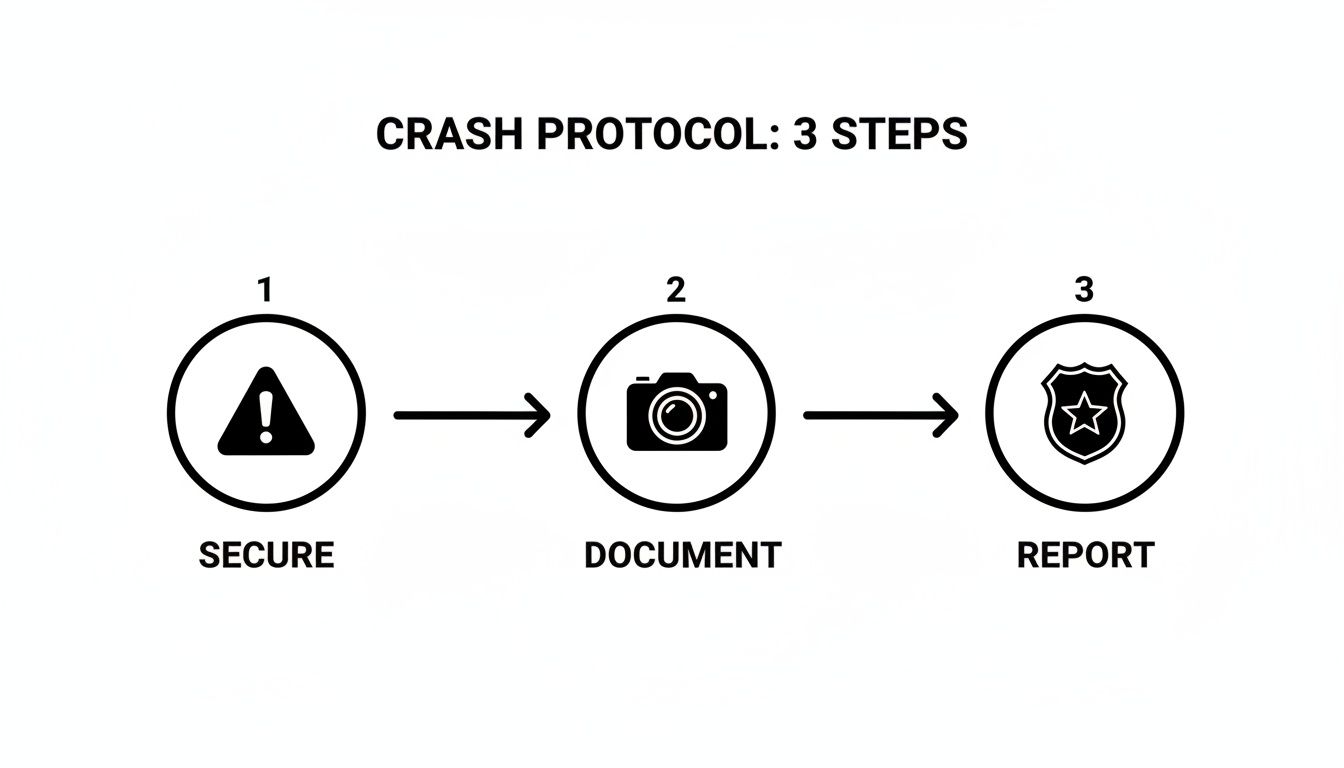

This three-step process—securing the scene, documenting the evidence, and reporting the crash officially—lays the groundwork for your entire insurance claim.

The Non-Negotiable Police Report

In any accident, a police report is a good idea. When the other driver is uninsured, it’s absolutely non-negotiable. Don’t let the other driver talk you out of calling 911, no matter how much they plead or offer to pay cash on the spot.

A police report is the official, third-party account of what happened. It identifies the at-fault driver, confirms their lack of insurance, and often includes the officer's initial assessment of who caused the crash. All of this is vital for a successful Uninsured Motorist (UM) claim.

Without that report, your claim devolves into a messy "he said, she said" scenario. This gives your own insurance company an easy reason to question the facts and potentially deny your claim.

With the number of uninsured drivers on the rise—the Insurance Research Council (IRC) estimated 15.4% of all motorists were uninsured in 2023, or about one in seven—this step is more critical than ever. Navigating the claims process for an uninsured driver accident can be tricky, and understanding your options is key.

