Negotiating Medical Bills After Settlement A Plaintiff's Guide

Protect your award. This guide provides actionable strategies for negotiating medical bills after settlement, reducing liens, and handling subrogation claims.

Finally getting that settlement check in hand feels like you've crossed the finish line. But in reality, it's the starting gun for another crucial race: negotiating your medical bills. The gross settlement amount you see on paper is almost never what you actually take home. Successfully negotiating medical bills after settlement is the key to protecting your financial future and keeping more of that hard-won money.

Why Your Settlement Check Is Just The Starting Line

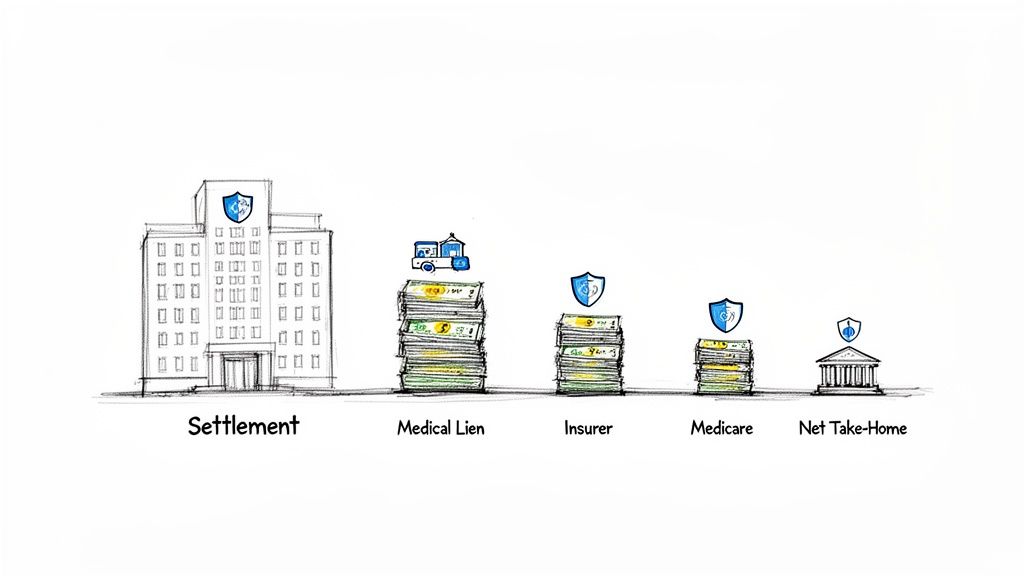

The moment your case settles, a whole new process kicks off—the distribution phase. Before a single dollar hits your bank account, several parties with a legal stake in your recovery will line up to collect their share. Knowing who they are and what they're entitled to is the first step in getting a handle on this.

The Key Players With A Claim To Your Award

Think of your settlement as a pie. Before you get your slice, a few others get to cut theirs first. These are the usual claimants:

- Medical Providers with Liens: Hospitals, surgeons, and therapists who treated you on the promise of future payment often file a legal claim, or lien, against your settlement proceeds.

- Health Insurers with Subrogation Rights: If your health insurance plan covered your treatment, they have a legal right called subrogation to get that money back from your settlement.

- Government Programs: Programs like Medicare and Medicaid don't work for free. They have powerful statutory rights to be reimbursed for any accident-related care they paid for.

A Real-World Scenario

Let’s put this into perspective. Picture a car accident victim in Dallas-Fort Worth who secures a $100,000 settlement. After legal fees are deducted, the remaining funds face claims. A hospital might have a $30,000 lien for the ER visit, and the health insurer could have a $40,000 subrogation claim for the surgeries that followed.

Without any negotiation, that $100,000 award shrinks fast. You can learn more about how auto accident attorney fees are typically structured, which is another important piece of the distribution puzzle.

This negotiation isn't just about saving a few bucks; it's about reclaiming a significant chunk of your award. A smart, fair-minded negotiation strategy can be the difference between getting back on your feet financially and being stuck with lingering medical debt.

This is more critical now than ever. Healthcare costs are ballooning, with medical inflation often outpacing the general rate. That $50,000 bill for your initial treatment can feel like an anchor if it isn't dealt with head-on. This is precisely why negotiating medical bills after a settlement has become a non-negotiable part of any personal injury case.

