sample demand letter auto accident: Auto Claim Templates

Discover a proven sample demand letter auto accident and editable templates to win your auto accident claim. Simple steps, real examples, and expert tips.

Think of your demand letter as your opening argument, not just another piece of paperwork. It’s the formal, comprehensive story you present to the at-fault driver's insurance company. This is where you lay out exactly what happened, how you were injured, and precisely what you're asking for in compensation.

Why Your Demand Letter Is So Important

Before you even start looking for a sample demand letter for an auto accident, you need to grasp its real power. This isn't just a formality; it's the foundation of your entire claim. With this single document, you get to frame the narrative, control the information, and show you mean business right from the start.

For the insurance adjuster, this is their first real look at your case. A strong letter does a few critical things all at once:

- It sets a professional, serious tone. When an adjuster sees a clear, organized, fact-based letter, it signals that you're a credible person who is prepared to follow through.

- It creates a formal record. Sending the letter via certified mail gives you a paper trail. You can prove exactly when the insurance company received your demand, which is a small but critical detail for keeping them on a timeline.

- It can actually speed things up. A letter that logically presents all the facts, evidence, and financial calculations makes the adjuster's job easier. When you make it easy for them to understand your position, you often get a faster, more reasonable response.

Setting the Stage for Negotiation

Your demand letter is more than a simple request for a check; it's the official kickoff to the negotiation process. You're giving the adjuster everything they need to evaluate their driver's fault and understand the full extent of your damages. It tells your side of the story completely and persuasively.

A powerful demand letter sets the anchor for settlement talks. It presents your highest reasonable figure, backed by solid evidence, forcing the insurer to negotiate from your number, not from zero.

This positioning is priceless. Without a detailed demand, you're just a claim number in their system. With one, you're a person with a documented story of injury and loss. It makes the adjuster face the real-world consequences of the crash—the medical treatments, the pain, the lost wages, and the overall impact on your life.

By putting all your cards on the table upfront—police report, medical bills, photos, and lost wage statements—you cut off common delay tactics. The adjuster can't claim they're "waiting for more information" when you've already provided it. This transparency shows you're ready to negotiate in good faith, but it also sends a clear message that you're prepared.

Ultimately, a well-crafted letter transforms you from a passive victim into the driver of your own financial recovery.

Anatomy of a Winning Demand Letter

Let's pull back the curtain on what a truly effective demand letter looks like, piece by piece. This isn't just about filling in a template; it's about understanding the psychology behind each paragraph. A powerful letter tells a persuasive story, but one that’s backed by undeniable facts.

Think of each section as a building block. You’re constructing a logical argument for the insurance adjuster, moving them from the basic facts of the crash to the inescapable conclusion that your settlement demand is fair and justified.

Start with a Clear and Factual Introduction

Your opening paragraph has one job: to establish the core facts of your claim immediately. It needs to be direct, professional, and leave zero room for confusion. This is the "who, what, when, and where" of your case, laid out in black and white.

Get these key details on the table right away:

- Your full name and the name of their insured (the at-fault driver).

- The exact date, time, and location of the collision.

- Your claim number, if you have one.

- A clear statement that this is a formal demand for settlement.

For instance, a rock-solid opening might be: "This letter is a formal demand for settlement for the injuries I sustained in the auto accident on May 15, 2024, at the intersection of Main Street and Oak Avenue in Dallas, Texas. The crash was caused by your insured, John Smith. My claim number is 12345-ABC." This approach is all business and gets straight to the point.

Construct a Compelling Narrative of the Accident

After the intro, you need to walk the adjuster through how the crash happened. Your goal is to paint a clear, logical picture that leaves no doubt about the other driver's fault. Stick to the facts—this isn't the place for emotional language or accusations.

Briefly describe what you were doing right before the impact. For example, were you stopped at a red light? Traveling at the speed limit through an intersection with a green light? Then, detail the at-fault driver's actions. If you have the police report, reference it and include the report number to add weight to your account.

This section is all about proving liability. When the adjuster finishes reading it, their only logical conclusion should be that their insured was negligent and is therefore on the hook for your damages.

