settlement for whiplash: Maximize Your Payout with Our Guide

Learn how a settlement for whiplash is valued, the factors that affect your payout, and steps to strengthen your claim.

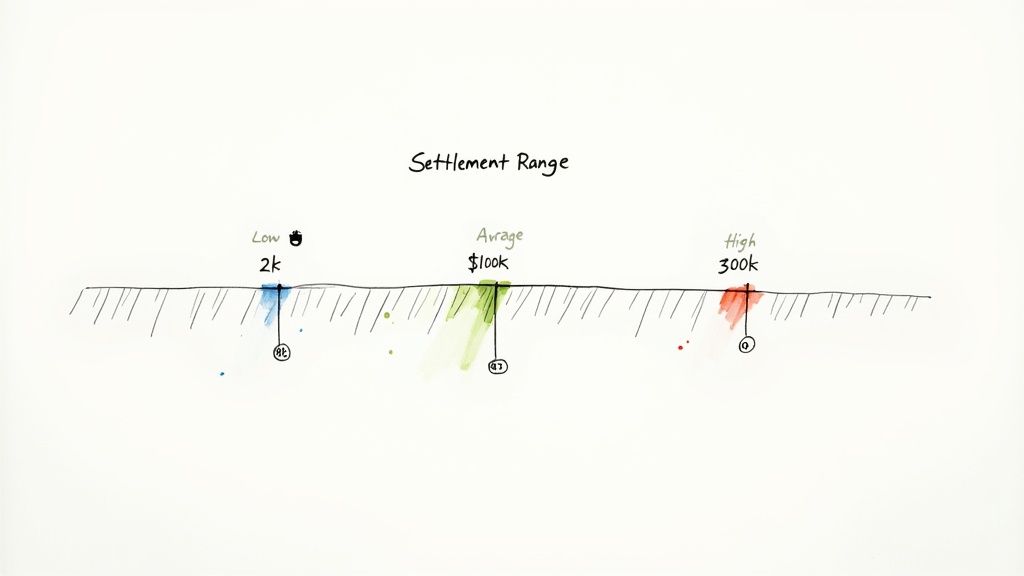

So, what's a typical whiplash settlement actually worth? While the average payout hovers around $18,950, that number alone can be misleading. The truth is, most claims for mild to moderate whiplash end up settling somewhere between $7,500 and $50,000.

The single biggest driver behind that final number? The severity of your injury.

What's My Whiplash Claim Really Worth?

After the shock of a car accident wears off, it's the first question on everyone's mind. But there’s no magic calculator for this stuff. Think of your claim's value as a unique puzzle. The final picture—and the final number—depends on how all the individual pieces fit together: your medical bills, lost paychecks, and the very real, but harder to price, impact of your pain and suffering.

An insurance adjuster won't just pull an "average" number out of a hat. They scrutinize every detail of your case to justify their offer. Knowing the typical settlement ranges gives you a solid starting point and helps you see whether their first offer is reasonable or just a lowball tactic.

A Look at the National Numbers

Looking at data from across the country can give us a helpful, big-picture view. While the overall average whiplash settlement is about $18,950, the story gets more interesting when you dig a bit deeper. Most payouts actually fall in that $7,500 to $50,000 bracket.

Why the big difference? The national median is closer to $7,500, which tells us there are a massive number of smaller, minor injury claims that pull the overall average down. You can get more insights into whiplash settlement averages and see how these figures are put together.

Key Takeaway: Don't get hung up on the "average." Your settlement will be built from the ground up based on the specific, provable facts of your case—from the severity of the injury to the total economic losses you've suffered.

How Injury Severity Shapes Your Settlement

More than anything else, the seriousness of your whiplash injury dictates the value of your claim. A minor neck sprain that clears up in a few weeks is in a completely different ballpark than an injury that leads to chronic pain and months of physical therapy.

To give you a clearer idea of what to expect, this table breaks down settlement ranges by how severe the injury is.