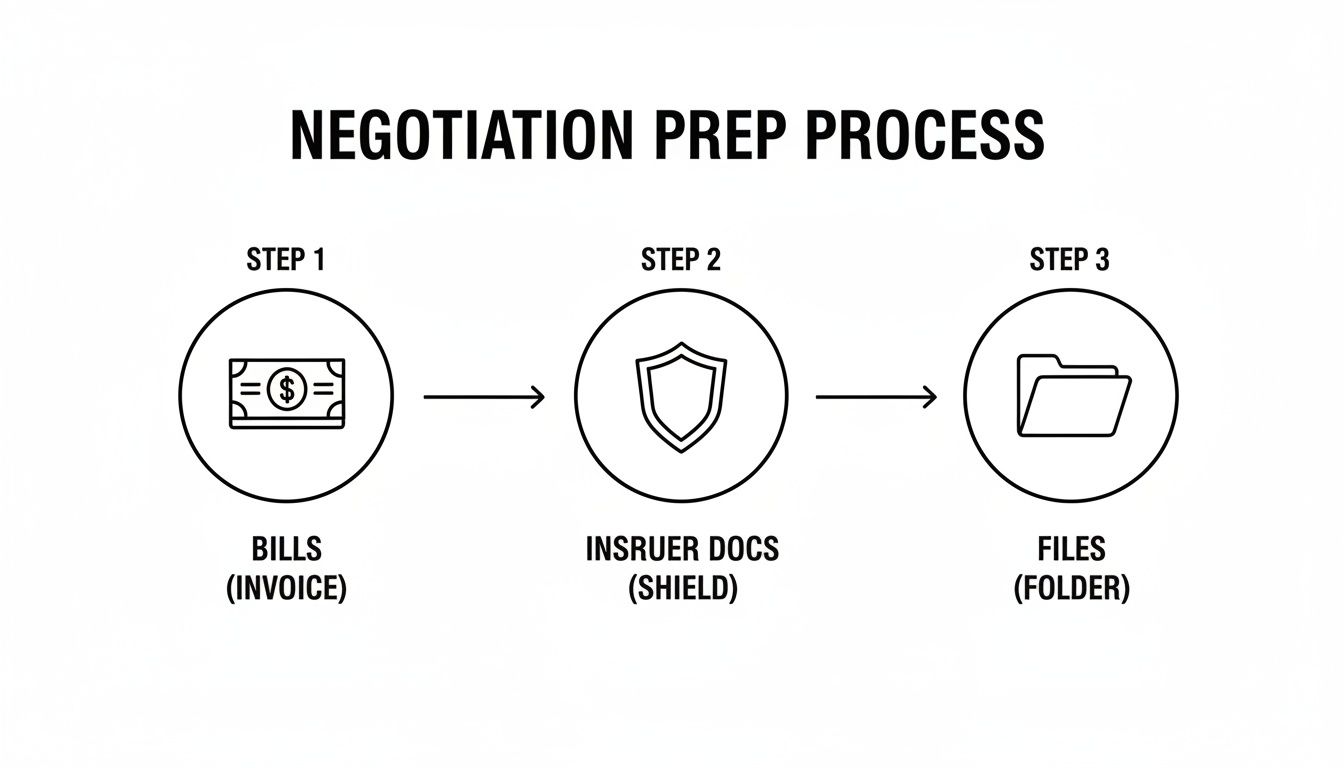

Building Your Pre-Negotiation Toolkit

Before you even pick up the phone, you need to get your house in order. Trying to negotiate a stack of medical bills without the right information is like walking into a courtroom without any evidence. It just won’t work. Taking the time to build a solid toolkit of documents and data is what separates a frustrating, fruitless effort from a successful reduction.

The absolute cornerstone of this toolkit is the itemized bill from every single provider. Don't even bother with the summary statement they send in the mail—it's useless for this purpose. You need the detailed, line-by-line breakdown of every single charge, because that's where the negotiation leverage lives.

Assembling Your Essential Paperwork

Get organized from day one. I recommend creating a dedicated folder, whether it’s a physical one or a digital one on your computer, for each doctor, hospital, and clinic. Tossing everything into one big pile is a recipe for disaster.