How Uninsured Motorist Coverage Protects You

Think of Uninsured Motorist (UM) coverage as your personal financial safety net. It's the shield you carry for the worst-case scenario: you get hit by someone who has no insurance at all. When an accident isn't your fault, your own UM policy steps in to pay for your damages.

Without it, you could be staring down a mountain of medical bills and repair costs after an uninsured driver accident, with no clear path to getting paid back. Your UM coverage acts as a stand-in for the at-fault driver's missing insurance, giving you a way to recover financially.

The Two Pillars of UM Coverage

This coverage is typically broken down into two main parts, each designed to handle a different kind of loss. Knowing the difference is crucial to understanding what you're really protected against.

-

Uninsured Motorist Bodily Injury (UMBI): This is the part that covers people. It's designed to pay for medical treatment, lost income from being out of work, pain and suffering, and other costs tied to physical injuries for you and anyone in your car. It’s your first line of defense against the crippling financial fallout of a serious injury.

-

Uninsured Motorist Property Damage (UMPD): This part covers your car. It pays to get your vehicle fixed after it's been damaged by an uninsured driver. You might have a small deductible, but it keeps you from footing the entire repair bill yourself.

It's also worth noting Underinsured Motorist (UIM) coverage, which is usually sold together with UM. UIM is for situations where the other driver has insurance, but their policy limits are too low to cover all of your bills. Your UIM coverage kicks in to make up the difference.

Finding UM Coverage on Your Policy

So, do you have this vital protection? The easiest way to check is by looking at your insurance "declarations page." This is the summary sheet, usually right at the front of your policy documents.

On that page, you'll see a breakdown of your coverages and their limits. Scan for lines like "Uninsured Motorist Bodily Injury" (or UMBI) and "Uninsured Motorist Property Damage" (or UMPD). The numbers next to them represent the maximum amount your insurance company will pay out.

For instance, you might see limits shown as $30,000/$60,000. This means your policy provides up to $30,000 for one person's injuries and a total of $60,000 for everyone hurt in that single accident.

Pay close attention to these limits. If they're too low, a major accident could easily blow past them, leaving you to cover the rest out of pocket.

Why State Minimums Are Often Not Enough

A lot of drivers just buy the cheapest policy they can find, which usually means they only have the bare minimum liability coverage required by the state. The problem is, when a serious crash happens, those minimums are almost never enough to cover the actual costs.

Let's say your medical bills and lost wages add up to $75,000. If your UMBI limit is only $30,000, you’re stuck with a $45,000 shortfall. This is a common and devastating reality for victims of uninsured driver accidents, even those who thought they were protected.

This is exactly why many insurance professionals recommend you set your UM/UIM limits to be the same as your own liability limits. In other words, give yourself the same level of financial protection that you give to others on the road. You can find many great articles that take a closer look at UM/UIM coverage to help you choose the right limits for your own situation. It's a small investment for some very real peace of mind.

Filing Your Uninsured Motorist Insurance Claim

When you're hit by a driver with no insurance, your first thought is probably relief that you have Uninsured Motorist (UM) coverage. You’ve been paying your premiums for this exact scenario, expecting your own insurance company to have your back.

But here’s where things get tricky. The moment you file a UM claim, the dynamic with your insurer flips completely. It can feel surprisingly adversarial.

Think of it this way: your insurance company now has to step into the shoes of the at-fault driver's insurance—which doesn't exist. Their new role is to defend against your claim, and their goal is often the same as any other insurer in an accident case: pay out as little as possible.

This shift can be jarring. You suddenly have to prove everything to your own company, just as you would to a stranger's. You'll need to show that the other driver was at fault, detail the severity of your injuries, and document every single dollar you've lost.

Initiating the Claim and the Recorded Statement

Your first move is to officially notify your insurance company about the accident and that you intend to file a UM claim. Don't wait on this. Policies have strict reporting deadlines, and you don’t want to give them an easy reason to deny your claim.

Soon after, an adjuster will probably ask for a recorded statement. Be very careful here. It might sound like a simple formality, but every word you say can be picked apart later to downplay your injuries or question your story.

Before you agree to a recorded statement, it's best to stick to the hard, objective facts. Avoid guessing about fault or saying things like "I'm fine." Adrenaline is a powerful painkiller, and an injury that feels minor at the scene can become a serious problem days later.

