Average Car Accident Settlement Texas: What to Expect

Explore the average car accident settlement texas factors, data, and tips to evaluate your claim and maximize compensation.

If you've been in a wreck, one question is probably nagging at you: what is a typical car accident settlement in Texas? While there's no single magic number, the data gives us a ballpark. Recently, bodily injury claims have settled for an average of around $22,734, with property damage claims coming in closer to $5,314.

But let's be clear—these figures are just a starting point. They don’t tell the story of your accident.

Unpacking the Average Settlement in Texas

Relying on an "average" settlement amount is a bit like asking for the average price of a house in Texas. Sure, a number exists, but it doesn't tell you much about the two-bedroom bungalow in Waco versus the sprawling ranch in Dallas. They're in completely different leagues.

The same idea holds true for car accident cases. A fender-bender with minor scrapes and a multi-car pileup with catastrophic injuries will have vastly different outcomes. A few massive, multi-million dollar verdicts can skew the "average" sky-high, making it a misleading benchmark for most people.

To get a real sense of what your case could be worth, you have to dig deeper than a simple average and look at the specific details that insurance adjusters and juries actually care about.

A Closer Look at the Numbers

Let's break down the recent statistics to get a clearer picture of what's happening here in the Lone Star State.

Here's a quick reference for typical settlement ranges based on claim and injury type.

Texas Car Accident Settlement Averages at a Glance

| Claim/Injury Type | Average Settlement Amount (Texas) |

|---|---|

| Property Damage Only | $5,314 |

| Minor Injuries (Cuts/Bruises) | $20,000 |

| Bodily Injury (General) | $22,734 |

| Moderate Injuries (Broken Bones/Surgery) | $45,596 |

As you can see, the numbers tell a story. In 2022, the average Texas payout for bodily injury was approximately $22,734, which is quite a bit higher than the national average. When you drill down, you see a wide spectrum—from around $20,000 for minor cuts and bruises to nearly $45,596 for cases involving broken bones or surgery.

The key takeaway is this: An "average" is just a blend of thousands of unique stories. Your settlement value will be built from the ground up based on your specific damages, not pulled from a statewide statistic.

What Really Determines a Settlement Amount

So, what are the building blocks of a settlement? Several core factors will push your claim's value up or down, moving it far away from any statistical average. These are the details that truly matter.

- Severity of Your Injuries: This is the big one. A whiplash claim that resolves in a few months is valued very differently than a traumatic brain injury that requires a lifetime of care.

- Total Medical Bills: We're talking about everything. The ambulance ride, the ER visit, surgeries, hospital stays, physical therapy, and even any medical care you'll need down the road.

- Lost Income and Earning Capacity: You're entitled to compensation for the paychecks you missed while recovering. But it goes deeper—if a permanent disability impacts your ability to earn a living in the future, that has to be factored in, too.

- Who Was at Fault: Texas plays by a "modified comparative fault" rule. It’s a bit technical, but what it means is if you are found to be 51% or more to blame for the accident, you can't recover a dime.

Getting a handle on these components is the first real step toward figuring out a realistic settlement range for your situation. For a more detailed breakdown of how these pieces fit together, check out our complete guide on car accident settlements.

Why Averages Don't Tell the Whole Story

When you hear a number for the average car accident settlement in Texas, it’s tempting to grab onto it and think, "That's what my case is worth." But honestly, that's a dangerous trap.

Think of it like this: imagine you're in a room with nine regular folks who each make $50,000 a year. Then, a billionaire walks in. Suddenly, the average income in that room skyrockets to over $100 million. Does that number tell you anything useful about what the first nine people actually earn? Of course not.

That’s exactly what happens with car accident settlements. A few catastrophic injury cases—the ones that result in massive, multi-million dollar verdicts—drag the average way, way up. It creates a completely skewed picture and sets unrealistic expectations for the vast majority of people whose claims involve more common injuries. Your case is unique, and its value is tied to its specific facts, not some sensationalized average.