Here’s what needs to go into each folder:

- Itemized Medical Bills: You'll likely have to call each provider's billing department and specifically ask for this. Use the magic words: "I need a complete, itemized bill with CPT codes for all dates of service."

- Explanation of Benefits (EOBs): These are the statements from your health insurance company. They're critical because they show what the hospital billed, what your insurance actually paid, and what they think your responsibility is. This is your best tool for cross-referencing.

- Copies of Filed Liens: If a hospital or provider has filed a legal lien against your settlement, you need a copy of that official document. It's their formal claim to a piece of your recovery.

- The Settlement Agreement: This document is your proof of the final settlement amount. It shows creditors the reality of the situation—that there's a finite pot of money to be divided up, especially if the settlement doesn't cover all of your claimed damages.

Becoming a Billing Detective

Once you have all your documents, it's time to put on your detective hat. You have to comb through those itemized bills looking for mistakes. And trust me, you will find them. A 2023 analysis found that a staggering 80% of medical bills have some kind of error. Finding them is your golden ticket.

Keep an eye out for these common culprits:

- Duplicate Charges: Being billed twice for the same MRI, the same blood test, or the same dose of medication is incredibly common.

- Incorrect CPT Codes: Every medical service has a specific "Current Procedural Terminology" (CPT) code. A classic game is "upcoding," where a provider bills for a more complex and expensive procedure than what you actually received.

- Unbundled Services: Think of this like ordering a combo meal but being charged for the burger, fries, and drink separately. Certain procedures should be bundled under one code, and billing them individually inflates the cost.

- Charges for Canceled Services: It happens. A test gets canceled, a specialist visit is rescheduled, but the original charge magically stays on the bill.

I always tell my clients to create a simple spreadsheet. Make columns for the provider, date of service, the charge in question, and a quick note about the suspected error. This document isn't just for you; it becomes your script when you finally make the call.

Timing Your First Move

This last piece of advice is crucial: don't jump the gun. It’s so tempting to start calling providers the second you hear a settlement has been reached, but that’s a rookie mistake.

The absolute best time to start negotiating is after the settlement agreement is finalized and signed by all parties.

Why the wait? It's simple psychology. Before the settlement is official, providers see an unknown, potentially large amount of money on the horizon, so they have zero incentive to discount what they're owed. But once that agreement is signed, the game changes. There is now a fixed, limited amount of money available. This creates urgency and makes them far more willing to negotiate to get a guaranteed payment now, rather than fighting for the full amount later.

With your documents organized and your timing right, you're no longer just making a hopeful plea—you're opening a negotiation from a position of strength.

Mastering the Negotiation Dialogue

Once you've gathered all your documents, it's time to start the conversation. This is where solid prep work really pays off and turns into real dollars back in your pocket. When it comes to negotiating medical bills after a settlement, you can't use a one-size-fits-all approach. Each creditor—from the hospital to the insurance company—has different motivations and weak spots.

Getting your ducks in a row before you pick up the phone is absolutely critical. This flowchart gives you a clear picture of the process.

The key takeaway is simple: your power in these talks comes directly from having every bill, insurance record, and file organized and ready to go.

Opening The Conversation With Hospitals And Providers

When you first call a hospital’s billing department, your goal is to set a cooperative, non-confrontational tone. You're not there to accuse them of anything (even if you found billing errors). Instead, you're positioning yourself as someone who wants to partner with them to resolve the account quickly.

Always remember their main objective: get paid and close the file.

A great way to start is by immediately asking for their "prompt-pay" or "self-pay" discount. Doing this shifts the entire conversation away from the sky-high "chargemaster" rates and toward a number that’s actually based in reality.

Here’s a simple script that works wonders:

"Hello, I'm calling about account number [Your Account #]. I've received a settlement from my personal injury case and I'm ready to resolve this bill. I can make a one-time, lump-sum payment today if we can agree on a fair reduction. What is your standard prompt-pay discount?"

This tactic is powerful because you’re offering them what they value most: guaranteed cash, right now. Hospitals spend a fortune chasing down payments, so they're almost always willing to take a smaller, definite amount today over a larger, uncertain amount later.