Pro Tip: Never, ever admit any fault, not even a little. Phrases like "I didn't see him until the last second" can be twisted and used against you. Your account should focus exclusively on the factual chain of events and how the other driver's actions caused the collision.

Detail Your Injuries and Medical Treatment

Here, you draw a direct line from the driver's negligence to your physical injuries. Start with a high-level summary (e.g., "As a direct result of the collision, I suffered a herniated disc in my lower back, a concussion, and severe whiplash.").

Then, tell the story of your medical journey chronologically. Describe the initial trip to the emergency room, the follow-up appointments with specialists, your physical therapy regimen, and any diagnostic tests like MRIs or X-rays. Naming your doctors and medical facilities lends credibility to your story.

Don't forget to explain how these injuries have affected your day-to-day life. Mentioning things like being unable to sleep, perform simple household chores, or play with your kids humanizes your claim. It shows the adjuster you’re more than just a file number with a stack of medical bills.

Itemize All Your Damages

This is where you show your math. To justify your settlement figure, you must present a clean, organized breakdown of all your financial losses, known as special damages. You’ll want to separate them into categories so the adjuster can easily cross-reference them with the documentation you provide.

Your list of special damages should include:

- Medical Expenses: Every bill, from the ambulance ride to physical therapy co-pays.

- Lost Wages: The total income you missed out on because you couldn't work. A letter from your HR department is perfect here.

- Property Damage: The bill to repair your car or its total loss value.

- Out-of-Pocket Costs: Any other related expenses, like ride-sharing fees to get to doctor’s appointments or rental car costs.

Of course, your losses go beyond what can be tallied on a receipt. You also have to account for your general damages, which is the legal term for pain and suffering. This figure is meant to compensate you for the physical pain, emotional distress, and disruption to your life that you've endured. While it’s harder to put a number on, it’s a critical component of your settlement.

To learn more about how to properly categorize and calculate all these different losses, you can explore our detailed guide on the types of damages in personal injury cases.

Finally, you present your total demand. This is the grand total—the sum of your special and general damages. State it as a firm, confident figure that fully reflects the extent of everything you've been through.

Before we move on, let's summarize the key parts of your letter in a table.

Essential Components of Your Demand Letter

This table breaks down the core sections of a strong auto accident demand letter, outlining the purpose of each and the key information you must include.

| Letter Section | What It Does | Key Information to Include |

|---|---|---|

| Introduction | Establishes the basics of the claim. | Your name, at-fault driver's name, claim number, date/location of the accident. |

| Accident Narrative | Proves the other driver's liability. | A factual, step-by-step account of the crash, referencing the police report. |

| Injuries & Treatment | Connects the crash to your physical harm. | A list of your injuries, a timeline of your medical care, and the impact on your daily life. |

| Damages Breakdown | Justifies your settlement amount. | An itemized list of all medical bills, lost wages, and out-of-pocket expenses. |

| Pain & Suffering | Accounts for non-economic losses. | A clear explanation of your physical pain, emotional distress, and loss of enjoyment of life. |

| Final Demand | States your total settlement figure. | A single, firm number representing the sum of all your special and general damages. |

Having these components organized clearly makes it much easier for an adjuster to understand and process your claim, which is the first step toward getting a fair offer.

Calculating Your True Settlement Value

Your demand letter is only as strong as the math behind it. An insurance adjuster isn't just going to take your word for it—they've seen it all. They need to see a logical, well-documented calculation that justifies the number you're asking for. It's all about translating what you've gone through into a clear financial figure.