Median vs. Average: The Real Story

If you want a more grounded picture of what most people actually receive, you have to look at the median settlement amount. The median is simply the "middle" number. If you lined up every single settlement from smallest to largest, the median is the one sitting right in the center.

It's not pulled up or down by those few outlier cases worth millions. This is why the median is so important—it shows you what the typical claimant actually recovers, which is a far more helpful starting point for understanding your own case's potential value.

A median value gives you a much better snapshot of the common settlement landscape. It filters out the noise from the exceptionally high or low awards and reflects what’s really happening for everyday Texans.

The Numbers Tell the Tale

The difference between the median and average in Texas is staggering. It perfectly illustrates just how misleading an average can be.

While the average personal injury settlement can climb as high as $826,892, the median settlement in Texas is a far more modest $12,281. That enormous gap is created by that handful of very high-value cases. In fact, federal data shows that more than half of all claimants receive settlements at or below $24,000, which is much more in line with the median figure. You can explore more about these recent trends in motor vehicle accident settlements to see how these numbers shake out.

This doesn't mean your case is only worth the median amount. It just means that your specific damages, medical bills, and the severity of your injuries are what truly drive the value—not a statewide average that lumps your situation in with multi-million dollar catastrophic claims.

What This Means for Your Claim

Understanding this difference is a game-changer. It allows you to walk into negotiations with a clear-eyed, realistic perspective. Instead of getting fixated on an inflated average, you can get down to the business of building a case based on its actual merits.

So, what should you be focused on instead of averages?

- Your Documented Economic Losses: This is the hard math—all your medical bills (past and future), lost wages from time off work, and any damage to your future earning capacity.

- The Severity and Permanence of Your Injuries: A broken arm that heals completely is valued very differently than a back injury that will cause you chronic pain for the rest of your life.

- Your Non-Economic Damages: This is the human cost. It covers your physical pain, emotional distress, and the real-world impact the accident has had on your quality of life.

- The Clarity of Fault: How easily and clearly can you prove the other driver was to blame? A clear-cut case gives you a much stronger negotiating position.

By focusing on these individual pieces, you and your attorney can build a demand that accurately reflects your specific losses, rather than chasing a misleading statistical average.

What Goes Into a Car Accident Settlement?

Think of your potential settlement like building a house. The final value isn't based on a single number; it's built piece by piece, with each piece of evidence acting as a crucial building block. A strong case isn't a guess—it's carefully constructed from clear, documented proof.