Crafting Your Approach for Insurance Subrogation

Talking to an insurance company’s subrogation department is a different ballgame. These are professional negotiators, but they also have to follow specific legal rules—and you can use those rules to your advantage.

The most effective tool in your arsenal is often the "common fund doctrine." This legal principle argues that because your attorney did all the work to secure the settlement (the "common fund"), the insurance company should have to chip in for the cost of creating it. In plain English, they should reduce their claim by a percentage that matches your attorney’s contingency fee.

Another strong argument is that your settlement didn't make you "whole." If your settlement amount was less than the total value of all your damages—including your pain and suffering—you can argue that the insurer shouldn't get all their money back if you weren't fully compensated.

Our guide on how to negotiate with an insurance adjuster offers more great insights into the mindset and strategies of insurance pros, which can give you a real edge in these discussions.

Dealing With Medicare And Medicaid Recovery

Government agencies like Medicare and Medicaid have a legal right to be reimbursed, which makes them seem tough to negotiate with. But don't be discouraged—even their claims can be reduced. For Medicare, you'll be working with the Benefits Coordination & Recovery Center (BCRC).

You have a few solid grounds for requesting a reduction or even a waiver:

- Financial Hardship: You can argue that paying the full amount would put you in significant financial distress.

- Best Interests of the Program: Frame it as a compromise that is better for Medicare than getting nothing after a long, drawn-out dispute.

- Procurement Costs: Similar to the common fund doctrine, you can formally request that Medicare reduce its lien to account for the legal fees and other costs you paid to get the settlement.

A Tactical Comparison of Negotiation Strategies

To set realistic goals, you need to know which tactics work best with different creditors and what kind of discount you can reasonably expect. The American healthcare billing system is a mess, and that chaos creates opportunities. In fact, U.S. healthcare organizations spend an astounding $20 billion a year just trying to collect on denied claims. This massive inefficiency, combined with medical inflation projected to hit 4.3% in July 2025, leads to overbilling and makes providers more willing to settle for less.

The table below breaks down the best approach for each type of creditor.

Negotiation Strategies by Creditor Type

A breakdown of common creditors, their motivations, effective negotiation tactics, and typical reduction ranges you can aim for.

| Creditor Type | Primary Contact | Key Negotiation Tactic | Typical Reduction Range |

|---|---|---|---|

| Hospital / Clinic | Billing or Patient Financial Services | Prompt-Pay Offer: A lump-sum cash payment for immediate resolution. | 30% - 60% |

| Health Insurer (Subrogation) | Subrogation Department or Third-Party Recovery Vendor | Common Fund Doctrine: Argue they must share in the cost of litigation. | 25% - 40% (often equivalent to attorney's fee %) |

| ERISA Health Plan | Plan Administrator or Recovery Specialist | "Make Whole" Doctrine (if applicable): Argue they can't recover if you weren't fully compensated. | 15% - 35% |

| Medicare | Benefits Coordination & Recovery Center (BCRC) | Procurement Cost Reduction: Request a reduction for your legal fees and costs. | Varies, can be significant |

| Medicaid | State's Third Party Liability (TPL) Unit | Statutory Formulas & Hardship: Reductions are often governed by state law but can be waived. | Varies by state |

At the end of the day, successful negotiation comes down to being polite, persistent, and prepared. When you understand what makes each party tick and use the right language, you shift the dynamic. It’s no longer about asking for a handout; it’s about conducting a business transaction where a fair compromise works for everyone.