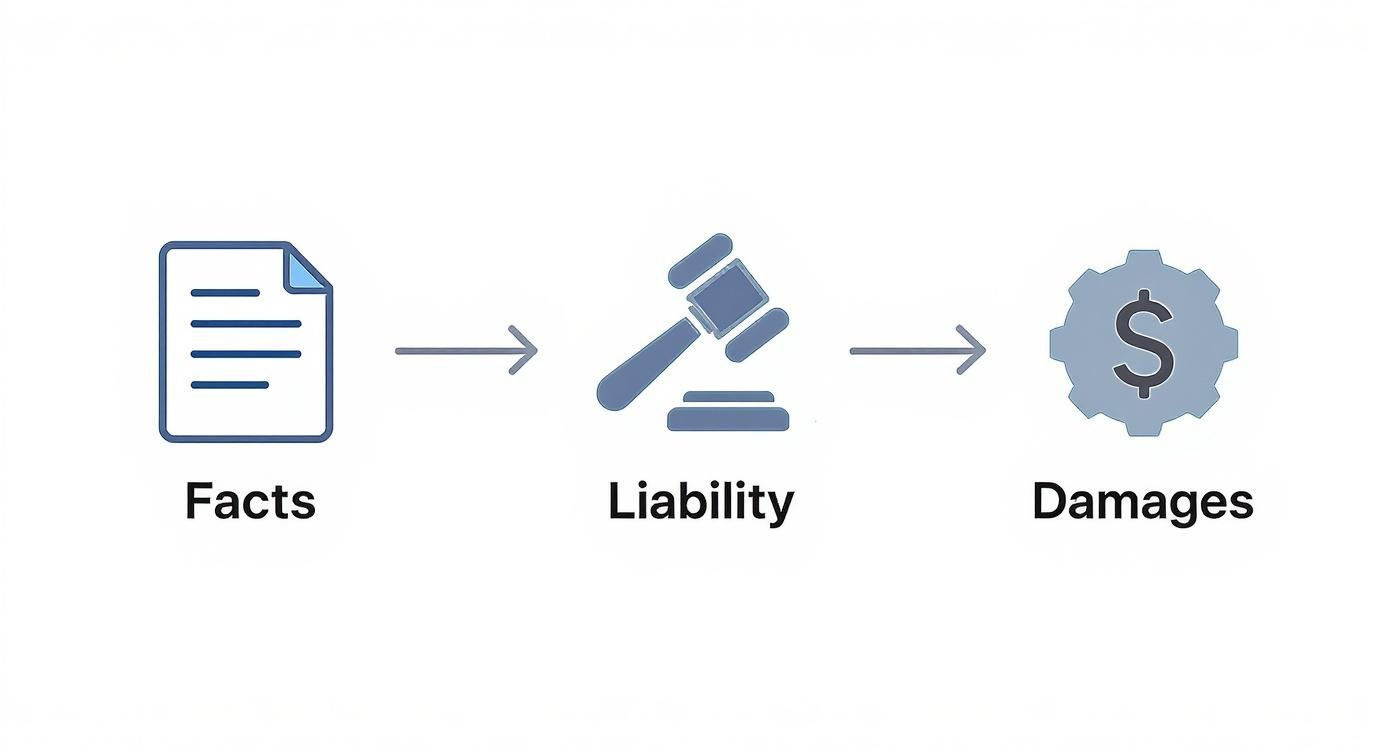

The best way to start is by sorting your losses into two distinct buckets: special damages and general damages. Getting this right is the foundation of a credible and compelling claim.

Tallying Up Your Special Damages

Let’s start with the easy stuff. Special damages, also known as economic damages, are the tangible, out-of-pocket costs you’ve paid because of the accident. These are the straightforward losses with a clear paper trail. If you have a receipt or an invoice for it, it’s a special damage.

Your list of special damages needs to be perfectly organized and backed up with documentation. I'm talking about:

- All Medical Bills: This is the big one. You need to gather every single bill, from the ambulance ride and ER visit to follow-up appointments, physical therapy, chiropractic care, prescriptions, and even things like crutches or a knee brace.

- Lost Income: Calculate the exact amount of pay you lost from being unable to work. The gold standard here is a letter from your employer on company letterhead confirming your pay rate and the specific dates you missed.

- Future Medical Costs: If your doctor says you’ll need more treatment down the road, like another surgery or ongoing physical therapy, that needs to be estimated and included. A formal note from your doctor outlining this prognosis is non-negotiable.

- Property Damage: This is usually the repair or replacement cost of your vehicle. But don’t forget other personal items that were damaged in the crash, like a laptop, phone, or a child's car seat.

