What Is the Value of a Totalled Car and How Is It Calculated?

Your car is totalled. What now? Learn how insurers determine the value of a totalled car using ACV and how you can negotiate a fair settlement.

When an insurance company tells you your car is a "total loss," what they’re really talking about is its Actual Cash Value (ACV). This isn't what you originally paid for the car, and it's certainly not what a brand-new replacement would cost. The ACV is a snapshot of what your specific vehicle was worth in the moments right before the crash. Getting a grip on this concept is your first and most important step toward a fair settlement.

So, What's My Totaled Car Really Worth?

Think about it like selling a used phone. A three-year-old iPhone doesn't sell for what it cost new. Its price today depends on the model, its condition, and what someone else is willing to pay for an identical one in the current market. Your car's value works the exact same way. The insurance company is trying to figure out the real-world cost to buy a vehicle just like yours—same make, model, year, mileage, and overall condition—in your local area.

This conversation is happening more and more often. In fact, by mid-2025, a staggering 22.6% of all collision claims were ending in a total loss, a record high in the U.S. Why? It's a combination of falling used car values and the sky-high cost of repairing modern vehicles packed with complex tech. You can dig deeper into these trends in the Crash Course report from CCC Intelligent Solutions.

Key Factors That Determine Your Car's Total Loss Value

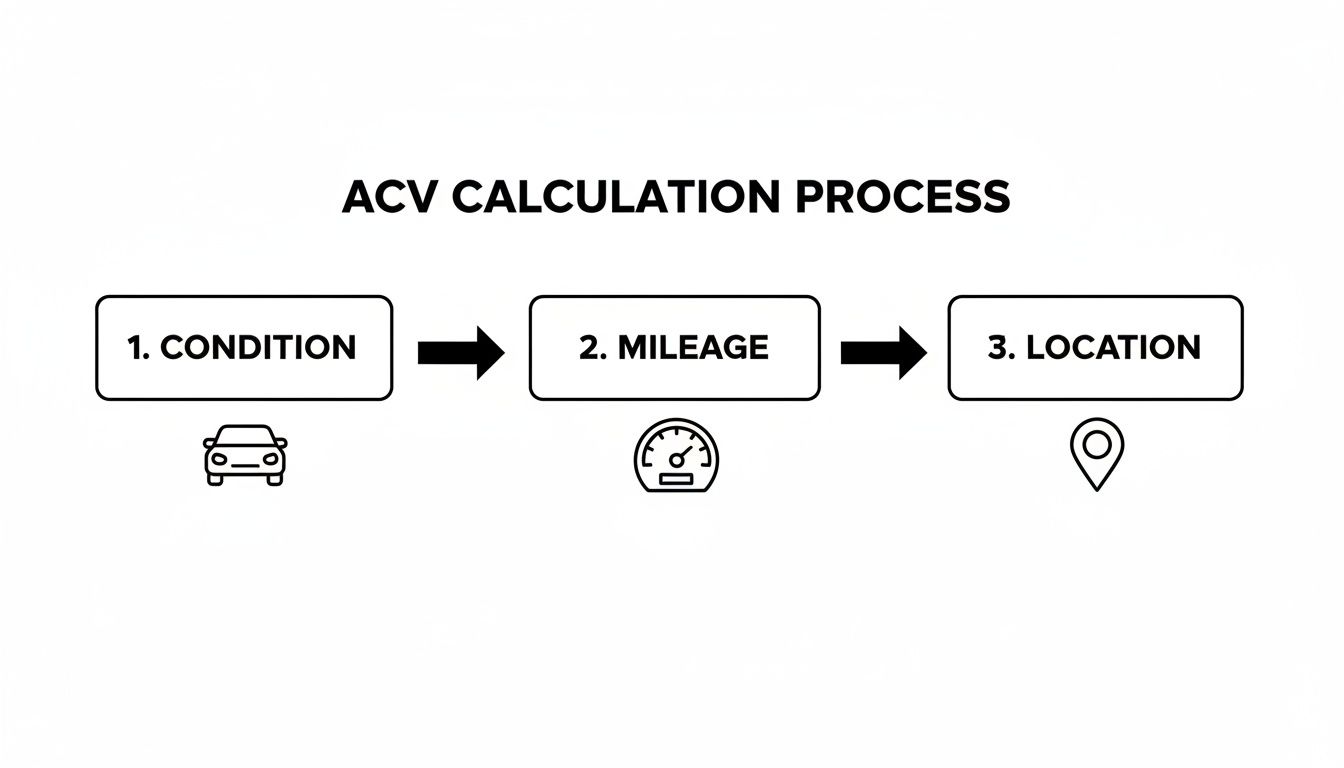

Insurance adjusters don't just guess a number; they follow a specific formula to calculate the ACV. The good news is, once you know what they're looking for, you can start building a case for a higher valuation. Here's a quick breakdown of the main factors they consider.

| Factor | How It Impacts Your Settlement |

|---|---|

| Pre-Accident Condition | Was your car showroom-clean or did it have dings and worn seats? The difference between "fair" and "excellent" can mean thousands of dollars. |

| Mileage | A car with low mileage for its age is almost always worth more. High mileage, on the other hand, is a major driver of depreciation. |

| Geographic Location | The market for your car can change from one zip code to the next. A 4x4 truck is often worth more in a rural area, while a fuel-efficient compact might sell for a premium in a crowded city. |

| Recent Upgrades | Did you just put on a new set of tires, replace the battery, or install a better sound system? Documented, recent improvements can add real value. |

These are the core components of the valuation puzzle. The adjuster's job is to put a dollar figure on each one to arrive at the final ACV.

Remember, the insurer's first offer is exactly that—an offer. It's the start of a negotiation, not the final word. Your job is to gather the evidence that proves your car was worth more.