The Role Reversal: Your Insurer Is Not Your Friend

This is the single most important thing to understand about a UM claim. The company you trust and pay for protection now has a direct financial incentive to minimize your payout.

When you file a UM claim, your insurer effectively becomes your legal opponent. Their adjusters are trained to investigate claims for inconsistencies and find reasons to reduce the settlement amount. They will protect their bottom line, even at your expense.

This adversarial relationship is exactly why thorough documentation is non-negotiable. You aren't just filing a report; you are meticulously building a case against a team that knows how to spot and exploit weaknesses.

Building Your Case With Strong Evidence

To get a fair settlement, you need to arm yourself with compelling evidence. The goal is to build a case so strong that it leaves no room for your insurer to argue about the other driver's fault or the true cost of your damages.

A solid claim is built on a foundation of clear, organized proof. Here’s a rundown of the essential evidence you’ll need to start gathering right away.

Essential Evidence Checklist for Your UM/UIM Claim

Building a successful Uninsured Motorist claim is all about the details. The stronger and more organized your evidence, the harder it is for your insurance company to dispute your claim's value. The table below outlines the critical documents you'll need.

| Evidence Type | Purpose in Your Claim |

|---|---|

| Official Police Report | Establishes the facts of the crash, identifies the uninsured driver, and often includes the officer’s initial assessment of fault. |

| Medical Records and Bills | Documents the full extent of your injuries, the treatment required, and the total cost of your medical care, both past and future. |

| Proof of Lost Wages | Includes pay stubs and a letter from your employer detailing the time you missed from work and the income you lost as a result. |

| Photos and Videos | Provides visual proof of vehicle damage, the accident scene, and your physical injuries (bruises, casts, etc.). |

| Repair Estimates | Shows the cost to repair or replace your vehicle, supporting your property damage claim. |

| Witness Statements | Offers independent, third-party corroboration of how the accident occurred, strengthening your argument for the other driver's fault. |

Having these documents is the first step. The next is presenting them in a way that tells a powerful story.

Once you’ve collected everything, you’ll bundle it all into a formal settlement demand package. The centerpiece of this is a persuasive demand letter. To make sure you get it right, take the time to learn about the essential components of a strong settlement demand letter. This document is your most important negotiation tool and sets the tone for a fair resolution.

When Your Insurance Claim Is Not Enough

You’ve done everything right. You filed your Uninsured Motorist (UM) claim and sent over a mountain of evidence to prove your case. But what happens when the bills from your uninsured driver accident stack up higher than what your policy will cover? Or even worse, what if your own insurance company gives you an insultingly low offer or denies your claim outright?

It’s an incredibly frustrating position to be in. When your UM coverage runs out or your insurer refuses to play fair, it can feel like you’ve hit a dead end. But the standard claims process isn’t your only option. You still have powerful legal avenues to explore to get the compensation you deserve.

Suing the Uninsured Driver Directly

Your most direct route is to file a personal injury lawsuit against the driver who caused the crash. It’s your legal right, and in a perfect world, this would allow you to recover all of your damages, far beyond your insurance limits.

But we don't live in a perfect world. This path has a major practical roadblock: people who drive without insurance often do so for a reason—they typically don’t have much money or assets. The harsh reality is that even if you go to court and win a huge judgment, actually collecting that money can be next to impossible.

You can win the battle in court, but the driver might be “judgment-proof,” meaning they have no wages to garnish or property to seize. Lawsuits are long and expensive, so it’s a big gamble if the person on the other end of it has empty pockets. Because of this, suing the at-fault driver is usually a last resort.

Recognizing Insurance Bad Faith

A much more common, and often more successful, strategy involves holding your own insurance company accountable for its promises. You pay your premiums faithfully, and in return, they have a legal and ethical duty to handle your claim fairly and in good faith. When they fail to do so, you might have grounds for a separate legal claim against them.

Insurance bad faith happens when your insurer unreasonably delays, denies, or underpays a valid UM claim without a good reason. They do this to protect their bottom line, breaking the trust you placed in them when you bought the policy.

Think of your insurance policy as a contract. When your insurer doesn't hold up their end of the deal, they aren't just being difficult—they may be breaking the law. A bad faith lawsuit allows you to pursue damages that go beyond your policy limits, holding the company accountable for its wrongful actions.