Whiplash Settlement Ranges by Injury Severity

This table provides a quick overview of potential settlement amounts based on the severity of the whiplash injury and associated complications.

| Injury Severity Level | Common Characteristics | Typical Settlement Range |

|---|---|---|

| Minor Whiplash | Symptoms like stiffness and soreness last for a few weeks; requires minimal medical treatment (e.g., check-ups, pain medication). | $2,500 – $10,000 |

| Moderate Whiplash | Persistent pain, limited range of motion, and headaches; may require physical therapy or chiropractic care for several months. | $10,000 – $50,000 |

| Severe Whiplash | Chronic pain, neurological symptoms (numbness, tingling), or complications like herniated discs; may require long-term care or injections. | $50,000 – $100,000+ |

As you can see, the difference is stark. A case involving only a few doctor's visits will resolve for a much smaller amount than one requiring MRIs, specialist consultations, and ongoing treatment for long-term symptoms.

Whiplash Isn't Just a "Pain in the Neck"

When most people hear the word "whiplash," they often picture a minor neckache that goes away with a couple of aspirin. This couldn't be further from the truth, and that misconception can seriously hurt your chances of getting a fair settlement.

Think about the sharp, violent motion of cracking a whip. That’s exactly what happens to your neck in a car accident. Your head is jolted forward and then snapped back so fast your muscles can't possibly keep up. This sudden, forceful movement stretches and tears the delicate muscles, ligaments, and tendons in your neck.

This is also why the pain often doesn't hit you right away. The adrenaline pumping through your system after a crash can mask the injury for hours. But once that wears off and the inflammation kicks in over the next 24 to 48 hours, you start to feel the real damage.

The True Scope of Whiplash Symptoms

Because whiplash affects the cervical spine—the command center for so much of your body's function—the symptoms go way beyond a stiff neck. It can trigger a whole host of problems that can turn your life upside down.

Many people who've had whiplash report a wide range of issues, including:

- Nagging Headaches: These usually start at the base of your skull and can feel like a constant, dull throb.

- Neck Pain and Stiffness: This is the classic sign, often making it difficult to turn your head from side to side.

- Dizziness or Vertigo: A persistent feeling of being off-balance or that the room is spinning.

- "Brain Fog": You might struggle to concentrate, feel mentally sluggish, or have trouble with your memory.

- Pain or Numbness in Your Arms: A tingling or "pins and needles" sensation shooting down your shoulders and into your hands can be a sign of nerve irritation.

When you look at this list, it’s clear that whiplash is a serious, full-body injury, not just a minor ache.

The force of a rear-end collision can strain the delicate structures of the neck, leading to symptoms that may not fully develop for hours or even days. This delayed onset is a critical reason why seeking immediate medical attention is non-negotiable for proving your injury's link to the accident.

Why Getting to a Doctor Immediately is Non-Negotiable

Insurance adjusters love to argue that whiplash injuries are either exaggerated or not related to the accident at all. Without medical records, it’s just your word against theirs, and that’s a battle you’re likely to lose. A prompt medical evaluation is the single most important step you can take to build a solid claim.

A doctor will document your condition, test your range of motion, and look for any neurological red flags. In some cases, they might order an MRI to check for hidden damage to the soft tissues, like a herniated disc. A specific diagnosis like this can dramatically change the value of your case. For a real-world example, you can see how a cervical disc injury can influence Texas MVA cases.

Getting checked out right away creates a clear, undeniable timeline that links your injuries directly to the accident, shutting down the insurance company's favorite arguments before they can even make them.

How Insurance Companies Calculate Your Whiplash Payout

Insurance adjusters don't just pick a number out of a hat when they make a settlement offer. They have a specific formula they follow to turn your medical records and financial losses into a dollar amount. Knowing how they do it is the first step to making sure you get a fair settlement for whiplash.

The process starts by splitting your losses into two buckets. I like to think of it like building a house: you start with a concrete foundation of hard, measurable costs, then you build the rest of the structure on top—that’s where the human impact of the injury comes in.

The Foundation: Special Damages

First up are special damages, which you might also hear called economic damages. These are the tangible, black-and-white costs that come with a paper trail. Frankly, they’re the easiest part of your claim to prove because you have receipts and statements to back them up.

These costs form the bedrock of your settlement value and include things like:

- All Medical Bills: We’re talking about everything—the ambulance ride, the ER visit, your physical therapy sessions, chiropractor appointments, and any prescription medications.

- Lost Wages: If whiplash kept you out of work, you are entitled to the income you lost. You'll just need a letter from your employer or pay stubs to prove it.

- Future Medical Needs: If your doctor says you'll need more treatment down the road, like pain management injections or more physical therapy, the estimated cost for that care gets added in.

