Single Car Accident Claims in Texas Explained

Involved in a single car accident? Learn how Texas law applies, who else could be at fault, and the steps to take to build a successful injury claim.

It's a common, and frankly, expensive myth that the driver is always at fault in a single-car accident. The name is a bit of a misnomer. While only one vehicle might be directly involved in the crash itself, the real cause often traces back to a negligent third party whose actions—or lack thereof—set the whole thing in motion.

You might have a solid claim for compensation, even if you were the only one at the scene when the dust settled.

Unraveling Liability in a Single-Car Accident

When you're the only driver in a wreck, it’s easy to think the blame automatically lands on you. But the reality is almost always more complicated. Think of it like a domino effect: your car might have been the last piece to fall, but some external force likely tipped over the first domino, starting a chain reaction you couldn't stop.

The truth is, a host of hidden factors can trigger a single-vehicle crash. These aren't just simple cases of a driver losing control; they're often the direct result of someone else's carelessness.

Beyond Driver Error: Exploring Other Causes

Getting to the root cause is the only way to figure out who is truly liable for your damages. A deep dive into the moments before the crash can uncover that the responsibility lies with a party you might never have suspected. Several common scenarios can completely shift the blame away from the driver.

- Hazardous Road Conditions: Think about massive potholes, dangerously sharp curves with no warning signs, missing guardrails, or construction debris left scattered across the highway. Any of these can cause a driver to lose control, and the government entity responsible for road maintenance could be held liable.

- Defective Vehicle Parts: A sudden tire blowout, a catastrophic brake failure, or a steering system that just gives out isn't driver error—it’s a product defect. The manufacturer of that part, or even the mechanic who recently worked on your car, could be responsible.

- "Phantom" Drivers: This happens all the time. Another driver cuts you off or forces you to swerve into a ditch to avoid a head-on collision. Their car never even touched yours, but their negligent driving was the direct cause of your accident.

The key takeaway is this: A single-car accident does not automatically mean the driver is at fault. The circumstances leading up to the crash are what determine legal responsibility.

These crashes are a serious, widespread problem. Globally, single-vehicle incidents account for a huge percentage of all traffic fatalities. In some European nations, that number is as high as 70%, which really underscores how often factors beyond the driver's immediate control can lead to tragic outcomes.

Proving third-party negligence requires a meticulous investigation and a solid grasp of Texas personal injury law. It’s critical to move quickly, as evidence can get cleaned up or disappear and legal deadlines are unforgiving. To learn more about how timelines can impact your case, you can read about why a court might dismiss a motor vehicle accident claim. Understanding your rights is the first step toward getting the compensation you deserve.

Uncovering Who Is Really at Fault

When a crash involves just one car, it’s easy to jump to conclusions. Insurance adjusters and even police often start with the assumption that the driver must have done something wrong. But from my experience, that first assumption is often dead wrong.

The reality is that many single-car accidents are the final link in a chain of events set in motion by someone else's negligence. To find the true cause, you have to look beyond the driver's seat and investigate every possibility. It's less about who was behind the wheel and more about why they lost control in the first place.

Was It a Defective Vehicle or a Botched Repair?

Today’s cars are marvels of engineering, but they're also incredibly complex. Thousands of parts have to work together perfectly, and when one fails, the consequences can be devastating. A sudden loss of control isn't always a driving mistake; it can easily be a mechanical failure that gave the driver no chance to react.

Think about it this way: you’re cruising down the highway when a tire suddenly blows out, sending your car careening into a guardrail. That’s not a case of bad driving. The real fault could lie with a number of different parties:

- The Tire Manufacturer: If a design flaw or a defect during production made the tire unsafe.

- The Retailer: If they sold you a tire that was old or had been stored improperly, causing the rubber to degrade.

- The Auto Shop: If the mechanic installed the wrong size tire or damaged it while mounting it on the rim.

This same principle applies to any critical component. Brake lines can burst, steering racks can fail, and even airbags can deploy at the wrong time, causing a driver to crash. When this happens, the blame shifts from the driver to the company that made the faulty part or the mechanic who failed to install it correctly.

When the Road Itself Is the Hazard

Sometimes, the car is fine, but the road is the problem. The government agencies responsible for our roads—whether it's the city, county, or state—have a legal obligation to keep them reasonably safe. When they drop the ball and their negligence leads to an accident, they can be held accountable.