- Miscellaneous Expenses: The little things add up. Think about costs like paying for Ubers to get to doctor's appointments or hiring someone for lawn care because you physically couldn't do it.

This whole process is about building a case, piece by piece. You establish the facts, prove who was at fault, and then you can accurately calculate the damages.

As you can see, a strong damages calculation is the final, critical step that rests on a solid foundation of facts and proven liability.

Valuing Your General Damages

Now we get into the grey area. General damages, often just called "pain and suffering," are meant to compensate you for the non-financial impact the accident had on your life. This covers everything from the physical pain and emotional distress to the anxiety and simple loss of enjoyment of life.

Since there's no receipt for pain, insurance companies have to put a number on it somehow. They often use a formula to get to a starting point, and a common one is the multiplier approach.

The Multiplier Method Explained: The adjuster takes your total special damages (your hard costs) and multiplies that figure by a certain number, usually between 1.5 and 5. The more severe, painful, and long-lasting your injuries, the higher the multiplier they'll consider.

A minor whiplash case that clears up in a few weeks might get a 1.5x multiplier. On the other hand, an accident that results in a broken bone, surgery, and a permanent limp could easily justify a 4x or 5x multiplier.

The trick is you have to justify the multiplier you're asking for. You can’t just pick the highest number. Your demand letter needs to paint a vivid, human picture of your experience. Talk about the sleepless nights from the pain, how you couldn't pick up your kids, or the panic you now feel getting behind the wheel. That's the story that gives your number weight.

And make no mistake, these claims are a huge deal. Car accidents account for over 50% of all personal injury claims filed in the U.S. each year. That's a big reason why insurers scrutinize these calculations so carefully.

Bringing It All Together for Your Final Demand

Once you have a solid number for both your special and general damages, you simply add them together. That sum is your total settlement demand.

Special Damages + General Damages = Total Demand

Let's look at a simple example:

- Total Medical Bills & Lost Wages (Special): $10,000

- Pain and Suffering (General - using a 2x multiplier): $20,000

- Total Settlement Demand: $30,000

This final figure becomes your starting point for negotiations. You need to present it clearly at the end of your letter, showing the adjuster exactly how you got there. This proves your demand is fair and, more importantly, rooted in the evidence you've provided.

For a deeper dive into this part of the process, check out our guide on how much your car accident case is worth.

Ready-to-Use Demand Letter Templates for Common Accidents

Knowing what to include in a demand letter is great, but seeing it all come together is even better. It's time to move from theory to practice with some real-world templates you can actually use.

No two crashes are the same, but most fall into a few common categories. Starting with a solid template ensures you don't miss any crucial details while still giving you the flexibility to tell your unique story.

Below, you’ll find two templates designed for typical Texas car accident scenarios. Think of these as your starting point, not the final product. You'll see placeholders like [Text in brackets]—this is where your personal details go. Be sure to replace every single one with the specific, accurate facts from your case.

Sample for a Clear-Cut Rear-End Collision

Rear-end collisions are usually the most straightforward claims. Nine times out of ten, the driver who rear-ended you is considered at fault. This template reflects that reality with a direct, no-nonsense tone. It gets right to the point, focusing on the facts and common injuries like whiplash.

[Your Full Name] [Your Address] [Your Phone Number & Email]

[Date]

[Insurance Adjuster’s Name] [Insurance Company Name] [Insurance Company Address]

RE: Demand for Settlement Claimant: [Your Full Name] Insured: [At-Fault Driver’s Name] Claim Number: [Your Claim Number] Date of Accident: [Date of Accident]

Dear Mr./Ms. [Adjuster’s Last Name],

As you know, I was injured in an accident on [Date of Accident] when your insured, [At-Fault Driver’s Name], slammed into the back of my vehicle. The collision took place on [Street or Highway Name] near [Nearest Cross-Street or Landmark] in [City, Texas]. Your insured’s complete failure to control their speed and maintain a safe following distance was the sole cause of this crash and my resulting injuries.

I was fully stopped in traffic when, without any warning, your insured’s car struck mine. The force of that impact caused a severe whiplash injury, along with significant neck and upper back pain. I was treated at [Name of Hospital or Urgent Care] and subsequently completed [Number] weeks of physical therapy at [Name of Therapy Clinic] just to regain normal function.