Learning to spot the warning signs of bad faith is the first step in protecting yourself. Keep an eye out for tactics designed to wear you down until you accept less than you’re owed.

Common Signs Your Insurer Is Acting Unfairly

Bad faith isn’t always a dramatic, in-your-face denial. It often shows up as a pattern of frustrating and unreasonable behavior. If you start noticing these red flags, it’s probably time to talk to an attorney.

Here are some tell-tale signs:

- Unreasonable Delays: Your adjuster consistently misses deadlines, never returns your calls, or lets the investigation drag on for months without any real explanation.

- Failure to Investigate: The insurance company barely looks into your accident or completely ignores important evidence you’ve sent them.

- Lowball Settlement Offers: You get an offer that is nowhere near the documented value of your claim. They’re banking on you being desperate enough to take it.

- Misrepresenting the Policy: The adjuster tells you something isn’t covered when it clearly is or tries to use a policy exclusion that doesn’t apply to your situation.

- Threatening to Raise Rates: They hint that your premiums will go up if you use your UM coverage—something that’s illegal for not-at-fault accidents in most states.

The number of uninsured drivers on the road can vary wildly from state to state, which often affects how aggressively insurers handle these claims. For instance, states like Mississippi and New Mexico see uninsured motorist rates climbing well over 20%. You can dig into these state-by-state uninsured motorist statistics to get a feel for the situation where you live. If you suspect bad faith in any uninsured driver accident claim, make sure to document every single phone call, email, and letter. It could be the key to building a strong case.

The Hidden Costs of Uninsured Driving

When you get hit by an uninsured driver, it feels like a personal financial disaster. But the truth is, the problem is much bigger than just your own crash. These accidents send a financial shockwave through the entire insurance system, and the aftershocks eventually raise the price for every single responsible driver on the road. It’s like a hidden tax we all pay.

So, who picks up the tab when an uninsured driver causes a wreck? The medical bills and repair costs don't just disappear. The financial burden shifts squarely onto the shoulders of the person who was hit. You're forced to turn to your own Uninsured Motorist (UM) coverage, assuming you were wise enough to get it. Your insurance company then has to pay for a mess it had no hand in creating—a cost it eventually bakes into everyone's premiums.

This is exactly why uninsured driver accidents make your insurance bill go up. Insurers set their rates by calculating risk and the potential for payouts. The more they have to shell out for UM claims, the more they have to charge everyone else just to stay afloat.

The Financial Ripple Effect

Think of the insurance system as a giant community pool of money. Every premium payment you make is a drop of water going in, and every claim is a bucket of water coming out. Uninsured drivers cause accidents that take huge buckets of water out of the pool, but they never add a single drop.

This imbalance forces everyone who does have insurance to pour more into the pool just to keep it from going empty. It creates a frustrating system where the responsible majority ends up footing the bill for the risks created by a reckless few.

When a big chunk of drivers are on the road without coverage, the whole system feels the strain. The financial risk for victims and insurers goes through the roof, leading to a flood of UM/UIM claims and steady, upward pressure on the premiums we all have to pay.

And this isn't a small problem. We're talking about a significant portion of drivers. Nationally, about 14–15% of drivers were uninsured in 2023, with another 18% being underinsured. That means a huge number of accidents involve someone without enough—or any—coverage. To see just how these numbers affect what you pay, it’s worth checking out some detailed uninsured motorist statistics.

How States Try to Fight Back

States know what a massive burden this puts on their citizens, so they've rolled out a few different strategies to try and get a handle on it. The effectiveness varies from state to state, but the goal is always the same: get uninsured cars off the road and protect insured drivers from financial ruin.

These efforts usually fall into one of three buckets:

-

Mandatory UM/UIM Coverage: Some states make it a rule that UM and UIM coverage must be included in every auto policy. While you can sometimes opt out in writing, making it the default ensures far more people are protected.

-

Strict Insurance Laws: Just about every state requires liability insurance, but enforcement is where it gets tricky. Many states now use electronic verification systems, linking DMV databases directly with insurance company records to flag uninsured vehicles almost instantly.

-

"No-Pay, No-Play" Laws: A growing number of states have adopted these laws, which basically say that if you're an uninsured driver and get into an accident, your ability to recover damages is limited—even if the other person was 100% at fault. It’s a powerful financial reason to not drive without insurance.