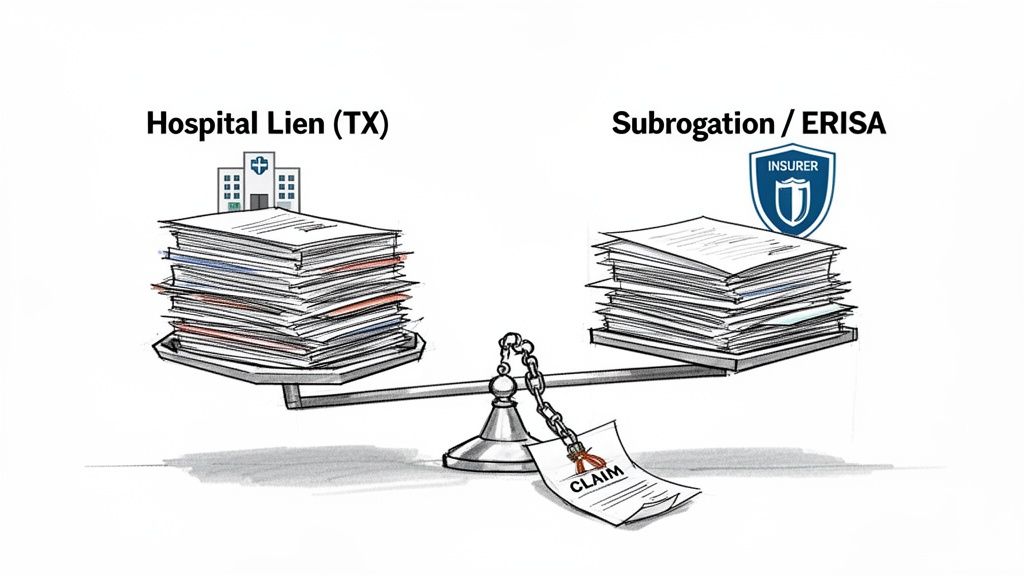

Navigating Liens And Subrogation Claims

After an accident, the medical bills themselves are only half the story. The other half involves the legal claims that attach to them—and to your settlement money. These are called liens and subrogation claims, and they represent formal demands for a piece of your recovery. You absolutely have to get a handle on these before you can see a dime of your net settlement.

So, what are we talking about? A lien is a legal right someone else has against your property, which in this case, is your settlement. A subrogation claim is a bit different. It’s the right of your insurer, who already paid for your medical care, to step into your shoes and claw that money back from the settlement. Both have to be resolved.

The Power Of A Hospital Lien

In some states, like Texas, hospitals have a potent weapon called a statutory hospital lien. This is much more than just a bill. It's a legal claim filed with the county clerk that attaches directly to your personal injury settlement. Think of it as the hospital putting a legal lock on a portion of your funds.

For one of these liens to be legitimate, it has to follow the rules to the letter. Hospitals must file it within a specific window after you're admitted and give proper notice to everyone involved. Any procedural slip-up can become a powerful negotiating tool for you or your attorney.

Challenging a lien's validity is often the first move. Was it filed on time? Does it include charges for treatments unrelated to the accident? Digging into the details for technical errors can sometimes get a lien thrown out entirely or at least seriously reduced.

Untangling Health Insurance Subrogation

While a hospital lien comes from a provider you haven't paid yet, a subrogation claim comes from an insurance company that has paid your bills. Your health insurer covered the costs as they came up, and now that you've recovered money from the at-fault party, they want to be reimbursed. It's a standard clause buried in the fine print of almost every health plan.

But here’s the critical part: not all subrogation rights are created equal. The kind of health plan you have makes a massive difference in how much power the insurer has to get its money back.

- Standard Health Insurance Plans: Most of these are governed by state law. Thankfully, many states have rules that favor the injured person, like the "common fund doctrine" (making the insurer pay a share of your attorney's fees) or the "make whole" doctrine (meaning you must be fully compensated for all your losses before they can get paid).

- ERISA Health Plans: These are the big ones. If your health insurance comes from a private employer, there's a good chance it's an ERISA plan, governed by federal law. ERISA plans have teeth—their reimbursement rights are incredibly strong and can override those helpful state laws, making them a much bigger challenge to negotiate.

Navigating ERISA is tricky. These plans often have language that explicitly rejects state-law protections, giving them immense power to demand full reimbursement. Success here often requires a deep dive into the specific plan language and federal case law.

Medicare And Medicaid Statutory Rights

When a government entity pays your medical bills, they get their money back. It's the law. Medicare and Medicaid liens are often called "super liens" because their right to recovery is written into federal and state statutes. In principle, you can't just negotiate them away.

But that doesn’t mean the amounts are set in stone.

Medicare's recovery is handled by a contractor called the Benefits Coordination & Recovery Center (BCRC). You can't just ignore their claim, but you can formally ask for a reduction. A common way to do this is to show that Medicare should share in the costs of getting the settlement, meaning their claim should be reduced by a proportionate share of your attorney fees and expenses.