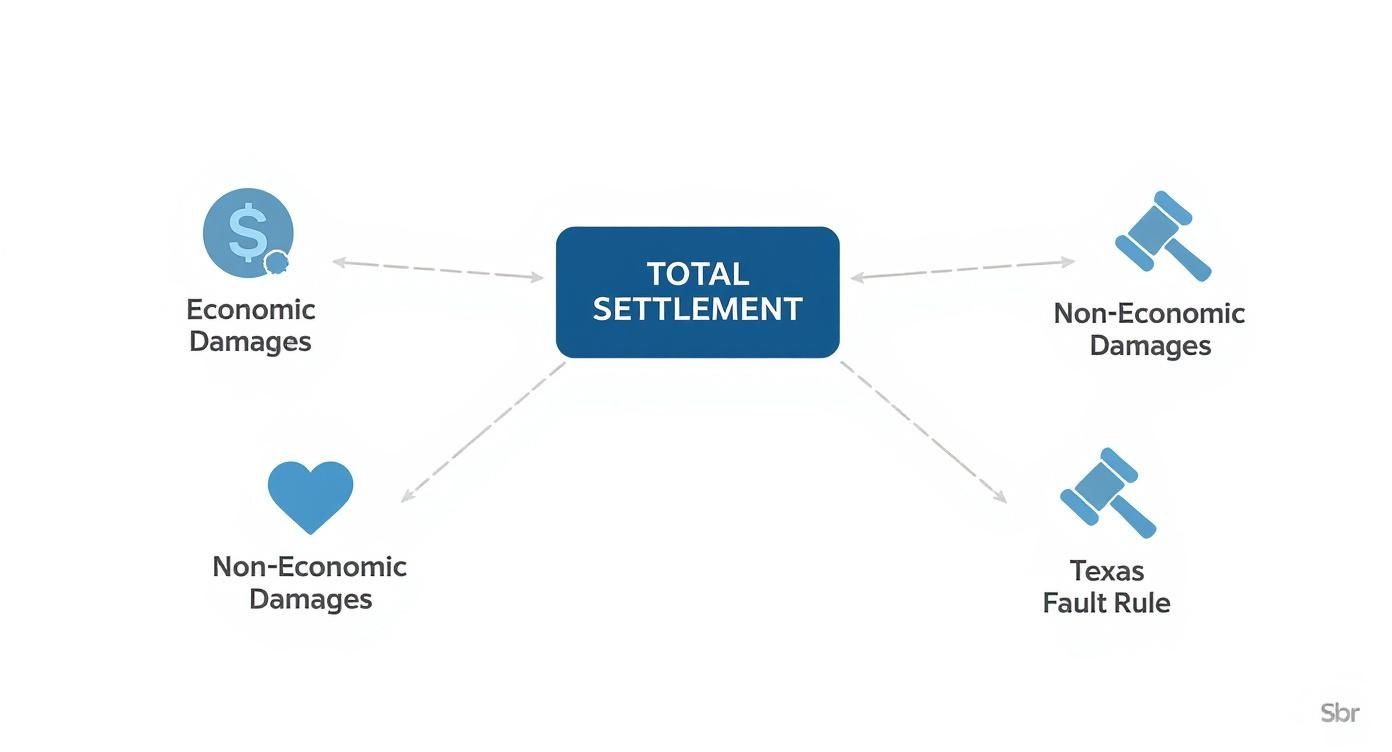

Every bill, every diagnosis, and every impact on your daily life adds weight and stability to your claim. These building blocks generally fall into two categories: economic damages and non-economic damages. Getting a handle on both is the only way to understand what your case is truly worth.

Economic Damages: The Black-and-White Costs

Economic damages are the most straightforward part of any claim. They are the tangible, out-of-pocket financial losses you've suffered because of the accident. These are the receipts, invoices, and pay stubs that add up to a hard number.

This isn't just about the first hospital bill. The main components include:

- Medical Expenses (Past and Future): This is the foundation of your claim. It covers everything from the ambulance ride and ER visit to surgery, prescriptions, and physical therapy. Critically, it must also project the cost of any future medical care you'll need. A few stitches are one thing; a lifetime of pain management or the possibility of a future knee replacement is something else entirely, and your settlement has to account for that.

- Lost Wages: This is the income you lost because you couldn't work while recovering. It's a simple calculation based on your pay stubs and time off.

- Loss of Future Earning Capacity: This one is more complex but vital for serious injuries. If the accident left you with a permanent impairment that stops you from returning to your old job or limits your ability to earn a living, your settlement should compensate you for that lost potential income over your expected career.

Non-Economic Damages: The Human Toll

While economic damages are about numbers on a spreadsheet, non-economic damages are about the very real human impact of the crash. You can't put a price tag on pain or trauma, but our legal system recognizes these losses are devastating and deserve compensation.

Insurance companies fight hard to downplay these damages because they're subjective. But a good lawyer knows how to paint a clear picture of how the accident turned your life upside down, justifying significant compensation for this "human cost."

These damages cover the personal suffering you’ve endured:

- Pain and Suffering: This is for the physical pain, discomfort, and general misery your injuries have caused.

- Emotional Distress and Mental Anguish: This covers the psychological fallout—the anxiety, depression, fear, or even PTSD that follows a traumatic crash.