The journey from the moment of impact to a medical diagnosis is what creates these foundational costs.

As you can see, the crash itself is a physical event that directly causes a medical condition, and that condition generates the specific, quantifiable costs that are essential to building your claim.

The Structure: General Damages and the Multiplier Method

Once that foundation of special damages is solid, the adjuster builds upon it with general damages. This is money meant to compensate you for everything you've gone through that doesn't have a price tag—the physical pain, the emotional distress, and the way the injury has messed with your daily life.

Since you can't get a receipt for "pain and suffering," insurers have a go-to formula called the "multiplier method" to figure out a number.

The Multiplier Method: An adjuster will take your total special damages (all those hard costs) and multiply that figure by a number, usually somewhere between 1.5 and 5. The specific multiplier they choose depends entirely on how severe your injuries are.

A mild sprain that heals up in a few weeks might only get a 1.5x multiplier. But a serious whiplash injury that causes chronic neck pain, neurological issues like tingling in your arms, and keeps you from work for months? That could easily justify a multiplier of 4x or even 5x.

Putting It All Together: A Real-World Example

Let's walk through how this plays out with a realistic example. Say you were rear-ended at a stoplight and your documented expenses look like this:

- Medical Bills: $3,500

- Lost Wages: $1,500

- Total Special Damages: $5,000

Your injury was pretty painful. It took two months of physical therapy to get back to normal, and during that time, you couldn't play with your kids or go to the gym. Given that, the insurance adjuster might decide a multiplier of 3 is fair.

Here’s the math:

- Calculate General Damages: $5,000 (Special Damages) x 3 (Multiplier) = $15,000

- Calculate Total Settlement Value: $5,000 (Special Damages) + $15,000 (General Damages) = $20,000

In this situation, a case with $5,000 in direct costs ends up having a total settlement value of $20,000. This shows exactly why it’s so important to track every single expense. Every dollar you document not only gets reimbursed but also directly boosts the value of your pain and suffering compensation.

This framework is the starting point for negotiations. To see how these calculations fit into the entire claims process, take a look at our complete guide to car accident settlements.

What Makes Your Whiplash Settlement Go Up or Down?

It’s a common scenario: two people get into nearly identical car accidents, but one walks away with a settlement three times larger than the other. What gives?

The answer isn't luck. It comes down to a handful of critical factors that can either build up your claim's value or hand the insurance company the perfect excuse to slash their offer. Understanding these "value drivers" is like knowing the rules of the game before you start playing—it puts you in a much stronger position to fight for what you deserve.

The Strength of Your Medical Evidence

Let's be blunt: in any injury claim, your medical records are the bedrock of your case. Without them, your claim is just your word against the insurance company’s—and that's a battle you’re likely to lose. Vague complaints of "neck pain" are easy for an adjuster to brush aside, but detailed, consistent medical records are tough to argue with.

Several key pieces of your medical story can dramatically increase your claim's value:

- Quick Treatment: Did you see a doctor within 24-72 hours? Doing so creates a clear, immediate link between the crash and your injuries that’s hard for an insurer to dispute.

- A Specific Diagnosis: "Neck strain" is one thing. But a diagnosis of a herniated disc, nerve impingement, or torn ligaments—especially one confirmed by an MRI—is a completely different ballgame. That's the kind of objective proof that gets an adjuster's attention.

- Consistent Care: Following through with your treatment plan is non-negotiable. If your doctor prescribes physical therapy, you go to every single session. This demonstrates to the insurance company that your injuries are legitimate and that you're taking your recovery seriously.

Any gaps in your treatment are a huge red flag for insurance adjusters. If you skip physical therapy for a month because you were "feeling a little better," they'll seize on that. Their argument will be that your injury must not have been that severe, giving them leverage to make a lowball offer.

A strong whiplash settlement is built on a foundation of irrefutable medical proof. Every doctor's visit, every therapy session, and every diagnostic test adds another brick to that foundation, justifying the real value of your claim.

Proving Clear Liability

This one is simple: who caused the wreck? If the other driver was clearly 100% at fault—they ran a red light and T-boned you, or they rear-ended you while texting—you’re in the driver’s seat during negotiations.