State Medicaid agencies have their own recovery units. They, too, are often willing to compromise their liens, especially when a settlement is small and the injured person has significant ongoing medical needs or is facing financial hardship.

Proportional Reduction Arguments

One of the most effective arguments you can make—especially when your settlement isn't enough to cover all your losses—is based on proportional reduction.

Let's say your total damages, including all medical bills, lost income, and pain and suffering, add up to $200,000. But because the at-fault driver had limited insurance, you could only settle the case for $100,000.

In this situation, you’ve only recovered 50% of what you were truly owed. You can now go to every lienholder and subrogation claimant and argue they should also accept 50% of their claim. This is a powerful fairness argument that many adjusters and recovery agents will listen to, as seen in cases like this Houston pedestrian collision. You can read more about how that subrogation claim was handled to see it in action.

This strategy changes the conversation. You're no longer just someone trying to avoid a debt; you're asking all parties to share in the reality of a limited recovery. When you understand the legal basis for each claim and have your arguments ready, you move from being a passive debtor to an active, empowered negotiator.

Locking It In: Finalizing the Agreement and Getting Paid

You've done the hard part. You've been on the phone, you've negotiated, and you've gotten a "yes" on a reduced medical bill. It's a huge relief, but don't celebrate just yet. A verbal agreement is just that—words. Until you have it in writing, the deal isn't done.

This last phase is all about getting everything on paper, creating an ironclad record, and making sure your settlement funds are protected from any future surprises. Think of it as building a fortress around your money.

Get It in Writing, Every Single Time

Never, ever rely on a handshake deal over the phone. Billing departments are a revolving door of employees, and the helpful person you spoke with today might be gone tomorrow. That's why getting every single agreement in writing is absolutely non-negotiable.

Once you’ve reached a verbal agreement, your very next move is to ask for a formal confirmation letter. This piece of paper is your proof. It needs to spell out three key things:

- The original balance they claimed you owed.

- The new, final payment amount you both agreed on.

- A clear statement that this payment will satisfy the debt in full.

If they drag their feet on sending it, don't wait around. Draft a letter yourself that outlines the terms of your conversation and send it over for them to sign. You have to be your own best advocate here.

Expert Tip: A verbal promise is worthless in a billing dispute. A written confirmation is your shield. Without it, a creditor could sell the "forgiven" portion of your debt to a collections agency, and you'll be fighting the same battle all over again a year from now.

This final document is what ensures your settlement money stays yours.

The Final Release and Satisfaction of Lien

Once you have the confirmation letter and you're ready to cut the check, there’s one more critical document you need: a Final Release and Satisfaction of Lien. This is especially crucial if a hospital or another major provider filed a formal lien against your settlement.

This is a legally binding document. It confirms that once they receive your payment, their claim against you and your settlement is completely and permanently gone. It’s your official receipt, proving the account is closed for good. Your lawyer will almost always handle drafting this and will send it along with the final payment.

How the Money Actually Moves

A word of caution: never pay these bills directly from your personal bank account. All settlement funds should be held safely in your attorney's trust account (often called an IOLTA account).

Your lawyer will manage the distribution from there, cutting individual checks to each medical provider, lienholder, and insurer based on the written agreements you secured. This creates a clean, professional paper trail and proves that everyone was paid exactly what was negotiated. There's no room for dispute later.

The current economic climate makes this precision more important than ever. With U.S. healthcare spending projected to hit a staggering $5 trillion in 2025, providers are feeling the squeeze. We see this play out in negotiations every day. For example, in Texas, it’s not uncommon for a $30,000 physical therapy bill to be settled for $12,000—a 60% reduction—simply by offering a prompt, lump-sum payment.

In fact, our data shows that for plaintiffs in the Dallas-Fort Worth area, offering to pay 35-45% of the total outstanding medical bills after a settlement is accepted roughly 70% of the time. This shows just how motivated providers are to close out old accounts. If you want to dig deeper into what’s driving this, you can explore the latest financial trends in healthcare.

Thinking About Your Financial Future

For those with life-altering injuries that will require years of care, a single lump-sum check can be both a blessing and a curse. This is where a structured settlement can be a smart alternative.