My total out-of-pocket damages are:

- Medical Bills: $[Total Amount of Medical Bills]

- Lost Wages: $[Total Amount of Lost Wages]

- Total Special Damages: $[Sum of Above]

To compensate me for my medical costs, lost income, and the significant pain this ordeal has caused, I am demanding $[Total Settlement Amount] to resolve my claim. Please provide your written response within 30 days.

Sincerely, [Your Signature] [Your Typed Name]

Sample for an Accident with More Serious Injuries and Lost Work Time

When a crash leaves you with more severe injuries that keep you from working, your demand letter needs to carry more weight. It's crucial to draw a clear, undeniable line from the at-fault driver's actions to your injuries and your empty pocketbook.

This sample demand letter for a car accident is built for those situations. It has dedicated space for more extensive medical treatments and makes a much stronger case for why you deserve compensation for your pain and suffering.

[Your Full Name] [Your Address] [Your Phone Number & Email]

[Date]

[Insurance Adjuster’s Name] [Insurance Company Name] [Insurance Company Address]

RE: Formal Demand for Settlement Claimant: [Your Full Name] Insured: [At-Fault Driver’s Name] Claim Number: [Your Claim Number] Date of Accident: [Date of Accident]

Dear Mr./Ms. [Adjuster’s Last Name],

I am writing to formally demand a settlement for the serious injuries and financial losses I have suffered because of the negligence of your insured, [At-Fault Driver’s Name], on [Date of Accident]. Your insured ran a red light at the intersection of [Street Name 1] and [Street Name 2], causing the crash.

I was legally proceeding through the intersection with a green light when your insured blew through the red and T-boned my vehicle. The violent impact left me with a concussion and a fractured wrist that required surgery. My medical treatment has been long and difficult, involving an emergency room visit, surgery with Dr. [Doctor’s Name] at [Hospital Name], and months of occupational therapy.

Because of these injuries, I was unable to work for [Number] weeks at my job as a [Your Job Title]. My inability to perform my duties during this time is confirmed in the attached letter from my employer.

My documented economic losses are as follows:

- Emergency Room & Hospital Bill: $[Amount]

- Orthopedic Surgeon Fees: $[Amount]

- Occupational Therapy: $[Amount]

- Lost Income: $[Amount]

- Total Special Damages: $[Sum of Above]

This crash and the painful recovery process have caused me immense physical pain, stress, and disruption to my life. Given the severity of my injuries and the undeniable liability of your insured, I demand $[Total Settlement Amount] to fully and finally resolve this claim. I expect to receive your response within 30 days.

Sincerely, [Your Signature] [Your Typed Name]

So, You Hit Send. What Happens Next in the Negotiation?

Sending your demand letter isn’t the finish line; it’s really just the starting gun for the real race: the negotiation. Once that letter is in the mail, the waiting game begins. The key is knowing what to expect, because one thing is for sure—a check for your full amount is almost certainly not going to show up overnight.