- Loss of Enjoyment of Life: If your injuries keep you from coaching your kid's soccer team, working in your garden, or enjoying any of the hobbies that used to bring you joy, this part of the claim accounts for that loss.

The Texas Fault Rule: A Critical Twist

Once you've gathered all your building blocks—your economic and non-economic damages—there's one more major factor that can change everything: fault. Texas follows a rule called Modified Comparative Fault, also known as the 51% Bar Rule.

Here’s what that means in plain English:

- If you are found to be 50% or less at fault for the accident, you can still get paid. However, your final settlement will be reduced by your percentage of fault.

- If you are found to be 51% or more at fault, you get nothing. Zero.

Let's use a quick example. Say your total damages add up to $100,000. If the insurance company (or a jury) decides you were 20% at fault—maybe you were going a few miles over the speed limit—your award would be cut by 20%, and you’d get $80,000. But if they decide you were 51% at fault, that $100,000 claim is suddenly worth $0.

This rule is precisely why proving the other driver was primarily responsible is so important. Solid evidence like the police report, witness statements, and photos from the scene are your best defense against having your claim unfairly reduced or denied altogether.

How Different Injuries Impact Settlement Amounts

When it comes to your car accident settlement, the single biggest factor is the nature of your injury. It’s a simple truth: a minor sprain that heals in a few weeks just doesn't carry the same weight as an injury that needs surgery and creates a lifetime of challenges. Getting a handle on these differences is the first step to setting realistic expectations for your claim.

Think of it this way: the more an injury turns your life upside down, both today and for years to come, the higher its value. This is where we stop talking about general averages and start looking at real numbers based on the actual harm you’ve suffered.

The infographic below breaks down the key pieces that come together to form your total settlement value.

As you can see, your final compensation is a mix of hard numbers like medical bills (economic damages), the more personal impact of pain and suffering (non-economic damages), and how Texas’s fault laws apply to your specific case.

Estimated Texas Settlement Ranges by Injury Type

To give you a clearer picture, we've put together a table showing how settlement values often scale with the severity of the injury. These are estimates, of course, but they highlight the strong connection between the level of harm and the potential compensation.

| Type of Injury | Typical Settlement Range (Low to High) | Key Factors |

|---|---|---|

| Minor Soft Tissue Injuries | $10,000 – $25,000 | Covered medical bills, short-term physical therapy, limited time off work. |

| Moderate Injuries | $50,000 – $100,000 | Surgery needs, longer recovery, potential for some lasting pain or limitations. |

| Severe Injuries | $500,000+ | Permanent disability, need for future medical care, significant loss of income. |

This table shows a clear pattern: the more intensive the medical treatment and the longer the road to recovery, the more substantial the settlement needs to be to fairly compensate for the disruption to your life.

The Special Case of Neck and Back Injuries

In Texas car accident claims, neck and back injuries are a whole different ballgame. Why? Because they have a nasty habit of causing chronic pain and long-term problems. What feels like a simple backache right after the crash can easily escalate into a debilitating condition that requires injections, multiple surgeries, and years of pain management.

This potential for lifelong suffering is what gives these claims so much weight. In fact, 2025 data shows the average neck and back injury settlement in Texas is around $503,648, with the median sitting at $350,000. For severe spinal trauma from a major collision, settlements have even reached $2.1 million.

The potential for a lifetime of pain is a powerful factor in negotiations. Insurance companies know that juries are sympathetic to victims with documented, long-term back and neck problems, which gives these claims significant leverage.

Catastrophic Injuries: Traumatic Brain Injuries

Traumatic brain injuries (TBIs) sit at the top of the pyramid as the most severe and complex personal injury cases. A TBI can completely change someone's life, affecting everything from their cognitive abilities and personality to their very ability to live on their own. The financial cost for a lifetime of care—including specialized therapy, in-home help, and lost earning capacity—is staggering.