These measures certainly help, but they don't solve the problem completely. The core issue is that every single uninsured driver accident is a drain on the system, and that cost always trickles back down to your insurance bill. Once you understand that, it becomes crystal clear why having solid UM coverage isn't just a good idea—it's your essential financial armor on the road.

Common Questions About Uninsured Driver Claims

Getting into a wreck is stressful enough, but when the other driver doesn't have insurance, it can feel like you've been left holding the bag. It’s a frustrating and confusing situation, and it’s completely normal to have a lot of questions. Let’s walk through some of the most common ones we hear from people trying to navigate the aftermath.

What If the At-Fault Driver Gives Me False Insurance Information?

It’s a truly awful scenario. You think you've done everything right at the scene, only to call the other driver's "insurance company" and find out the policy is expired or never existed. It happens more often than you'd think, but it doesn't mean you're out of luck.

The moment you discover the information is bogus, you need to do two things: report it to the police and notify your own insurance company. Reporting it to the police can trigger a fraud investigation, which creates an official record of the other driver's deception. For your own claim, your insurer will typically treat this situation just like a hit-and-run or a standard uninsured motorist accident.

This is exactly why gathering your own proof at the scene is so critical. The photos you took of their license plate, their driver's license, and their car are now your key evidence. That proof helps you show your insurer that the at-fault driver was unidentifiable or uninsured, which is what you need to do to open the door to your Uninsured Motorist (UM) coverage.

Will My Insurance Rates Go Up If I File a UM Claim?

This is probably the number one fear people have in this situation. Why pay for coverage if you're just going to get penalized for using it?

Here’s the good news: in Texas, it’s illegal for an insurance company to raise your premiums for an accident that wasn’t your fault.

A UM claim is what’s known as a “not-at-fault” claim. You aren’t asking your insurer for a favor; you are exercising a contractual right you paid for. This is the very reason you have the coverage in the first place.

Never let the fear of a rate hike stop you from filing a legitimate UM claim. If your insurance company tries to jack up your rates or threatens to cancel your policy after a not-at-fault uninsured driver accident, you have every right to fight back. Document everything and consider filing a complaint with the Texas Department of Insurance.

Can I Sue the Uninsured Driver Personally?

The short answer is yes. You absolutely have the legal right to file a personal injury lawsuit against the driver who caused the crash. A successful lawsuit could result in a court judgment that covers all of your damages, potentially far more than your UM policy limits.

But here’s the hard reality: there's a huge gap between winning a lawsuit and actually collecting any money. People who drive without car insurance often don't have many assets to their name. They might be "judgment-proof," which is a legal term meaning they have no money or property that you can seize to satisfy the court's judgment.

You can spend a ton of time, money, and emotional energy suing someone, only to end up with a piece of paper that says you won but no way to collect. It can be a completely hollow victory. That’s why filing a UM claim is almost always the smarter, faster, and more practical way to get compensated. A personal lawsuit is usually a last resort, not the first move.

How Is Fault Determined in an Uninsured Motorist Accident?

This is a key point that trips a lot of people up. Even though you’re filing a claim with your own insurance company, you still have to prove the other driver was at fault.

In an uninsured driver accident, fault is determined the same way it is in any other crash: by looking at the evidence. Your insurer will do its own investigation, but the strength of your claim will come down to a few core things:

- The Police Report: This is your foundational document. It’s an impartial account from a law enforcement officer that often includes their initial take on who caused the collision.

- Photos and Videos: Nothing tells a story like a picture. Your photos of the final resting positions of the cars, the damage, skid marks, and relevant traffic signs are crucial for piecing together what happened.

- Witness Statements: An independent witness who saw the crash is pure gold. A neutral third party who can back up your story makes it much harder for the at-fault driver to change their tune later.

To tap into your UM coverage, the evidence has to clearly show the other driver was negligent. If the proof is weak, your own insurer could deny the claim, making your recovery an uphill battle.

When you're facing the uncertainty of a car accident claim, having access to real data can make all the difference. At Verdictly, we believe that transparency is key to fair negotiations. Our AI-powered platform gives you access to a searchable database of real verdicts and settlements from across Texas, so you can see what cases like yours are actually worth. Don't go into negotiations blind. Explore real case outcomes and empower yourself with the information you need at https://verdictly.co.