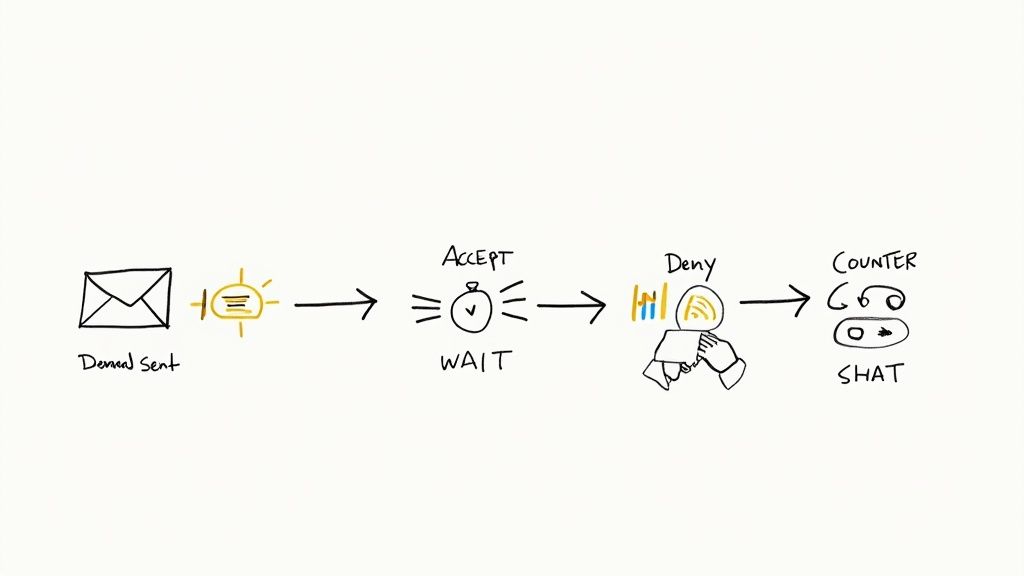

You can typically expect one of three things to happen after the insurance company reviews your claim:

- Quick Acceptance: Let's be clear, this almost never happens. If an adjuster accepts your first demand without a single question, you should probably be more worried than relieved. It’s a strong signal you might have drastically undervalued your claim.

- Outright Denial: This is also pretty rare, especially if you've built a solid, evidence-backed case. A flat-out denial usually means the insurer is confident their driver has zero fault or they have a reason to believe your injuries aren't connected to the crash.

- A Counteroffer: This is the one to expect. A counteroffer is the standard response in the vast majority of claims. Mentally prepare for it—this is where the back-and-forth truly begins.

Analyzing That First Counteroffer

The first offer you get from the adjuster will almost certainly be low. Sometimes, it’s insultingly low. Don't take it personally. This is a classic, time-tested tactic to see if you’re serious and to test your resolve. They want to find out if you’ll just take a fraction of what you’re owed and go away.

Your job is to stay calm and strategic.

When you receive that first offer, take a moment. Read the adjuster's reasoning carefully. Do they point out specific perceived weaknesses in your claim? For instance, they might question whether a particular medical treatment was truly necessary or argue that you were partially to blame for the accident.

This is a huge deal in Texas. You’ll want to have a firm grasp of how shared fault works, as it can directly reduce your settlement amount. You can learn more about comparative negligence in Texas to understand precisely how this rule could be used against you.

How to Craft a Smart Response

Rule number one: Never accept the first offer.

Your response needs to be just as calculated as your initial demand letter. Address the points the adjuster raised, but do it without getting emotional or defensive. If they're questioning a physical therapy bill, for example, be ready to send a brief note from your doctor explaining why that specific treatment was critical to your recovery.

Your goal is to make a reasonable counteroffer. It should be lower than your initial demand but still significantly higher than their lowball number. This simple act shows you're willing to negotiate in good faith while also sending a clear signal that you understand the true value of your claim.

Let’s say you demanded $30,000 and they came back with $8,000. A smart counter might be in the $25,000 range, accompanied by a polite letter that reinforces the strongest evidence you have.

My Two Cents: Treat this process like a marathon, not a sprint. Every email, letter, and phone call should be professional and grounded in facts. Leave emotion at the door and stick to the evidence you’ve worked so hard to gather.

Knowing When You're Out of Your Depth

While many people successfully navigate this process on their own, you need to recognize the red flags that mean it's time to call an attorney.

If the adjuster starts using bad-faith tactics—like ignoring your calls for weeks, making subtle threats, or blatantly misrepresenting what the law or the policy says—you need professional backup. These are clear signs that they aren't planning to deal with you fairly.

Common Questions About Auto Accident Demand Letters

After a car wreck, you’ve got a lot on your plate. It's completely normal to have questions as you start putting together your demand letter. Think of this letter as your opening argument in a negotiation with the insurance company—it’s your first and best chance to tell your side of the story, so you want to get it right.

Let's walk through some of the most common questions that pop up when people are working from a sample demand letter for an auto accident.

When Is the Right Time to Send a Demand Letter?

This is a big one, and the answer is simple: wait. Patience is your best friend here.