It’s no surprise, then, that TBI settlements are among the highest possible. These cases almost always end up in a lawsuit because the stakes are incredibly high for everyone involved. For a powerful real-world example, you can read about a Texas jury award of $4.8 million for a traumatic brain injury from a truck crash. That case shows just what it takes to truly account for such a devastating injury.

Navigating the Texas Settlement Timeline

After a crash, the settlement process can feel like a complete mystery. You're trying to heal, and on top of that, you're wondering when—or if—you'll get a fair settlement. Let's pull back the curtain on the typical timeline so you know what to expect.

Every case moves at its own pace. A straightforward claim with minor injuries might wrap up in a few months. But if your injuries are severe or the other driver is fighting about who’s at fault, it could easily take a year or more. The most important thing to remember is that patience is your friend. Rushing to a settlement almost always means leaving money on the table.

The First Steps After the Accident

This initial phase is all about laying the groundwork for your claim. It’s where you gather the essential facts and officially put the at-fault driver's insurance company on notice. Getting this part right is critical; being thorough now will save you headaches later.

Here’s what needs to happen right away:

- Seek Medical Attention: Your health comes first, always. Seeing a doctor right after the accident creates a crucial medical record that directly ties your injuries to the crash.

- Report the Accident: A police report is an official, unbiased account of what happened. It's one of the strongest pieces of evidence for proving fault.

- Notify the Insurance Company: You need to inform the other party's insurer about the accident promptly. This starts their claims process and gets an adjuster assigned to your case.

Building Your Case and Reaching MMI

This is usually the longest stretch of the process. While you focus on recovering, your legal team will be busy gathering all the evidence needed to prove the true value of your claim. The single most important milestone during this period is reaching Maximum Medical Improvement (MMI).

What is MMI? It’s the point when your doctor says your condition has stabilized and you’re not likely to get any better. Hitting MMI is a critical turning point because until you do, you can't possibly know the full extent of your damages, especially what you'll need for future medical care. Settling before you reach MMI is a huge gamble.

A classic insurance adjuster tactic is to dangle a quick, lowball settlement offer before you've reached MMI. They're betting you'll grab the easy cash without realizing your injuries will need more treatment—and more money—down the line.

The Negotiation and Settlement Phase

Once you’ve reached MMI and all your damages have been tallied up, your attorney will draft and send a formal demand letter to the insurance company. This document lays out the facts, details your injuries and all associated costs, and makes a specific demand for settlement.

The insurance adjuster will review your demand and come back with a counteroffer. You can bet it will be much lower than what you asked for. This is where the real negotiation begins. A skilled attorney understands the games adjusters play and knows how to push back with facts and evidence to justify your demand.

The vast majority of car accident cases—over 95%—are settled right here, during negotiations, without ever seeing the inside of a courtroom. If you and the insurer can agree on a fair number, you'll sign a release, and they’ll cut the check. If they simply won't offer a fair amount, the next step is filing a lawsuit to show them you mean business.

Why an Attorney Can Maximize Your Settlement

Trying to negotiate a car accident claim by yourself is a bit like stepping into a professional boxing ring with no training. On the other side is the insurance adjuster—a pro whose entire job is to protect their company's money by paying out as little as possible.

An experienced personal injury attorney completely changes the dynamic. They know the playbook adjusters use, from dangling a fast, lowball offer before you even know how serious your injuries are, to picking apart your medical records. Simply having a lawyer on your side signals to the insurance company that they have to negotiate seriously.

Calculating the True Value of Your Claim

One of the biggest mistakes people make is underestimating the real value of their claim. It's easy enough to add up the medical bills you have in hand, but that's often just the tip of the iceberg.

A good attorney digs much deeper to uncover the full extent of your losses.

- Future Medical Needs: What about that surgery your doctor says you might need next year? Or the ongoing physical therapy? Your lawyer will work with medical experts to forecast those future costs and make sure they're included in your demand.

- Lost Earning Capacity: If your injuries prevent you from returning to your old job or limit your ability to work, an attorney can calculate the total impact on your income over a lifetime. This is a huge, often overlooked, component of a claim.