Things get trickier if liability is shared. Texas operates under a "modified comparative fault" rule. This means if you're found to be partially at fault, your settlement gets reduced by your percentage of blame. Even worse, if a jury decides you were 51% or more at fault, you get nothing. Zero.

This is exactly why a police report that puts the blame squarely on the other driver is such a crucial piece of evidence.

Documenting the Severity and Duration of Your Injuries

The real story of a whiplash injury isn't just the initial pain; it's how long it disrupts your life. An injury that’s gone in three weeks is worth far less than one that causes chronic pain and limitations for six months or more. This is where the "pain and suffering" part of your settlement really takes shape.

Here are the factors that signal a more severe, higher-value injury:

- A Long Recovery: If you needed months of physical therapy or chiropractic care, it shows the injury was significant.

- Specialist Referrals: When your family doctor sends you to a neurologist or an orthopedic surgeon, it tells the insurer that this is a complex injury beyond a simple sprain.

- Objective Test Results: An MRI or CT scan showing physical damage to your spine is infinitely more powerful than just telling an adjuster your neck hurts.

- Lasting Problems: If the whiplash leaves you with a permanent issue—like chronic headaches, nerve pain, or a permanently reduced range of motion—the settlement value increases significantly to compensate for that future suffering.

These factors are why whiplash settlement amounts can vary so wildly. Based on real case data, minor sprains that heal quickly often settle in the $2,500 to $10,000 range. However, moderate cases with documented, ongoing treatment frequently land between $10,000 and $50,000. As you can discover from these settlement examples on LawsuitLegal.com, the more evidence you have to prove severity and duration, the stronger your case for higher compensation becomes.

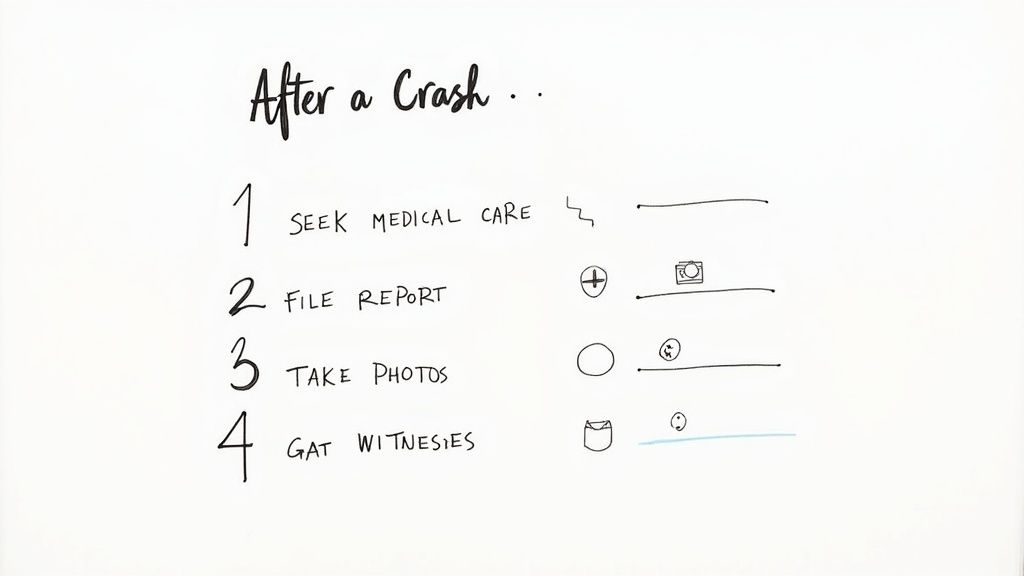

A Step-by-Step Guide to Documenting Your Claim

The aftermath of a car accident is disorienting and chaotic. Despite the confusion, the actions you take in those first hours and days can make or break your potential settlement for whiplash. Think of this as your playbook for building a rock-solid claim from day one.

Strong documentation is everything. It’s what turns your personal experience of pain and financial loss into a clear, factual story that an insurance adjuster can't simply brush aside. Every receipt, photo, and report you gather adds another layer of proof, making your claim undeniable.

Your Immediate Post-Accident Checklist

What you do right after the collision is absolutely critical. Adrenaline is a powerful painkiller and can easily mask serious injuries, so your first priority is always your health. After that, it’s all about gathering evidence.