Here are a few all-too-common examples I've seen:

- A massive, un-patched pothole that acts like a trap, causing a driver to lose control.

- A dangerous curve on a rural road that has no warning signs or guardrails.

- A poorly managed road construction zone that leaves loose gravel or debris scattered across the pavement.

- A broken traffic light that creates chaos at an intersection.

Taking on a government entity is tough. They have special legal protections that can make these cases tricky, but it's certainly not impossible. The key is to prove that the agency knew (or should have known) about the dangerous condition and had plenty of time to fix it but simply failed to do so.

The Problem of the Phantom Driver

One of the most maddening situations is the "phantom vehicle" accident. This is where another driver's reckless action forces you off the road or into an obstacle, but they never actually hit your car. They just speed away, leaving you to deal with the aftermath alone.

Maybe someone ran a red light, and you had to swerve into a telephone pole to avoid getting T-boned. Or perhaps a driver drifted into your lane on the freeway, forcing you into the median. They're gone, and you're left with a wrecked car and serious injuries. While difficult, you might still have a path to compensation through your own Uninsured/Underinsured Motorist (UM/UIM) coverage, provided you can find evidence to prove what happened.

These situations aren't rare. In fact, single-vehicle crashes are a serious and growing problem. Data from Australia, for instance, shows these incidents made up 54.1% of all fatal crashes over a recent 12-month span—a figure that jumped 8.7% from the year before. You can explore more of these sobering road safety statistics at their national data hub. It’s a stark reminder that the person behind the wheel isn't always the only one responsible.

Looking beyond the driver is crucial. Here’s a quick breakdown of other parties who could potentially be at fault.

Potential At-Fault Parties in a Single Car Accident

| Potentially Liable Party | Examples of Negligence |

|---|---|

| Vehicle/Part Manufacturer | Design defects, manufacturing errors, failure to warn of known issues, faulty tires, bad brakes. |

| Auto Mechanic/Repair Shop | Incorrect repairs, using wrong or defective parts, failing to identify a dangerous issue. |

| Government Entity | Poor road maintenance, unrepaired potholes, lack of proper signage, malfunctioning traffic signals. |

| Construction Company | Leaving debris on the road, creating unsafe detours, lack of clear warnings in work zones. |

| Another Driver ("Phantom") | Cutting someone off, running a stop sign, swerving into another lane, causing a "miss-and-run." |

| Property Owner | Obstructed views at an intersection (e.g., overgrown hedges), creating a hazard near a roadway. |

As you can see, the list of potential third parties is longer than most people realize. A thorough investigation is the only way to uncover the complete story and ensure the truly responsible party is held accountable.

How Texas Negligence Laws Affect Your Claim

When a third party's actions cause your single-car accident, you might assume they’ll cover 100% of your damages. It’s a logical thought, but Texas law doesn't quite work that way. Instead, the state uses a system of shared responsibility that can feel a bit complicated at first glance. Getting a handle on these rules is vital, as they directly control whether you can get paid and how much you can ultimately receive.

At the core of any personal injury case is the idea of negligence. Proving someone else was negligent isn't just about pointing fingers; it's like building a legal argument with four essential pillars. If even one of those pillars is weak, the whole claim can come crashing down.

The Four Pillars of a Negligence Claim

To build a solid claim, you and your lawyer have to prove four distinct elements. Let’s walk through a common scenario to make it clear: imagine you crash after your car hits a huge, unmarked pothole on a county-maintained road.

- Duty: First, the at-fault party must have owed you a legal "duty of care." In this case, the county has a clear legal duty to keep its roads in a reasonably safe condition for all drivers.

- Breach: Next, you have to show that they breached, or failed, that duty. The county breached its duty by not fixing the dangerous pothole or, at the very least, putting up warning signs to alert drivers.

- Causation: The breach of duty has to be the direct cause of your injuries and the crash itself. Because the county failed to fix the pothole, you lost control of your car and crashed. The link is direct.

- Damages: Finally, you must have suffered real, measurable harm. Your medical bills, the income you lost while out of work, and the cost to repair your car are all tangible damages.

When all four of these pillars stand strong, you’ve laid the foundation for a valid negligence claim. This framework is the key to figuring out whether an external hazard, a faulty car part, or even the driver's own actions were the root cause of the crash.