At the end of the day, the value of a totaled car is a direct reflection of its pre-crash condition and market demand. While understanding ACV is a huge part of the process, it's also tied to the overall value of your claim. To see how this fits into the bigger picture, check out our guide on how much your car accident is worth. Having this knowledge will set you up perfectly for the next phase: challenging the insurance company’s numbers and fighting for the payout you truly deserve.

How Insurers Actually Calculate a Total Loss

So, your car has been declared a total loss. That decision wasn't just a gut call from the insurance adjuster; it's the result of a specific formula. Getting a handle on how this math works is your first and best defense in making sure you get a fair payout for the value of your totalled car.

At its core, the "total loss" label comes down to a simple comparison: is it cheaper to fix the car or just pay you what it was worth right before the crash? A car is officially "totalled" when the estimated repair cost, plus what the wrecked car could be sold for as scrap (its salvage value), is more than its Actual Cash Value (ACV).

But here’s a wrinkle: state laws add another layer called the Total Loss Threshold (TLT). This is a percentage set by each state that dictates the exact point a car is considered totaled. Some states say the repair costs must hit 100% of the car's value. Others, like Texas, have a slightly different rule—a car is totaled if repair costs just exceed the ACV minus its salvage value. This little detail means a car could be a total loss in one state but considered fixable just across the state line.

The Tools Behind the Valuation

Adjusters don't just guess your car's value. They rely on powerful, third-party software to do the heavy lifting. The two big names you'll hear are CCC ONE (which used to be CCC Information Services) and Audatex. These platforms are the industry go-to for figuring out a car's ACV.

Think of these systems as massive, automated market analysis engines. They vacuum up data from all over to build a profile of your car's value, looking at things like:

- Recent Dealer Sales: What have cars just like yours—same make, model, trim, and year—actually sold for at dealerships in your local area?

- Private Party Listings: They also scan online marketplaces to see the asking prices for similar vehicles sold by private individuals.

- Vehicle History: Your car's VIN is run to pull its entire history, from mileage to prior accidents and any title issues.

The end product is a detailed valuation report that the adjuster uses to come up with their settlement offer. While it’s based on data, it’s far from foolproof.

This flowchart gives you a simplified look at how those key factors—condition, mileage, and your location—get crunched to produce that final ACV number.

As you can see, the insurer's ACV is built on these three pillars. That’s why it's so critical for you to have your own evidence for each to make sure their valuation is accurate.