Instead of getting all the money at once, a structured settlement provides a steady stream of guaranteed, tax-free payments over time. It’s a powerful tool for managing future medical costs, ensuring you have the money you need for ongoing therapy, future treatments, and daily living expenses without the pressure or risk of mismanaging a large sum. It offers true financial stability, turning a one-time settlement into a reliable lifeline for your future.

Frequently Asked Questions About Handling Medical Bills After a Settlement

Once your case settles, it can feel like the fight is over. But in many ways, a new, equally important phase is just beginning: tackling the mountain of medical bills. This is where a lot of clients get understandably overwhelmed. Let's walk through some of the most common questions that come up.

Can I Negotiate Medical Bills Even If I Have Health Insurance?

Yes, you absolutely can. And you should. When you have health insurance, you're actually dealing with a two-front negotiation.

First, you have your direct out-of-pocket costs—deductibles, co-pays, and any charges insurance didn't cover. You’ll negotiate these directly with the hospital or clinic.

The bigger piece, however, is dealing with your health insurance company's subrogation claim. They've paid your medical bills at their contracted, discounted rate, and now they have a legal right to get that money back out of your settlement. The key here is to argue for a significant reduction. Your attorney can make a powerful case that your settlement didn't make you "whole" and that the insurer should share in the costs of recovery (like attorney's fees) and compromise their claim.

What’s the Single Best Tactic for Negotiating a Hospital Bill?

Hands down, your most effective tool is the offer of a quick, lump-sum payment. Hospitals are businesses, and like any business, they hate chasing down money. The administrative burden of collections is enormous, and they always face the risk of getting nothing.

An offer of guaranteed cash right now cuts through all of that red tape. It’s a powerful incentive for them to close out your account.

Don't start by pleading your case. Start by asking for their "cash-pay" or "prompt-pay" discount. This immediately changes the conversation from the sky-high "chargemaster" rates to a much more realistic starting point.

Instead of asking for a handout, make a business proposal. Try this: "I'm in a position to pay this bill in full with one payment today. What's the best possible reduction you can offer for immediate resolution?"

This approach frames you as a problem-solver, not just a debtor. It’s a small shift in language that can lead to a dramatically better outcome.

Realistically, How Long Does This Whole Negotiation Process Take?

This is a classic "it depends" situation, but you should be prepared for it to take a few weeks at best, and several months at worst.

Here’s a rough idea of what to expect:

- Simpler Cases (30-60 days): If you're only dealing with a couple of local doctors and there are no complicated liens, you might get everything wrapped up within a month or two after the settlement check clears your attorney's trust account.

- Complex Cases (4-6+ months): The timeline gets much longer if your case involves big hospital liens, Medicare or Medicaid reimbursement claims, or a difficult ERISA subrogation battle. These can easily stretch out for half a year or even longer.

Patience is key. Rushing this part of the process almost always means leaving money on the table.

Do I Really Need a Lawyer to Negotiate These Bills for Me?

While you certainly can negotiate on your own, having a seasoned personal injury attorney manage this process is a game-changer. They aren't just skilled negotiators; they're legal experts who know exactly which laws and legal principles create leverage.

An attorney brings a few critical advantages to the fight:

- Legal Know-How: They're fluent in the language of Texas hospital liens, the "common fund doctrine," and the federal laws that govern Medicare and ERISA claims. This isn't knowledge you can pick up from a Google search.

- Existing Relationships: Experienced lawyers often deal with the same hospital billing departments and insurance recovery agents day in and day out. These established relationships can cut through the bureaucracy and get to a resolution faster.

- Serious Leverage: A demand letter on law firm letterhead signals that you’re prepared to fight for a fair reduction. It simply carries more weight and often gets a much better result than an individual could achieve on their own.

At Verdictly, we believe that transparent data leads to fairer outcomes. Before you negotiate, arm yourself with real information on what cases like yours are actually worth in Texas. Our AI-powered platform gives you access to thousands of real motor vehicle verdicts and settlements, so you can negotiate from a position of strength and knowledge. Explore real Texas case values on Verdictly and see what your case is truly worth.

Related Posts

Pain and Suffering Calculation (pain and suffering calculation): Texas Damages

Explore how the pain and suffering calculation works in Texas, including multiplier and per diem methods, to help you estimate your settlement.