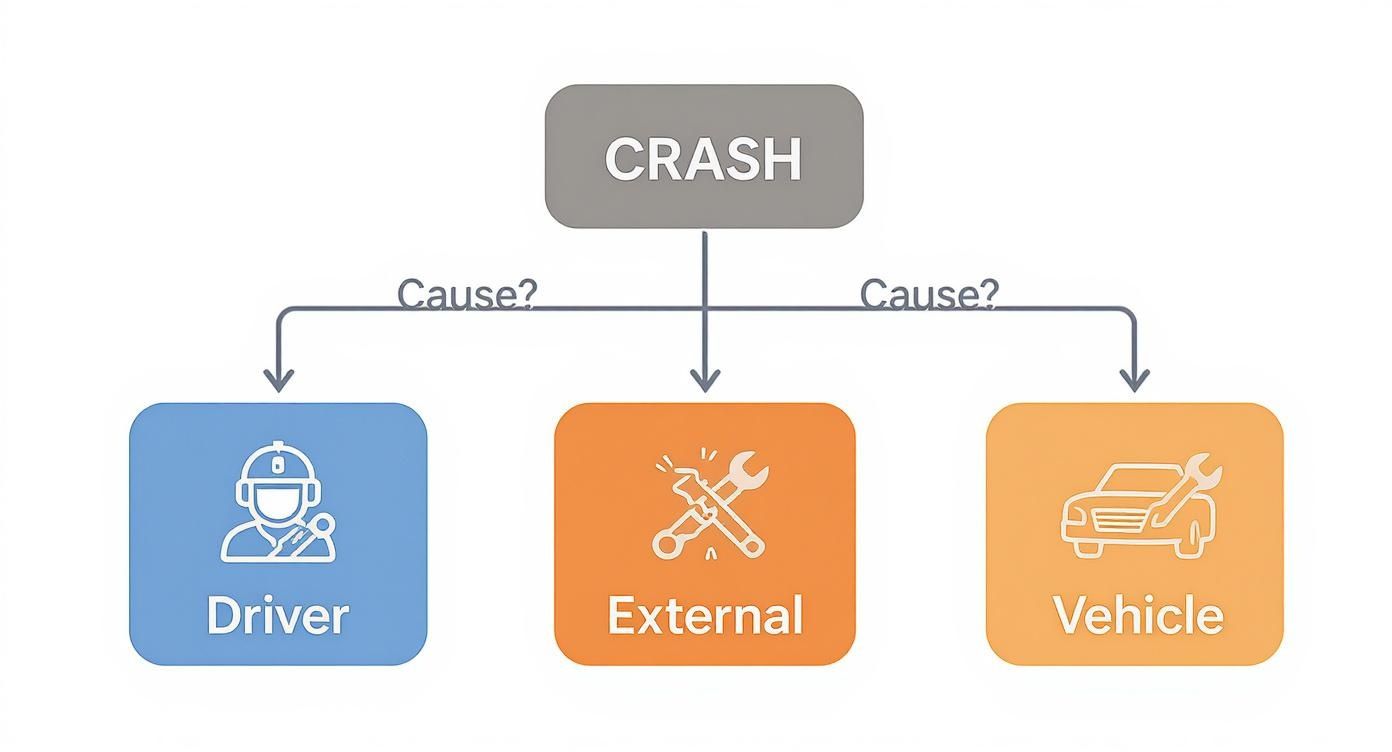

This diagram helps visualize how an investigation into a single-car crash often branches out to uncover the true cause.

As you can see, while driver behavior is a major factor, external conditions and vehicle failures are equally important avenues to explore.

Understanding Texas's 51% Bar Rule

Now, let's add a Texas-specific twist to the mix: a legal doctrine called modified comparative fault, better known as the 51% Bar Rule. This law recognizes that in the real world, accidents are rarely 100% one person's fault.

Think of the total blame for an accident as a pie that adds up to 100%. A judge or jury will look at the facts and assign a percentage of that blame to everyone involved—including you. Were you driving a few miles over the speed limit when you hit that pothole? If so, they might decide you were 10% at fault, leaving the county with the other 90%.

Under the 51% Bar Rule, you can only recover damages if your share of the fault is 50% or less. If you are found to be 51% or more responsible, Texas law bars you from collecting a single dollar.

This rule also directly reduces your compensation. Let's say your total damages add up to $100,000. If you're found 10% at fault, your award is cut by $10,000, so you receive $90,000. If you were found 50% responsible, you’d walk away with $50,000.