Here are the non-negotiable first moves:

- Seek Immediate Medical Attention: This is the most important step. Even if you think you’re fine, get checked out at an urgent care clinic or ER. This creates a crucial medical record linking your injuries directly to the accident.

- File an Official Police Report: A police report is an impartial, third-party account of what happened. It locks in key details like the date, location, and often includes the officer’s initial take on who was at fault.

- Gather Evidence at the Scene: If you’re able, use your phone to document everything. Snap pictures of the damage to all vehicles, skid marks on the road, traffic signs, and any visible injuries you have.

- Collect Witness Information: Get the names and phone numbers of anyone who saw the crash. An independent witness can be your best ally if the other driver’s story changes later on.

Navigating Conversations with Insurance Adjusters

It won’t be long before you get a call from the at-fault driver’s insurance adjuster. You need to remember their job isn't to help you—it’s to pay out as little as possible for the company. Anything you say can and will be used against you.

Keep these tips in your back pocket for that first phone call:

- Provide Only Basic Facts: Stick to your name, contact info, and the date and location of the crash. Don’t volunteer details about the accident or your injuries.

- Do Not Give a Recorded Statement: You are not legally required to give a recorded statement. Politely decline. It’s too easy for them to twist your words or take something out of context later.

- Never Admit Fault: Avoid saying things like “I’m sorry” or “I should have seen them.” Let the evidence and the police report do the talking.

- Don't Downplay Your Injuries: It's tempting to say "I'm fine," but that can seriously damage your claim when whiplash symptoms show up a day or two later. Simply state that you are getting a medical evaluation.

An insurance adjuster's primary goal is to close your claim for the lowest possible amount. Every piece of documentation you collect serves as leverage, strengthening your position and justifying a fair settlement amount.

Crafting an Effective Demand Letter

Once you’ve reached Maximum Medical Improvement (MMI)—that’s the point where your doctor confirms you’ve recovered as much as you’re going to—it’s time to formally present your claim. This is done with a demand letter, a professional document that lays out the facts and calculates your total damages.

Your demand letter is the official kickoff to settlement talks. It needs to be clear, organized, and backed by every piece of evidence you’ve collected. This is your chance to tell your story in a compelling, fact-based way.

A strong demand letter must include:

- A detailed summary of how the accident happened, clearly showing the other driver’s fault.

- A complete description of your injuries, the treatment you received, and your recovery journey.

- An itemized list of all your hard costs, or economic damages (medical bills, lost wages).

- A specific, calculated amount for your non-economic damages (pain and suffering).

- The total settlement amount you are demanding.

Make sure to attach copies of all your supporting documents, from medical records and bills to the police report. An organized, thorough package tells the adjuster you’re serious. To get a better feel for what’s realistic, you can explore a database of real verdicts and settlements for back strain and soft tissue injuries in Texas, which provides incredible context for potential outcomes.

Knowing When to Hire a Personal Injury Lawyer

Let’s be honest, for a minor fender-bender with a little neck soreness, you might be able to handle the claim yourself. If the other driver’s fault is crystal clear and your medical bills are small, many people can navigate the insurance process without hiring a lawyer.

But things can get complicated, and fast. The key is knowing when you're in over your head and when it’s time to bring in a professional to protect your right to a fair settlement for whiplash.

Trying to take on a complex claim alone puts you at a huge disadvantage. You're up against seasoned insurance adjusters whose entire job is to pay out as little as possible.

Red Flags That Signal You Need an Attorney

If you see any of these signs, it's time to stop talking to the insurance company and start talking to a lawyer. It's not just a good idea—it's essential.

- Your Injuries Are Serious or Long-Lasting: Is this more than just a sore neck? If you're dealing with chronic pain, need ongoing physical therapy, or have complications like a herniated disc, the value of your claim just shot up. An attorney will make sure all your future medical needs are properly calculated and included in the demand.

- The Insurance Company is Fighting You on Fault: This is a classic tactic. If the adjuster starts hinting that you were partly to blame or outright denies their driver was at fault, you’re in for a battle. A lawyer will immediately start gathering the evidence needed to shut that down and prove liability.

- You Get a Ridiculously Low Offer: The first offer is almost always a lowball. But if the amount they're offering doesn't even cover your existing medical bills, that's a bright red flag. They're testing you to see if you’ll take a quick, cheap payout. A professional negotiator will know exactly how to respond.