- Pain and Suffering: This is the toughest part to put a number on, but it's very real. Lawyers are skilled at building a powerful narrative around your experience to justify significant compensation for the physical pain and emotional trauma you’ve gone through.

An attorney’s job is to build a comprehensive demand package that tells the full story of your losses—not just what has already happened, but what you will face for years to come. This ensures you don’t leave money on the table that you will desperately need later.

When Legal Help Is Essential

Look, if you had a minor fender-bender with no injuries, you can probably handle it on your own. But in many situations, going it alone is a major risk. If you find yourself in any of the following scenarios, getting legal help isn't just a good idea—it's critical.

You should seriously consider hiring an attorney if:

- You suffered serious or permanent injuries that will require long-term medical attention.

- The insurance company is disputing who was at fault for the crash.

- The first settlement offer they sent over is laughably low and doesn't even cover your bills.

- You're overwhelmed and just don't know how to properly document everything to prove your case.

An experienced lawyer knows exactly how to navigate these challenges. They gather the right evidence, build a solid case, and fight to get you the settlement you actually deserve. To see how legal strategy plays out in the real world, check out the case file on this Dallas County rear-end collision that settled after mediation.

Common Questions About Texas Car Accident Settlements

Even after getting the basics down, you probably still have a few lingering questions. Let's tackle some of the most common ones that come up when you're navigating a car accident claim in Texas.

How Do You Actually Calculate Pain and Suffering in Texas?

This is one of the trickiest parts because there’s no official calculator for pain and suffering. Instead, attorneys and insurance companies lean on a couple of common methods to put a number on it.

The most popular is the "multiplier method." Here, your hard costs—things like medical bills and lost paychecks—are added up and then multiplied by a number, usually between 1.5 and 5. A minor sprain might get a 1.5 multiplier, while a life-altering injury could command a 5.

Another way to look at it is the "per diem" (per day) approach, which assigns a daily dollar amount for every day you have to live with the pain. In the end, though, the final figure really comes down to how well you can document your suffering, the long-term impact of your injuries, and the strength of your legal counsel.

How Long Do I Have to File a Claim After an Accident?

In Texas, you're up against a hard deadline. The state has a statute of limitations of two years for personal injury claims.

That means you have exactly two years from the date of the wreck to file a lawsuit. If you let that deadline pass, your ability to get any compensation is almost certainly gone for good. It's a critical window, so moving quickly is key to protecting your rights.

Waiting too long is one of the most common mistakes an accident victim can make. The clock starts ticking the moment the accident happens, so don't delay in seeking legal advice.

Does My Case Have to Go to Court to Get a Settlement?

Almost certainly not. People often picture dramatic courtroom battles, but the reality is that the vast majority of car accident claims in Texas—well over 95%—are resolved without ever seeing the inside of a courtroom.

Settlements are reached through direct negotiations between your attorney and the insurance company. Going to trial is typically the last resort, reserved for when an insurer simply refuses to offer a fair amount. That said, a good lawyer prepares every single case as if it's heading to trial. This powerful stance is often what convinces the insurance company to come to the table and negotiate a fair settlement.

Get the data you need to negotiate a better outcome. Verdictly provides access to thousands of real Texas motor vehicle case outcomes, so you can see what cases like yours are actually worth. Don't guess—get the facts from Verdictly.

Related Posts

Kinds of Negligence (kinds of negligence): How They Impact Your Injury Claim

Discover kinds of negligence in Texas personal injury cases and how they can impact your motor vehicle claim. Get clear guidance on your rights now.

Calculating pain and suffering car accident: A Practical Guide to Damages

Learn how calculating pain and suffering car accident damages works, with factors and tips to maximize your settlement.

How to guide: how to negotiate with insurance adjuster

Learn how to negotiate with insurance adjuster effectively to maximize your settlement, protect your rights, and avoid common claim pitfalls.