This all-or-nothing cutoff at 51% makes proving the other party's negligence incredibly important. Even a small shift in the fault percentage can make a massive difference in your financial recovery. Looking at real-world case results can be eye-opening; you can explore a range of Texas motor vehicle accident verdicts and settlements to see how fault was determined in situations similar to yours. That kind of knowledge is power when it's time to negotiate a fair outcome.

Building a Strong Case with the Right Evidence

![]()

When you're in a single-car accident, proving someone else is at fault feels a lot like building a house. You need a solid foundation, and that foundation is evidence. Without strong, undeniable proof, even the most legitimate claim is just a story—and stories don't win settlements.

The tough part? The proof you need can disappear in the blink of an eye.

Time is not on your side here. A city crew could patch that massive pothole the very next day. A key witness might forget exactly what they saw. The broken guardrail that caused the crash could be replaced before you even get out of the hospital. This is why gathering evidence isn't just a good idea; it's the single most important thing you can do to protect your rights. Acting fast can make or break your case.

Your Immediate Post-Accident Evidence Checklist

Right after a crash, you need to shift into investigator mode. Every little detail you can document helps piece together the full story, drawing a clear line from another party's negligence to your injuries. In those first few moments, your smartphone is your best friend.

Try to capture these key pieces of evidence:

- Photos and Videos of the Scene: Don't just snap a picture of your car. Get the whole scene. Take wide shots showing the road layout, any traffic signs (or the lack of them), and the weather conditions. Walk around and get pictures from every possible angle.

- The Specific Hazard: This is the star of the show. Get up close and personal with the pothole, the missing section of guardrail, the oil slick, or the overgrown bushes blocking the stop sign. A detailed, timestamped photo of the defect that caused your wreck is incredibly powerful.

- Your Vehicle's Damage: Take photos of the damage to your car, inside and out. This helps accident reconstruction experts understand the physics of the crash and the forces you were subjected to.

- Your Injuries: If you have any visible cuts, scrapes, or bruises, take pictures. This creates a direct visual link between the accident and the physical harm you suffered.

Think of every photo and video clip as an objective witness—one that can't forget details or have its credibility questioned later on.

Gathering Official Documents and Human Accounts

While pictures tell a thousand words, the official paper trail and firsthand accounts add crucial layers of authority to your claim. These elements turn your personal story into a documented legal matter that insurers have to take seriously.

Your next step is to start collecting these records:

-

The Official Police Report: This is ground zero. It’s one of the first things any lawyer or adjuster will ask for. It contains the officer's initial assessment, a diagram of the scene, and, crucially, the names and contact information for any witnesses they spoke to.

-

Medical Records: At the end of the day, your case is about the harm you endured. Every doctor's appointment, ER report, medical bill, and physical therapy session creates a concrete timeline of your injuries, the treatment you needed, and the financial cost of your recovery.

-

Witness Information: Did anyone stop to help or see what happened? Get their name and phone number. An independent third party who can back up your story is priceless, especially in a "phantom vehicle" case where another driver forced you off the road. Their testimony can be the deciding factor.

A common mistake is thinking you don't need much evidence because the situation seems obvious to you. In a single-car accident, it's the exact opposite. The entire burden of proof is on you to show an external cause, and that requires a mountain of evidence.

Unlocking Your Vehicle's Secrets

Believe it or not, your car was a witness, too. Modern vehicles are equipped with an Event Data Recorder (EDR), also known as a "black box," which records critical data in the moments just before a collision. This little device can provide cold, hard facts that support your version of events.

An expert can pull data points from the EDR that show:

- Vehicle Speed: Was your speed safe for the conditions? The EDR knows.

- Brake Application: Did you hit the brakes? This shows you tried to avoid the crash.

- Steering Wheel Angle: This can prove you made a sudden evasive maneuver to dodge a hazard.

- Airbag Deployment: This confirms the severity of the impact.

This data can single-handedly shut down an insurance company's argument that you were speeding or driving recklessly. It turns their opinion into your fact. Making sure this information is preserved before your car is repaired or junked is absolutely vital to building a data-driven, compelling case.

What's My Single Car Accident Case Actually Worth?

When someone else's mistake causes your single-car accident, getting back on your feet is about more than just healing your injuries—it's also about financial recovery. So, how do you put a number on everything you've been through? It really boils down to adding up all your losses, which lawyers and insurance companies break down into two main types.