Where the System Can Fail You

These valuation reports look official, printed with logos and full of data, but they’re often riddled with errors that can drag down your car's value. Knowing where to look for these mistakes is your best weapon against a lowball offer.

Here are some of the most common problems I see:

- Outdated "Comps": The report might use "comparable" vehicle sales from months ago, completely missing a recent spike in used car prices.

- Distant Listings: An adjuster might pull comps from a dealership 100 miles away where cars sell for less, instead of using dealers right in your own, more expensive market.

- Incorrect Condition: This is a big one. The report might automatically classify your car’s pre-accident condition as "average" when it was actually in "excellent" shape. That difference alone can be worth thousands.

The insurer's valuation report is a starting point for negotiation, not an undisputed final number. It’s your right to review this report and point out any inaccuracies you find.

Once you realize the insurer's process is automated and prone to error, your whole perspective can shift. Their first offer isn't the final word; it's just an opening bid based on data that might not tell the whole story. To get a broader perspective on what your entire claim could be worth, you can use tools like a car accident settlement calculator to arm yourself with more information. This is how you start building a counter-argument grounded in better, more accurate facts.

What Really Drives Your Car's Total Loss Value?

The insurance adjuster's first offer isn't the final word. It's the starting point. That initial number comes from a standard report based on your car's make, model, and year, but it almost never captures the full story. The real money in a total loss claim is won in the details—the specific, unique qualities of your car.

This is where you shift from being a victim of an accident to the manager of your claim. Your goal is to build a case so strong that the adjuster has to acknowledge the true, higher value of your vehicle. You're not just sharing an opinion; you're presenting cold, hard facts.

Prove It Was in Great Shape Before the Crash

The most wiggle room in any car valuation comes down to its pre-accident condition. An adjuster sitting at a desk hundreds of miles away has no idea if your car was meticulously cared for or if it was on its last legs. Their default setting is usually "average," which can cost you.

If your car was in great shape, you need to prove it. Don't just tell them it was well-maintained; show them.

- Become a Photo Detective: Scroll through your phone's camera roll. That picture from last summer's road trip or the one you snapped after a car wash can be your best evidence, showing off a gleaming exterior and a spotless interior.

- Maintenance Records are Gold: A thick folder of service receipts is an adjuster's nightmare and your best friend. It proves you were a responsible owner who never missed an oil change or a tire rotation.

- Show Off Recent Repairs: Just put on new brakes? Replaced the battery a few months ago? These receipts demonstrate that major components were in peak condition, directly challenging the assumption that your car was just "average."

Every piece of proof helps push the adjuster's rating from their default "fair" or "average" up to "excellent." That small change in classification can easily add hundreds, if not thousands, to the value of a totalled car.

Low Mileage is Your Ace in the Hole

Mileage is simple, direct, and powerful. The software insurers use, like the popular CCC ONE platform, heavily weighs a car's odometer reading against the average for its model year. If your car has significantly fewer miles on it, it's worth more. Period.

Think about it: if a typical 2020 Honda Accord has 60,000 miles, but yours was totaled with only 35,000, it means your engine, transmission, and suspension have endured far less stress. That translates directly to a higher market value.

When you get the valuation report from the insurer, the first thing you should check is the mileage they used. Compare it to the average for your car's year and point out the difference. It's a clean, data-driven argument for a bigger check.

This is especially critical right now. With the vehicle fleet getting older, a low-mileage car really stands out. In fact, a staggering 74% of all total loss valuations in the US were on vehicles seven years or older in early 2025. In a market full of high-mileage cars, your well-preserved vehicle is a rare find. You can dig deeper into these industry trends on total loss accidents to see just how much of an outlier your car might be.

Don't Forget Recent Upgrades and Better Features

What have you spent money on recently? Standard valuation reports are notorious for missing aftermarket parts and high-end features unless you spell them out for the adjuster.

Get your receipts together for anything that adds real, tangible value:

- New Tires: A fresh set of quality tires is a major expense, often over a thousand dollars. If you bought them in the last year, make sure that value is reflected in the offer.