You absolutely should not send your demand letter until you've reached what's called Maximum Medical Improvement (MMI). In plain English, MMI is the point where your doctor says your condition is as good as it's going to get. They can now give you a clear, final prognosis about any future medical care or permanent limitations you might have.

Sending a letter before you hit MMI is a critical mistake. If you jump the gun, you won't know the full extent of your damages. You could end up settling for a fraction of what your claim is actually worth, leaving you on the hook for future medical bills that you didn't see coming.

Don’t rush this. A premature demand letter can easily cost you thousands. Wait until you and your doctor have a complete picture of your recovery and total medical costs before you even think about sending that letter.

Waiting for MMI means every single doctor's visit, physical therapy session, and prescription is accounted for. This gives you a rock-solid, itemized list of your special damages, making it much harder for an insurance adjuster to pick your numbers apart.

Should I Email My Demand Letter or Use Certified Mail?

Always, always, always use certified mail with a return receipt requested. It might feel a little old-school in a digital world, but that paper trail is your proof. That little green card that comes back to you in the mail is an official, legally recognized record showing exactly when the insurance company received your demand. It’s undeniable.

Now, it’s perfectly fine to also email a copy to the adjuster. They often appreciate the convenience, and it can speed things up. But email should only be a courtesy copy, never the official method. That certified mail receipt is your safeguard if any arguments about deadlines or communication pop up later.

What Are the Biggest Mistakes People Make in Demand Letters?

I’ve seen plenty of well-written demand letters fall flat because of simple, avoidable errors. Knowing what these common traps are can make a huge difference in how seriously the adjuster takes your claim.

Here are the biggest mistakes you need to steer clear of:

- Getting emotional. Stick to the facts. Using angry or accusatory language just makes you look unprofessional and can weaken your position.

- Accidentally admitting fault. Be careful with your words. A seemingly innocent phrase like, "I wish I had been paying closer attention," can be twisted to assign you partial blame, which will absolutely reduce your settlement.

- Exaggerating your injuries or damages. This is the fastest way to kill your claim. If an adjuster catches you in even a small lie, your credibility is shot, and they'll question everything else you've said.

- Forgetting the proof. Every single dollar you ask for needs to be backed up by a document. That means including copies of medical bills, repair shop estimates, and a letter from your boss detailing lost wages.

- Demanding a fantasy number. Your final settlement demand shouldn't be a number you just pull out of thin air. It needs to be grounded in a logical calculation of your actual special and general damages.

Avoiding these pitfalls from the start shows the adjuster that you're organized, serious, and know what you're doing.

At What Point Should I Just Hire an Attorney?

While you can definitely handle a straightforward claim on your own, some situations are clear signals that it’s time to bring in a professional. You should give serious thought to hiring an attorney if any of these things are happening:

- Your injuries are severe, will require long-term care, or have left you with a permanent disability.

- The insurance company is trying to pin the blame on you when it wasn't your fault.

- The adjuster is dragging their feet, ignoring your calls, or generally acting in bad faith.

- They’ve made a lowball offer that doesn’t even cover your medical bills.

In more complex cases, a good attorney can often get you a much larger settlement, even after their fee is paid. They know the insurance company’s playbook inside and out and won't let you get taken advantage of.

Walking into settlement negotiations armed with data gives you confidence. With Verdictly, you can see what real Texas motor vehicle cases with similar accidents and injuries have settled for. Our platform pulls back the curtain on legal data, helping you understand your claim's true value before you even think about accepting an offer. Level the playing field and negotiate from a position of strength by visiting https://verdictly.co.

Related Posts

A Guide to Medical Records Reviews in Personal Injury Claims

Learn how medical records reviews can strengthen your Texas injury claim. This guide explains the process, key findings, and how to build a stronger case.

Why Insurance Companies Deny Claims: why insurance companies deny claims

Learn why insurance companies deny claims and how to overcome common denials with proven appeals and tips to maximize your compensation.

How Much Can I Get From a Car Accident Settlement?

Wondering how much can I get from a car accident? This guide breaks down settlement factors, damages, and claim values to help you estimate your compensation.