A fair settlement is supposed to make you "whole" again, at least financially. To do that, it has to cover all of your damages, which are split into two buckets: economic and non-economic. The easiest way to think about it is tangible versus intangible costs.

H3: Tallying Up the Tangible Costs

Economic damages are the most straightforward part of the equation. These are the black-and-white expenses that have a paper trail—the direct financial hit you took because of the crash. You can literally add these up with a calculator using bills, receipts, and pay stubs.

These out-of-pocket costs typically include:

- Medical Bills: Think of everything from the ambulance ride and ER visit to surgery, hospital stays, physical therapy, and even the future medical care you'll need down the road.

- Lost Wages & Earning Capacity: This covers the paychecks you missed while you were out of work recovering. If the injury permanently impacts your ability to do your job, it also accounts for the money you won't be able to earn in the future.

- Rehabilitation Costs: This bucket holds the expenses for specialized therapy, medical gear like crutches or a wheelchair, and any modifications you had to make to your home to accommodate a new disability.

- Property Damage: This one's simple—it's the cost to either repair your car or, if it's totaled, replace it. It also covers any other personal items destroyed in the wreck.

These numbers create the financial foundation of your claim and serve as the starting point for any settlement negotiation.

H3: Putting a Price on the Intangible Impact

While economic damages cover the bills, they don't touch on the human cost of an accident. That’s where non-economic damages come into play. These are meant to compensate you for the very real, personal suffering that doesn't come with a neat invoice.

Non-economic damages are designed to compensate for the real but intangible ways an injury shatters your quality of life. This includes your physical pain, the emotional trauma, and the simple joys of daily life that have been taken from you.

Trying to assign a dollar value to suffering is tough, no question. But it's an absolutely critical part of getting a fair settlement. Imagine a driver whose injuries from a defective tire blowout mean they can never again lift up their toddler. The emotional devastation of that loss is profound, and non-economic damages are meant to acknowledge it. To get a better sense of how these values are calculated, check out our complete guide to car accident settlements.

Now, let's break down the types of compensation you can pursue.

Types of Compensation in a Single Car Accident Claim

This table separates the concrete financial losses from the more personal, human-centric ones.

| Damage Category | Description | Examples |

|---|---|---|

| Economic Damages | These are the tangible, verifiable financial losses you've incurred as a direct result of the accident. They have a clear dollar value. | • Medical treatment (past & future) • Lost income and wages • Loss of future earning capacity • Vehicle repair or replacement • Rehabilitation and therapy costs |

| Non-Economic Damages | These are the intangible, non-financial losses related to the accident's impact on your quality of life. They are subjective and harder to quantify. | • Pain and suffering • Emotional distress and mental anguish • Loss of enjoyment of life • Physical impairment or disfigurement • Loss of consortium (for spouses) |

Understanding both categories is the key to building a comprehensive claim that reflects the true scope of your losses.

H3: The Power of Expert Witnesses

Proving the full extent of your damages—especially when it comes to future medical needs or the lifelong impact of a disability—often requires calling in the professionals. Expert witnesses are specialists who can analyze the facts of your case and provide an authoritative opinion to back up your claim.

For instance, an accident reconstructionist can show exactly how a faulty guardrail failure caused your crash. A vocational expert can testify about how your injuries have permanently limited your earning potential. And of course, medical specialists can explain the long-term prognosis of your injuries and the kind of care you'll need for the rest of your life. Their testimony turns your claims from words on a page into hard, evidence-backed facts, giving everyone a much clearer picture of what a truly fair settlement should look like.

Crucial Steps to Take After Your Accident

The moments after a single car accident are a blur of adrenaline and confusion. It's tough to think straight when your heart is pounding, but what you do right then and there can make all the difference for your health and your ability to get fair compensation down the road.

Having a clear plan helps you protect your rights when you’re feeling rattled and vulnerable. This is your roadmap for navigating the aftermath with confidence, putting all the pieces we've discussed into a simple, actionable game plan.

Prioritize Your Health and Document Everything

First things first: your health. Get checked out by a doctor right away, even if you think you’re okay. Some of the most serious injuries, like concussions or internal bleeding, don't always show immediate, obvious signs.

A trip to the ER or an urgent care clinic accomplishes two critical things:

- It protects your well-being. A doctor can spot and treat injuries before they get worse.

- It creates a paper trail. Your medical records are undeniable proof connecting the accident to your injuries—the kind of evidence you absolutely need for a claim.