- Upgraded Stereo: Did you install a new head unit, speakers, or a subwoofer? That's not part of the stock vehicle, and you should be compensated for it.

- Custom Wheels: Aftermarket rims can significantly boost a car's appeal and price.

- Premium Trim Package: This is a big one. Make sure the report correctly lists your car's trim level. A "Limited" or "Platinum" model is worth much more than the base "LE" version, and it's an easy detail for an adjuster to miss.

Look at the insurer's report as a generic template. Your job is to customize it with all the specific details that made your car better than average. By methodically collecting your photos, service logs, and receipts, you build an airtight case that leaves the adjuster no choice but to recognize your car's true worth and increase their offer.

How to Build Your Case and Negotiate a Fair Settlement

When the insurance adjuster calls with a settlement offer for your totalled car, it's easy to feel like that's the final number. But here's the reality: that first offer is almost always a starting point. It’s an opening bid in a negotiation you might not have realized you were in.

Think of it this way: the insurance company wants to close the claim for the lowest reasonable amount. Your job is to shift from being a passive recipient to an active, informed participant. This isn't about being confrontational; it's about being prepared with facts. A well-researched counter-offer doesn't just ask for more money—it proves why your vehicle was worth more right before the crash.

Become Your Own Market Detective

Your first move is to put on your detective hat and do some independent market research. You need to uncover what a car just like yours—same make, model, year, trim, and in similar condition—is actually selling for in your local area. Right now. This data is the bedrock of your entire negotiation.

A single source isn't enough. To build a truly compelling case, you need to pull data from several places to paint a clear picture of your car's real-world market value.

- Start with the Big Guides: Check well-known sites like Kelley Blue Book and Edmunds. Make sure you’re looking at the "private party sale" or "dealer retail" values, which are typically much higher than the "trade-in" value the insurer might lean on.

- Scour Local Listings: Dive into online marketplaces like Autotrader, Cars.com, and even Facebook Marketplace. Set your search radius to about 50-75 miles to reflect your true local market. Take screenshots of every relevant listing—these are your "comps."

- Get Quotes from Dealers: Call or visit a few local used car lots. Ask them for a written quote stating what they would sell an identical vehicle for on their lot. This gives you powerful, real-world proof of retail value.

When you gather this information, you're no longer just stating an opinion. You're presenting cold, hard market facts that can directly challenge the outdated or mismatched "comps" the insurer might be using.

To make this process a bit easier, it helps to understand what each valuation source brings to the table.

Valuation Sources Comparison

Here’s a quick breakdown of the most common sources you'll use and how they fit into your negotiation strategy.

| Valuation Source | What It Measures | Best Use Case |

|---|---|---|

| Kelley Blue Book (KBB) / Edmunds | Standardized industry value ranges based on make, model, year, condition, and region. | Establishes a baseline, third-party valuation that adjusters recognize and respect. |

| Local Online Listings | The actual asking price for comparable vehicles for sale in your immediate area right now. | Provides the most compelling evidence of your car's true, current market value. |

| Used Car Dealership Quotes | A professional retail price estimate from experts who buy and sell cars for a living. | Adds a layer of expert opinion and reinforces the retail value you're trying to establish. |

By combining all three, you create a powerful, multi-faceted argument that is much harder for an adjuster to dismiss.

Assemble Your Counter-Offer Package

With your research done, it’s time to organize it into a professional and persuasive counter-offer. Simply telling the adjuster, "Your offer is too low," won't get you anywhere. You have to show them why, using organized documentation.

Your goal is to create a clean, easy-to-understand package that gives the adjuster everything they need to justify a higher settlement for the value of a totalled car like yours.

- A Clear Summary of Your Position: Begin with a brief, polite letter or email. Clearly state that you are rejecting their initial offer and present the average value you calculated from your comprehensive research.

- Your "Comps" as Evidence: Attach the screenshots and printouts of all the comparable vehicles you found for sale. Highlight the prices, mileage, and condition on each one to make your point impossible to miss.

- Proof of Your Car's Superior Condition: This is where you include the evidence you gathered earlier—maintenance records, receipts for those new tires or that recent brake job, and clear photos showing how well you cared for your vehicle.