- Your Doctor Says You'll Need Future Care: Did your doctor mention the possibility of future injections, pain management, or even surgery down the road? Calculating these future costs is incredibly complex and not something you should ever do on your own. Lawyers work with medical and financial experts to put a real number on this.

What a Good Lawyer Actually Does for You

Hiring a personal injury lawyer isn’t just about having someone fill out forms. It's about leveling the playing field. The moment an attorney is involved, the insurance company knows it has to take your claim seriously.

They take over all the stressful communications, protect you from giving recorded statements that can be twisted against you, and use their experience negotiating claims just like yours to fight for every dollar you deserve.

Most personal injury attorneys work on a contingency fee basis. This is a crucial point. It means you pay absolutely nothing upfront. Their fee is simply a percentage of the final settlement or verdict they win for you. If you don't get paid, they don't get paid.

This setup is designed to give you access to expert legal help without any financial risk. It puts your lawyer's interests on the exact same page as yours: the bigger your recovery, the better it is for everyone. It's a powerful way to get the expertise you need to secure a just result.

Common Questions About Whiplash Settlements

After a wreck, your head is probably spinning with questions. Let's cut through the noise and get you some straight answers to the most common things people worry about when dealing with a whiplash settlement. Knowing what to expect can make a world of difference.

The road to a settlement can feel like a maze of legal terms and insurance company runarounds. Our goal here is to give you a clear map, so you can feel more in control of your recovery and your financial future.

How Long Does It Take to Get a Settlement for Whiplash?

This is the million-dollar question, and the honest answer is: it depends. A simple case where the injuries are minor and the other driver is clearly at fault might wrap up in a few months.

But if your injuries are more serious, it's going to take longer—sometimes a year or more. The biggest hold-up is waiting for you to reach what’s called Maximum Medical Improvement (MMI). That’s the point when your doctor says you’re as healed as you’re going to get. It’s a huge mistake to settle before you know the full story of your injuries and what kind of care you might need down the road.

Can I Still Get a Settlement If I Was Partially at Fault?

Yes, you can. Texas has a rule called "modified comparative fault," and it’s a pretty important one to understand.

Here’s how it works: your settlement is just reduced by whatever percentage of fault is assigned to you. For example, if a jury decides you were 20% to blame for the crash and your total damages are $20,000, you can still walk away with $16,000. The key thing to remember is the 51% bar. If you’re found to be 51% or more responsible, you get nothing.

A Word of Caution: Insurance adjusters know this rule inside and out. They will often try to pin more of the blame on you to lower their payout. This is a standard negotiation tactic, and it’s one of the main reasons having solid evidence is so critical.

Do I Have to Pay Taxes on My Whiplash Settlement?

For the most part, no. The IRS doesn’t typically count compensation for physical injuries as taxable income.

This means the money you get for the following is usually yours to keep, tax-free:

- Medical expenses (past and future)

- Pain and suffering

- Emotional distress

The one exception is any portion of the settlement that is specifically for lost wages. That part might be taxed as income. It's always smart to run this by a tax professional once you have a settlement so there are no surprises later.

Should I Accept the Insurance Company's First Offer?

It is almost never a good idea to take the first offer. Think of it as their opening bid in a negotiation—and it's almost always a lowball.

Insurance companies love to make quick offers, sometimes before you’ve even finished your first round of physical therapy. They’re hoping you’ll take the fast cash. But once you accept, that's it. You sign away your right to any more money, even if your injury gets worse. Always make sure you understand the true value of your claim before even thinking about settling.

Navigating a whiplash claim is tough, but you don’t have to do it in the dark. At Verdictly, we pull back the curtain and give you access to real Texas motor vehicle verdicts and settlements. See what cases like yours are actually worth, so you can negotiate from a position of strength.

Related Posts

What to Do After a Hit and Run Car Accident in Texas

A complete guide on what to do after a hit and run car accident in Texas. Learn the critical first steps, your legal options, and how to file a claim.

How Much Can I Get From a Car Accident Settlement?

Wondering how much can I get from a car accident? This guide breaks down settlement factors, damages, and claim values to help you estimate your compensation.

Calculating Pain and Suffering: calculating pain and suffering in Texas

Learn how to calculate pain and suffering damages in a Texas car accident. See key factors and how calculating pain and suffering affects your claim.