If you skip this step, you’re handing the insurance company an easy way to argue that your injuries weren't actually caused by the crash.

Preserve Evidence and Report the Incident

If you're physically able while waiting for help, start acting like a detective. Pull out your phone and take photos and videos of absolutely everything. Capture the pothole or slick spot on the road, the damage to your car from every angle, and the wider scene. This kind of evidence has a way of disappearing fast.

You must also report the accident to the police. A formal police report is a cornerstone of your case. It serves as an official, third-party narrative of what happened, notes the conditions, and often includes the names of any witnesses who stopped to help.

Crucial Tip: Never admit fault or say things like "I'm fine" at the scene. Just stick to the facts. The real cause of the crash often isn't clear until after a proper investigation.

Be Cautious with Insurance Companies

It won’t be long before an insurance adjuster calls. They’ll likely sound incredibly friendly and concerned, but you have to remember whose side they’re on—and it isn’t yours. Their job is to protect their company's bottom line by paying out as little as possible.

Do not agree to give a recorded statement until you've spoken with a lawyer. Adjusters are skilled at asking leading questions designed to get you to say something they can use to weaken or deny your claim. Just politely tell them your representative will be in touch.

Finally, the single most powerful step you can take is to talk to a personal injury attorney who knows these cases inside and out. They can dig into what really caused your single car accident, take over all communications with the insurance company, and make sure you understand every legal option available to you.

Frequently Asked Questions

After a single-car accident, it’s natural to have a lot of questions running through your mind. The legal side of things can feel overwhelming, so let's walk through some of the most common concerns we hear from people in your situation.

I Hit a Pothole and Crashed. Am I Automatically at Fault?

Not necessarily. In Texas, government bodies are supposed to keep the roads reasonably safe. If a city or county knew about a dangerous road hazard like a massive pothole and didn't bother to fix it or put up a warning, they could be on the hook for your crash.

But be warned: suing a government entity is tough. They have special legal protections, and your own driving actions will still be scrutinized under Texas's comparative fault rules. An experienced attorney is your best bet for figuring out if the government was truly negligent and if you have a real shot at a claim.

What if Another Car Ran Me Off the Road but Never Made Contact?

This is what we call a "miss-and-run" or a "phantom vehicle" case, and it happens more often than you'd think. You can still seek compensation, but the claim is usually filed under your own Uninsured/Underinsured Motorist (UM/UIM) coverage.

The main hurdle here is proving the other driver even existed and that their actions forced you to crash. Without a witness, it's a classic "he said, she said" scenario, except the other side isn't there to talk.

In a "miss-and-run" case, an independent witness isn't just a bonus—they're often the key to unlocking your claim. Their testimony can be the difference between getting fair compensation and having your claim denied outright.

How Long Do I Have to File an Accident Lawsuit in Texas?

In Texas, you generally have a two-year window from the date of the crash to file a personal injury lawsuit. This is called the statute of limitations, and it's a hard deadline.

However, the clock ticks much faster if you're trying to sue a government entity for a bad road. In those cases, you might have as little as 90 days to give them formal notice of your claim. Miss that short deadline, and you lose your right to sue forever. Time is not on your side.

Will My Insurance Rates Go Up After a Single-Car Wreck?

It all comes down to who was at fault. If you can prove a third party was to blame—like a car manufacturer for a faulty part or a city for a poorly designed road—your insurance rates shouldn't be affected.

On the other hand, if you're found responsible or you simply file a claim against your own collision policy, you can almost certainly expect your premiums to increase. This is why proving someone else was negligent is so important; it protects your physical and financial well-being.

At Verdictly, we believe knowledge is power. Our platform gives you transparent data on real Texas motor vehicle accident verdicts and settlements, helping you understand what similar cases are worth. See what's possible before you negotiate by exploring our database.

Related Posts

Using a Compensation Calculator for Car Accident Claims

Discover how to use a compensation calculator for car accident claims in Texas. Get practical steps for estimating your settlement value with real-world data.

Failure to Maintain Lane in Texas A Motorist's Essential Guide

Injured after a crash? Understand Texas 'failure to maintain lane' laws, how fault is proven, and what your car accident claim could be worth.

Uninsured Driver Accidents (uninsured driver accidents) Steps to Compensation

If you're dealing with uninsured driver accidents, learn the immediate steps, how to file claims, and your legal options to secure compensation.