- Third-Party Valuation Reports: Include printouts of the reports from KBB and Edmunds. This adds an official-looking, third-party validation that backs up your own findings.

A well-organized package makes the adjuster's job easier. It gives them the ammunition they need to go to their manager and get a revised, higher offer approved. For a deep dive into how to structure this, check out our guide on writing a powerful settlement demand letter.

Master Proven Negotiation Tactics

Once you submit your counter-offer, the real negotiation begins. The key here is to remain calm, patient, and professional throughout the process.

Remember, the person on the other end of the line is a professional negotiator. Your power comes from being better prepared with facts and knowing your rights.

Here are a few tactics that can make all the difference:

- Stick to the Facts: Keep emotion out of it. Instead of saying, "I just feel like my car was worth more," try this: "My research of the local market shows that comparable vehicles are currently selling for an average of $15,500." The first is an opinion; the second is a fact.

- Ask to See Their Homework: Politely ask the adjuster to send you the specific valuation report and the list of "comps" they used to generate their offer. Go through it with a fine-tooth comb. Are the cars a lower trim level? Are they from a different state with a cheaper market? Point out every single discrepancy.

- Know Your Secret Weapon: The Appraisal Clause: If you hit a wall and the adjuster won’t budge, check your insurance policy for an "appraisal clause." This provision allows you and the insurer to each hire an independent appraiser. If they can't agree, they select a neutral third appraiser (an umpire) whose decision is binding. It’s often a last resort, but simply knowing it exists can be enough to break a stalemate.

By arming yourself with solid research and maintaining a firm but respectful approach, you dramatically improve your odds of walking away with a settlement that truly reflects what your car was worth.

Understanding Salvage Value and Your Options

When the insurance company declares your car a total loss, a new question pops up: what actually happens to the wrecked vehicle? This is where a critical term comes into play: salvage value.

Think of it as the car's scrap value. It’s what an insurer can get by selling the damaged vehicle to a salvage yard or a rebuilder at auction. This isn't just an afterthought; it’s a key piece of their financial puzzle. The insurance company subtracts this salvage value from the settlement they offer you, because they plan on getting that money back by selling the wreck.

This is also where you face a major decision that can completely change the outcome of your claim. You have two main options, and it’s vital to understand what each one really means for your wallet and your future.

Your Two Paths Forward

You're at a fork in the road. You can either let the insurer handle everything and take the vehicle, or you can choose to keep the car yourself.

- Option 1: Let the Insurer Take the Car. This is the path most people take. It's clean and simple. You sign the title over to the insurance company, they tow the car away, and you get a check for its full Actual Cash Value (ACV), minus your deductible. Done and dusted.

- Option 2: Retain Salvage and Keep the Car. You also have the right to tell the insurer you want to keep your vehicle. If you go this route, your settlement check will be smaller—they'll subtract both your deductible and the car's salvage value. You get to keep the car, but now it's your problem, along with all the costs that come with it.

Choosing to retain salvage means you are effectively "buying" your wrecked car back from the insurance company at its salvage price. This decision should never be made lightly, as it opens a new chapter of challenges and expenses.

This whole salvage process is more relevant than ever. With repair costs soaring, insurers are totaling cars more frequently. For instance, in the UK, the share of write-offs in non-fault claims shot up from 58% to 66% between 2019 and mid-2025. This was fueled by a staggering 24.7% jump in average repair costs. It’s a global trend showing that it's often cheaper for an insurer to write a check than to fix the car, making salvage a huge part of their business model. You can read more about these rising repair costs and total loss trends.

The Reality of a Salvage Title

If you decide to keep the car, its clean title is gone for good. The state will slap a salvage title on it, a permanent brand that screams "this car was once a total wreck." That brand makes it illegal to drive on public roads.

To get it back on the road, you have to get a "rebuilt" title, and that's a tough, expensive journey. Here's what's involved:

- Completing All Repairs: You have to fix everything to meet state safety standards. This isn't a DIY weekend project; it often requires professional mechanics and costly parts.

- Passing a Rigorous Inspection: A state-certified inspector will go over your vehicle with a fine-tooth comb to ensure it’s actually safe.

- Submitting a Mountain of Paperwork: You'll need to show proof of everything, including receipts for every part and all the labor, to prove the car was restored correctly.

Even if you clear all those hurdles and get a rebuilt title, the car is permanently scarred. Its resale value will have plummeted, and good luck finding an insurer willing to offer anything beyond basic liability coverage. For most people, the hassle and expense just aren't worth it.

Frequently Asked Questions About Totalled Car Value

Even with a solid grasp of the valuation process, you're bound to have some specific questions once your car is declared a total loss. It's easy to get overwhelmed by the details, but getting straight answers is the key to managing your claim with confidence. Let's tackle some of the most common questions that pop up.

Think of this as the practical advice you need to clear up any lingering confusion and protect your bottom line.

Can I Dispute the Decision to Total My Car?

Technically, yes, you can dispute the insurer’s decision, but it's an uphill battle and often not the best use of your energy. The "total loss" label isn't subjective; it's a simple math problem comparing the cost of repairs to your car's pre-accident value.

If the repair estimate is just a hair over your state's total loss threshold, you might have a shot by getting a couple of independent quotes that come in lower. But if the damage is severe and the repair costs are clearly way higher than the car's value, that total loss designation is almost certainly going to stick.

A much smarter move is to accept the "total loss" status and pivot your focus to disputing the value they've placed on your car. That's where you have real leverage to get a fair settlement check.

What Happens if I Still Owe Money on My Car Loan?

This is a really common and incredibly stressful spot to be in. When your car is totalled, the insurance check doesn't come directly to you—it goes to your lender first to pay off what you owe.

If the settlement amount (the ACV) is less than your remaining loan balance, you're on the hook for the difference. This gap is what people mean when they say they're "upside down" on their loan.

This exact situation is why GAP (Guaranteed Asset Protection) insurance is so important.

- With GAP Coverage: Your GAP policy kicks in and pays off that remaining loan balance, wiping the slate clean so you're not stuck with the debt.

- Without GAP Coverage: You'll find yourself making monthly payments on a car that's sitting in a salvage yard. It's a huge financial strain, especially when you're also trying to figure out how to buy a new vehicle.

How Long Does the Total Loss Settlement Process Take?

There's no single, fixed deadline, but the total loss process generally follows a predictable rhythm. While some states require insurers to act within a "reasonable" timeframe, the whole thing can feel like it's dragging on.

Here’s a rough breakdown of what to expect:

- Initial Inspection and Offer (1-2 weeks): After the accident, it usually takes about a week for the adjuster to inspect the car, officially call it a total loss, and send you their first settlement offer.

- Negotiation Period (1-4 weeks): This is the wild card. If you take the first offer, it’s over quickly. But if you decide to negotiate for a higher value—which you often should—this stage can add several weeks as you go back and forth and provide your own evidence.

- Finalizing Payment (1-2 weeks): Once you and the insurer agree on a number, you'll have to sign release forms and hand over the title. After they get the signed paperwork, it typically takes another week or two to cut the check and get it in the mail.

Does My Deductible Apply to a Total Loss Claim?

Yes, it almost always does. When you file a claim with your own insurance company, your collision or comprehensive deductible is subtracted from the final settlement. The deductible is simply the amount you agreed to pay out of pocket when you bought the policy.

For example, if you agree on a final ACV of $20,000 for your car and you have a $1,000 deductible, the check from your insurer will be for $19,000.

The main exception is if you're filing a claim directly against the at-fault driver's insurance policy. In a third-party claim like that, their liability coverage is responsible for the full value of your car, and you shouldn't have to pay any deductible at all.

It's a small detail, but it makes a big difference to your final payout. Always remember to factor in your deductible when you're trying to figure out what you'll actually receive for the value of a totalled car.

Dealing with the aftermath of an accident is tough, but knowing what similar cases are worth can be a game-changer. At Verdictly, we open up access to real motor vehicle case outcomes from across Texas, making complex legal data clear and useful. Arm yourself with the facts you need for a fairer negotiation by exploring our database at https://verdictly.co.